Finally all efforts of a technical analysis come down to estimate direction and trend volume, and therefore any assistant can be helpful in searching of a key point. Forex divergence trade situation are considered to be a strong advance reversal signal, but they are work unstably - their reliability raises reasonable doubts. Let`s try to explore.

Let`s remember what is divergence in biology: a discrepancy of qualitative characters of organisms in the course of evolution. This concept was used by Charles Darwin for an explanation of emergence of a set of options of wild and cultural plants, pets and other biologic species.

Forex divergence - is a violation of balance of price indicators and technical indicators, in case of which the direction of movement of the price and graphics of the indicator does not match, the oscillator does not confirm higher price max or lower price min. The estimation of dynamics of this difference is carried out from the point of view of structure and general influence on the market.

All options of divergence are considered as an obvious trading signal, but technical contradictions are peculiar to it, which the beginning speculators do not consider in case of making decisions. According to the theory, the divergence situation means that the current trend weakens and in the market interest in a turn accumulates.

Nevertheless, these calculations are carried out without real amounts (rather, their directions!), and therefore without confirmation by volume setups, for example, by PinBar or a turning candle pattern, the signal of divergence can be false.

Forex divergence is shown in a comparative assessment of the price and statements of the technical indicator. It is possible to use to estimate of divergence practically all indicators of oscillator type: CCI, all types of stochastics, RSI, MACD, AO. The direction of a trend is usually estimated on moving average, it is better than all - exponential. The trend line is built on closing prices, cutting off speculative «tails». The more difference (discrepancy) of the price with statements of the indicator, the more strong the reversal signal is considered.

Actually the result of an estimate relies heavily on a response time of the oscillator chosen by you.

Divergence types

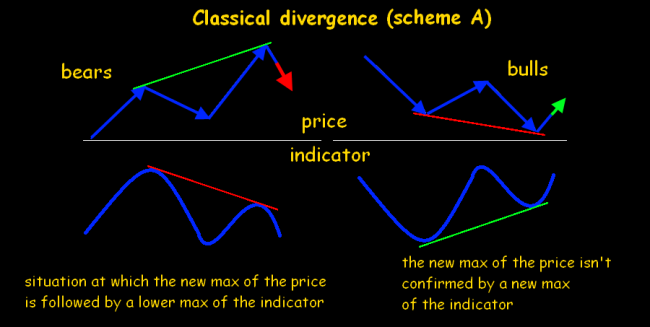

Let us take a brief look at main options. Division of divergence on correct (classical) and hidden is traditionally applied. In turn classical situations can have three structural options (class) which signals strongly differ on the importance.

Class A divergence

It is considered the strongest variant, it is possible to expect a sharp turn of the price in the near future (1-3 periods of the schedule) and further long movement. When the price draws new max, and the indicator lacks an impulse to be developed behind the price, and it continues to reduce with attenuation of amplitude of fluctuations. We wait for a turn down. For the growing market - we argue similar to - we wait for breakthrough up.

It is commonly believed that such Forex divergence took place yet after second key point formation. Carry on trade by pending orders on distance 5-15 pips higher/lower than extremum (depend on asset volatility).

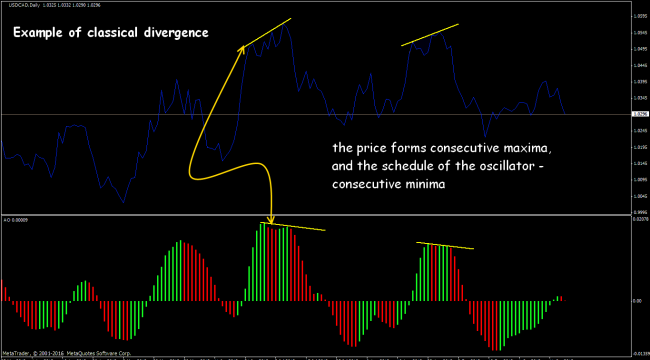

Bear variant: on real schedule it looks something like this:

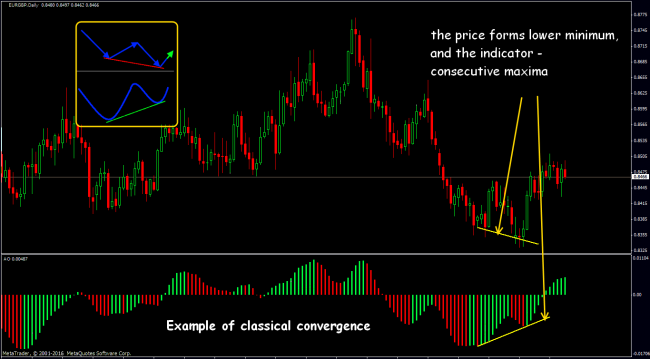

Bull variant of the classic divergence is called convergence:

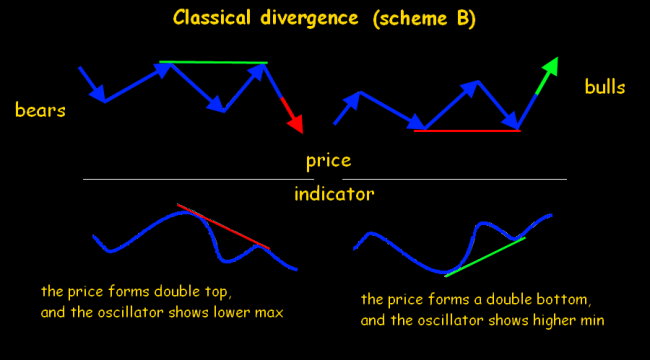

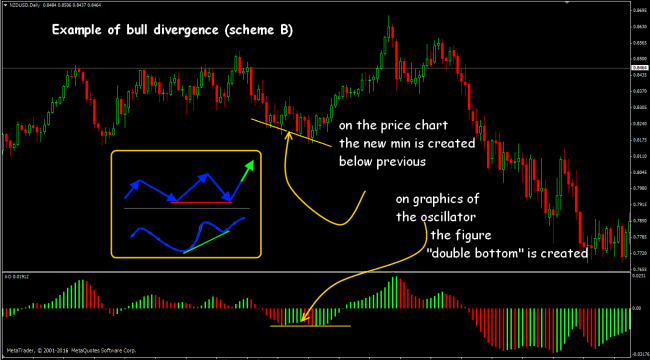

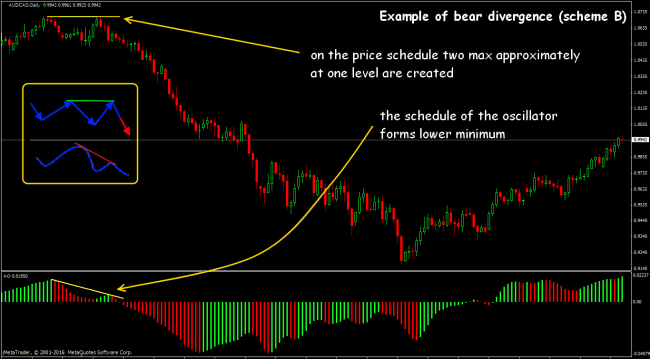

Class B divergence

It is worth being careful on an entrance as it is weaker signal. Price extrema at one level signal about temporary balance «bulls/bears». The price is going to receive an impulse, but so far both options are equally possible. In the most propitious case it is possible to wait for a turn not earlier, than through 3-5 periods of the schedule.

The Bull variant (we wait for growing trend):

The Bear variant (we wait for turn down):

Usually such Forex divergence construction are followed by speculative breakthroughs of price level with the subsequent return (we remind that we build the line on closing prices with "free motion" in 1-3 points). You should not expect a sharp turn, for an entrance it is required additional confirmations.

