At the end of trading on Wednesday, the U.S. dollar fell against most currencies. At the forefront of growth were the European currency and the British pound sterling. For the growth of the major currencies against the U.S. dollar has several reasons, one of them weak economic data from the U.S. labor market, the second - the president's speech, Mario Draghi supported the single currency. Restart the government in the United States also put pressure on the dollar and creates additional risks associated with the technical default.

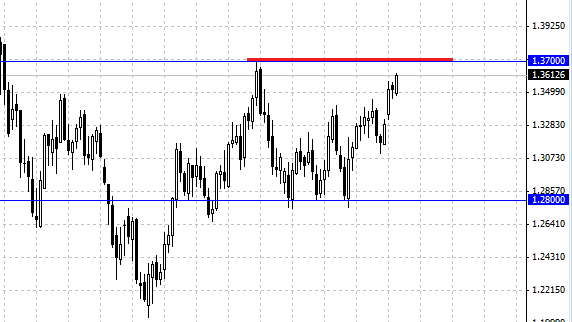

The European currency continues to rise. Now the pair EUR/USD is trading above 1.3600 and is likely in the future to achieve the level of 1.3700 . A significant increase in EUR/USD is demonstrated in the performance of the president of the European Central Bank M. Draghi. The main highlight of the press conference was the decision to leave interest rates unchanged. And Mario Draghi said that it is possible lowering of the rates in the future. "At the current or lower levels of interest rates will be for a long time" - said the president of the ECB.

The central bank will continue to stick with a soft policy to address the economic problems and financial turmoil, in order to maintain the economic recovery in the Eurozone. The U.S. dollar weakened after the publication of data on the number of jobs in the private sector. So instead of the expected 177 000 jobs, an increase was recorded by only 166 000. In general, the pair EUR/USD is in a phase of strong growth and in achieving the target level of 1.37 can begin a deeper correction.

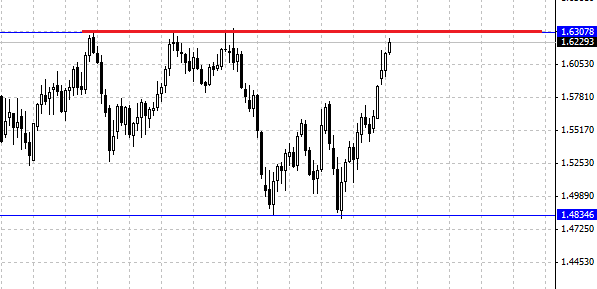

The British pound slightly slowed the growth of the matter is that a modest economic data. GBP/USD pair is trading close to the maximum values for the achievement of which the British pound needs to grow about another 100 points. It is worth noting that the euro and the pound suited to strong resistance levels that from a technical point of view creates downside risks to these currencies. The head of the Bank of England said that as long as the state of the UK economy is stable, the Central Bank will not tighten monetary policy. Reaching the top, the currency pair GBP/USD may continue to grow, because the reasons for the decline, other than speculation, no. The same goes for the euro, combined with a weak dollar and the political instability of the U.S., investors are looking for any possible capital increase, which provide riskier currencies.

Social button for Joomla