The dynamics of trading on Thursday, will largely depend on the news background. Yesterday's economic data provided support to the British pound and the euro. Many believe that there was a rise in the euro against the abolition vote on military intervention in the conflict.

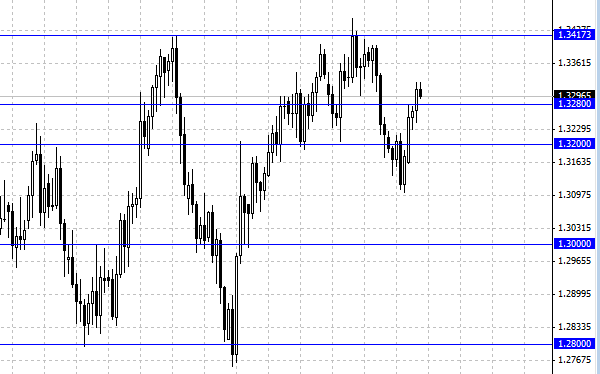

So, the European currency broke the level of 1.33 and is now trading in this area. An important event that may affect the dynamics of the pair EUR/USD will be the M. Draghi's speech today. Of America are expected labor market data.

Since the beginning of the week the euro shows growth, but, unfortunately, it is not associated with the improvement of the economic situation. At the moment the currency pair EUR/USD decline. On the eve of the publication of data on industrial production and the speech of M. Draghi market participants close their long positions and wait for further signals. It is difficult to predict what the mood will be at the ECB President's speech, but the last time the ECB press conference had a lot of pressure on the European currency, and for major changes took place not too long.

The British pound has shown robust growth, GBP/USD pair rose to 1.58 resistance on positive data on the UK labor market. Add volatility can and today's data. Although the pound and looks convincing, we are still bearish on the situation. A strong area of resistance 1.58 - 1.59 will be a serious obstacle for bulls, bulls pound. The British pound also rose amid speculation of good economic data, but from a global point of view of the UK economy is experiencing the downside risks.

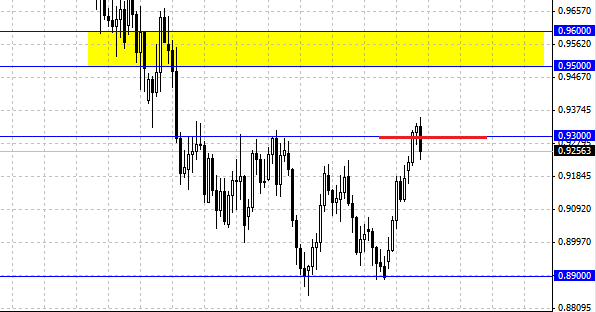

The victorious ascent Austrian dollar stopped negative statistics on the labor market. AUD/USD has not been able to gain a foothold above 0.93 and is now trading down at 0.9250 . Australian Movement, which we have seen, of course, point to the weakness of the bears, the current decline was a technical (resistance 0.93) and fundamental (weak labor market data) character. In such a situation would not buy one, so the decline is natural and justified, but nevertheless it is only temporary factors. More importantly, the Aussie (AUD/USD) broke out of the downtrend and sideways which can now watch the market participant, is the basis for a possible change in trend. Bulls are gaining strength, and if investors are playing against Australian will not be able to give a new round of decline, then run the show there will be other forces.

Social button for Joomla