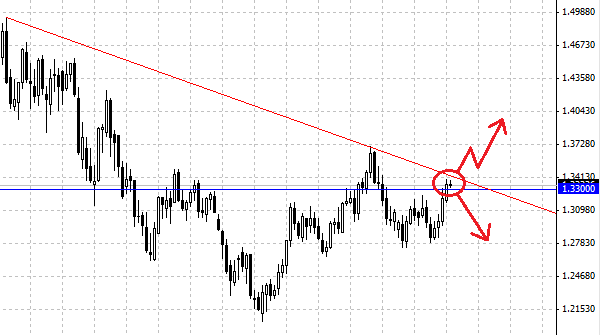

Will the descending trend on EUR/USD end?

EUR/USD pair has been falling for the most part of Monday. But it found enough support in the area of 1.33 to attract customers. The most interesting fact on graphs is that the market just formed 4 consequent hummers in succession, based on this level of support. Due to that we assume that the level of 1.33 will continue supporting euro. However if you look at the daily graph, one can bring strong arguments in support of line of fall of business activity on EUR/USD pair, which is passing the level of 1.34, and the descent of the pair confirms its existence. If the market can grow higher than that line of descent tendency, we assume that this market will become dangerous, and we will be able to see a rapid growth of euro.

We think that the catalyst to abrupt change of quotations towards a higher level will become the speech of chairman of FRS and words that he utters at the meeting later this week. If there is no word about ending the program of quantitative easing, there is a possibility that markets will consider this as "QE Forever", as they had done earlier and one can forget about US dollar. If that happens, euro will grow naturally.

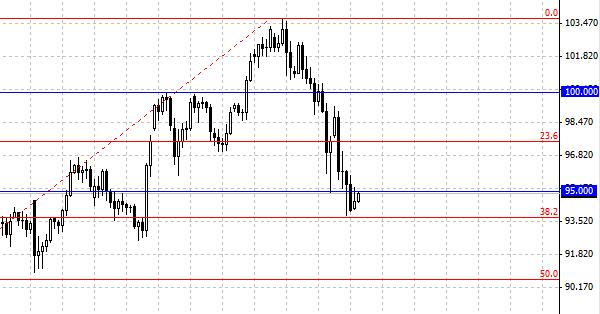

Meteorite shower near the level of 95

USD/JPY pair tried to consolidate during the session on Monday, but enough resistance was demonstrated at the level of 95 to push prices back. Because of that the market formed a candle meteor which is a nice sign. The market dropped lower than the level of 95, and now it seems that the market is just trying to check its resistance. Reaching this level looked as if it had been tested and now we should wait and see whether the pair be able to consolidate higher than 95.

But here are the main 3 problems with the pair: Nikkei index, Japan Bank and Federal Reserve system. One should also note that Japanese yen was one of the most changeable trading currencies for the last several months. It is necessary to watch Nikkei index, it shows the level of risk in Japan itself. Japan Bank was planning to lower the value of Yen, although currently we see the opposite, we suppose that the situation of the market should make them act. However, one should not expect any actions from Japan Bank, at least until the end of FOMC meeting, because after publishing the inform of FOMC this pair can fly up long before the Japanese awakening.