Advertising says that the fractal analysis allows to study dynamics of the market without long handling of historical data – it is enough five bars for primary assessment. Symmetry of long-term and short-term price fluctuations in the market doesn't raise doubts any more, but it`s better to be careful using fractals on Forex.

Initially, the fractals is any structure, which in case of division into parts of any scale is the reduced copy of a whole, that is has property of sameness. Benoit Mandelbrot who entered this term wrote about it in the book «Fractal Geometry of the Nature». It is considered that the concept of a fractal as indicator for trading was entered by famous Bill Williams («Trading Chaos: Maximize Profits with Proven Technical Techniques» and «New Trading Dimensions: How to Profit from Chaos in Stocks, Bonds, and Commodities»). It was expected to used them both an independent unit, which can help to understand natural structure of the market, and additions for any systems and strategies, for example, for determination of number of a wave in the wave analysis. In due time the application of this theory for the financial markets caused a set of a controversies, at least because the author used many standard scientific terms (a fractal, an attractor and so forth), and used them not absolutely correctly. Thanks to it now the concept «Fractals on Forex» is usually supplemented with specifying of a surname of the author.

Williams's fractals practically don't correspond to the mathematical theory of fractals and, in fact, are simple local extrema on a stretch of 5 (or more) bars. It is a classical extremum, which assumes trade from correction − to open the order towards a trend. Nevertheless, they appear on a price chart quite often, reliability of such signals isn't really high, but in case of reasonable use they can be rather effective.

According to the theory, turning fractals on Forex shall work the best way within the flat market, though Williams uses them only in trend systems. Let's talk about the hidden problems of use of fractals, which prefer to hold back those who advertise «supereffective» trade strategies based on such structures.

Some theory

Let's remind, a fractal (from lat. fractus) is any structure, which consists of parts, similar to whole. The basic combination of a fractal requires, at least, five candles, and the fifth candle in the scheme shall be closed before making decision on the basis of this fractal. Otherwise the price throw is possible during forming of the fifth bar, as a result the price structure won't correspond to conditions any more – the fractal «isn't confirmed». The difference between value of the price growth in the left part of a fractal (impulse) and in its right part (kickback), according to classics, is called «lever». The more lever, the more opportunity for profit. When the price returned to the time of forming of a fractal, the lever is equal to zero, and the fractal is closed.

The fractal structure on Forex, irrespective of quantity of the candles (internal bars) entering it, shall have at first two consecutive bars in one direction, and then two subsequent bars − in the return, that is two bases for a fractal up (or two tops – for a fractal down), and also the central top (bottom). According to Williams, in case of identification of a fractal you can disregard the internal bars. Knowing the general principles of creation of a fractal, development of fractal models can quite be counted. And should to use not only Fibo, Pivot, trend lines and other methods of determination of strong levels, but also time.

Only bars with extreme values are includes in calculation, the others are considered as internal. For making decision take into account only the highest price value for a fractal up or the lowest − for a fractal down.

For a steady fractal up a stretch, connecting bases of extreme bars from the left and right part, should be less than each of the stretches, connecting the basis and the top of the central bar. For a fractal down – the logic is similarly concerning tops of extreme bars and basis of the central bar.

An «effect» of compression is at any scheme of a fractal, which arises only in case of accomplishment of the conditions stated above. As soon as power of compression decreases (the fractal is fulfilled), the market begins to create other fractal, most often − the turning.

The forming of the fractals on Forex is a result of regular market factors. If the market moves in one of the «cash» directions, then the moment comes when all who want to open positions already entered the market (open interest), therefore after a while the price begins to roll away back. For example, in the bull market it means that there are no buyers any more this moment. After working off of stops of «nervous» sellers, the price moves again up to implement the remained interest in purchases. The new fractal creates after a point of balance and, depending on its direction, it is possible either to open positions on a trend, or to trade in the direction of a turn.

Properties of fractals: benefits and problems

The price fractals on Forex have the main classical properties of fractal objects.

The first − irregularity: it is shown on a price chart in the form of the unstable volatility and sharp price throws, «breaking» movement after the created fractals.

The second property − self-similarity: the fractal model repeats on all timeframes without essential changes. Because of similarity property the use of fractals is profitable for application of a technique of a Helder`s three screens technique.

The third property (according to analysts, very disputable) – «memory» of a fractal about «entry conditions».

