Many beginning traders sincerely believe the highest volatility is inherent in currency pairs, but it is one of the most popular errors as really powerful trends are often created by the CFD market on non-ferrous metals.

To be fair we will note, about 10 years ago many private traders couldn't earn by CFD on non-ferrous metals as the corresponding futures, circulating on COMEX and London Exchange, are one of most «expensive» (they have a high cost of a tick and strict marginal requirements).

The situation began to change cardinally after the crisis of 2009 when the large dealing centers, offering in addition to currency pairs the special contracts on a difference of the prices of underlying assets (Contract For Difference - CFD), began to enter the retail market of financial services.

At first, similar contracts were used for generation of profit from rate fluctuations of popular shares, but later it became clear the raw market gives much more opportunities both for speculative earnings and in respect of forming of long-term investment portfolios.

Now CFD on non-ferrous metals are in the specifications of many Forex dealers, at the same time their main distinctive feature is the partitive lots thanks to which the private trader can open positions, having small seed capital.

General theory

All metals are divided into two big groups – ferrous and non-ferrous. In particular, the iron, manganese and chrome (the last option disputable, but market specialists adhere to such classification), and also all alloys as a part of which there are listed elements referred to the first category.

According to the official statistics, ferrous metallurgy produces about 90% of all products made in an industry, therefore, the logic prompts in the stock exchange market futures for iron ore and rolled iron shall have special popularity.

Nevertheless, the bulk of steel delivery contracts concludes directly between the supplier and the buyer (passing the exchange), therefore, the liquidity of the futures market leaves much to be desired even now. For the same reason, brokers don't hurry to implement the CFD on non-ferrous metals, for instance, on iron and steel – there won`t be demand from clients for them, and the risk will increase multiply (because it`s very problematic to hedge a cumulative position).

The situation is absolutely different with non-ferrous metals. Let's remind, all metals on which surface the thin oxidic film protecting an element from the further impact of aggressive environment is formed belong to this category.

In the exchange market, the special popularity in category CFD on non-ferrous metals have gold, silver, platinum, palladium, copper, aluminum, zinc and nickel. As we devoted the separate overview to the «jewelry», today it will be a question mainly of industrial metals without which the life of the modern person is unimaginable.

CFD on copper – follow the electronic industry

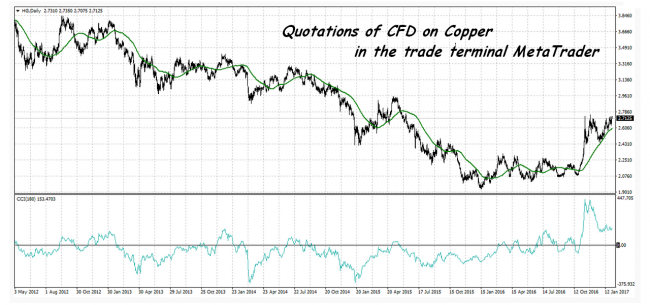

No doubt, the copper is the most important and popular (from the speculative point of view) non-ferrous metal, provided in the majority of point-of-sale terminals under HG ticker. This tool is attractive, first of all, by «technical skill», therefore, many traders successfully trade CFD of the same name, without taking into consideration the fundamental factors.

In our opinion, the technical analysis is the ideal assistant for short-term traders, but if decisions are made on charts of the senior order (from H4 and more senior), then it is necessary to consider the base after all, and, therefore, it is better to begin with studying the map of deposits.

