Far from everybody is ready to trade by tools which requires not only studying the technical and fundamental analysis, but also accounting of national traditions − all that on Forex slang is called «exotic». Let's consider features of trade in European currencies − these assets are always available, more liquid and, as a rule, much more profitable.

Today large investment and industrial funds, official and private financial institutions work in the territory of Europe, the largest banks which are active participants of the exchange tradings create to European currencies permanent high liquidity. The exchanges of Europe are the international financial center, the second for the importance, and trade assets habitual to us occupy the main amount of trading activities on Forex.

Key moments of trading day

Asia. Market opening. (UTC: 00:00 … 09.00)

Features of trade in European currencies begin with the fact that these assets generally «sleep» at night, and therefore direct pairs with the dollar are considered suitable only for fans of a night flat. The base amount of the trade after the opening of a session in Tokyo «made» by the large capital and hedgers who actively adjust the prices on the European assets to strong price levels: large stops and options.

Within the Asian session, large Japanese exporters transfer the profit from euro and pound to yen for this reason for technical traders with small risk crosses of GBP/CHF and GBP/JPY are recommended: they have a sufficient price range and good opportunities for short-term transactions.

From the European pairs with moderate volatility, it is possible to work on GBP/USD and USD/CHF. At the beginning of a month, there is a statistics on GBP (BRC retail price index, Gfk consumer confidence index and so on) which is published right after the opening of a session in Tokyo. Data, in general, are considered low-volatile for GBP/USD, but on GBP/JPY usually cause a speculative throw.

01:00 UTC. At the opening of Singapore euro and pound in pair with the yen give a speculative throw.

01:30 … 02.30 UTC. Generally through crosses with Asians, the euro adjusts the opening price of the day. The euro most often goes up within an hour.

02:30 … 06.00 UTC. There are mass amounts for euro and pound because of transactions at Asian stock markets, speculative throws in both sides, but in limits of the daily average range, are possible.

06:00 … 07.00 UTC. The exchange «Chinese hour» which dynamics is determined by a situation at Asian stock markets. Time of currency interventions of the People's Bank of China. The maximum amounts on USD/INR are provided because of the exchange in Bombay. China usually purchases dollar a little, but even a delicate hint of the fact that the Chinese investors get rid of dollar or gold, there will be enough for panic growth practically all Asian assets. If China «buys up» dollar in currency pair or in stock assets − the whole trading day will be unstable. Similarly, if Chinese «buy up» euro, then speculative movement top on euro will be provided till 09:00 UTC.

06:00 … 07.00 UTC. Euro and pound through yen cross-pairs adjust night movement. If euro actively fell up to this moment, then after the closing of Tokyo Chinese will surely raise the price.

Asia−Europe. (UTC: 07:00 … 09.00)

07:00 UTC. If there is no strong base, then at the opening of the European exchanges sale of euro goes for an hour.

09:00 UTC. If there are no publications of statistics, then on the closing of Asia (Singapore) the European players pick off Asian stops − active movement on euro and pound against the opening price of the European session within an hour.

Europe. (UTC: 07:00 … 16.30)

The main trade period for all European pairs with the dollar, including EUR/GBP and crosses with yen, and also GBP/AUD, EUR/CAD, EUR/AUD. The publishing and development of the main statistics – till 09:30 UTC. The period 11.45−12.30 UTC − time of the ECB (the publishing of data and/or Draghi's performances). Features of trade in European currencies till 10:00 UTC are generally determined by Asian participants, and therefore USD/JPY, EUR/JPY, GBP/JPY actively move. As a rule, EUR/USD, GBP/USD decrease before the opening of the American session.

Europe−America. (UTC: 13:30 … 16.30)

45-50% of transactions of the European session and 60-70% American are in this period. The largest amounts, high liquidity and aggressive trade on all European assets. Publishing of key statistics of the USA, corporate statements, active transactions of the Central Banks. Within this period and along with the euro and its crosses, transactions on GBP/USD, USD/CHF, GBP/JPY, and GBP/CHF can be highly risky, but profitable.

13:30 UTC. Turns of a day trend on EUR and GBP within the first hour of the American session are possible.

15:30 UTC. There are speculative kickbacks in the direction of a day trend on EUR/USD, GBP/USD, EUR/JPY, GBP/JPY, EUR/AUD most often before the closing of Europe.

America (UTC: 13:30 … 20.00)

At this time features of trade in European currencies are provided with the strengthening of the dollar by means of an overflow of the equities on EUR, JPY, CHF, GBP between currency and stock transactions. High volatility is provided with stock players who actively convert currency assets into the dollar for transactions on these platforms. The European stops are actively removed.

