Many traders start the career from the Forex market, even without suspecting that through well known dealing centres it`s possible to work with CFD on commodities (raw materials) which price dynamics better submits to classical laws of supply and demand.

Generally, CFD is a financial derivative in case of purchase/sale of which the parties stake on growth or decrease of a basic asset value then they make mutual settlement: the market participant who has made the right forecast gains income, while his contractor fixes a loss, and the broker or the dealing center charges the fee for the fact that has given an opportunity to conclude the deal.

Thus, «contracts for difference of the prices» on the economic essence have no differences with the standardized settlement futures upon which sale/purchase there is no delivery of a real physical asset. Unlike the timely contract which minimum volume often is very heavy for the beginning speculator, CFD on commodities allow working at small accounts.

CFD on agricultural goods

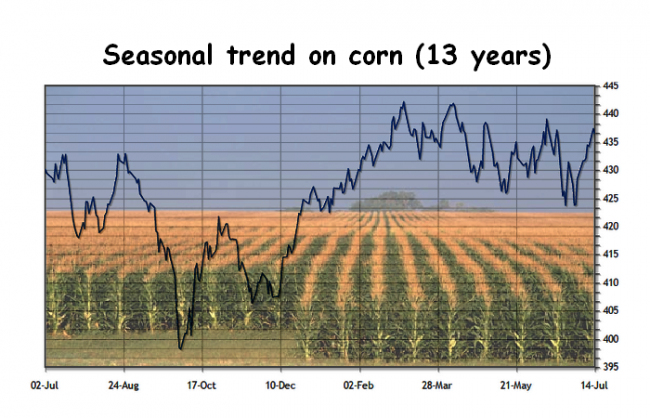

Contrary to stereotypes which say that the most popular speculative asset is crude oil, traders much more often show positive results in case of trade in agricultural raw materials. Everything is very simple: dynamics of similar goods has pronounced seasonality and depends on weather conditions, in particular, the most predictable goods are grain and bean – wheat, corn, oats and soybeans (and also their derivatives).

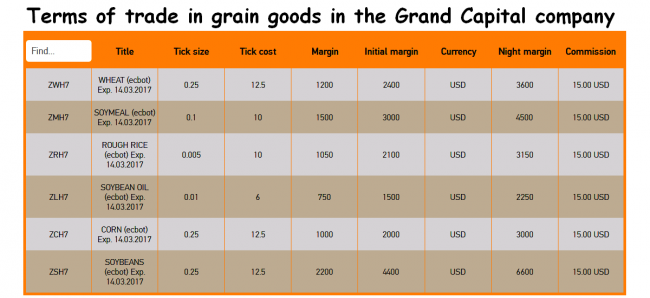

Considering the fact that CFD take quotations of the futures of the same name which are trading on CBOT platform as a basis, they are most often presented under similar tickers in Forex dealers terminals: soft wheat – ZW, corn – ZC, oats – ZO, beans – ZS.

In comparison with Forex pairs, CFD on commodities much more simply for analysis, in particular, for drawing up forecasts we recommend to adhere to the simple instruction at first stage of which you should reveal a seasonal component.

As a rule, similar calculations come down to simple averaging of the prices of the chosen asset for different years, for example, if we need to estimate a seasonal 5-year May trend, each element of a required number of dynamics will be calculated by the following formula.

As a result of the elementary calculations (which, in turn, can be automated by special indicators) we will obtain the required seasonal tendencies allowing to estimate quickly the preferable direction for transactions namely:

- If the average prices grow throughout the designated interval –we buy an asset only;

- If the synthetic indicator decreases – we sell contracts.

The advantage of similar estimates in comparison with the analysis of each factor separately (for instance, a research of market participants moods during the sowing time) is that they allow rejecting all insignificant events. As a result, on graphics dynamics of demand for goods according to the season and to concrete months is visible at once.

