Bidding on Wednesday, stir strong volatility and volume news background. Today everyone is talking about only one, the problems associated with the suspension of the U.S. government and the question of raising the national debt ceiling ended. The result is quite expected, at the last minute Congress decided that increases the U.S. debt limit, the government can now return to work fully. Also identified specific date, the United States can make borrowing until February 7, and the government will run until 15 January 2014. In financial markets, this agreement caused a rise in global indices.

The EUR/USD rose sharply to a level of 1.3635, breaking through resistance at 1.3600 . Despite strong growth, this trend may be short-term. Euro out of the side channel, but recent high 1.3645 has not been reached, so there is every chance that the pair EUR/USD will fall. News from America, of course, has stirred up the markets, adding positive for investors and traders, but do not forget about the systemic problems in the Eurozone. Recently, the following is only for U.S. problems, but now when the trouble was over, the market will once again closely monitor the state of the Eurozone. By the way, the data on the current balance of the euro area, which was published today, were worse than analysts had expected, the negative trend observed for many other economic data. Therefore, traders should proceed with caution, the positive effect of the news will remain just facts and figures, which so far do not indicate good prospects.

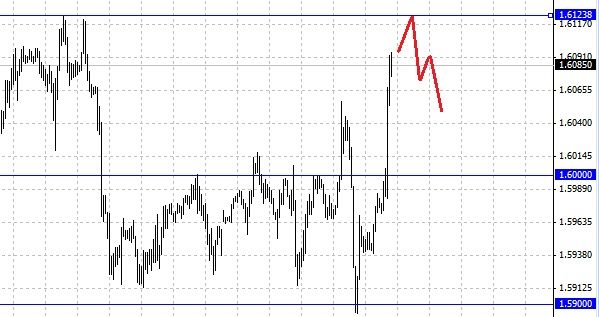

The British pound, as other riskier currencies rose. GBP/USD is trading above 1.6000, the pair is likely to be limited by the resistance level at 1.6123 . Yesterday the pound was not feeling well, unemployment in the UK is still above the target level and is 7.7 %. The sharp increase in prices should always be corrected or rolled back as a long entry dubious decision, it is better to try to play on the slide.

The Australian dollar is suitable to the level of 0.9600 . His breakthrough will give the bulls confidence and consolidate the position of a pair AUD/USD in total. The U.S. decision to give a good push to strengthen the Australian. AUD/USD pair is good, the slow progress towards the north, for 6 consecutive days, closing in the green zone. Unfortunately, the growth can not last forever, so investors and traders should think about the possible withdrawal of long positions.

Social button for Joomla