Large amounts on futures on gold, WTI crude oil, an index of dollar and S&P are also traded. For this reason, GBP/JPY right after the opening of the American session is usually traded at first against the dollar, and then − against the yen. Players on GBP/CHF act similarly.

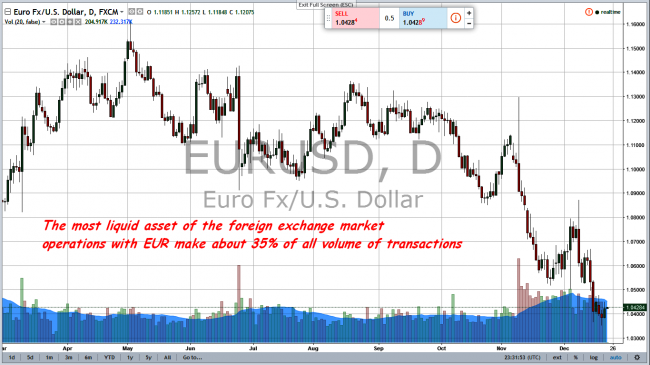

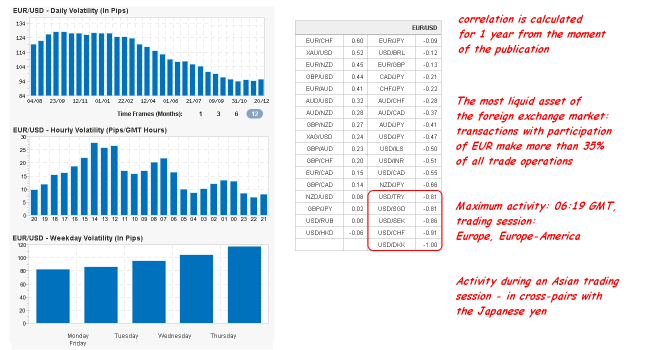

The main financial competitor of US dollar on all types of the markets. Except for a spot tools, derivative financial instruments − CFD, currency futures, options − are actively traded on the main currency. Movement and correlation with euro are the market situation indicator on the most of trading assets. Together with the American dollar constitutes a basis of all currency weight which is in market circulation.

The effective multiple-factor analysis of EUR/USD pair is possible thanks to huge amount of information and actual statistics. This pair actively fulfills any political instability in America or in the Eurozone. Due to high liquidity differs by the low spread and the minimum trading costs.

The technical and fundamental estimation for EUR/USD shall consider:

- economic statistics and estimation of global political events the Eurozone and the USA;

- information of finance regulators of Europe and America, statement of officials and key participants of the market;

- features of monetary policy of the ECB and FRS;

- dynamics of the European market indexes (FTSE 100, DAX, CAC 40), reporting of large corporations, change in price for energy resources, raw materials and basic goods.

Main amount: transactions of the ECB, bank hedging, commercial and long-term option contracts, commodity and speculative transactions of the large companies.

Strategy: this asset well gives in to the technical analysis and practically any trade techniques work at it: trend, not a speculative channel on release/breakthrough, hedging and an intraday scalping.