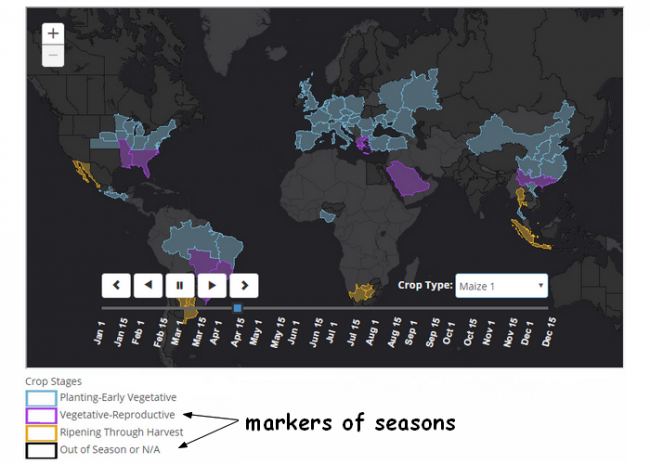

Nevertheless, if there is a need for specification of season « borders», you may use the cards provided by specialized resources, for instance, by geoglam-crop-monitor.org. Experts of this project specialize in corn, rice, wheat and soybeans.

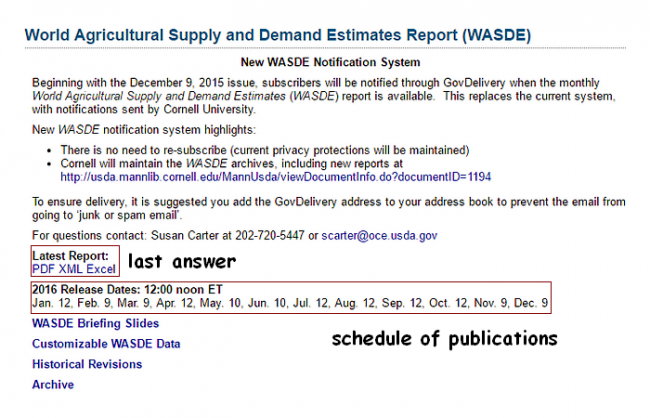

At the second analysis stage you should estimate the current balance of supply and demand, at the same time it is about a real situation in the market, but not exchange volumes. To make conclusions objective, it will be required to compare forecasts of a world harvest, raw materials consumption, and also the entering and final stocks for the current season.

On grain this information can be obtained from several sources at once, the first (and the most objective) from which is a report of WASDE from the US Ministry of Agriculture (an assessment of world demand and deliveries). It`s published once a month on the official site of the ministry.

We may treat the indicators presented in the report differently, but in the course of the analysis of CFD on commodities it is enough to adhere to the simple principle: if following the results of a season experts expect increase in stocks – probably reduction of prices, but if the dead stock of grain must be reduced – growth of quotations is possible.

The second source of information is a report of the Food and Agriculture Organization of the United Nations (FAO) which also appears once a month and covers information on all countries and regions.

It is necessary to use the obtained information as one more filter, for example, if seasonality indicates purchase of wheat, but to all appearances following the results of a season stocks on farms and warehouses will increase – reasonably to refuse long positions, or, at least, you must reduce risks (to reduce transaction volume).

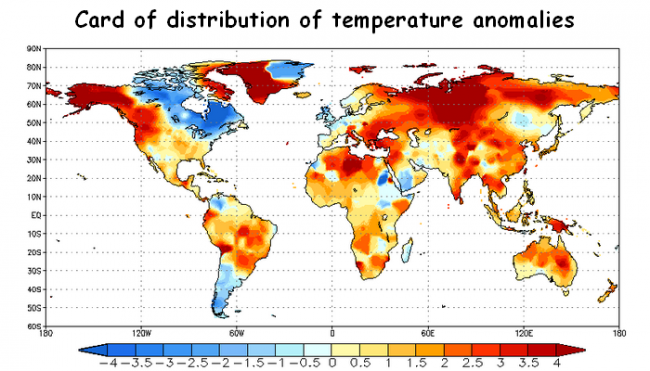

Starting the third analysis stage of CFD on commodities of the agricultural sector, it is necessary to study the current weather conditions. Perhaps, it is the most difficult stage of researches for beginners, as basic knowledge in the field of agriculture will be required. The matter is that cultures differently «react» to fluctuations of humidity and temperature, for example, long May and June rains negatively affect a condition of wheat, but the similar weather isn't so critical for soybeans.

