On Tuesday, during the trading U.S. dollar rose against the euro, thereby continuing strengthening. The EUR/USD closed the trading day at the same level at which it was opening day - 1.3260 . On the daily chart shows the pair remains in a tight range with the boundaries of 1.3300 - 1.3250 . Such dynamics proves once again that market participants expect the FED and the ECB speeches, and yet refrain from any action.

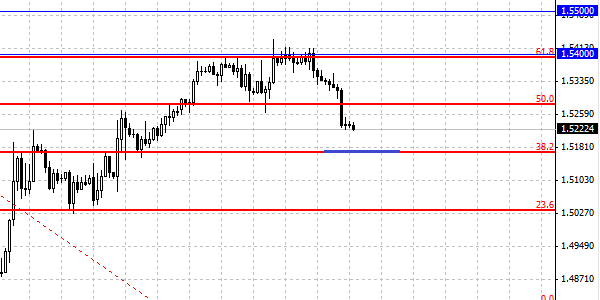

The pound was down against the U.S. dollar in anticipation of the Bank of England's MPC meeting, as investors prefer to close long positions. On Thursday at 11:00 GMT the Bank of England will announce its decision on monetary policy. We should not exclude the likelihood of surprises. The growth of the British economy by 0.6 % in the second quarter eased speculation as to what the Bank of England near the end of the current monetary policy. In case of additional evidence supporting fears pound can resume growth.

The Australian dollar fell sharply after the Governor of the Reserve Bank of Australia Governor Glenn Stevens, like, opened the way to a new lower interest rate. During his speech, which was remembered hints of policy easing, Stevens said that restrained inflation means that the RBA may, if necessary to lower the benchmark interest rate, which is already at a record low of 2.75 %.

Leading banks about what to expect from today's announcement FOMC.

BNP Paribas: According to our forecasts, FOMC will try to formalize all the information provided about the prospects of the head of the FED and the conditions for reducing the volume of QE3. Perhaps in a document to be said about that, presumably, it will happen later this year, will be gradual and depend on improved state of the economy and rising inflation towards the target level. Completion of the program is expected with a decrease in the unemployment rate to 7 %.

Credit Suisse: presumably, the emphasis will be made on the fact that the incentive policy continues even after the end of QE3; Bank of America: probably it will be noted that inflation remains low for longer than expected. This, and the clearly expressed intention to defend the established inflation target (ex. ProFinance.ru: 2 % against the current value of 1 %, which shows the indicators used by the FED) would signal a soft position FOMC.

JPMorgan Chase: probably, "apostates" will again be the head of the Federal Reserve Bank of St. Louis and Kansas. Note that, according to a survey 54 economists conducted by Bloomberg, none of them expects to reduce the volume of QE3 already at this meeting FOMC. Half of the experts predicted a decrease in incentive to 20 billion dollars per month for the September meeting.