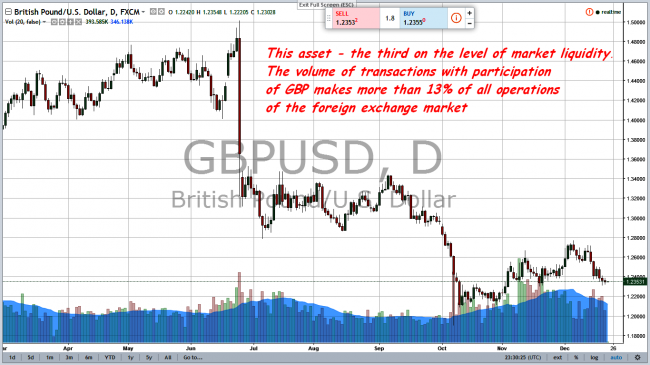

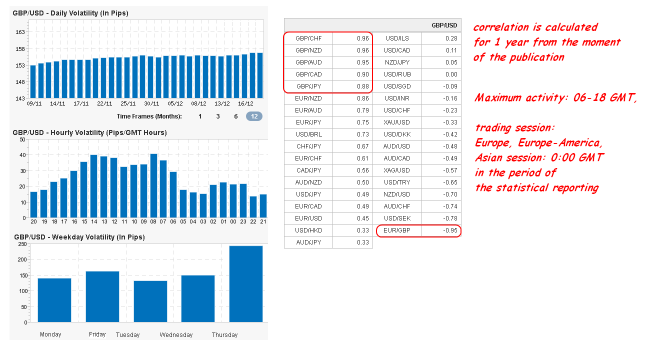

Independence of financial policy of Great Britain from the European Union forces to consider pound a stable and safe asset though the idea of an exit from the EU weakened currency politically for a long time. The idea that the pound moves together with euro in the case of the common base was considered as a feature of trade in European currencies for a long time, but the statistics for the last year doesn't show a strong correlation between these assets. High volatility and features of statistics require a tough money management. At the time the news publishing gaps with the sharp subsequent kickback of GBP/USD are characteristic.

High and unstable volatility is characteristic, dependence on dollar dynamics − average.

There is things influence the estimations on this pair:

- statistics of Great Britain, Eurozone and USA (refinancing rate, CPI, PMI, GDP, inflation, level of unemployment and so on);

- statements of officials and large financial leaders of Great Britain, regulators of Europe and America;

- monetary policy and statements of heads of the ECB and Bank of England;

- dynamics of the European market indexes (FTSE 100, DAX, CAC 40).

Speculatively reacts to all economic news and force-majeur situations.

Shows high liquidity practically all trading day, except for an Asian session. Historical British business interests in the Asian region, price throws on Asian assets during the publication of the English statistics. The trade volume is provided with exchange and speculative transactions of the Bank of England and the ECB, commodity option contracts, short-term hedging.

Trade strategy: medium-term and short-term trend, intraday scalping. Techniques on breakthrough of power levels are dangerous by a set of «false» signals. It isn't recommended to speculators and to beginners.

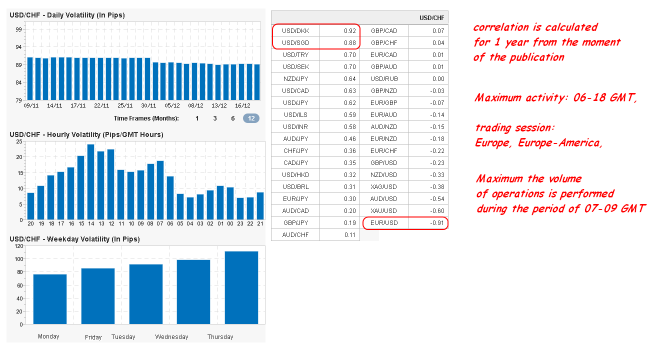

Dynamics of the pair has an equally strong dependence on the European stock indexes, euro, US dollar and futures for gold. Reflects communication of the European banking and industrial capital with international financial centers, Asian and American business. Historically the franc is considered a world protective asset, but after cancellation in January 2015 of a tough connection to EUR/CHF rate sharply negatively reacts to all crisis phenomena in the eurozone.

There is things influence the estimations concerning this asset:

- statistics, statements of officials and financial structures of Switzerland, Eurozone, USA;

- currency interventions of the Swiss franc, the monetary policy of the ECB and FRS, dynamics of the European and American stock market;

- stock exchange indexes (FTSE 100, Swiss Market Index, DAX, CAC 40);

- market speculation, news and political factors.

Main amount: hedging transactions, exchange transactions of SNB, share transactions and short-term option contracts. After adjustments of the main interest rates in a negative zone, the pair became attractive to carry trade.

Strategy: short-term trend or transactions of hedging. The asset is subject to speculation, especially in the European session. In spite of all external stability, trade on franc isn't recommended to beginners as the continuous fundamental analysis including the adjacent markets is necessary. On the current statistics, the return correlation with EUR/USD is lost, but the strong direct connection with pair of GBP/CHF is present. The pair of USD/CHF actively reacts to the American and European data, a speculative demand for the yen, gold, on the government and private securities (European and Asian). The rate of USD/CHF can be used as an advanced indicator for all assets with the franc.

Main cross-pairs: features of trade

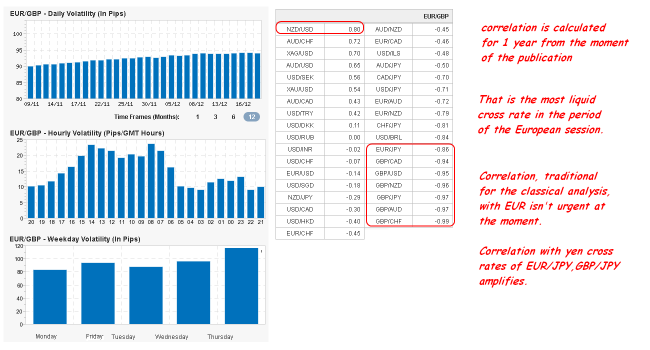

EUR/GBP

Popular and most liquid cross-rate at the European session. Well gives in to the technical analysis, and estimations for fall, as a rule, are more reliable than on growth. The high cost of the point is the one dangerous factor. Strong correlation with USD/JPY was created for the last year.

