On Tuesday were subdued by the majority of currencies is still moving sideways, with the exception of the European currency. The euro fell to a 3-month low against the U.S. dollar. The reason for that was representative of the ECB's comments about low interest rates. Governing Council member Joerg Asmussen, explaining ECB President Mario Draghi made to them last week, said the ECB will probably keep rates low for more than 12 months. Asmussen also said that would not rule out another round of cheap credit. These statements have a negative impact on the euro and the currency fell sharply as investors are not profitable to keep the assets in Euro if the ECB does not intend to raise rates. Later, however the ECB acted with objections as to the timing relative to the course of action guide monetary policy.

The next blow to the EUR/USD pair was lowering the credit rating of Italy from BBB+ to the level of BBB. Agency "Standard & Poor's", explains the slowdown in the decline of Italy because of the weakness and low vitality of its economy. "Standard & Poor's" maintained a negative outlook on the rating, which indicates the possibility of further downgrade in 2013 or 2014, with a probability of 1.3, which to some extent will have an additional pressure on the euro.

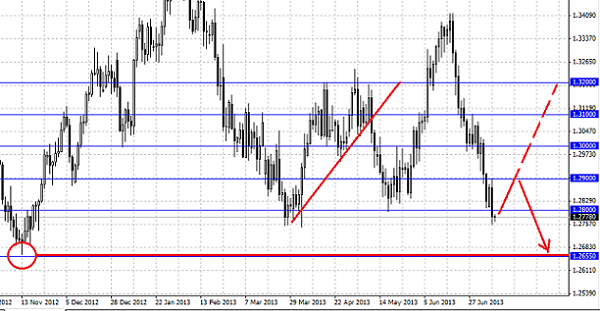

As a result, EUR/USD pair has broken support at 1.2800, falling over near the level of 1.2750, where we have previously said to be a strong support. Recently, the pair EUR/USD is quite technically fulfills the levels today can expect a rollback to the level of 1.2800, near which aggressive traders can start selling the European currency again. Since 1.2750 level is a watershed that may need more time to punch him, the euro's failure lasts long enough, and the market may well begin a large-scale consolidation. This will allow the euro to rise to the level of 1.29 - 1.30, and can, like the last time it was up to the level of 1.32 . But such a scenario is unlikely, the Eurozone problems remain, and the prospects for the U.S. are still attractive, so traders should keep an eye on support for the euro area, in the case of continued downward movement of the next target level for the pair is 1.2650 .