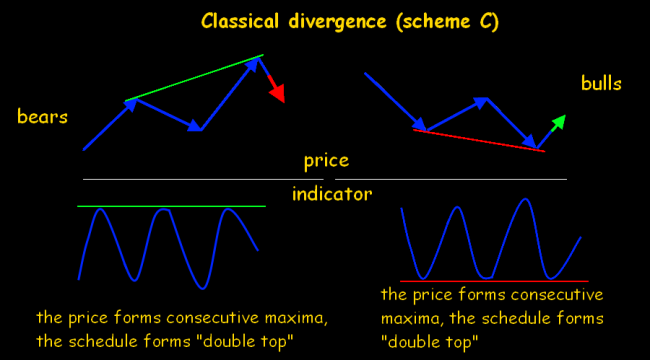

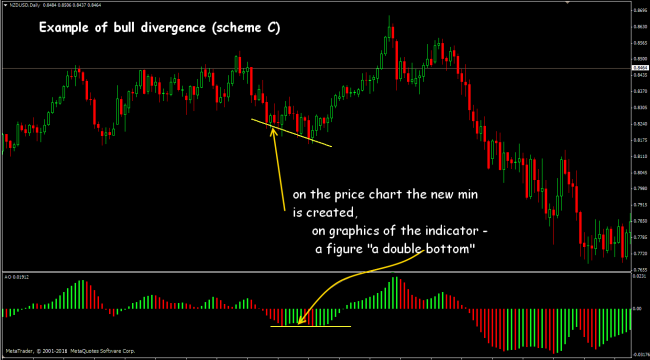

Class C divergence

The market is in an uncertainty condition, before transition in flat or waiting for strong speculation. The oscillator shows a stop of movement, dynamics of the price is provided with working off of the small amounts trading in the «dying» trend. It is the weakest signal of divergence, trade is not recommended at all.

«Sleep» bears looks like this (we wait for breakthrough up):

«Braking» bulls wait for breakthrough down:

Forex divergence – it`s just mathematics concept, counted practically on one oscillator, for this reason it`s appeared on any of assets. For example:

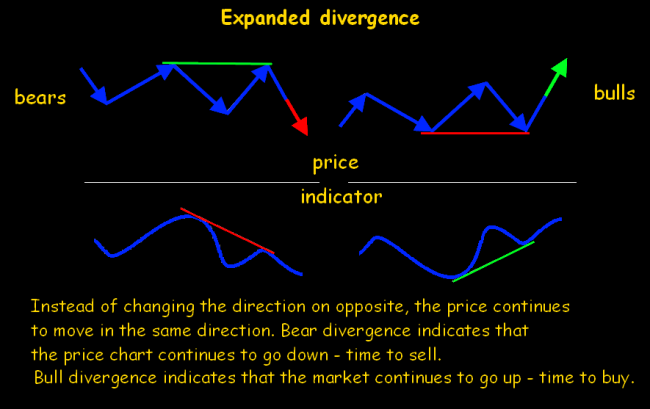

Expanded divergence or we go on a trend

It is very similar on classical, but it is necessary to call attention to a relative arrangement of local extrema. While the price chart draws Double Top / Double Bottom, the schedule of the indicator shows max/min at more considerable level. It means that with high probability the current trend will proceed, but movement speed comes down a little. Consolidation before long movement is possible.

In the real market such Forex divergences arise quite often, but, as a rule, pass unnoticed. They give quite reliable advancing signal on an exit out of the flat channel. Complete with the volume levels analysis and candle patterns this divergence version can be used as full trade strategy.

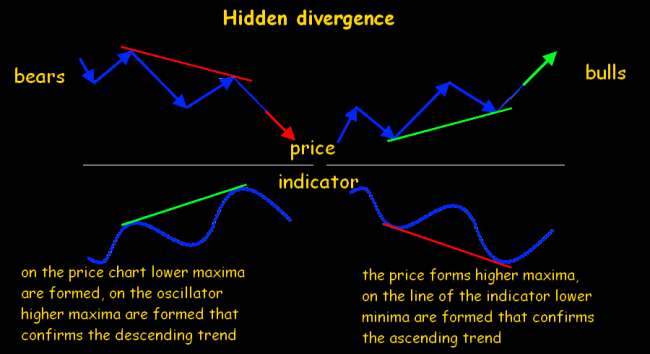

The hidden divergence – we go on a trend carefully

Meets very seldom and to see it some experience of supervision over dynamics of an asset is necessary. The bull type of such situation arises on the ascending trend at the moment of forming of new price min above previous, and the indicator shall update "Bottom". For bear variant we argue similarly.

In this situation a reversal signal is minimum and the algorithm of an entrance differs from a method of an entrance of classical Forex divergence therefore it is necessary to trade on a trend. Such divergences are most often visible on the MACD indicator exactly thanks to complex calculation of moving averages in its structure.

The signal of the hidden divergence speaks about considerable weakness of the traded asset, therefore such scheme is often shown in the stock market, just during the periods of correctional rallies on the general descending trend and, as a rule, at the same time there is a repeated test of key tops.

