The foreign exchange market gives ample opportunities for earnings, but it has one essential shortcoming – the small list of the assets available to trade. On this background, CFD on the stocks, allowing to diversify a portfolio, become attractive.

There are assets which change with smaller intensity, than currencies, but at the same time also allow to get notable profit. Moreover, they allow building an efficient investment portfolio within which we can work with absolutely different tools.

We offer for your attention a new method of investment – trade by contracts on differences in prices of large world companies stocks. The trader's task is to determine either positive or negative difference among current price for the asset and its future price.

Let`s remind: the classic CFD is the special contract for difference of prices of a basic asset, in the case of purchase/sale of which the losing side pay the gain to the partner which has made a more accurate estimation, and the broker withdraws a fee for an intermediary.

The CFD contract has been thought up by brokers who planned to attract clients to stock trade without tax advance payment. Officially commission of the contractual transaction with CFD was fictitious that didn't assume payment of tax duties. Then CFD became in the advantageous way for the persons which don't have an opportunity for entry into the market, the sufficient sum of means. Now the essence of the agreement of CFD consists in payment of a cost positive difference of a financial instrument by the seller to the buyer, and negative – the buyer to the seller. The agreement also establishes terms of this difference.

In the case of trade by CFD contracts on difference, there is no real supply of the tool, which is the subject of the deal. A trader purchases the CFD on stocks as a usual trade asset, and to achieve the result he has to sell them, absorbing interest at price changes. Contracts for difference allow to use a traditional method of the marginal trade and make a transaction for chosen number of stocks, despite the high mortgage value of such exchange assets.

CFD is the derivative finance tool of securities. Price movement dynamics of the contract on difference on securities (stocks) completely coincide with stock price movement dynamics, which is the basis asset for the similar CFD.

The first CFD start to be used in Great Britain recently – at 90`s of the last century, but for the short time they are already hardly fixed in the financial markets and have acknowledged as a full-fledged investment tool by the powerful European regulators. CFD on stocks became popular within a few last years after the usual forex-brokers began to make access to them.

Specifics of CFD on the stocks in case of trade through Forex dealer

Before speaking about features of modern CFD, let`s imagine for a minute what was this market at a stage of the formation.

First, as it becomes already clear according to the name, contracts on difference belong to the off-exchange category, i.e. these transactions were never brought to the main market.

Secondly, to open a position on a security or a raw asset, interested persons (or the companies) shall discuss terms of the transaction and sign the agreement «on paper» according to which the profit got by one of the parties after a change of quotations of the basic tool is paid by the losing party.

Transactions with CFD on the stocks don't lead to the fact that finally, the rights to shares change. And here it is necessary to consider several moments.

1. First of all, it gives the chance to get rid of additional expenses which are inherent in stock trading. Here it is also possible to carry such expenses as fees of the depositary, exchange, registrar, etc. Generally, in this case, it is possible to get rid of these expenses and essentially cut own expenses when carrying out transactions.

2. In spite of the fact that CFD price on stocks has a direct dependence on the share price in basis, but it isn't always equal to it. It can be used profitable.

3. As a result of transactions with CFD on stocks, the trader doesn't acquire full title for the acquired shares for shares as it happens to the real owner in case of regular (physical) security purchase.

4. In the case of trade of CFD on the stocks it is possible to open a short position, that is to fulfill transactions on the decline in the rate.

Let`s review an example for clarification what we are talking about. Let's assume the speculators A (bull) and B (bear) concluded CFD on a security which by the time of the expiration of the agreement rose in price for $10. The amount of the transaction corresponded 1000 shares.

It means the party A will gain income in the amount of $10 thousand, and the investor B will lose $10 thousand. In principle, the scheme is very similar to regular stock exchange trading, because in the stock market earnings of one investor are always a direct loss of his partners.

But this is all the theory, in practice, there are a lot of problems, beginning from breaching of contract terms by individuals and finishing with difficulties in the determination of obligations repayment date. Now practically all CFD are opened with mediation Forex companies.

