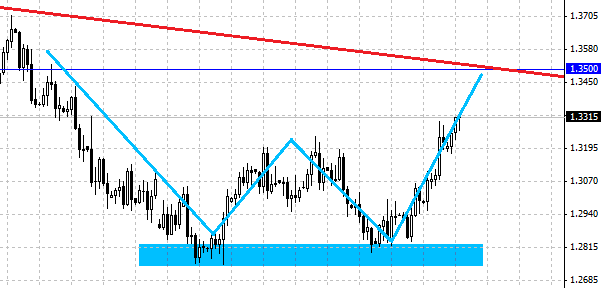

Expect significant resistance near levels of 1.34.

For EUR/USD pair the session of Tuesday was successful, despite the fact that at the beginning the pair was lowering slightly, but as a result it closed higher than the level of 1.33. Even if you do not like Euro you should not ignore the fact that market is ascending and it is what a trader should know. With the break of maximum formed on Tuesday one should buy a pair and get short-term profits. As you can see we are singling out red lowering line of the trend which is based on long-term daily graph.

Due to fall line of business activity and fact that there is a resistance at the level of 1.34, any deal for purchase that you open should be seen as a short-term trade. There is a specific distrust to EURO, because there are many possible news, negative news to influence negatively European currency. The market is not ready yet to move upward long-term, nevertheless it was trading calm during a defined period of time, that is why we think that the activeness of the pair EUR/USD is a short-term rampage of players. We do not assume that currently the market has bulls with short-term mood.

The future movement will meet significant resistance higher and probably the market will soon lower to the level of 1.32, catching in the trap relaxed traders. During summer we expect that EUR/USD pair will become cheaper.

Growth for USD/JPY

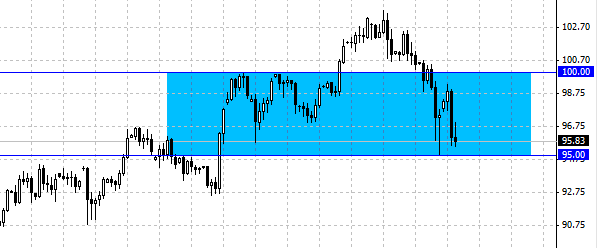

USD/JPY pair made an abrupt dive on Tuesday, bumping into the level of 96. Now we are approaching the area that must be a significant support for this market and as a result to open deals to sell pair is risky at the moment. In general, we are not supporting short positions on the pair USD/JPY, because Japan bank in the end will begin to type Japanese currency.

We are expecting growth of the pair from the level of 95, because Japan bank made a statement that they were not content with Yen that was trading between 95 and 100. We consider this as a hint or help that signals the fact that the area will offer enough support to raise the market. That is why one should watch the price movement and look for possibilities to buy USD/JPY pair near the level of 95. The growth higher than the level of 100 Рis now harder, but we think that rehabilitation of recent losses has high chances for success.

Japan bank and Federal Reserve System

Follow American interest rates and Federal Reserve System acts. Japan bank undoubtedly will continue weakening Yen. This is a perfect scenario where this pair must continue ascending in a long-term perspective. Put simply, the Japanese must reduce price as much as possible, due to massive debt.

In our opinion the market will find resistance at the level of 99, although in the short-term perspective a trading diapason will form at the market. Eventually USD/JPY pair will raise, but there are many traders that suffered from abrupt recent fall, and this fact will make market fluctuate, because in order to move forward it is necessary to take a certain risk. To continue the ascending trend, it is necessary to wait for some time, so that the market can calm down and move smoothly in the old direction.

Social button for Joomla