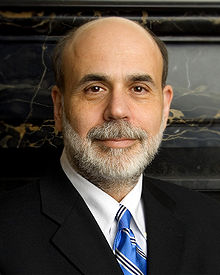

Summer is affecting traders’ activity. On Tuesday, despite good corporate accounts of American companies for the second quarter, the markets were decreasing until a kind man Ben Bernanke (a chairman of FRS) arrived. Of course markets were affected by the pressure and high inflation of Great Britain and low business expectations in Germany.

Summer is affecting traders’ activity. On Tuesday, despite good corporate accounts of American companies for the second quarter, the markets were decreasing until a kind man Ben Bernanke (a chairman of FRS) arrived. Of course markets were affected by the pressure and high inflation of Great Britain and low business expectations in Germany.

But there was one important idea that appeared after hearing Ben Bernanke’s ambiguous statement about a possibility of continuing and expansion of a current program of quantitative easing. It was just a reference to low rates of inflation decrease and US economy growth.

Such hint gave markets a pushup but not for a long time, since it was either a hint or just thinking aloud. The situation is really interesting, with markets ignoring economic indicators and reacting to another money printing, nobody believes in economy effectiveness.

Under the circumstances there is a general negative sentiment on the market, impeding quotations growth. EURUSD pair is in a narrow consolidation, approaching a resistance level of 1.2320. On Tuesday a rebound from this level took place. On Wednesday a second attempt may be made to climb above this level. In case of a failure a sale with short stop is possible. And if performed successfully a EURUSD may return to a trading range of 1.2320 – 1.2660.