Among the various spheres of human activity, the profession of a trader perhaps stands out stronger than the others. The reasons for this attention is not just many – there are a lot of them, ranging from scandals and lawsuits in the largest financial conglomerates to the pursuit of attractive image of a successful and financially independent person. In this publication we’ll take a brief look at who the Forex traders are and what their professional interest is.

First of all, let's start with the destruction of stereotypes that are spread among the population and prevent an objective assessment of a respected profession. The very first of them is the fear of losing everything, being got to trial, and so on. The matter is that in the general case the trader is a specialist who performs operations on purchase and sale of various assets in their own name or under the order of administration of the company in order to derive profits.

Forex traders: one goal and different status

Thus, there are several types of speculators: professionals employed by banks and corporations, “self-employed” professionals trading with investors’ money, and independent people trading with their own money. Let’s take a closer look at each of them.

Professional on the foreign exchange market is the very image of a person wearing a jacket and a tie shown in documentaries and fictional movies about the beautiful life and a headlines on investigations, fraud and jail terms. The matter is that, despite their large salaries and commissions, such people still remain the “mercenaries” of someone else’s capital, so the slightest mistake and violation of the rules of the transactions can result in fines in the best case, and in a jail term in the worst case.

These are people who jump out of the skyscrapers in times of crisis, taking their own lives, and, of course, such vivid examples have strengthened the fear of the financial market, which is absurd by definition: below we’ll explain why such fears are groundless.

Entrepreneur is also a qualified specialist, but the one who created their own company and is attracting investors' money by signing individual contracts with them. A similar situation is the creation of the fund. In this case, all the risks are specified and a manager has a greater freedom of action, so if the fund isn’t engaged in outright fraud, no scandals arise.

And the last option, which would be interesting for most of the readers, is Forex traders who are trading with their own money. Such approach has minimal risks and a complete lack of legal liability, as there are no obligations to third parties, and the loss is limited to the amount deposited to the trading account.

Sometimes the newcomers wonder if the dealing center (hereafter – DC) can fail to fix a loss on purpose, when the funds in the account has reached zero and then demand to the missing amount. The answer is simple – no, because offers of almost all DCs (note: not brokers) are not legally binding as such in many countries, so any court will declare such requirements illegal. This situation is also impossible with the brokers providing access to the derivatives market, where currency futures are traded, or ECN-system.

What traits Forex traders possess

To become a trader and make money on fluctuations in exchange rates, you don’t have to be a genius. Nevertheless, all successful speculators share common traits. Firstly, you must have self-control, which creates prerequisites for the successful completion of the training and support of open positions in the future.

Secondly, all the speculators are not reckless and make deals only with good judgment, based on the statistics of outcomes in the past and the expectation of operation. When the term "market gambling" is used, many people misunderstand its true meaning – in fact, "gambling" shall mean a branch of mathematics called "games theory", which appeared later than marketplaces, but has taken the understanding of the relevant processes to a new level.

The third important aspect is related to psychology – it is the ability to take responsibility for your own life. The trader takes every decision on their own – even if they read analytics and recommendation of brokers, it is them who click. Consequently, if you want to blame someone else for losses, the success in the future is unlikely until the attitude to the processes doesn’t fundamentally change.

As it was noted above, not all Forex traders have an outstanding ability to develop unique methods of trading. Very often you may encounter a situation where a gifted man came up with a highly accurate and profitable system, but does not trade on their own due to the fear of responsibility, while their followers successfully work strictly according to the rules, without attempting to change something and modify. So you should not despair if you don’t manage to create your own system – as they say, “everything has already been invented”.

Some facts about the speculations and traders

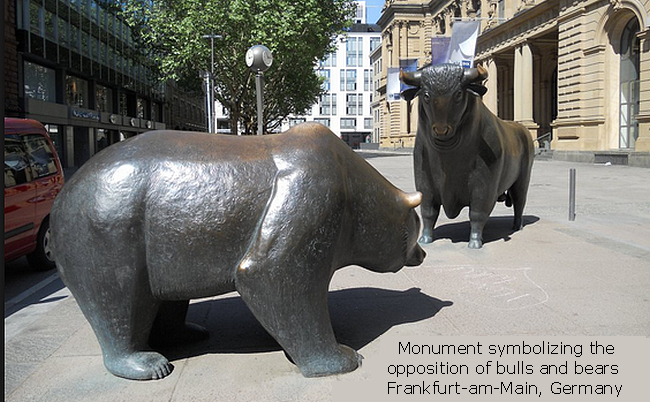

A significant advantage of professional speculation, as compared to a regular job and even investment, is complete independence from the economic crisis. The trader does not care at what stage the economy is now – even special terms were invented: the "bulls" are speculators to profit from the price rise, and the "bears", on the contrary, make money from the price fall.

Forex traders use the additional advantage that other markets lack. The matter is that the nature of the currency pair movement in both directions is the same, because in any case one currency rises relative to the other.

But in the commodities market, for example, the nature of asset growth is fundamentally different from a bearish market, both in terms of volatility and the nature of the fluctuations, so more market knowledge and experience are required to distinguish the phases than on Forex, and this, in turn, is time-consuming.

Some argued that for substantial profit (which is a subjective amount) you need at least tens of thousands of dollars. Practice refutes the stereotype, because the traders carrying out a lot of short-term transactions with small goals are able to earn dozens of percents on a monthly basis. Such trading style is called "scalping" and is characteristic of experienced traders, as it takes a lot of time and replaces another job.

In addition, many traders combine speculation with primary profession, making medium and long term deals. This approach has both pros and cons, the main one of which, in turn, is the loss of the very competitive advantage in times of crisis, because the longer a position in the market, the higher the risk of getting caught into a difficult situation in terms of macroeconomic factors. Thus, traders are able to derive benefit from the risk, but still remain the same “workaholics” as other specialists.

Social button for Joomla