In addition to regular factors, the estimation for EUR/GBP is influenced by political events of the Eurozone and Great Britain, commercial and options contracts. In the case of a reasonable money management, the intraday scalping gives considerable profit on this pair.

EUR/JPY

Highly liquid asset, especially within the European and Asian sessions. It is considered rather difficult for a short-term trade, requires the fundamental analysis of USD/JPY. The currency pair is very politized. Shows the greatest activity at the opening of the American trading session, has a strong correlation with Japanese exchange indexes, demand for the Japanese goods, futures of S&P and WTI crude oil. For lack of speculative factors is characterized by steady medium-term trends. It isn't recommended to beginners.

GBP/JPY

Thanks to active business interests between Great Britain and Japan has high volatility and average influence of dollar. Dynamics is generally provided by the Central Banks of Japan and Great Britain. While Japan holds refinancing rates about zero, the pair keeps growth in the long term.

Very active and «sharp» cross-rate, as a rule, has a high swap, the high trading volumes during the Asian and European sessions. Due to high liquidity has the smallest spread from all European yen crosses.

The estimation for GBP/JPY is influenced by energy costs, demand for the Japanese goods in the European markets, the Asian and European stock indexes. It poorly gives to a technical analysis and requires a tough money management, liquidity at the European session is maintained only by market makers. In general moves synchronously with the pair USD/JPY, especially within the Asian session. Because of the difficult base and speculative throws it isn't recommended to beginners, but in general the aggressive scalping, speculative channel strategy on breakthrough and carry trade transactions are possible.

CHF/JPY

Features of trade in European currencies in a cross with CHF are the franc/yen is considered a reliable indicator of dynamics of financial communications of Europe and Asia. Continuous currency interventions on both sides do the pair dangerous to short-term speculations. Actively reacts to any crisis situations or force-majeure which can cause a too great demand on the yen. The estimation of CHF/JPY is in addition influenced by the Asian and European stock market, actions of large speculators and any policy even if it isn't connected directly with Switzerland, Europe or Japan. It isn't recommended to beginners. Strategy: carry trade, hedging and medium-term trend.

EUR/CHF

The maximum pressure upon an asset is put by euro and yen, the influence of the American dollar is weak. The pair can move in a narrow flat for a long time, it is possible to earn on medium-term transactions. As a result of any currency interventions including verbal gives an uncontrolled reaction, therefore, it isn't recommended to beginners and short-term speculators.

GBP/CHF

Historically − the oldest currency cross-rate without the dollar, the main danger – speculative nature of GBP, but the high cost of a point in a cross gives the chance to earn on a short-term scalping. Practically repeats EUR/CHF movement, but with bigger volatility. Has characteristic turns on news: if the statistics for pound is positive, then its purchases usually weak, and in the case of the slightest negative the pound is quickly sold and take away the equity in safer CHF. It is recommended only to experienced traders.

AUD/CHF

Low liquid asset, but AUD and CHF components react with a different speed to dollar rate that allows to use its volatility as the indicator of change speed of these currencies. The pair reflects connection of the European banking capital with the raw business of Australia. It is practically not used for speculation.

Except for traditional features of trade in European currencies the estimation of AUD/CHF depends on a price dynamics on basic raw materials (gold, oil, iron ore, non-ferrous metals), Asian (Hang Seng, KOSPI, Nikkei 225, SET50, SSE Composite, TOPIX) and the European stock exchange indexes.

