U.S. inaction on raising the national debt plates and renewal of the government keeps the market under pressure. Today the major currencies against the U.S. dollar, analysts believe that Asian investors are buying dollars because see the speedy resolution of the political problem, the ECB representative Joerg Asmussen also spoke in favor of the United States, noting that the decision will no doubt be found. Attention Tuesday was also drawn to the speeches of the President of America, Barack Obama, who spoke about the unthinkable failure to raise the national debt, and demanded an immediate decisive action to resume the work of the government.

The EUR/USD was trading Tuesday neutral at the moment the European currency has declined substantially and is trading below 1.3550 at around 1.3520 . Support for the euro is in the 1.3500 - 1.3480 . From a technical point of view, EUR/USD is drifting between the boundaries of the range and moving south. We believe euro to remain in the channel until the problem in the United States will not be resolved. Once the U.S. problems persist, the dollar could rise significantly in the positive mood of investors, so expect more of the dollar than the euro, which, in fact, traded near a one-year maximum. Traders await the release of data on industrial production in Germany, who will give a boost to the market.

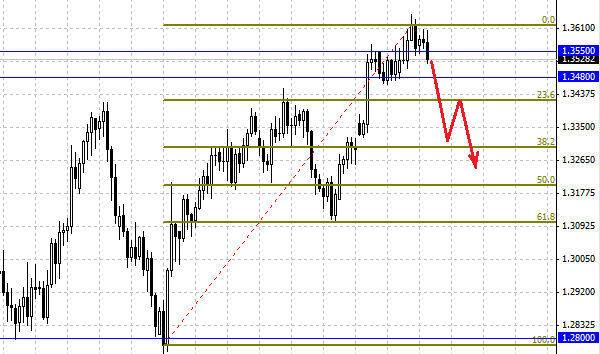

The pressure on the European currency has and changes outlook on France's GDP downward, instead of 0.2 % growth analysts are now forecasting 0.1 %. Many factors, not only reflect the economic slowdown in the euro area, which is why traders and investors sidestep risky assets. The dollar and the U.S. with the permission of the current crisis will look like heroes and saviors of the economy without problems possess the location of the market participants. In case of further strengthening of the American currency pair EUR/USD could reach 1.33, where the way to pass the 38.2 Fibonacci.

After reaching the level of 1.3630 euros went to the turn, before there was an upward trend broken. It remains an open question - is the correction or a new wave of recession? If the pair EUR/USD to fall below 34 figures, the bulls finally lose their strength and initiative intercept bears, who will be trying to push the single currency even lower.

Social button for Joomla