In the course of trading in the currency market on Thursday showed growth of major currencies against the U.S. currency. Dollar shows a negative trend, and every day is losing ground. Support currencies have economic data, as well as statements of central banks.

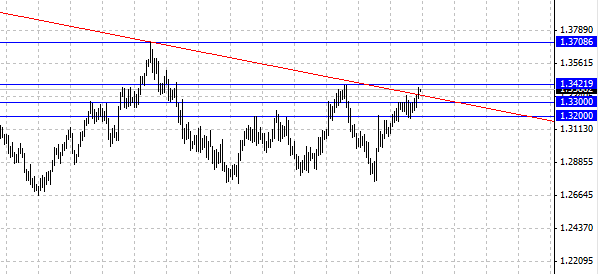

The EUR/USD rose on positive data from Germany and the ECB report. The Federal Statistical Office reported that the results of German exports rebounded in June, which was supported by strong demand from countries not included in the composition of the euro area, while the volume of imports unexpectedly declined, reflecting the weakness in domestic demand. ECB report confirmed the intention of the ECB to keep interest rates at the current (0.5 %) or a low level for a long time. Monetary policy will remain accommodative for as long as it is required in order to support the economic recovery, which is expected to grow by gradual pace over this year and next. If you look at the daily chart of EUR/USD, we see that the euro has reached a new high, and now goes to the 1.34 resistance. Also, the euro rose above the downtrend line, posing a risk for traders that put the drop in EUR/USD. Immediate support for the pair is at the level of 1.33 .

Exchange rate AUD/USD, overcoming the resistance of 0.90, showing strong growth. The immediate objectives for the Australian is the level of 0.92 - 0.93 . Perhaps we will again see a trading range, the level of 0.93 is strong resistance, the rise above this level will be difficult for the Australian. If this happens, the next target will be the level of 0.95, and we will see a deeper correction.

BNPP experts expect the Australian dollar may continue to grow:

"Australian dollar may continue to grow, despite the publication on the eve of a disappointing jobs report in Australia, said in BNPP. The bank attributed this to the fact that although the Reserve Bank of Australia and switched to a neutral policy, market participants still consider pricing in the likelihood of further easing of monetary policy, so the Australian dollar is more sensitive to positive economic data than negative. The Australian dollar also belatedly reacted to the rebound in the stock market in China, and short positions in this currency is still very stretched."

Social button for Joomla