That day came, so long expected by market participants. Today will be the FED meeting, which will provide new information about the quantitative easing policy and the further development of the U.S. economy. On Tuesday, the major currencies traded restraint, keeping almost neutral. In general, at the end of the day the dollar suffered minor losses, but almost all currency pairs remain in a narrow range since Monday. Other important news today, waiting for data on the British pound.

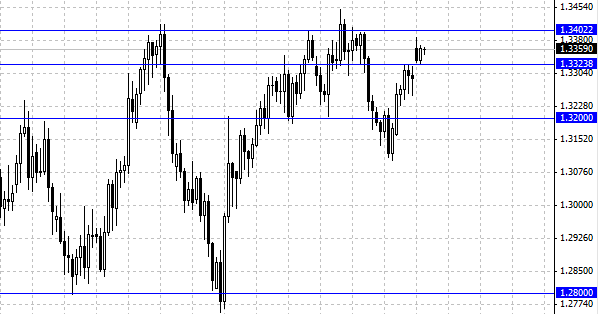

The EUR/USD showed a rise on upbeat data on business activity in the euro area and Germany. The European currency is trading against the U.S. dollar within a daily candle formed on Monday. All eyes are on today's FED meeting. What to expect from the meeting? - The opinion of Goldman Sachs.

The first thing the bank's analysts say, is that the FED will decide on the decline in purchases of government bonds. Closing a program of purchases completed in the second half of 2014, will be the key indicator of the level of unemployment. When the level of unemployment, and 7 % lower purchase program will collapse. The best action would be to give the FED more or less clear stance on monetary and fiscal policy - analysts say Goldman Sachs.

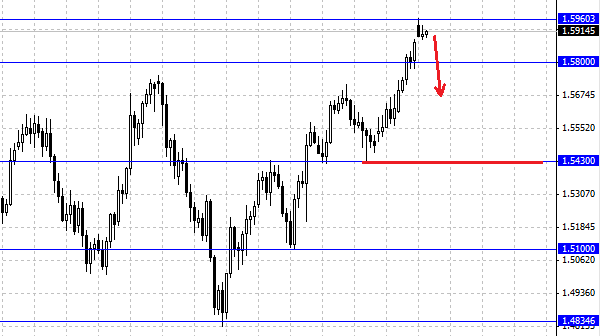

The British pound was unable to stay on the highs reached on Tuesday. Interesting opinion has a bank BNP Paribas. Bank strategists believe strongly overvalued pound against the U.S. dollar and against the euro. A model built on the basis of the correlation between exchange rates, interest rates and stock market indicates the weakening of the pound in the near future. Moreover model indicates a fair level for the currency pair GBP/USD and EUR/GBP, they are equal to 1.5430 and 0.8640, respectively. Bulls, bulls British currency, hardly keep their positions. The British pound by speculating transactions reached a level not commensurate with the economic situation and does not reflect the real situation. In conclusion, the experts say that the market is a high risk of a sharp decline in the pound. The data, the pound as the euro - is in limbo, traders and investors are inactive in anticipation of the FED meeting.

Social button for Joomla