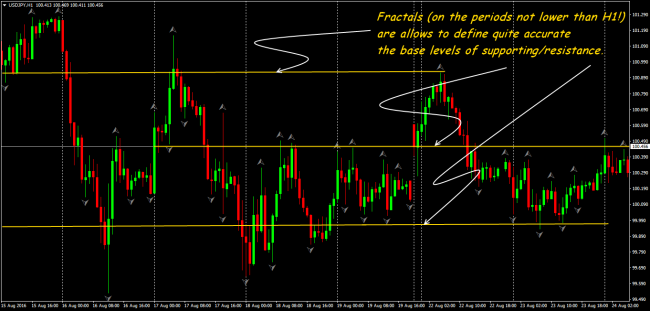

A term fractal dimension is applied also – from a longer timeframe to shorter, that is application of the fractal analysis makes a sense only from top to down: that is max/min of any fractal on longer scale will be the same point on a fractal on shorter scale. But the fractal peak/bottom on M15, for example, on D1.

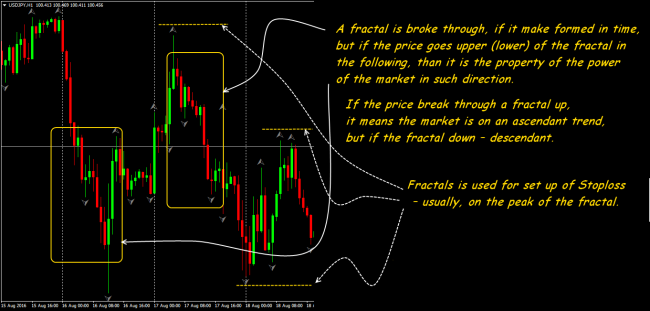

After the structure is formed, it isn't redrawn (the fractal always remains a fractal), and its trading signal isn't cancelled, while the new fractal won't appear. Power of a fractal signal depends on its arrangement to other indicators.

Delay is the main lack − any fractal won't be constructed, while two bars of a turn won't appear. That is the signal on an entrance to the market is late a minimum for two candles − it quite enough for seriously miss, especially, if to work on the timeframe recommended by analysts (from H1and above). But it is just profitable for long-term trade, that is − the main trend proceeds, and the current kickbacks – are insignificant. Each new fractal in the direction of the main trend can be used for increasing of a trade position.

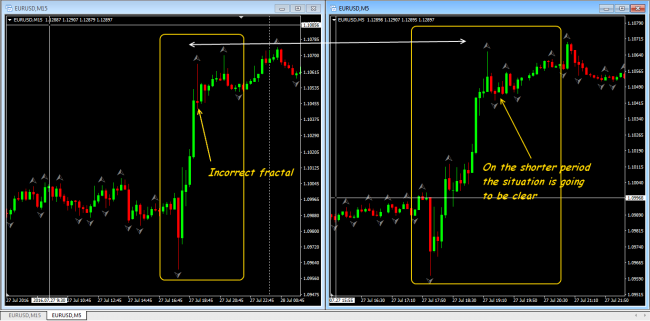

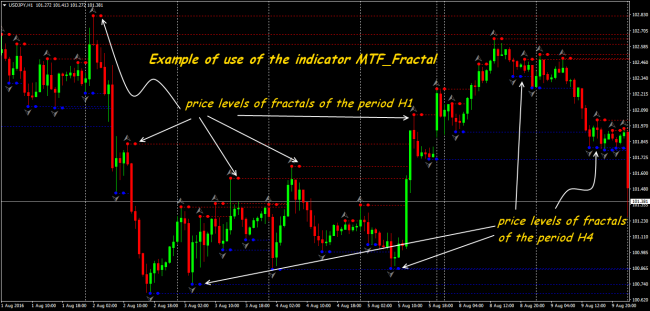

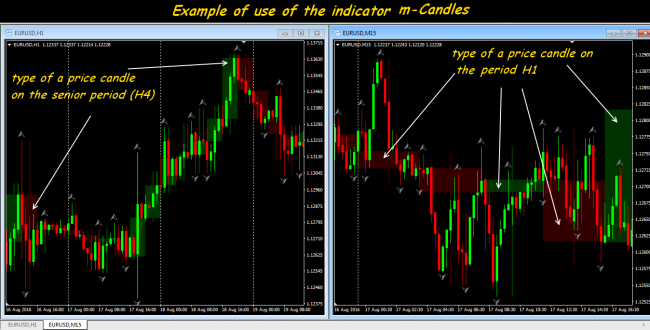

To solve the problem of delay of fractals on Forex we can suggest to divide the timeframes. The non-standard indicators of fractals, which allows to place up models at several periods in one window, will be useful to this purpose.

