The dynamics of the dollar last week was mixed. Friday's trading was very volatile matter is that commotion about the new head of the U.S. Federal Reserve. News block only added fuel to the fire, if you look at the data published this week, unfortunately, we see poor numbers. But it is not all that bad, positive news pleases investors the UK economy. The main event of the week will be the FOMC meeting and everything connected with it - speech rates, statements and reports. Recall that market participants are interested in the fate of the quantitative easing program, so there is no doubt that the FOMC Steytment stir markets.

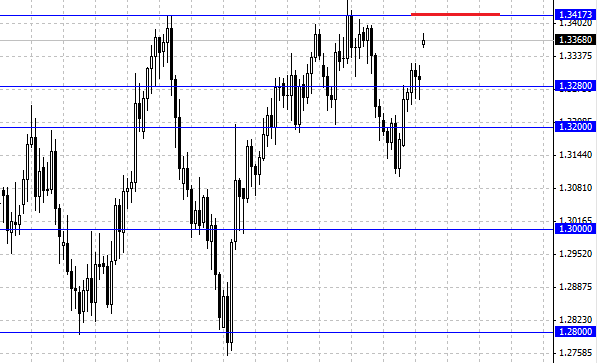

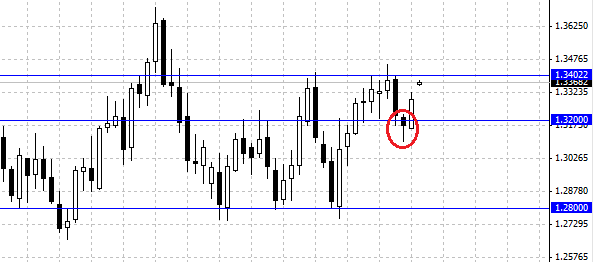

First of all, any news regarding U.S. monetary policy will affect the currency pair EUR/USD. The European currency benefits from risk aversion and buy dollars before the application FOMC. From a technical point of view, the growth of euro 1.33 hindered resistance, the last three days, the European currency was in a narrow range of 1.3325 - 1.3250 . In the end, we got a strong gap, the pair EUR/USD opened at 1.3360 level. At the moment resistance is at 1.34 .

Analyzing the weekly chart, you can watch the bears could not break through the 1.32 level. Consequently, such a smooth wave of decline EUR/USD as the last time we will not see. And the decline of the euro was swift and fast enough, now this dynamic is also not observed. The reasons may be two, first - degree flat market before the application FOMC, the second - the lack of strength in the bears continue downward movement. And if the first reason is quite obvious and predictable, the second guard. By candlestick analysis, many are skeptical, however, the chart indicated hammer candle, and it signals a reversal of the trend that is currently happening.

On Monday, a public holiday in Japan, so the Japanese market and banks are closed on currency pairs involving the Japanese yen will be reduced volume of trade that can bring to the absence of significant movements. During the Asian session, the situation is similar.

Social button for Joomla