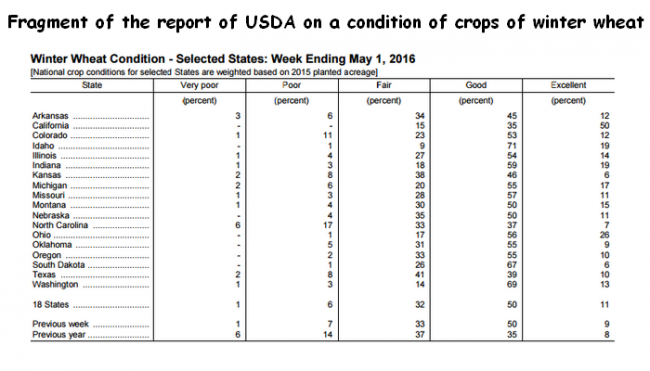

If you want to have at least an approximate idea of a situation on fields in the USA, we recommend watching estimates of the Ministry of Agriculture about a condition of seeds. They are published in the separate report of National Service of Agricultural statistics (USDA) which is called «Crop Progress».

Estimations of a condition of seeds are separated on several categories on pages of the report: Very poor – very bad; Poor – bad; Fair – normal; Good – good; Excellent – excellent. Depending on what percentage categories prevail, it is possible to draw a conclusion on the influence of the current weather conditions on a concrete cereal.

At the fourth stage of the analysis, it is expedient to construct a basic technical marking as CFD on commodities very not bad fulfill levels, and moving averages rather precisely show the prevailing tendency. As a rule, concrete entry points are identified on «technique».

The special attention should be paid to a news background as, unlike information stream on Forex, data on important events, such as restriction for import/export, increase in duties, etc., can have a significant effect on agricultural products market participants moods.

CFD on commodities of «soft» category

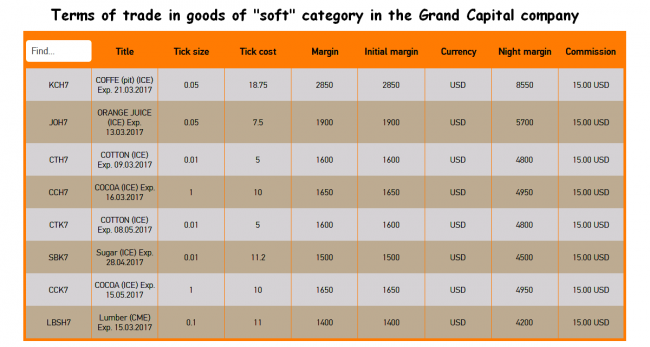

So-called «soft goods» − cocoa, coffee, sugar, cotton, wood and orange juice enjoy not smaller popularity among traders. The simple fact tells about it − nowaday it is possible to trade in similar CFD in many large and well known dealing centers.

Unlike grain assets which are the subject of reports, provided by US Ministry of Agriculture, the listed goods are little more difficult in analyzing, therefore, «we go through briefly» on each of the mentioned tools and we will consider their main features.

Cocoa beans are one of the most popular food exchange products, futures for which is listed on platforms in New York (ICE division) and London. Dealing centers most often presents CFD, which basis is quotations in US dollars (for a ton).

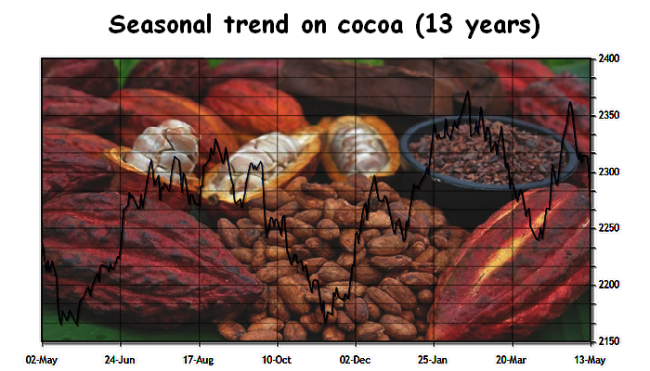

As well as all other CFD on goods, these contracts should be analyzed in the context of seasonality, as the future harvest of cocoa depends heavily on what weather conditions «ovaries» on trees were formed and also drying of beans was carried out.

The matter is that the main suppliers of cocoa beans are the African countries − Côte d'Ivoire and Ghana which often face the unfavorable climatic phenomena – a drought and the seasonal wind (Harmattan) from the Sahara.

Besides, due to underdeveloped infrastructure in the Western Africa, delivery of beans to ports are often delayed in connection with showers which stably turn earth roads into the liquid dirt. Thus, moods of traders and institutional players depend on at what stage of a season weather anomaly was watched.

