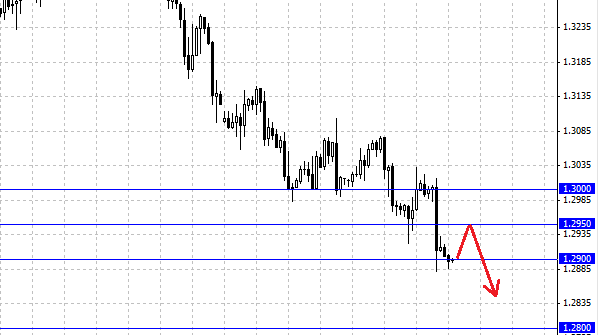

Trading on the foreign exchange market on Thursday held a press conference in anticipation of the ECB and the speech of the head of the bank Draghi. During the conference, Draghi said the ECB will keep rate soft policy and will do it as long as necessary. The European currency has reacted to this statement a strong reduction, increased pressure on the euro and the fact that Moody's has downgraded the ratings of three troubled Spanish banks. All of this eventually led down a pair of EUR/USD to 1.2880 level, reinforcing the downward movement. Support is at 1.2900 area did not allow the pair to consolidate below, the pair EUR/USD rebounded from the lows to the level of 1.2930, and then again began to decline. European currency is now in limbo, Draghi comments left a negative mark on the market, but at the same time reducing the currency is constrained by the level of 1.2900 . We believe that the EUR/USD pair will be some time to trade above 1.2900, next target is to roll back the level of 1.2950 . Since It's Friday, and this week the European currency fell well enough it's likely that many of the medium-term traders will take profits, this will surely have support for the euro and then we can expect a strong recovery up to 1.3000 . However, the basic mood of the pair EUR/USD negative and immediate goal in the medium term is the level of 1.2800, the territory of which the market has already came.

Before the start of the U.S. session on Friday, traders expect the output statistics of the U.S. and Canada. Particular attention is paid to such news as the change in the number of employed in non-agricultural sector (Non-Farm Employment Change) and the U.S. unemployment rate (Unemployment Rate). In connection with these data we can only say that the U.S. unemployment rate is gradually reduced and it has a certain regularity. Analysts expect the U.S. unemployment rate will be at 7.5 % and the change in the number of employees will reach 163K. Therefore, most likely, the publication of economic data support the dollar. Otherwise, we will see an increase in demand for the euro, but do not forget that its growth is limited. Upon reaching the highest levels of the euro such as, for example 1.3000, you should consider opening short positions on the EUR/USD pair to 1.2900 - 1.2800 with relatively little risk.

Social button for Joomla