The European currency is adjusted back to a level of 1.30 after the recent breakdown, downward pressure is constrained by market expectations of the ECB. ECB meeting should shed light on the future prospects of the euro, although we do not expect the ECB comments can change the overall downward trend in the euro, they can still provide temporary support to the European currency. It should be noted that Morgan Stanley analysts maintain a short position on the euro, while the EUR/USD pair dropped sharply after rising tensions in peripheral Europe. "Sustainable fall below 1.30 dollar now opens the way for the decline in the direction of our target level of 1.2800 dollars" - note in the bank. The weakness of the euro, and also indicates that the attempt to gain a foothold above the 1.30 level, though hosted on the closure of the day, but the movement stopped in this area. If after report ECB pair EUR/USD will overcome the level of 1.31, then we can talk in the possibility of reaching the level of 1.32, at which we believe will begin selling the new active.

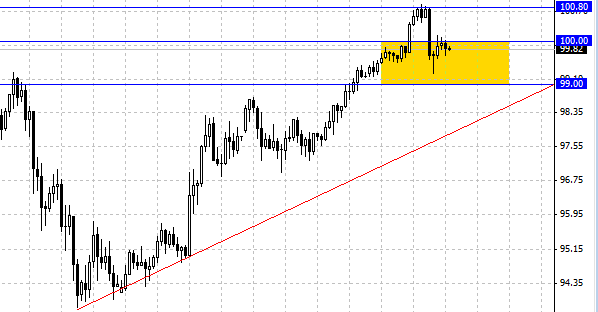

Other currency pairs are also frozen in anticipation of the signals from the European Central Bank. The Japanese yen has stopped growing and yet continues to move in the range of 99 - 100. The situation is similar in the Australian dollar which slowed the rate of decline and restrained support at 0.9050 . Also, the weakening of the U.S. dollar has had a news section, which showed more negative than positive. Especially disappointed investors index of business activity in the service sector, which was below analysts' forecasts.

Gold after a strong downward movement was restored to the level of 1260, at the moment it's trading in a narrow range of 1235 - 1265 dollars per ounce. If you look at long-term charts, we can see a strong and sharp decline in asset such dynamics discourage any desire to buy a "gold bar", so we keep our forecasts on gold and expect further decline in prices. Traders should monitor the level of 1200, the price has already punched this level, but failed to gain a foothold below. Consolidation below this level would signal a further decline, which will continue until the level of 1100 - 1000 dollars per ounce.