Currency trading on Tuesday for most currencies were in the red zone. The market continues to be adjusted, the U.S. dollar is slightly recovering. The main influence on the auctions had a business climate in Germany, it has not met the expectations of the market and was below analysts' forecasts, and thereby lend support to the U.S. dollar.

At the end of the day, EUR/USD pair dropped below the support level of 1.3500 to 1.3470 . Fixing the euro below 1.3500 creates increased downward pressure, so it is possible that we will see the EUR/USD pair at even lower levels. Support for the euro is now at 1.3400 , 1.3500 level acts as resistance. Publication of data on the business climate in Germany is also not pleased investors and traders, the index was weaker than expected forecast. Although a monthly basis rose by 0.1 compared to the previous month and reached 107.7 in August figure was 107.6 . The result is that a modest increase, triggered selling of the European currency. The pair EUR/USD decline.

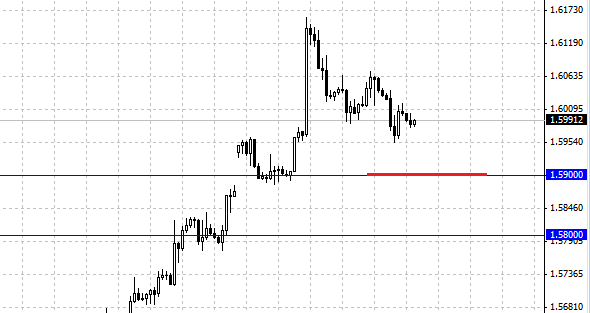

The British pound also could not stand against the U.S. currency. GBP/USD pair is trading lower, and has already dropped below the 1.6000 level. Correction for the British pound may be stronger than the euro, as the pair GBP/USD was much stronger and swifter. Tomorrow is expected to block the news from the UK, particular attention will be paid to the current balance and GDP data. Support for the pound is at a local minimum 1.5960 and resistance at 1.6000 . From the pair GBP/USD, as well as on the rest of the high probability of lateral movement.

The Australian dollar is currently trading near the 0.9365 support level, that level was a heavy growth triggered by the FED's statement. If the AUD/USD breaks through this level, the lower will be the level to 0.93 . Do not forget the fact that from a technical point of view, with AUD/USD has the potential to grow. Double bottom and the apparent weakening of the Australian Bear Hug gives great potential for upward movement.

An interesting opinion is divided Goldman Sachs - Janet Yellen may be the new chairman of the Federal Reserve. For the candidate Yellenna long time already watching the White House. Janet Yellen has already talked about his model of optimal control. The main objectives is to achieve full employment, inflation, there may be more than 2 %.

Social button for Joomla