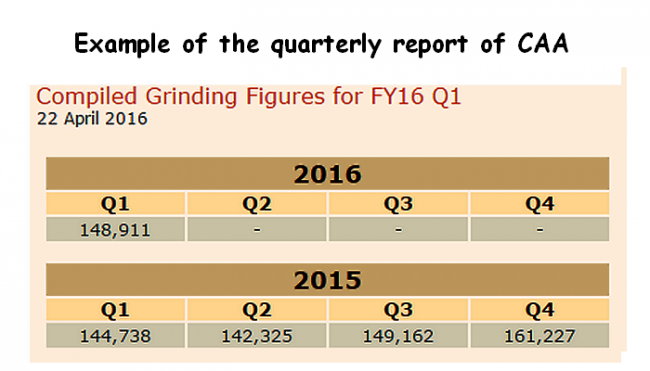

As for information sources on volumes of supply and demand in the physical market, we recommend paying attention to quarterly reports of Asian and European Cocoa Associations (CAA and ECA) which pages show the statistics of beans processing.

CFD on commodities can't also be considered without emphasis on coffee − one more product popular and loved by many traders. Statistically, the main output of coffee grains (arabica and robusta) is the share of Latin America (Brazil, Colombia) and Southeast Asia (Indonesia, Vietnam), therefore, the prices of the relevant exchange contracts significantly depend on the weather in the listed countries.

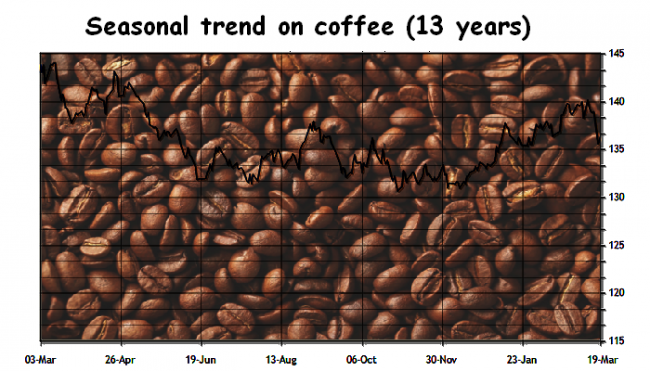

If to estimate seasonal factors, then within the analysis of tendencies in the coffee market close attention should be paid to two main sites: 1. from December to February (inclusive); 2. since March to the middle of July (if more precisely – till the third decade of the month).

Throughout the first interval, the coffee prices enjoy support as at this time the harvest in Brazil ripens (and some other Latin American countries), that is large market participants are in tension, and the offer of grains in the world market is reduced.

At this stage, considerable impact on the prices is exerted by various force majeurs which can damage to plants, for instance, frosts in mountain areas, a severe drought during blossoming and growth of fruits or spread of plant pest. Considering the fact that during the season at least one of the listed factors has an effect, as well as in a case with other CFD on goods, in the analysis of a situation it`s recommended to watch news and weather fixedly.

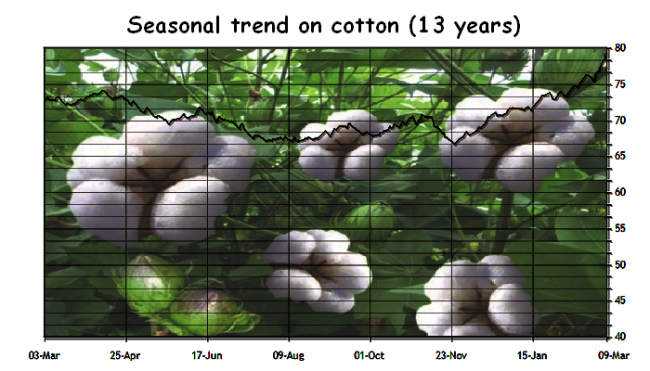

A cotton is the following important goods available to trade in many DCs. Unlike the listed above assets, he is used mainly in consumer goods industry, but not food industry, though cotton oil is rather popular in Asia.

In this case, the trend depends mainly on a stage of agricultural works in supplying countries, for instance, in India which tropical climate, contrary to popular beliefs, has pronounced seasonality because of monsoonal rains. In general, cotton gets strong support since the end of November and to the first March days.