Trade with use of divergence

Sometimes beginners, trying to pass from a traditional scalping to big periods, try to create systems only on divergence. The visual estimate of a joint arrangement of the price and the line of the oscillator is very subjective. The difference between movements can be estimated only relatively, and therefore such system does not give either real point of entry or the target objectives to you especially as not each Forex divergence comes to the end with a turn of the market.

During the work with divergence you should not to forget that its reliability depends practically only on the correct settings of the oscillator. All oscillators were initially created for day schedules, and therefore the period 1 week (5 trading days) will be significant for them. It means that smaller periods are almost not suitable for identification of divergence because of the low probability. The small periods will mean correction of a standard trend only that leads to frequent errors of interpretation of situations.

If in the market divergence is visible, then there is a natural question - when to enter? The situation needs to be estimated in a complex, depending on the market. You should not forget that any divergence – only an auxiliary signal. Significant levels of support/resistance are traditionally applied on the schedule, and only by results of interaction with them it will be possible to make the decision on an entrance.

We will consider on an example above. Breakthrough of the green trend line can be treated as temporary change of the direction of the current trend, but - not a turn yet. The trend line of red color – the main, its breakthrough shall confirm a final turn. EMA(21) acts as the dynamic level of support/resistance.

The first signal on an entrance: neutral bar at the strong level of support. There is a strong bull bar further (perhaps, speculation or attempts of false breakthrough). And only after closing of this bar it is possible to consider that bull divergence of a class A true. We receive the second point for an entrance.

For making decision there shall be the main signal (a price bounce from level); additional signals from technical indicators (breakthrough of a trend line and divergence), and several confirmatory - (breakthrough EMA and a hollow on the AO indicator). That is in this situation the fact of divergence will not make difference if there is no complex confirmation of a signal.

Several practical notes

Each beginner comes through idea of efficiency of Forex divergence, but most often - without income. From personal experience of use it`s possible to formulate several conclusions.

• The most probable from the point of view of a possible turn can consider only classical situations of divergence on the timeframes not below H1, and the asset shall show stable volatility, at least, for last day (or several days!).

• Any speculative price fluctuations (news, closing of large options and so on) easily break divergence and increase risk of emergence of false situations. All situations of direct divergence (discrepancy) are more reliable, than convergence variants.

• Minimum quantity of false signals generates trade situations of a class A, the class B and C - are equivalent on quality.

• The situation of a class B means short-term dynamic balance and acceptance of the trade decision requires confirmation from other sources.

• Class C situations are not recommended for trade on the periods of less H4 at all if there are only no other strong signals on an entrance.

• For an estimate of classical divergence it`s possible to use the second max(min), for hidden – only a final extremum.

• As well as for all figures of a technical analysis - the higher interval on which divergence is accurately visible, the higher probability of its working off.

• For an estimation of the validity of divergence it is possible to reduce the analysis period: if there is a repetition of a situation, then it is possible to work taking into account a timeframe of the higher level, that is to enter on signals on H4 or D1, and to fix profit on the return turns on smaller timeframes.

• An exit out of the transaction is carried out either when return divergence is forming, or on signals of the oscillator, or on a money management.

• Installation of stops in case of trade according to any Forex divergence schemes is obligatory!

