Euro is approaching the upper border of the descending movement

European currency dropped lower than 1.33 during the session on Wednesday, but the investors began to buy the pair EUR/USD, after which the pair suddenly grew higher than the indicate area. The level of 1.33 is now the support, and we expect growth to the level of 1.34 in the future, at the moment the pair has reached the level of 1.3390, now there is a consolidation on the market, because the level of 1.34 is a psychological level of resistance. The breakdown and consolidation higher than 1.34 will open a way for the EUR/USD pair to the level of 1.35, and upper border of the descending long-term trend.

The fall line of business activity that was formed on a daily graph is a significant resistance. However, we do not think that the market will consolidate higher than this weekly trend line, because European Union many problems at the moment. If the Federal Reserve System does not give efficient solutions on ending the softening politics and does not consider such a solution in the near future, then the European currency will fall very soon. Moreover, one should be very concerned with the state of European stock markets. Right now MIB, IBEX, FTSE, and CAC look very vulnerable.

Only short-term trading

It is a wise decision to look at the movement of EUR/USD pair, as a short-term one and to try to open deals quickly and to close them fast, do not become long-term investors. As a matter of fact, this market is so changeable that we think there are no possibilities for long-term deals. The beginning of a summer period is not a positive factor. In the summer period as a rule volumes fall, and it may be provoked by recent massive market fluctuations, especially on Yen market. At the same time traders should be very cautious, especially those that trade in big volumes, because the changeability of the market can be fatal, take care of your losses beforehand.

On the other hand, if the market can consolidate lower than the level of previous day, then one will be able to witness the figure of a “hanged man”. When that happens, it is a bear sign, and we think that the market would bring us down to the level of 1.30.

Is the game worth the candle?

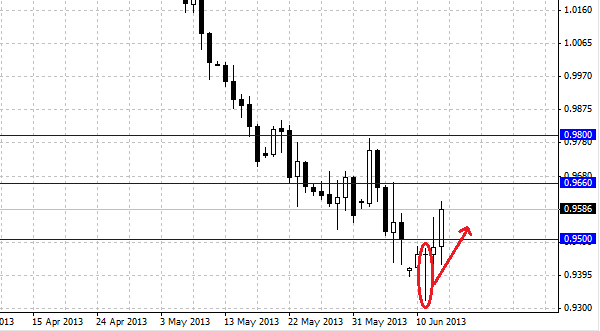

The AUD/USD pair consolidated during the big part of the session on Wednesday, while breaking down the level of 0.95. This level has been a significant support earlier, thus, we expected to see it as a resistance, but the trades on Thursday allowed the pair to consolidate higher than that level. On Wednesday the market disappointed many traders taking away their profits at the end of the session.

One may notice on the graph that the candle on Tuesday is the hummer- the sign of deployment, that is why one should expect trading at a higher level from the Australian.

Now, when the market broke the previous support at the level of 0.95, it plays a role of resistance. Despite the weakness of the pair of AUD/USD, Australian Reserve Bank is thinking about the following lowering of the rates, which will only strengthen the downward pressure. At the moment the pair is consolidating, but we expect that the movement downward will continue.

The level of 0.90

We see the tendency for lowering on the market and the Australian Dollar is trying to move upward to the level 0.90. There we will many obstacles, namely a psychological level with round figure and technical resistance most obvious on long-term graphs. It should be pointed out that if you look at the graph of the AUD/USD pair then every growth of the Australian, meeting was successfully suppressed, and the pair was descending. At the moment the movement upward is considered as a possibility to enter successfully the deal for purchases. In order to change our opinion about the descending trend the pair has to close higher than the level of 0.98, then it will become possible to think about opening long positions.

Social button for Joomla