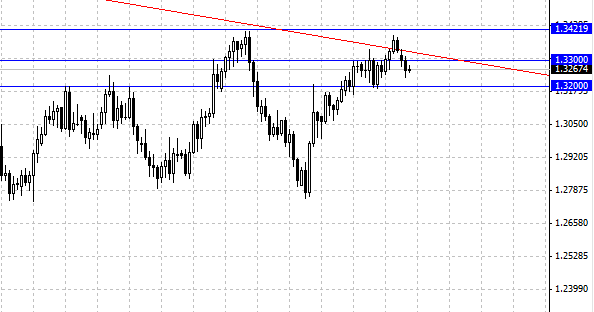

On Tuesday took place in the "dollar" bulls. Currencies continued to decline against the U.S. dollar. Since the euro fell against the dollar to 1.3230 level. Even the expected news on industrial production and positive economic sentiment could not stop the downward movement. Industrial production in the euro zone rose to a seasonally adjusted 0.7 percent in June on a monthly measurement, offsetting a decline of 0.2 percent the previous month, which was revised from 0.3 percent fall. Economists forecast that production will grow more rapidly by 1.1 percent. It also became known, the index of economic sentiment in Europe's largest economy rose to its highest level since March. A key indicator gave hope that a prolonged recession in the euro zone is coming to an end. Centre for European Economic Research ZEW reported an increase in the index to 42.0 in August, down from 36.3 in July, ahead of the growth forecast to 40.3 .

The dollar had U.S. data. Retail sales in the United States grew as expected in July. Experts note that the decline in the euro contribute to the expectations publication of the report on the euro area's GDP, which will be presented today. It's expected that in the second quarter, the eurozone economy was able to show growth, and interrupt a series of cuts, which is fixed for 6 consecutive quarters.

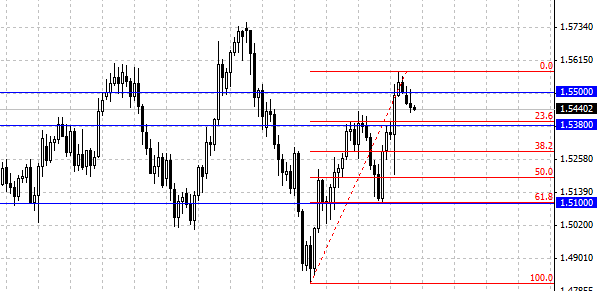

The British pound fell slightly against the dollar after data on price indices. GBP/USD is once again returning to the resistance 1.55 but was unable to continue to grow. During the day, the British pound showed a negative trend, and today continues to decline. The immediate goal in our opinion is the level of 1.5380 . The dynamics of couples will have an impact, no doubt, piece of news for the UK. Prior to the news traders should refrain from entering into transactions, economic data will give a signal about the future movement of the pair GBP/USD, and its worth the wait.

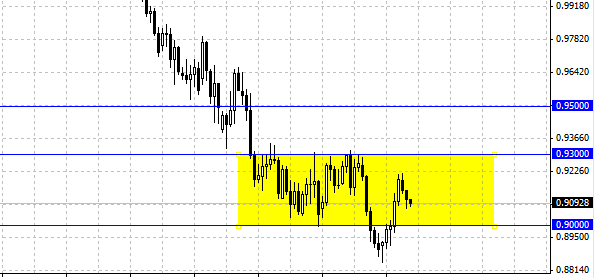

The Australian dollar reached 0.91 . A move below this level will open the way to 0.90 Australian, where the level of support. The overall dynamics depends on the strength of the Australian dollar, which is gaining momentum. Price fluctuations can cause economic data for the euro area. Resistance for AUD/USD is at 0.92 . We don't exclude the possibility of a trading range that will last for this and the following weeks.

Social button for Joomla