The breakthrough of any local extremum can be considered as a signal if not on a fast entrance, then, at least, on a trend change. If the fractal is formed on H4, then desirably «to see» it also on H1 or even on a shorter marking. The multi time frame indicators of fractals, allowing to see models of the older periods on the current schedule, come to the rescue.

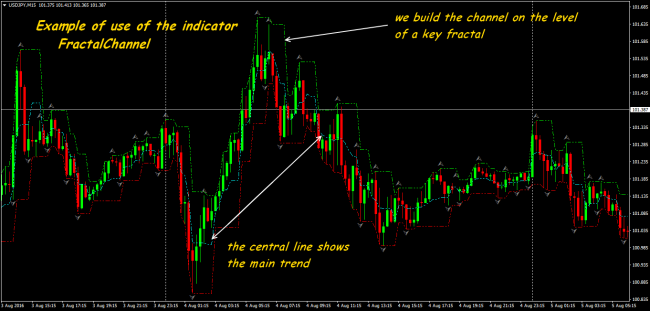

There is an alternative option of work on fractals on Forex – to build on them price channels, and different types, depending on a ratio of frequency of signals and sensitivity of the channel. Only the central line is practically used as the direction of a trend, and it is impossible to trade on breakthrough of bound, because the creation of a fractal «is late» to current price at least for 2 bars. Lines of the channel have only informational character.

M-candles indicator can be quite useful, it shows candles out of older timeframe on the current bar chart.

Indicators of multifractals display all summary information in one window, that allows to concentrate attention of the trader and to reduce losses from late entrances.

What actually fractals tell about

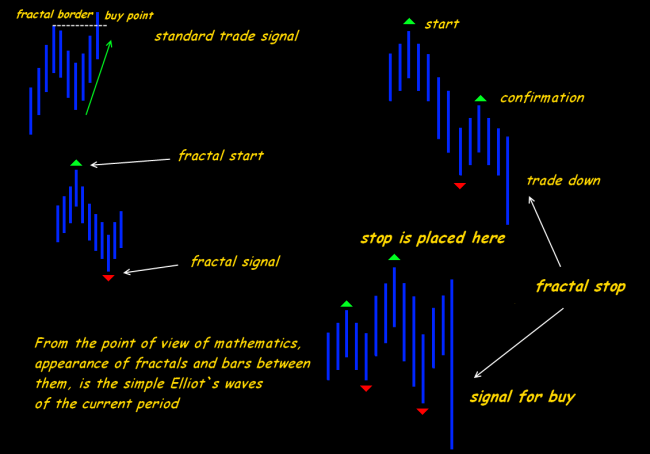

After the fractal is finally created, it can be a fractal start, a fractal signal or a fractal stop. It depends on in what point of the market it is. Fractal start is any structure, after which the fractal (a fractal signal) in the opposite direction is created. A fractal bunch of start/signal are created on one period.

Fractal stop is the most remote fractal extremum from two last fractals, running in the opposite direction, as a rule, it is next to last opposite running fractal.

For trade on fractals on Forex you should have on a price chart a certain line of balance, for example, moving average, bounds of the channel, Fibo's level, etc. You shouldn`t use a fractal on purchase, if during its working off the price left below the line of balance (for a fractal for sale − higher than the line).

In practice of trade fractals are used for:

• … determinations of point of entry:

on breakthrough of levels, which the price didn't manage to punch and couldn't be fixed at them.

An entrance on breakthrough is the most simple trade technique on fractals – most often by pending order some points higher/lower than bull/bear fractal.

• … construction of the power levels:

• … marking of the trend:

• … confirming of the trend:

The sequence of the signals of common direction approve a power of the current trend: if a trend is upward, the fractals up are restored more often, the fractals on local minimum are restored more often in time of bear trend.