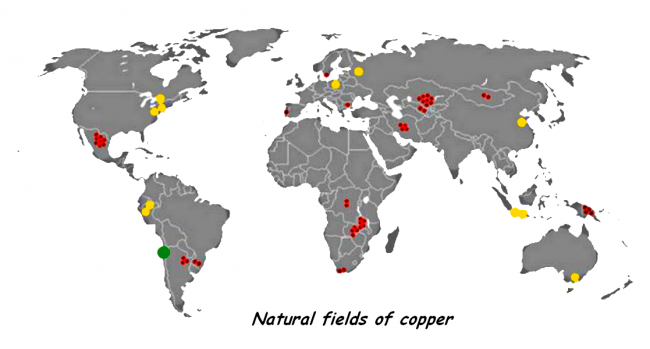

As you can see, the richest deposits of red metal are in Chile, therefore, events in this country directly impact not only on the actual supply-demand balance in the real market but also on actions of speculators. As such important news may be:

- Press releases of large corporations concerning intention to open/close mines;

- Strikes;

- Messages concerning assesses or cancellation (decrease) of customs duties;

- Devaluation of Chilean peso;

- News about earthquakes and mudflows (natural cataclysms can paralyze work of mines - the Chilean deposits are in the earthquake zone), etc.

If a complete calm of the news, the direction of medium-term and long-term trends of CFD on non-ferrous metals may be done by China – the largest producer of electronics, wire and other products in which copper is the main component.

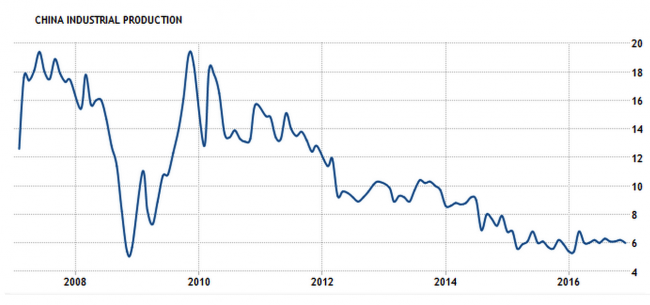

As a rule, copper price rises against the background of the quick growth rates of industrial production, and the market enters a bear phase after a deceleration of the Celestial Empire economy. For identification of the mentioned trends, Industrial Production indicator is usually used.

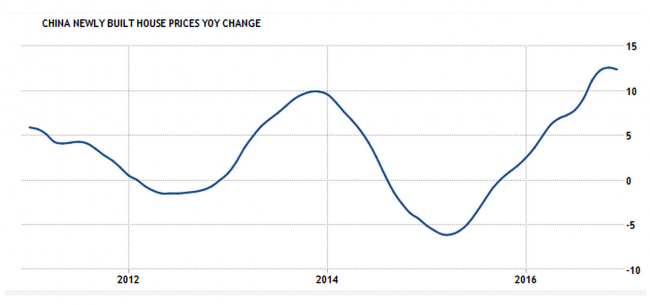

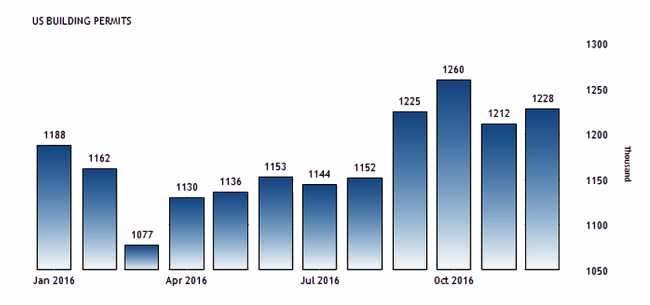

Besides, the «copper» prices strongly depend on a situation in a construction industry as in the case of construction of new structures a lot of metal is required for the creation of electric wire. Certainly, indirectly this demand reflects in Industrial Production, but for more correct estimation it is better to look at a «Newly Built House Prices» public indicator, which reflects moods in the real estate market.

The index is higher, the market becomes more attractive to a construction of new houses. If the indicator falls − it is a strong indication of industry stagnation, and in such situation, builders will use rather old warehouse stocks than to place new orders for materials.

