Wednesday ended with the strengthening of the U.S. dollar against other major currencies. The focus of the meeting was the Federal Reserve. The result was the news that the asset purchase program unchanged, interest rates have also remained at the same value. The reason for this decision is unconfirmed economic growth, the FED wants to see him more confident and stable, showing the weakness of the housing sector, as growth is constrained by the fiscal policy of the USA. The labor market is recovering at a good pace, with regard to interest rates, they will remain as low as possible for a long time, even after the completion of bond purchases.

The greatest impact of the FED meeting had on the currency pair EUR/USD, which is down more than 70 points. Currently the European currency still reduced and apparently moves towards support at 1.3650 . The pair is currently trading around the level of 1.3700, which hinders further decline. Theoretically, the results of the FED meeting were to hit the U.S., but apparently the market sentiment is still strong realities. In fact, the U.S. dollar isn't in a better situation, and we believe that the decline in EUR/USD pair is more of a consolidation pattern. In the euro has growth potential, and the economic situation in the United States favors the single currency. Area of 1.3700 - 1.3650 should activate "euro bulls" and become the basis for further growth in EUR/USD.

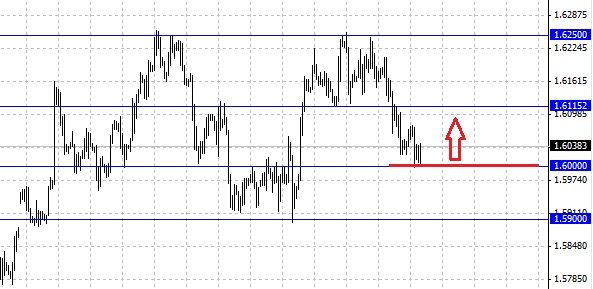

The pound sterling was also under pressure at the time of the FED meeting, but at the moment is almost completely restored the lost ground. GBP/USD pair reached a value of 1.6000, followed by the beginning of growth. Strategists at Commerzbank note that the decline in the British pound after reaching 1.6200 is completed around the level of 1.6000 . After that the uptrend resume if the 1.6250 level again stand, the pair GBP/USD back to trade at levels below 1.6000 .

Near the level of 0.95 for the currency pair AUD/USD is a real war. Market participants are watching out where the Australian dollar will move up or down, because 0.95 is, so to speak, the boundary between the upstream and downstream traffic. Recovering from a minimum of Australian values was a clear sign of the strength of bulls, so now for them the first priority is keeping the pair AUD/USD from falling below the level of 0.95 .

Social button for Joomla