• … confirming of the flat:

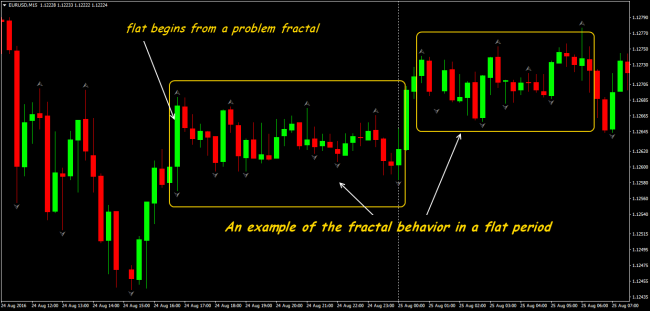

Inability of breakthrough of the previous extremum or emergence of an implicit (problem) fractal on Forex may mean the beginning of flat movement. In such case you should wait for response of the price to the return fractal. Perhaps, you should prepare for a flat in the range between two fractals.

Inability of breakthrough of the previous extremum or emergence of an implicit (problem) fractal on Forex may mean the beginning of flat movement. In such case you should wait for response of the price to the return fractal. Perhaps, you should prepare for a flat in the range between two fractals.

Reality of a fractal

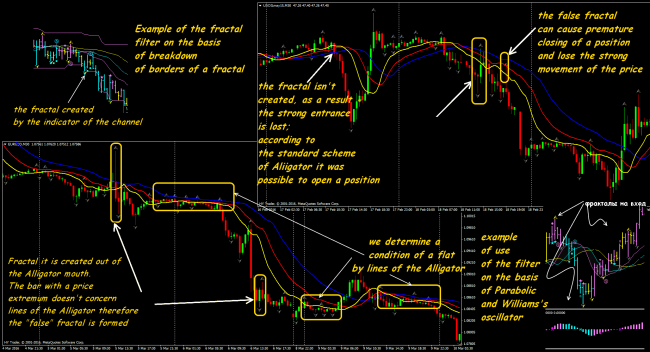

This question always gives most of all problems. All attempts of fractal estimation (true it or false) come down to estimation of the structure − any failure of a classical form shall be treated towards doubts. The structure of a fractal on Forex is more non-standard, the less trust to it. With reduction of the period of the analysis the quantity of false and problem fractals increases several times and just encumbers a price chart.

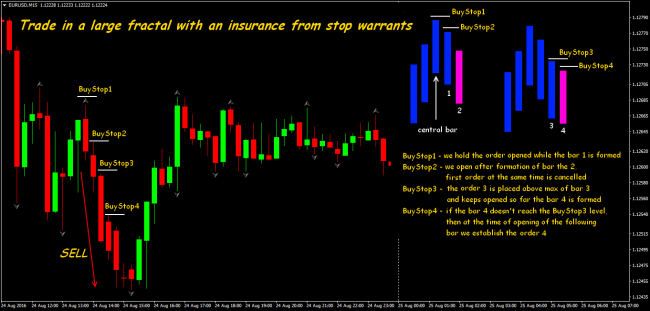

At working off of large fractals they recommend to open a position on correction from the previous pulse movement, which entirely fits into the left part of a fractal formation. Fibonacci's levels are good interim a fractal – classical corrections on 0.382 (38%), 0.50 (50%) and 0.618 well behave (62%). If «to stretch» Fibo's levels on distance between the next fractals, then you may trade by means of limit orders at the key levels.

By the same method protect a position from possible return breakthrough, when the moving stop order is used, tracking an opposite extremum of the last or next to the last bar. In case of creating of fractal up, stop orders for purchase are located on top (or slightly above it) the last completely created bar. For trade with a fractal down, such postponed orders are placed on the basis of the last bars. The idea is simple: as soon as movement changes, the stop order will be performed, having provided position opening in the new direction of the market.

According to Williams, breakthrough of any fractal higher/ lower than any line of balance (for example, the red line of the Alligator), with a high probability can lead to trend movement.

