Week draws to a close and we can take stock of trading on the foreign exchange markets. This week the U.S. dollar continued to weaken, the initiative seized the riskier currencies, the reason for this, of course, is the ever-increasing market confidence about the imminent decommissioning program of quantitative easing.

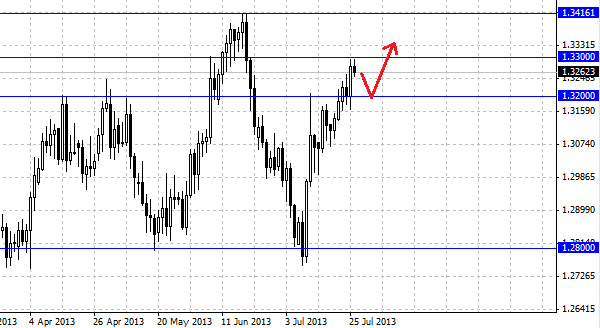

The EUR/USD this week managed to grow to 1.33 area, but apparently the market does not have enough power at the moment to overcome this level. At the end of the week, many traders take profits and exit positions, so in the last hours of trading European currency is likely to trade below 1.33 dollar. The momentum needed to break through the resistance may occur during the U.S. session, but such a scenario is likely to be postponed until next week. The nearest support level for the pair EUR/USD is at around 1.32 . The trend for the pair remains bullish.

The Australian dollar ended the week and could not get out of their trading range of 0.91 - 0.93 with borders, double-bounced down on the level of resistance. Even in a flagging U.S. dollar Australian dollar can not break the downward trend, and continues to be under pressure. The pair AUD/USD above 0.93 dollars will open the way to 0.95 . The chances of correction persist, traders still watch the behavior of couples in the corridor, breaking through one of the boundaries will be the signal for further action. But we still believe that the future of the Australian has a bad temper, slowing Chinese economy creates additional risks for the pair AUD/USD.

The British pound continued growth of three weeks after reaching the minimum at 1.48 . Negative data on GDP decreased value of the pound, but the pair GBP/USD was able to quickly recover losses. At the moment, the pair constrains the level of 1.54 . It's interesting to note that on the short position Morgan Stanley for the pair GBP/USD triggered stop order, with the bank intend to resume it. According to the bank, taking into account the uneven recovery of the British economy, the deterioration of the balance of foreign trade and negative real interest rates in the UK, the pound will be supported for long, which comes from the positive economic data the UK. According to the bank open a short position at the level of 1.52 dollars load stop at around 1.53 dollars. Morgan Stanley - intends to re-open a short position in a pair with a mark of 1.54 to a target level of 1.45 and a stop put to the mark - 1.55 dollars.