Now a partner on all CFD for the trader is directly his broker i.e. when the client stakes on the growth of the cost of an underlying asset, the company`s reverse position is automatically created. Further, depending on the amount of transactions and a share of this Dealing Сenters in the total retail market, the following options of risk management are possible:

- The company won't begin to undertake anything, i.e. in case of the successful client transaction it will pay it a prize at the expense of own means - it is the most dangerous and undesirable option as it can result in bankruptcy of the broker with all implied consequences;

- If the company large and actively offers CFD on stocks, it can consolidate opposite requests of two different clients, i.e. the classical scheme will be realized in this situation;

- The last option assumes hedging of a cumulative position in the real stock market.

Benefits and shortcomings of CFD on the stocks

Before studying of investment and speculative strategies it is necessary to pay attention to key pluses and minuses of contracts for difference, in particular, if to carry out the comparative analysis of these derivatives and real shares which are traded on the stock exchange, it is possible to note their following strengths:

- On CFD fractional lots are used, it means that it is possible to open a position under the contract a nominal in 50, 10 and even 1 share (if the cent or micro account is used);

- In this case, the trader is protected from negative balance, that is it will have no liabilities before Forex dealer. But in the stock market in case of using leverage the similar situations not a rarity at all;

- The most part of transactions on CFD is performed via standard point-of-sale terminals, for instance, MetaTrader4 (5), therefore, many indicators, strategy and robots created for currency pairs will be suitable for them;

- For trade in contracts for a difference it isn't obligatory to deposit to account the impressive amount at all;

- Even during crises when the markets synchronously fall, and brokers forbid short positions, on CFD on the stocks it is possible to open sales freely.

There are also more than enough shortcomings of CFD on the stocks, but the most noticeable minuses are:

- Spreads and fees on transactions with CFD are much higher than similar indicators on stocks, that`s why many intra-day and scalping strategy, revenue-producing on the stock exchange, begin to generate losses in case of trade in Dealing Centers;

- Forex dealer can change the specification and other conditions of CFD for stocks unilaterally, that occurs quite often;

- If the share broker goes bankrupt or will just stop activities, the trader will remain the owner of acquired shares, but it is practically impossible to collect something from Forex dealer in a similar situation (even if it had the license of the authoritative regulator).

Thus, knowing features and specifics of these contracts, it is possible to find quite good opportunities for earnings, but the greatest interest of CFD on the stocks is as risk diversification. Besides, many companies pay the positive the dividend adjustment.

Selection of contracts for trade

As quotations of CFD on stocks are practically (with a difference in 0,5-2 points) match the prices of the corresponding shares, they can be used freely in all medium-term and long-term strategy created for the stock market. Considering this circumstance, further, we won't place a particular emphasis on the fact that the contract for a difference is only the derivative.

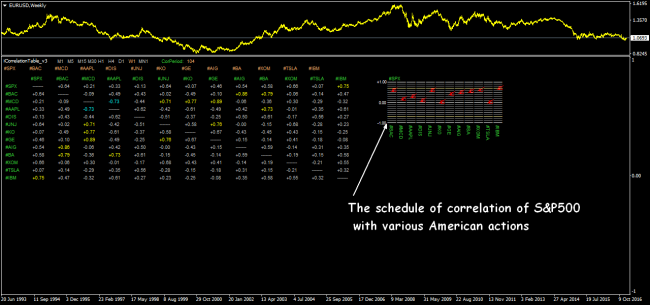

So, regardless of trade strategy, at the first analysis stage it is necessary to select only those tools which correlation is rather low in a portfolio. The special iCorrelationTable indicator helps to solve the task.

As you may notice, this algorithm builds a correlation matrix on which it is very convenient to estimate communication between different papers, in particular, tools, the correlation coefficient between which doesn't exceed 0,7, are of the greatest interest to investments and trade.

We recommend to use the following parameters of iCorrelationTable:

- CorPeriod = 104 – this value is suitable for the week schedule as it shows interrelation of the prices within the last two years (this interval more than enough);

- SymbolsListVariant = 2 is an option of display of a matrix, in particular, if here to set one, the indicator will construct the table for one and all tickers and if to specify «2», the program will research interrelations only between the papers set by the user.

