None of the new ideas can`t be implemented without the conflicts today, and HFT-trading is not an exception. You can perceive in different ways an informational and technical advantage of the high speed actions of speculators: from delight to criminal, but you will not ignore these modern predators already.

The appearance of the HFT-trading really starts from the scandal, just much earlier: at 28 January 1790. It was a discussion in the House of Representatives in New York of a law of the payment of a debt , which was suggested by the Secretary of the Treasury Alexander Hamilton, - the new Government of the USA was obliged to pay a debts, which were made by the central States and Continental Congress during the Revolution.

In that time informed speculators chartered the fastest ships practically in all directions to be in advance of the official couriers, and urgently bought up the papers of the old national debt, which in afterwar period were provided for not more than 10% of the nominal value. Obviously the enactment about authorized buy-out the papers could raise their market price by several times. The nervous performance of congressman Jackson about impermissibility of such methods was the first disclosure and critic of the high speed traders.

The following trade by these government stocks were happen so profitable, so after 2 years, at May 17, 1792, 24 «activists» (brokers) tried to create a monopoly for realization of such papers. Afterwards this group of people became that what now is called New York Stock Exchange.

Modern history and definition

It is recognized that a foundation of the NASDAQ (National Association of Securities Dealers Automated Quotation) was the beginning of algorithmic trade – a first automation system of the exchange trade, and a first negative result is the crisis at October 1987. Then for the first time a use of the program trading (on the basis of computer program indicators) were called as a reason of the stockmarket crash. As a result of such events the market prove once again – the exchange players just have to be faster than any authorized information.

Steven Swanson is reguarded as the author of the superfast trading, who worked on algorithms for estimate of the 30-seconds exchange quotation, it was he and his partners Jim Hawks and David Whitcomb who created Automated Trading Desk at 1989 – the first automated trading platform. While all the market traded by phone, the order processing speed on ATD was already 1 second. The technology receive the authorized push to the development only at 1998, when US Securities and Exchange Commission allowed a functioning of the electronic trading platforms on the main American exchanges.

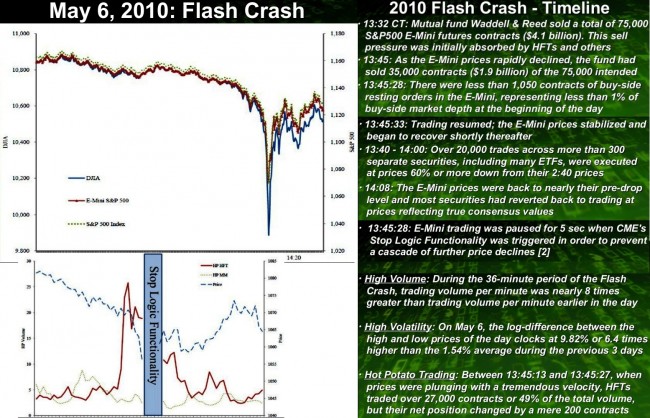

By the time of publication of the article «Stock Traders Find Speed Pays, in Milliseconds» at June 23, 2009 in New York Times, this financial phenomenon in professional environment existed for more than 10 years, but it was an author of the article Charles Dwigg who put into practice a definition High Frequence Trading. A scale of the problem became visible only after the next exchange crash at May 6, 2010, when Dow Jones Index with no apparent cause fell by 990 points less than 5 minutes (from 14:42 to 14:47). As was apparent later, in that moment a part of HFT-traders was more than 70% of current sales volume, and for creation of the «vacuum» of the liquidity of fabulous size the it was suffice massively to close positions by the «high frequency traders».

By the time of publication of the article «Stock Traders Find Speed Pays, in Milliseconds» at June 23, 2009 in New York Times, this financial phenomenon in professional environment existed for more than 10 years, but it was an author of the article Charles Dwigg who put into practice a definition High Frequence Trading. A scale of the problem became visible only after the next exchange crash at May 6, 2010, when Dow Jones Index with no apparent cause fell by 990 points less than 5 minutes (from 14:42 to 14:47). As was apparent later, in that moment a part of HFT-traders was more than 70% of current sales volume, and for creation of the «vacuum» of the liquidity of fabulous size the it was suffice massively to close positions by the «high frequency traders».

The public panic was quite illustrative: the informational channels splutter with the criticism, the politicians and the financiers convoke hearings and commissions, wrote the drafts about what is necessary urgently to stop, to prohibit, to control, assess etc. All this vanity was a cause of the opposite process – automatization of the trade sped up and, as a result of 5-years evolution, HFT-trading became the natural standard for profit-making by the player of any level, from Central banks to private traders.

