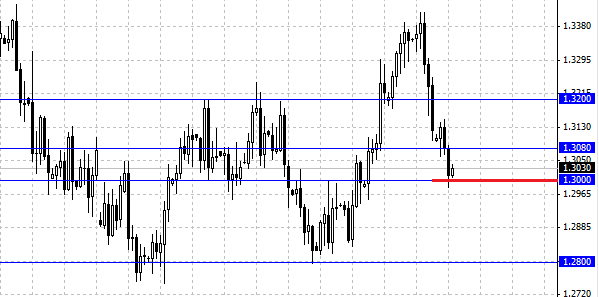

Currency pair EUR/USD during auctions on Wednesday was in a negative zone. European currency continued its fall even after publication of negative data on gdp from the USA, which instead of mentioned 2.4 % dropped to 1.8 %. Nevertheless, the investors decided to ignore economic data and euro sales continued throughout the day. From technical point of view EUR/USD pair reached its closest aim of 1.30, but without being able to break the support it rehabilitated from minimal value close to the end of the day. At the moment one may see technical rebound from the level of 1.30, but the growth is rather weak and most likely EUR/USD will try to consolidate lower than 1.30, thus continuing the descending trend, the growth of the pair will be restricted by the previous maximum which is at the level of 1.3080, achieving this level will be a good point of entry for sales. Today is full of statistics from the USA and Europe and this data will probably influence the market mood during the day, especially important news will be requests for unemployment benefits and unfinished deals on home sale.

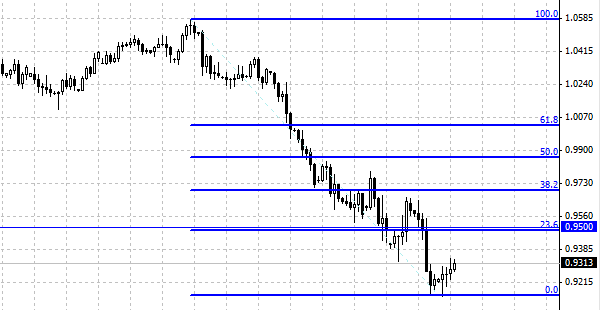

Australian dollar is more confident towards dollar than other currencies. During the whole week AUD/USD pair is showing a positive dynamics, but it still can’t consolidate higher than the resistance level which is situated at the level of 0.9300, such behavior signals weakness of the Australian, but as a whole we assume that the descending trend will continue on AUD/USD pair. A confident growth of the pair higher than the level of 0.9300 would open the way towards the level of 0.95, where, as it can be seen on the graph, the level of 23.6 passes on Fibonacci. Recently the dynamics of Australian dollar and gold started to part, the fall of dollar do not drag along the pair AUD/USD anymore. Despite the growth of the pair we consider it unnatural because it does not correspond to the overall direction of the market and we think that in case of dollar growth in comparison with other currencies and price drop of gold can provoke quick fall of AUD/USD, that is why it is recommended to watch this pair and be ready for sales. One should pay attention to Australian behavior near the local maximums and value of the previous day, the deployment of maximum of the previous day can be a signal for short-term purchase.