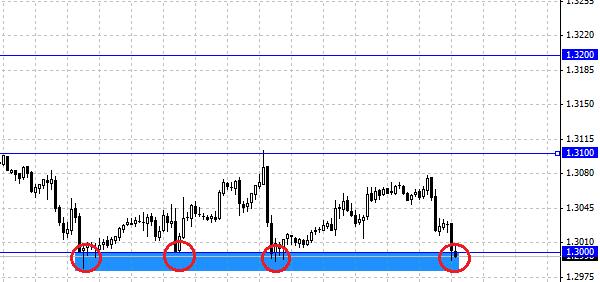

Before the opening of U.S. markets, it is possible to observe the strengthening of the U.S. dollar against other currencies. Since EUR/USD pair dropped to support at 1.30, this support does not always display their strength, and at the moment it will be a 4 dollar attempt to break it. Do not forget that the market moves in waves, a sharp increase in the dollar has pushed hard enough a couple of down, so we believe that before the euro starts to fall again, rollback should occur. The basis for this rollback just might serve as a level 1.30. Treyderam should closely monitor the movement of the pair near this level and the need to act - to open short positions if the euro will fall below the support level of 1.30 or buy the currency at current levels to 1.31 .

In the meantime, while the European currency is trying to maintain its position, the Japanese yen has been steadily declining. The increased strength of the dollar has helped the pair USD/JPY rise above 100 dollar. The main question now is - can it gain a foothold in the area above the level of 100 yen to the dollar? The very fact that such a strong psychological level is overcome, indicating that the uptrend USD/JPY pair is enhanced, and most likely we will see further growth of the U.S. dollar against the yen. The immediate goal for the pair is the level of 100.80, if the couple no longer effective it will be possible to observe the consolidation of the dollar to the level of 99 - 98.50 .

Double pressure on yourself experiencing the Australian dollar, because in addition to strengthening of the U.S. dollar has put pressure on gold prices. The Australian dollar has been declining for the second consecutive month. Inaction Bank of Australia only aggravates the prospects for the pair AUD/USD. Throughout the day, a pair of falls, and if the price of the Australian dollar will sink lower than the previous day, it will signal the continuation of the downward trend and traders should look for opportunities to trade opening on the sale. Long-term chart shows the pair slowly creeps up on his target at 0.90, at which consolidation may begin to higher levels, maybe even 0.95 . If you are trading Australian remember to follow the dynamics of the price of gold, which just raised the resistance at the 38.2 % Fibonacci retracement lines, so we believe that downside risks persist on these two assets.