Today high-frequency trading — the most current type of the algorithmic trading in the financial markets, whereby thanks to the use of the modern equipment, systems of communications, the software and special trade techniques the market transactions of purchase/sale are performed during fractions of a second. The analysis of data and search of trade opportunities are carried out by means of special algorithms, and implementation of a trade benefit is based on technical access and a territorial arrangement of HFT-trading servers as close to communicational gateway of the exchange as possible.

The basic differences of HFT-trading are:

- The hold of term of market trading positions at the level of 1-3 milliseconds thanks to high-technology systems.

- Profit earning from a margin and the minimum price movement.

- Exclusively intraday trade, but quantity of trading activities in a day reaches tens of thousands.

- Use of all types of arbitral situations.

HFT-traders carry out fast transactions with huge amounts and take minimum possible profit (sometimes a fraction of cent on the share). As a result the potential Sharpe index of the HFT-company is hugely more successful than for traditional strategies, and high-frequency traders compete only with each other.

Implementation mechanism

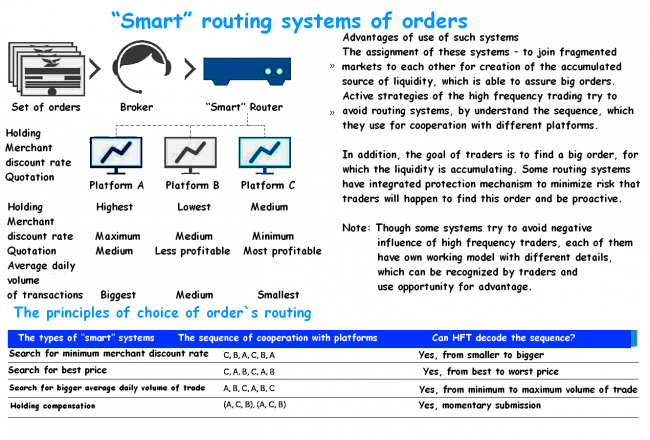

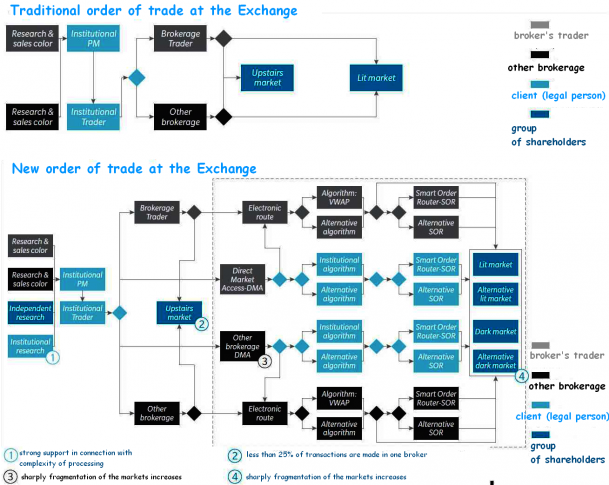

For understanding of benefits of HFT-trading we will remind how an order moves at the exchange. The client set the electronic order on an asset on the broker via the point-of-sale terminal. Orders for purchase/sale of an asset are compared in a glass of orders and bargains are concluded in case of coincidence of the demand / offer on an optimal price.

In principle, all orders shall be freely visible to all bidders thanks to technology of fid (a data flow from the special exchange organization, for example Options Price Reporting Authority (OPRA)) which transfers information of the order in the special protocol to the terminal of the client (Financial Information Exchange (FIX) or Adapted for Streaming (FAST)). For ensuring the maximum liquidity, the quotation and the orders shall gather in a single flow from all exchanges and trading platforms.

In principle, all orders shall be freely visible to all bidders thanks to technology of fid (a data flow from the special exchange organization, for example Options Price Reporting Authority (OPRA)) which transfers information of the order in the special protocol to the terminal of the client (Financial Information Exchange (FIX) or Adapted for Streaming (FAST)). For ensuring the maximum liquidity, the quotation and the orders shall gather in a single flow from all exchanges and trading platforms.

To get a trade advantage, in case of HFT-trading the optimization of data transmission at all levels, including a territorial arrangement, is carried out. Special bidders at separate (very high) payment obtain information directly from the exchange due to connection to primary exchange source of data transmission. Also at additional expense, the orders of the client can be hidden from general attention (the hidden or «dark» pools) and their action is visible only in case of operation of orders.