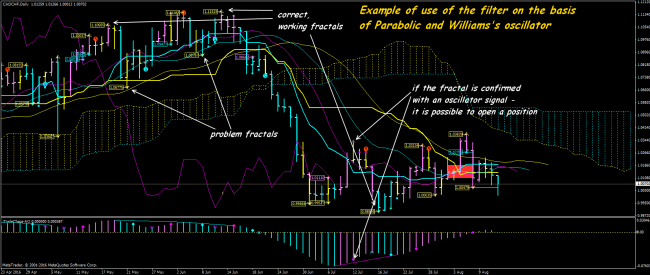

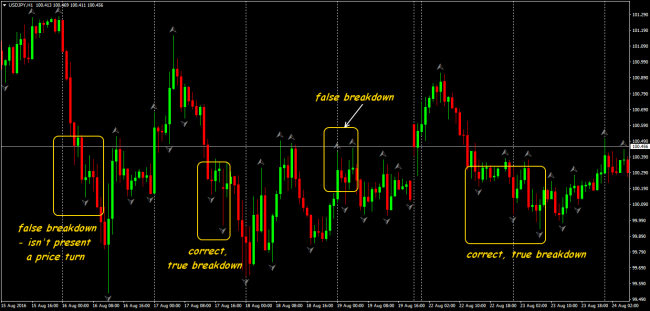

Breakthrough of buyers is a price exit out of bounds of a key fractal. According to classics – one point is enough. Respectively, leaving of the price down for 1 point out of fractal bounds is a breakthrough of sellers. In reality, unstable volatility of the modern market leads to a set of false fractals and false breakthroughs, and also non-standard structures with an implicit treatment, therefore a filtering of the fractal signals is binding, especially on the flat sites.

The author's Fractal system + the Alligator remains the most popular and reliable, but the bunch of Parabolic SAR+AO shows good results for the main currency pairs − such filter allows to determine reliability of a fractal on signals of the histogram of the oscillator.

If to use fractals as signals of breakthrough of bounds, than the option of trend system for work in the channel can be quite stable. Those, who don’t trust oscillators, can use the ordinary Ishimoku indicator as the fractal filter, especially its estimation SenkouSpanA and SenkouSpanB lines. Breakthrough of Tenkan and Kidzhun lines, and also lines of the Cloud (the truth, less reliable) will be the filtered signal of breakthrough of a fractal.

If to use fractals as signals of breakthrough of bounds, than the option of trend system for work in the channel can be quite stable. Those, who don’t trust oscillators, can use the ordinary Ishimoku indicator as the fractal filter, especially its estimation SenkouSpanA and SenkouSpanB lines. Breakthrough of Tenkan and Kidzhun lines, and also lines of the Cloud (the truth, less reliable) will be the filtered signal of breakthrough of a fractal.

Such complex system looks overloaded with indicators, but you can disable one of elements without special loss of accuracy.

There is quite reliable practical method of determination of false breakthrough of a fractal. It is a situation, when the fractal is breaking by bar with a small body and a big shadow. If such «nail» is big, than a signal is strong, if weak − than a turn signal is weak. It means the market can't come through the level of the last fractal at the first time. If the candle is closed lower than the low price of such «nail» (for sale – higher than high price) after breakthrough of a fractal, for example, on purchase, then breakthrough is false for а 90%. And such closing can be through 2-5 bars after a breakthrough candle, and for the analysis don`t need the fact of «breakthrough», but closing of the bar, which broke through a fractal is necessary.

And as the conclusion …

Modern technical indicators with pleasure will construct to you on a price chart the mass of fractals of any structure, color and dimension. Actually, the fractal analysis isn't so simple, ambiguous and it isn't strongly recommended to beginners.

Separately want to tell about attempts of use of fractal signals in trade counselors. A problem with them is the same, as well as in case of recognition of any graphical patterns. It`s difficult to provide, that a mathematical algorithm, which will treat implicit structures of fractals and their relative positioning more correct, than the man do, can be included in the adviser. At the best it will be the mass missing of profitable signals, in the worst … you know.

Fractals don't predict movement of the prices. Even according to Williams breakthrough of a fractal is an already third, finishing signal, which should be used for an entrance to the market. By the way, the standard Fractals indicator as a part of popular trade platforms doesn't provide any parameters, except a graphics, therefore it`s better to use the options allowing to choose the number of bars for calculation.

Fractals on Forex make a practical sense only as a part of complex trade strategy as the indicator of confirmation of a turn. All strategy in any type using fractals can be steadily effective only on the periods higher than one hour. The more timeframe, the less fractals arise (and the correct structure!), and that the trading signal of the created signal is more reliable. You should analyze jointly emergence of fractals on several periods: to trade on short-term fractals only in the long-term direction. But essential − only as support of the trade decision, but not as the basis for position opening.

Social button for Joomla