By the way, before specifying two to this field, it is necessary to create in a directory «MQL4 – Files» (we will remind, this folder is opened by the «file - to open the data catalog « command) the textual document «Symbols» which content shall look as follows:

In our example, a strong correlation between Boeing Co and Apple, and also between General Electric and Johnson & Johnson is observed, therefore, that`s why undesirable to combine these papers in case of portfolio creation. The matter is that there is no sense on purchase/sale of tools which prices move synchronously (positive correlation), as it is much simpler to increase working amount only on one of these papers. In this case, the trader spends much less time for the analysis.

Considering that we talk about amounts of transactions with CFD on the stocks, we remind that it isn't necessary to overestimate risks as volatility of these tools is much higher, than on Forex, in particular, there will be enough shoulder 1 to 10 for speculative transactions, and when forming investment portfolios it is reasonable to refuse borrowing facilities in general.

By the way, recently the European regulators (France, Belgium and other countries) make new demands to Forex dealers, among which there are points according to which the company shall limit a shoulder. So far these reports have advisory character, but we consider that in the near future this indicator will be legislatively established at the level of 1 to 20 or 1 to 10.

Earnings on dividends

The main feature of CFD on the stocks is that in the case of their purchase the dividend adjustment is charged. As a rule, traders consider this adjustment as a pleasant bonus to the main transaction because of its small size, but it is only a superficial glance.

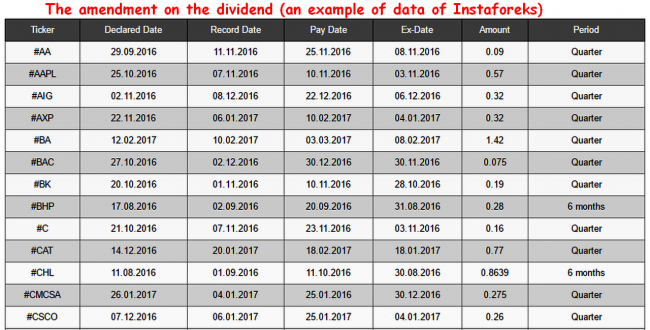

Dividends are paid for CFD – absolutely from each share which owner you are. For its obtaining, you should have an open position on a specific asset. Purchase of CFD one day before dividend date will be an optimal variant. It is possible to learn frequency and an exact payment date in the specification of the broker or on an official resource of the company in whose shares you are going to trade.

The matter is that the western investors sometimes use interesting method – collect a portfolio of «dividend shares» which dynamics strongly correlates with the stock indexes, and at the same time open an equal short position on future for SP500.

Some kind of «lock» within which the profit/loss from the movement of share quotations is compensated by loss/profit, received from a futures transaction is as a result formed, and the trader receives dividends from the companies. In general, such strategy is low-profitable, but also there are no practically risks on it.

Let's consider financial side – what are the costs in transactions of CFD for stocks.

- Fees. The fees amount is determined by the broker and averages 0.05-0,2%. In comparison with the stock market where it is necessary to pay the fees both when opening and closing a position, you shall pay fees for CFD transactions only when opening.

- Spread. It is necessary to pay spread for each transaction on CFD, as well as on currencies. CFD has a not floating spread, but static, and most often depends on the price of the agreement. The cost of the company is higher, the spread is higher.

- Payment for overnight or swap. Regular very small, insignificant expenses. If your broker has accounts of swap-free (as a rule, all have them) you may evade swap.

Now we will look at this scheme through CFD prism.

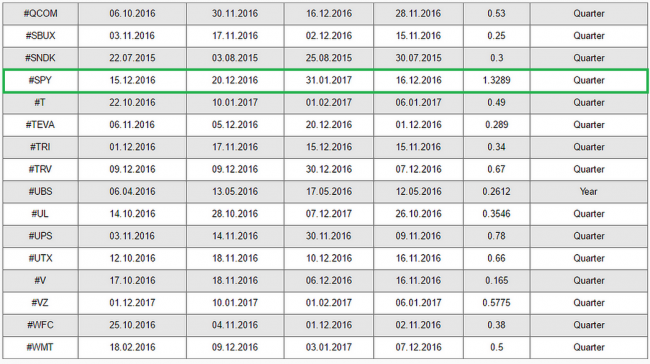

The first: as a rule, Forex brokers give an opportunity to work not only with shares, but also with indexes on the share, (for instance, the shares SPY − the index share on the broad market index S&P500).