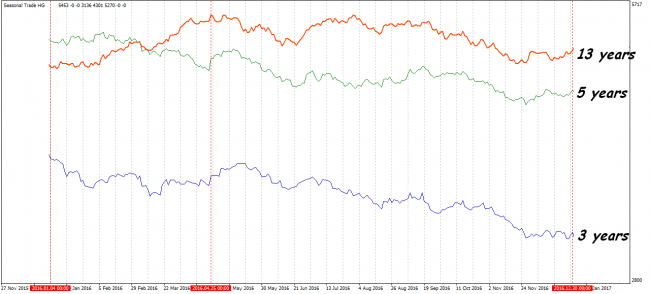

And one more important factor which needs to be considered in the case of trade by CFD on non-ferrous metals, in particular, − on copper, it is connected with seasonality. Let's remind, this term means the tendencies repeating almost an every year. As a rule, similar regularities are created because of climatic factors, actions of investment funds and production corporations (a situation when the company orders for materials in one and the same season, as an example).

As you can see, copper is in the seasonal demand from the middle of November till April 25, and sales are often since August 1 till November 15. The market microtrends are also created in May, June and July, but the probability of their fulfillment leaves much to be desired.

Certainly, seasonality is not Graal and not a panacea from all «trading» diseases. Only at first sight, it seems that it is enough to purchase/sell an asset during specified periods and the market simply have to move in the necessary direction.

In «ideal» it is necessary to combine seasonality, the listed above fundamental factors and a technical marking (for instance, the direction of moving average, the value of oscillators, etc.). Only the complex analysis will allow estimating precisely the current balance of forces and potential of movement.

Aluminium – winged metal

CFD on aluminium take the second place after copper in popularity. This metal is widely used in all industries, in particular, it uses in the production of the construction materials and constructions (in North America similar demand is about 20% of all consumption), cables, packaging materials, ocean ships, chemical reactants, but the biggest expense is the share of a space industry.

The matter is aluminium constructions are one of the easiest, therefore, along with the titan, they became the integral component of planes and spaceships. Unfortunately, CFD on titanium doesn't exist, therefore, you can trade only of Al.

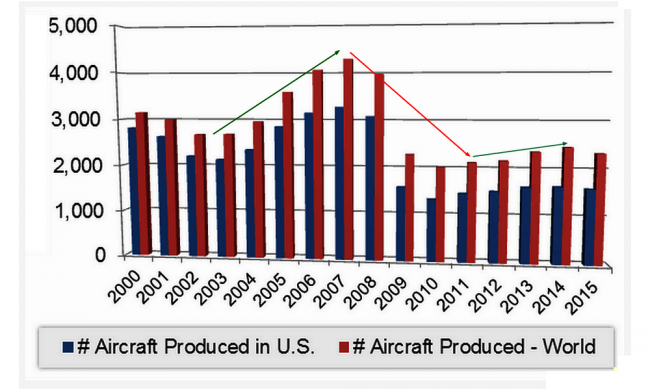

On a chart above is the dynamics of the Aircraft production in the USA and in the world in general. As you may notice, industry «peak» was reached in 2007/2008, then against the background of crisis the amount of release it fell twice. This tendency also became «guide» for the aluminium market.

Of course, it`s not reasonably to rely on annual statistics in case of the making speculative decisions, therefore, we recommend to consider data which are monthly published by U.S. Department of Trade and Commerce. Besides, important information can be found in the quarterly statements of such space giants as Boeing or Airbus.

It should be noted in the future (over the long term 15-20 years) in the market of aluminium the new super-cycle caused by development by mankind of the Solar System can begin. Indirect signs of this trend are noticeable already now – even the Boeing company, long time specializing mainly in the production of planes began to be engaged in the assembly of spacecrafts. For that matter the development of other corporations which were initially created for an exit out of limits of a terrestrial orbit (for instance, SpaceX).

As for other industries for which aluminium is important, the attention should be paid only to construction sector of the USA and Canada. All other spheres impact weakly on the market, in addition, secondary conversion of metal became popular now.