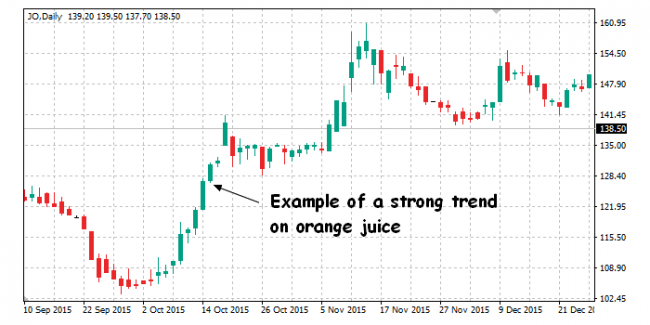

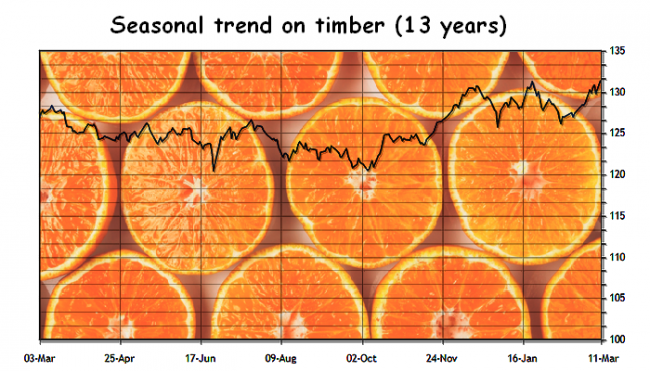

Orange juice (the frozen concentrate) and timber are not less interesting CFD on commodities though small traders trade in them seldom. The matter is that the similar markets are considered «thin», the most part of trade time their liquidity rather low, therefore, it is difficult to work at them within a day, and it is impossible scalping in general.

Nevertheless, for medium-term and long-term strategy these contracts give ample opportunities as low-liquid goods very sensitively react to news of real sector, in particular, orange juice promptly rises in price after the publication of negative estimations for a harvest of oranges in Florida.

Such information is regularly published by the US Ministry of Agriculture and department of a citrus of Florida, therefore, there is no deficiency in news, on the contrary, knowing the date of the publication of the next report, it is possible to conclude a good deal for purchase/sale of a concentrate in time.

Besides, you shouldn`t also forget seasonal factors as the orange juice market depends on a stage of an agricultural cycle on plantations in Florida and California, and also on dynamics of supply and demand. For instance, juice often rises in price on the eve of Christmas holidays and at the beginning of the academic year, as in the first case sales in shops and restaurants increase, and in the second schools and universities conclude contracts for delivery of drinks for lunches.

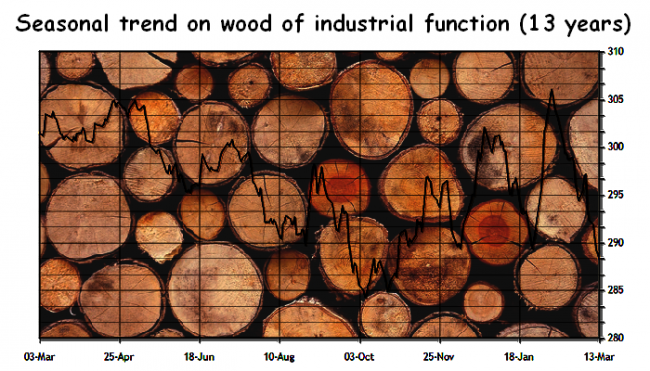

The similar principle is being affected by the CFD on commodities of building purpose, as the offer of industrial wood considerably increases at the beginning of spring − the logging companies start the capacities which are standing idle in the winter. Besides, the prices of timber depend on tendencies in real economy – the more construction licenses the companies get, the demand for wood is higher, and it means, as derivative financial instruments begin to grow in the price.

CFD on commodities of mining industry

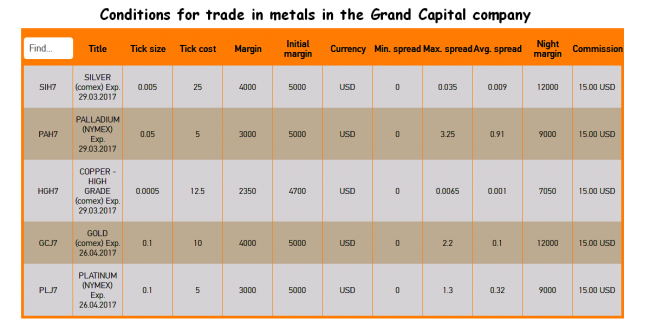

We have just considered assets with pronounced seasonality, as you may notice, these are mainly agricultural raw materials which offer depends on a stage of field works. Nevertheless, nature provides to traders chance to earn not only on an agriculture, but also on minerals, among which metals enjoy special popularity.

