Today, Wednesday, the foreign exchange market with the opening of trading the U.S. dollar shows growth. A significant decrease was observed for the pair GBP/USD and AUD/USD, the European currency is in no hurry to fall against the dollar, although moderately reduced.

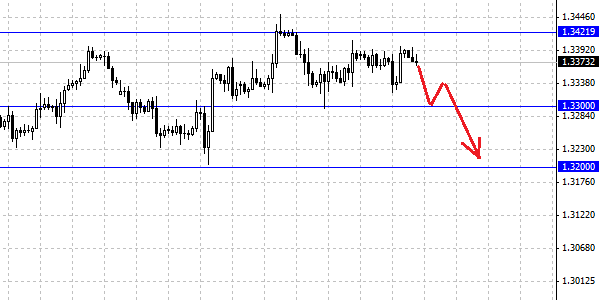

On Tuesday, the EUR/USD pair dropped to the level of 1.3320, but as we can see in the end of day the EUR/USD managed to recover and record daily gain. Positive data on the dollar, which would have to support him, not able to strengthen its market position. Unfounded at first glance the pair is called, according to analysts, the Syrian conflict and the dynamics of oil prices. Currently the pair is trading at 1.3380 . We believe that the dollar will continue to strengthen its position, the growth of the U.S. currency has been observed against other currencies, and soon bullish on the dollar and the euro will affect, which, by the way, by themselves, and nothing to show to investors and traders. This week it's possible drop in prices on the EUR/USD to the level of 1.32 . It was there that we think is an important support level, overcoming his side will end the trend and will continue the downward trend.

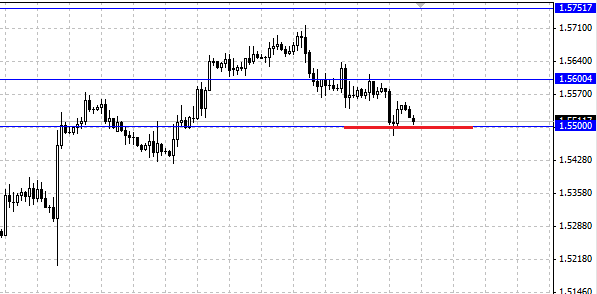

The pair GBP/USD at the end of trading on Tuesday, touched the support at 1.55, then began rolling back. Now the British continued yesterday's decline and is now coming back to the level of 1.55. This level is a psychological effect, and as we said earlier, the consolidation below this level would be a signal of a trend reversal and downward movement will continue. If the GBP/USD fails to consolidate below, then drop that we see are likely to be corrected, and the level of 1.55 the pair will continue. Therefore, the current situation on the market is very intense and should carefully monitor the dynamics of the pound against the U.S. dollar. Resistance for the pair is at 1.56 the next target after the 1.55 level will be the level 1.52 .

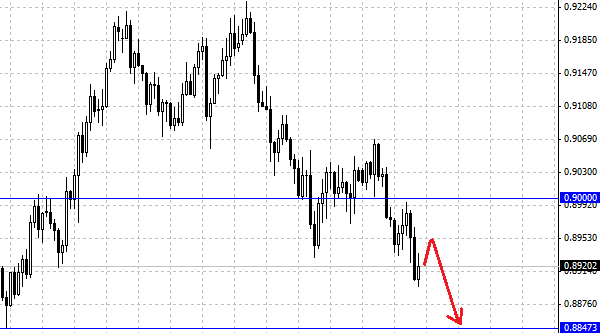

Shows a strong decline and the pair AUD/USD. After a bit of sludge near the level of 0.90, the Aussie swooped down, breaking support. Market participants are selling the Australian dollar and continue to do so as long as the pair will not appear at at 0.8850 . Further developments are likely to have a negative scenario. This is most likely we will see a rebound from the recent low, and after the fall of the Australian resume. The growth of AUD/USD is expected from the level of 0.8650, if you look at the weekly chart goes next level of support.

Social button for Joomla