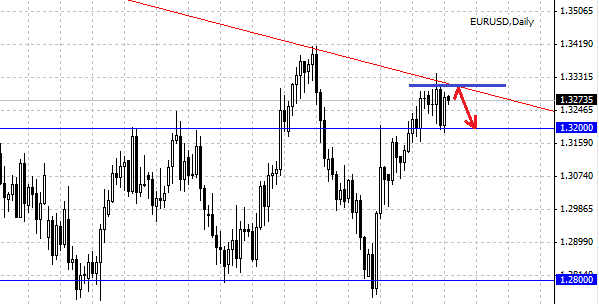

Over the past week, the U.S. dollar was feeling confident against other currencies, but report on the labor market on Friday, the dollar has seriously shaken. So at the end of the week EUR/USD pair almost did not budge. Most of the losses of the euro was able to play on Friday. The pair of almost 100 points, and in just a few minutes. From a technical point of view, we continue to see a sideways trend for the pair EUR/USD with the boundaries of 1.32 - 1.33 . It's worth recalling that the downward trend line passes through the 1.33 level in the euro area is closed. We expect a decline in the euro this week with the immediate goal of 1.32, on a break of this level will open the way to 1.30 .

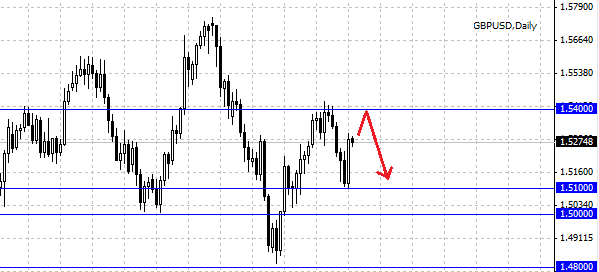

The British pound rose on Friday in relation to the U.S. dollar after strong data on construction PMI. Activity in the construction sector in the UK in July jumped to its highest level in more than three years amid a sharp revival of activity in the housing. Undoubtedly, the support of the pound and had a report on the U.S. labor market. The pound closed near the resistance area around the level of 1.53 . Although the pound on Friday showed good growth on the week still decrease pair GBP/USD. We maintain our forecast of the further weakening of the pound, but do not rule out growth to levels 1.53 - 1.54 . Level of 1.51 at the moment is strong support, which will constrain pair falling.

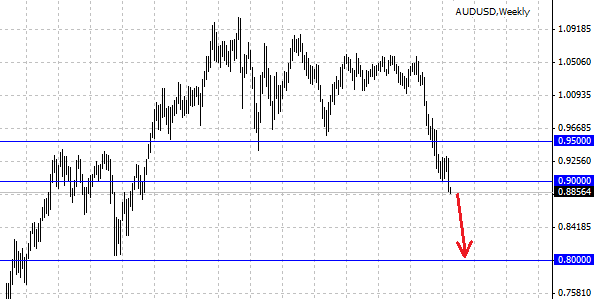

The Australian dollar fell to a three-year low on expectations that next week the Reserve Bank of Australia may lower the level of the discount rate. Earlier, the head of the RBA Governor Glenn Stevens found insufficient depreciation of the Australian dollar by 12 % over the past three months, so it's advised of the possibility of further interest rate cuts. In this regard, investors see a 95 % chance that the RBA will cut interest rates by a quarter percentage point to 2.5 % at the meeting, which will take place on August 6. This will put additional pressure on the pair AUD/USD. Resistance located at the level of 0.90 is by all means possible to restrain the growth of the pair. In the future it's expected further weakening of the Australian. If you look at long-term charts, the Reserve Bank of Australia may want to reach a level of 0.80, that there was a strong support during the bull market began in 2009.

Monday will feature such big news as retail sales (AUD); non-manufacturing purchasing managers' index ISM (USD); PMI index in the services sector (GBP).

Social button for Joomla