CFD on commodities taken from the earth are meant not only valuable metals (gold and silver), but also industrial metals – aluminum, zinc, copper, nickel and platinum.

The main difference of metals from agricultural raw materials is that their prices depend mainly on balance of supply and demand in real sector (in construction, mechanical engineering, metallurgy, instrument making, etc.), but not the weak controlling seasonal factors.

Certainly, seasonality has also an effect on the market of metals, but it is explained not by a stage of certain works on mines or plants, but business cycles and weather on the main trade maritime routes. As an example, it`s possible to give a situation with a supply of ores from Australia which can be broken and frozen by strong typhoons and hurricanes in water areas of Pacific or Indian Oceans.

Similar hindrances regularly arise also at the Chilean exporters, as Chile (the largest copper supplier) is cut off from neighbors by the Andes ridge in the east, and all transport connection of the country with contractors is carried out only by sea.

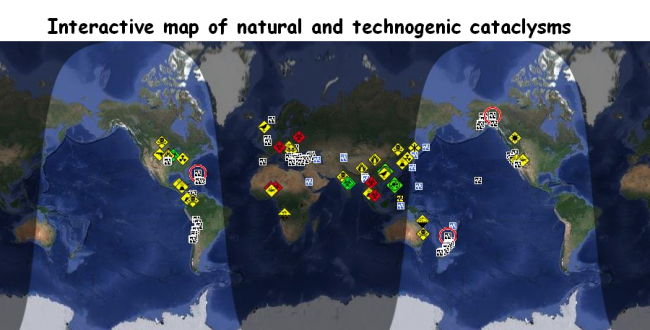

Unfortunately, news portals publish information on the approaching hurricanes too late, and similar messages can be ignored by the majority of news resources in general. Therefore the small private trader significantly loses to large market operators in decision-making speed, and is quite often forced both to buy CFD on metals too expensive, or he doesn't understand what occurs in the market at all. The hisz.rsoe.hu resource helps to avoid similar problems.

Information on all cataclysms including to hurricanes which prevent to transport industrial metals ores is traced on this map in real time. And as we talking about natural disasters, it`s not superfluous to remind that the prices of orange juice also depend on hurricanes as plantations in Florida are vulnerable to the tropical storms.

As for other information which should be taken into account before purchase/sale of CFD on commodities of mining sector, it is possible to give only one advice – you keep watch over macroeconomic statistics, especially across the USA and China as demand for metals depends on the current situation in real economy, in particular, market players rather sharply react to reports on:

- industrial output volume;

- GDP rates;

- the number of the sold cars;

- dynamics of building sector.

By the way, even the copper price which is associated with the electrotechnical industry by many speculators, significantly depend on tendencies in building – housing and industrial.

And as the conclusion …

In general, CFD on commodities are more favorable for the skilled trader, than currency pairs as have several important advantages.

Firstly, it is much simpler to analyze them from the point of view of the fundamental analysis, as in this case a lot of things depend on supply and demand in the real market. It is much more difficult with currency − monetary actions of the Central Bank, foreign policy and the other badly predicted factors influences its rate.

Secondly, quotations of contracts for difference duplicate the futures prices which, in turn, are nominated in US dollars. This circumstance considerably simplifies a decision-making algorithm as the binding to USD allows comparing a real picture on different assets. In the foreign exchange market, especially at trade in cross-pairs, it is necessary to work fairly to reveal and eliminate price «white noise».

Thirdly, CFD on commodities have pronounced seasonality which considerably simplifies the process of search of entry points into the transaction. To be fair, it is necessary to notice, similar tendencies are fulfilled not bad on currency pairs, but in case with goods the drawn conclusions are often coordinated with the result of the fundamental analysis.

Fourthly, the modern information resources, profile blogs and forums provide full support to the traders and investors trading in commodity assets, in particular, news, statistics and analytical reviews. In particular, the community of farmers are especially useful in this matter, as it is possible to learn about the approaching problems in them long before official resources, for instance, the US Ministry of Agriculture informs in the official report about the deterioration of seeds.

As for CFD shortcomings on goods, they are absent in classical understanding, the only thing that it is possible to consider as a negative factor, so it is rather high threshold of an entrance in the transaction (in this case the cost of one tick is higher, than on Forex). But it is not a hindrance for skilled players, of course.

Social button for Joomla