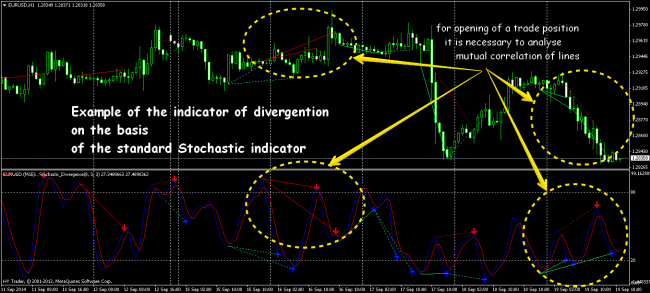

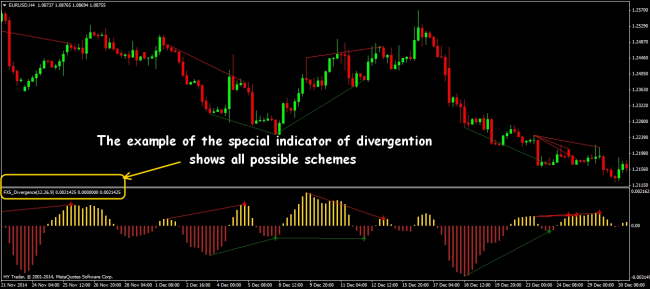

Indicators of divergence or we look for partners

Despite external simple view of divergence patterns, indicators for their identification have difficult structure. Any divergence Forex indicator shall visually estimate and show in a terminal window all essential discrepancies of the price from the indicator. It is difficult to cover all options, therefore each indicator suffers from something, one day - delay, another day - lose of very obvious situations. Actually everything depends on reliability of the oscillator which constitutes a calculation basis. It is the simplest to construct calculation on CCI or RSI, with all mistakes inherent in them, but we will not even remember such options.

The most reliable of those indicators which can be found freely in a network (with an open program code) are following:

The complex indicator combines the settlement MACD mechanism and the filter on the basis of a stochastic. It tracks practically everything, even the weakest options, and really facilitates necessary constructions. It is very favorable to use the MTF version of the indicator.

The complex indicator combines the settlement MACD mechanism and the filter on the basis of a stochastic. It tracks practically everything, even the weakest options, and really facilitates necessary constructions. It is very favorable to use the MTF version of the indicator.

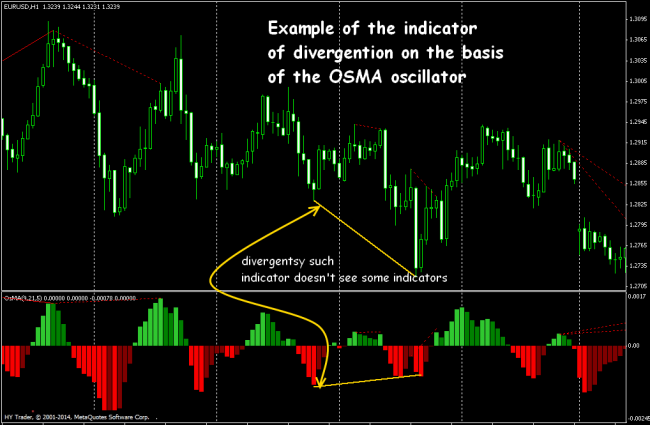

There are working versions on a basis stochastics of Stochastic Divergence MTF or OSMA_ Divergence, but because of their sensitivity thin setup of parameters is required. It is necessary to carry out calculations for closing prices, otherwise some obvious situations pass these indicators:

Who has got used to classics can use quite successfully traditional MACD, but then you can`t expect additional creations, everything should be done manually:

Obviously, any automatic advisers which will try to estimate a correctness of divergence situations shall be used without option of automatic opening of orders. The quantity of false patterns in all the popular and checked by practice mechanisms of creation is too high. The indicator or the adviser can really become the assistant by search of the situations similar to divergence, it facilitates their handling, but it is necessary to make the decision only manually.

And as the conclusion …

The correct identification and understanding of structure of various types of Forex divergence allows to estimate a correctness and danger of such signals. To earn on the divergence, it is enough to be just attentive. It is only one of signals of the technical analysis, that is, having seen divergence on graphics, you should not join in the market at once. It is necessary to estimate on what background, an asset and the period the signal was created, for example, if between a point of a signal and the last extremum very small distance, then you were already late for an entrance.

The fact that there is offered in the Forex terminal as divergence in the role of as a reversal signal has no communication with real trade volumes, and therefore allows to estimate only "trade inertia" of the market at the moment – whether players want to run behind the changed price or will quietly go. Remember that even the strongest divergence will not survive if the price reaches strong price levels with the postponed orders and large volumes will join the fight. And therefore it`s possible to enter on divergence only in the steady market, without news, closing of the large periods and other stresses. And surely estimate dynamics of amounts (at least the tick!) in the course of forming of divergence.

Ideal situations do not happen - and the graphical and technical analysis always contains some element of the imagination. And therefore, if suddenly something non-standard in divergence seemed to you - believe, it really only seems to you. Don`t listen to classics - they have become out of date! You always remember that the same designs of divergence are seen by all traders and all approximately equally react, that is very low advancing effect of divergence. Nevertheless, if to learn to distinguish Forex divergence as early as in the course of its forming, then such situations can be very useful as the auxiliary indicator in complex trade system.

Social button for Joomla