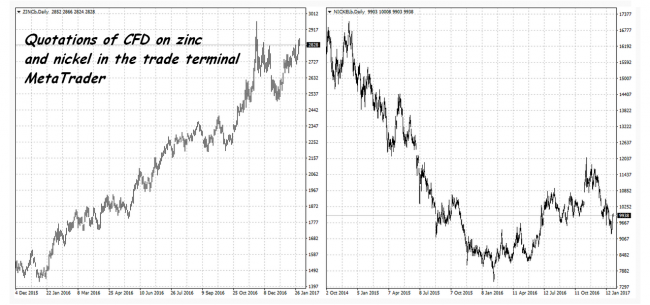

CFD on zinc and nickel

If copper and aluminium are at the specification of many dealing centers as CFD on non-ferrous metals, then «contracts for difference» of the zinc and nickel prices meet less often. It`s a great luck – to see the mentioned assets among trade instruments.

Certainly, so low popularity is caused by objective factors, first, on the market of nickel and zinc very few news and analysts are published, secondly, spreads under these contracts are rather high, and, thirdly, their prices seldom deviate a general «commodity» trend.

Nevertheless, if to work long-term, the quite good hint about future dynamics of zinc and nickel can be received frommetallurgy, electro technical industry and automotive industry, in particular, Zn is widely used as protective coating for iron details and is an indivisible element of some alloys.

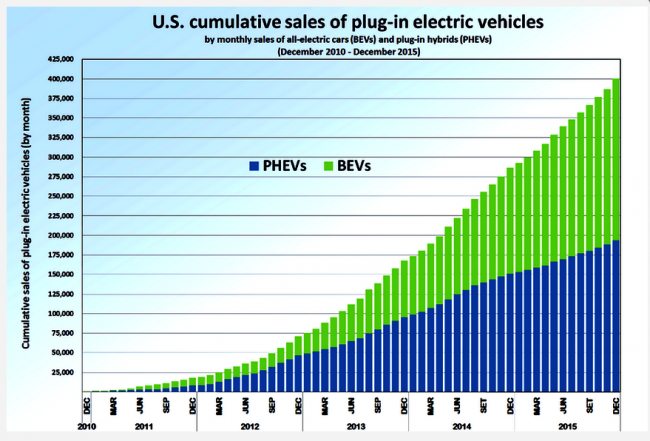

The situation with nickel even more interesting as it is used in the production of lithium-ion accumulators which are the integral detail of electric cars. It`s not a secret the fact that now many developed countries put legislative «obstacles» for cars with internal explosion engines and encourage the development of alternative power engineering, therefore, in the future demand for them will only increase.

If to speak about the medium terms of zinc and nickel, then their prices often depend on the current situation with deliveries, in particular, when the deficit is in the physical market (demand exceeds the offer!) – speculators push quotations to new maxima.

We sum up the results

As you may notice, CFD on non-ferrous metals are rather interesting tools as in the long term their prices are under the real laws of the demand and supply, in particular, copper follows the market of electronics, aluminium depends on «aero space», zinc is inseparably linked with metallurgy, and the future of nickel can solve the market of electric cars.

Unfortunately, the simple trader not always manages to obtain operational information on the relevant sectors, therefore, many people just refuse fulfillment of the fundamental analysis. In our opinion, it is a serious mistake as it is necessary to develop constantly.

Let's separately note in the process of decision making it is extremely undesirable to rely only on one analysis type, even within this overview we placed emphasis on seasonality and the base, and there is at least informative «technique» which gives hints on many questions.

If to speak about obvious shortcomings of CFD on non-ferrous metals, they not much differ from all other platforms and the exchanges, the only thing that extremely negatively affects results of trade, is the high spreads and the commissions doing, at least, the intraday transaction impossible. Partly, for this reason, we placed emphasis on long-term trade now.

In general, non-ferrous metals can be considered a quite good alternative to currency pairs as their prices strongly correlate with the world economy, but we recommend to use CFD of the same name only for diversification of the total portfolio.

Social button for Joomla