Since the beginning of the week the euro under pressure, show an increase in other currencies against the U.S. dollar. Drivers for the euro today could be the ECB Mario Draghi speech and speech Dudley and Dennis Lockhart, which will affect the rate of the U.S. currency. The rest of the foreign exchange market is influenced by the FED's statement made last week.

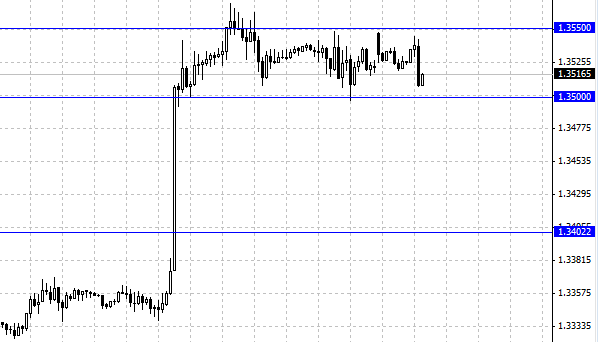

The EUR/USD began Monday with the decline, now the pair is trading at 1.3510 . It's worth noting that after the publication of minutes of the FED meeting and the rapid growth, the euro failed to progress beyond the market and formed a sideways movement. The range of flat market is 50 points, with the boundaries of 1.3500 and 1.3550, respectively. We believe that it's necessary to refrain from range trading and wait for the breakdown of one of the boundaries of the channel, as the chances of continuation of lateral movement in the current market situation is extremely small. From a fundamental point of view, the U.S. dollar is under pressure and is likely to continue the upward movement of the euro against him.

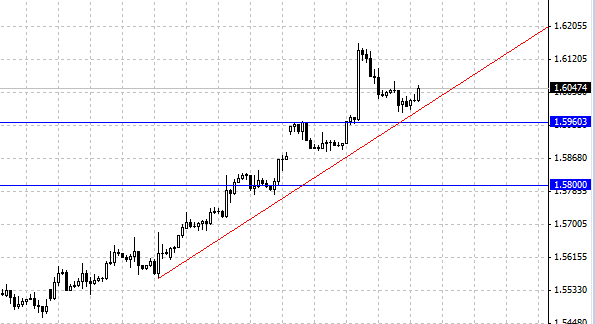

The British pound is growing after going below 1.60 the currency pair GBP/USD took a course to the north and continues to move in this direction. From a technical point of view, it can be stated a release from the support at 1.60 and continued an upward trend. The sharp depreciation of the British pound on Thursday and Friday is characterized by negative news and backgrounds consolidation factor that was to be expected after such a significant increase in prices.

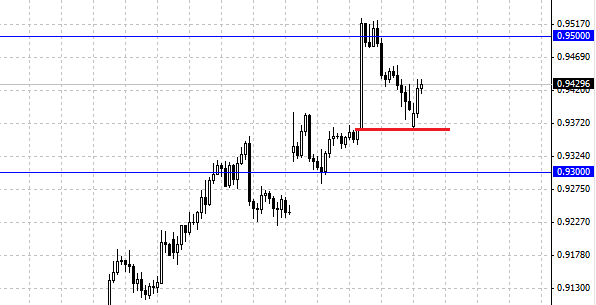

Australian dollar moves unidirectionally with the British pound. Therefore, the pair AUD/USD is also showing growth. It's worth noting that the pair opened daungepom, the level of opening came just at the level at which began weakening of the U.S. dollar after the FED statement. So to say there was a retreat from the technical and psychological level. The focus of the market resistance at 0.95 . Australian to be overcome for it to continue its upward movement and dispel the thought of continued downward trend. The inability to move beyond the level of 0.95 would indicate that the pair AUD/USD we saw, was the only consolidation movement within the global downward trend for Aussie.

Social button for Joomla