The second: the high leverage provided Forex broker, allows to open large deals, depositing to account a minimum of means, this is especially profitable as because of hedging the risk of losses of fixed capital is minimized.

Thus, it is possible to earn on dividends in the regular point-of-sale terminal, the main thing is to choose assets correctly, to calculate amounts of transactions and to disconnect swaps (if those were charged at all, nowaday many companies on CFD on the stocks don't write off them).

Complex index shares, such as the SPY shares, rather well fulfill the technique, isn't strongly volatile because of a large number of corporations in an index, and it is possible to apply quiet conservative strategy to trade in such CFD.

As appears from the table, at the time of writing of the overview this company paid $1,33 per each share, therefore, before the date of the register fixing there is a sense to purchase SPY and at the same time to open equal sale of CFD on an index (or the future) SP500.

The trader will lose a part of means on the fees and spreads in this transaction, but the profit of dividends shall cover all expenses. Perhaps, in the future, the situation will change, but in 2017 such scheme was rather profitable. As soon as the adjustment received to the account, the transaction can be closed.

For instance, should the broker decides to delete CFD on SPY from the list of assets, it is always possible to collect manually the portfolio correlating with SP500. Certainly, in this case, it is necessary to use the iCorrelationTable indicator again. And, in general, when forming portfolios (not only among CFD) this expert is irreplaceable.

Some brokers perform a half of analytical work for the trader and include total package procurement contracts in which the correlating dividend papers are picked already up in the list of trade assets, for instance, SPDR S&P 500 ETF Trust – actually is CFD on the share of the fund investing in SP500.

It`s always necessary to remember that volatility of habitual Forex trade assets is much lower than on shares, that is in case of an equal load on depo, risk in transactions on shares will be much higher. Moreover, for work with corporate shares you should carefully keep an ear to the ground, that is to constantly have up-to-date and reliable complex information about corporations (almost insider!). Such analytics can simply be not available to the small trader.

Additional recommendations and short conclusions

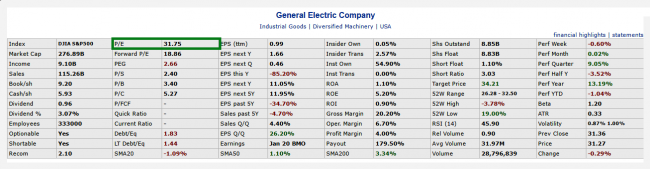

We didn't consider speculative technical strategy as they not much differ from trade methods on Forex, and placed emphasis on investments. On this background, we remind that many professional investors before making a decision about security purchase consider as well key fundamental indicators, the most important of which is P/E coefficient.

This size shows how the current capitalization of corporation corresponds to its profit, in other words, it is possible to estimate indirectly a payback period of investments into the company. If we speak about the stock market of the USA, then on a bull cycle for blue chips optimum P/E value can be considered 20-25.

When index considerably above of the stated sizes, the company is obviously overbought, i.e. it is possible to acquire such shares for a long-term outlook (with a reference point on a retirement age), but it is just better to speculate with them. CFD will just be suitable for the active trade.

Some investors also pay attention to the Forward P/E indicator, for which calculation the size of the estimated profit per share is used. It is considered that the low size of this index testifies to the quite good potential of the issuer.

Summing up the result of today's subject, we emphasize once again that CFD on the stocks belong mainly to the category of speculative tools, but in case of competent approach, they allow not only to collect the investment portfolio oriented to the medium term, but also to earn on dividends practically without risk for the deposit.

Choosing the dealing center providing similar products, the simple rule works here – better to open the account in the known companies. Besides, we strongly not recommend using services of the imposed «personal managers» as they are not liable for damages of clients. If there is a need of analytical information, it is better to address independent firms.

Social button for Joomla