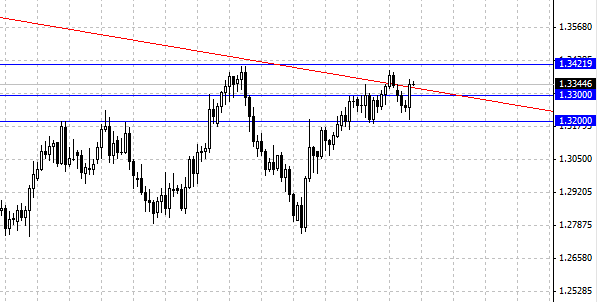

Thursday was marked by a sharp decline in the U.S. currency. Significant dollar sales have caused a surge of activity in other currencies. The EUR/USD jumps to 1.3350 and is trading near which at the moment. The reason for this increase is possibly a break of 1.33 . Prior to that, the dollar steadily in strength, and reached the level of 1.32, the purchase of this support level could also be a catalyst for a strong movement for the pair EUR/USD. After a number of positive statistics investors began to liquidate part of long dollar positions. His role in the weakening of the U.S. currency has played and the growth yield on 10-year U.S. Treasury bonds to two-year highs, which was perceived by market participants as an additional proof of intent FOMC to begin phasing out of stimulus measures is already at its September meeting.

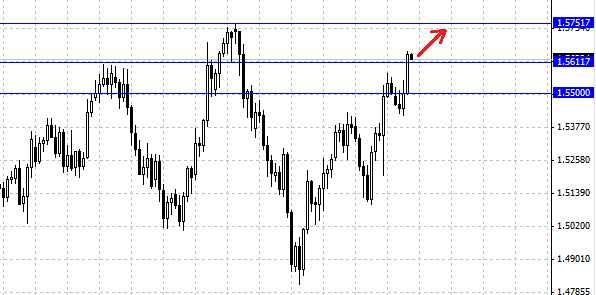

The sharp decline of the U.S. dollar was fixed against the British pound. In the first half of the session helped the pound data showed that retail sales rose sharply in July, buoyed by the warm weather. According to the report, retail sales in July rose by 1.1 % compared to the previous month. These data have become the latest signal that the economic situation in the UK is improving after several years, during which time she was on the brink of stagnation. As a result, GBP/USD pair was able to gain a foothold above the level of 1.56, which is now supported.

"The main reason for today's dollar weakness are not strong data on the U.S. labor market, and the decline in stock markets and rising bond yields", - said Richard Gilhuli, rates strategist at TD Securities in New York. Note that, according to the median forecast of 48 economists surveyed by Bloomberg 9 - 13 August, the results of the next FOMC meeting in September, the volume of QE3 will be reduced by 10 billion dollars a month. "In fact, 10 billion dollars - only a symbolic figure, and if Mr. Bernanke simultaneously announce a scenario in which the following reduction of QE3 may be quite distant in time event, the dollar may resume decline, despite the" folding "stimulus" - says Richard Franulovich, senior currency strategist at Westpac in New York.

Social button for Joomla