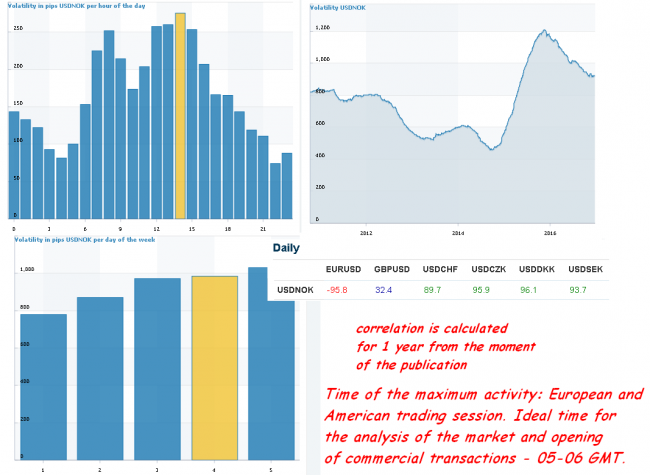

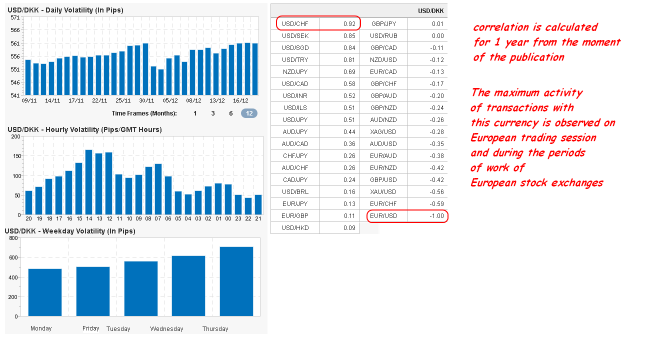

One of my teachers, which successfully trading USD/NOK for a lot of years, called this group of currencies «rebellious Kroner out of a zone». Today except for Great Britain, the members of the EU Denmark and Sweden doesn't include the zone of the euro. If Britain and Denmark even by preparation of the Maastricht Treaty stipulated the right to keep the national monetary unit, then Sweden has no such formal right, but also doesn't hurry to pass to euro. From the European currencies deserving attention still interesting Norway and the Czech Republic. Norwegian (USD/NOK), Danish (USD/DKK), Swedish (USD/SEK) and Czech (USD/CZK) krone obtain about 2% of trade volume of the European market.

Norway already tried to make the decision on the accession to the EU and both times (in 1972 and in 1994) the idea was rejected in the referendum.

The economy of Norway very much depends on stable supply of oil. At increase in the prices of Brent crude oil the rate of Norwegian krone sharply decreases. The country supports rigid monetary management from Norges Bank.

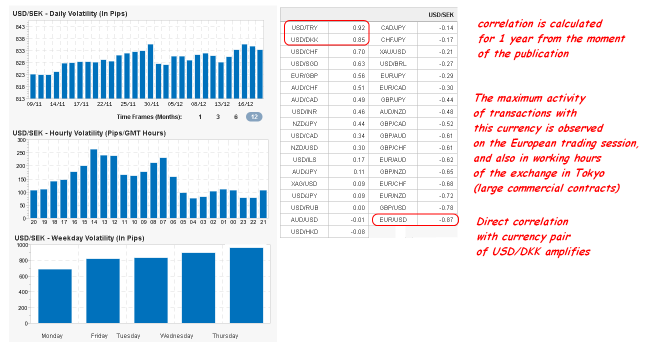

Sweden never brought a question of accession in euro to a national referendum. Now upon the unstable euro and threat of an exit of Great Britain from the EU, Sweden will follow British rather, than will refuse the currency.

And some words concerning Danish krone:

And though the large business of these countries takes serious steps on the way of accession to euro, the currency union with the refusal of «own» currency is perceived by the people as a threat to their welfare. All these countries, except for the Czech Republic, support steadily high level of living and aren't ready to give a financial support to weaker participants of the EU. From the point of view of the market, use of two currencies doesn't cause the conflicts, for example, the Stockholm stock exchange carries out transactions in euro since March 1999.

Denmark is the member of the EU, but as a result of a referendum in 2003 the decision to refuse transition to euro has been made.

But economic freedom which Great Britain, Denmark and Sweden use now, has the price. The macroeconomic policy of the Eurozone aside their «special» opinion, and without transition to euro, the monetary policy of these countries should be reconciled with decisions and instructions which they can't influence.

And as the conclusion …

You shouldn't forget that all specified features of trade in the European currencies are created by participants of the market, and therefore constantly change, adjusted and adapt to the current market situation. As the equal participant of the market, you independently choose a suitable trade asset including the European. Today from all European assets only EUR/USD pair give opportunities for any techniques, of course, in the case of correct fundamental analysis. For the breakthrough strategy volatile GBP/USD and GBP/JPY are recommended, for the quiet trend − EUR/AUD, EUR/CAD, USD/CHF, EUR/GBP and EUR/CHF are recommended, but let all of them will be profitable for you.

Social button for Joomla