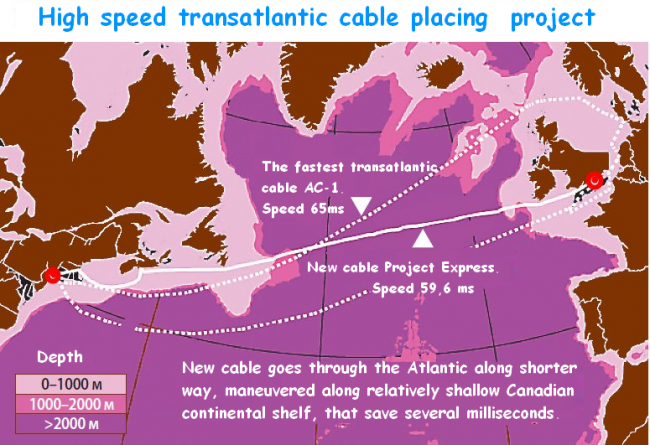

That`s exactly why Colocation or closeness to the server of exchange and quality of communications systems is critical for high frequency trading. Construction of the high technology communications on the territory of the length 1180 km between Avrora, suburb of Chicago, and township Mavo on the north of New Jersey, which was called in Russian internet «chord of capitalism», is the example of fight for optimal Colocation. In order to organize optimal communication between options and futures exchange in Chicago, servers of NYSE and trading platform NASDAQ, the brokers tried to install transmitter unit of microwave radiation through the ideal arc between these points. As for now the high speed is provided by MacKayBrothers company: quotation achieve from one exchange to another through the 22 stations for 4,09 milliseconds, the closest competitor fall behind by 60 thousand nanoseconds.

That`s exactly why Colocation or closeness to the server of exchange and quality of communications systems is critical for high frequency trading. Construction of the high technology communications on the territory of the length 1180 km between Avrora, suburb of Chicago, and township Mavo on the north of New Jersey, which was called in Russian internet «chord of capitalism», is the example of fight for optimal Colocation. In order to organize optimal communication between options and futures exchange in Chicago, servers of NYSE and trading platform NASDAQ, the brokers tried to install transmitter unit of microwave radiation through the ideal arc between these points. As for now the high speed is provided by MacKayBrothers company: quotation achieve from one exchange to another through the 22 stations for 4,09 milliseconds, the closest competitor fall behind by 60 thousand nanoseconds.

Computer algorithms of placement and execution of orders are integrated into exchange systems at primary level, but to be engaged in HFT-trading it isn't necessary to be Goldman Sachs branch at all. Today HFT transactions last for milliseconds, that is each thousand share — the key to success and its price.

Main participants of HFT-trading

Technically allocate the main types of participants:

- The private independent prop-trading firms (from proprietary trading), which works at the HFT market at the own expense without investment attraction.

- The HFT companies as affiliated divisions of the broker, with separate PropTrading Desk, with distribution of client trade and HFT transactions. The staff of the company performs high-frequency operations only at own expense of the broker.

- HFT firms in a type (and with tasks) hedge funds, usually are engaged in profit earning from situations of inefficiencies of pricing of various shares and other financial assets by means of arbitral strategy.

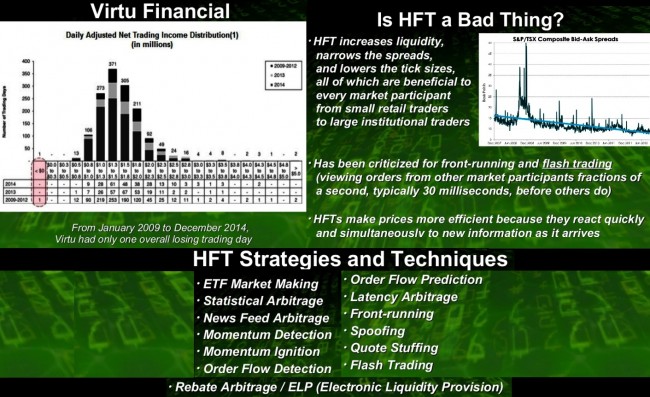

- The American Timber Hill, Chicago Trading, ATD, GETCO, Tradebot, Virtu Financial, Citadel LLC are the largest official high-frequency companies, but practically all large banks, investment companies and hedge funds in addition to the traditional biddings actively are engaged in high-frequency trading.

Strategies of high-frequency trading

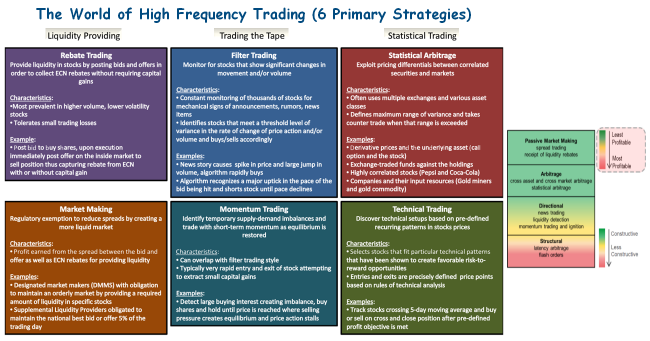

We`ll give comments only by the main techniques:

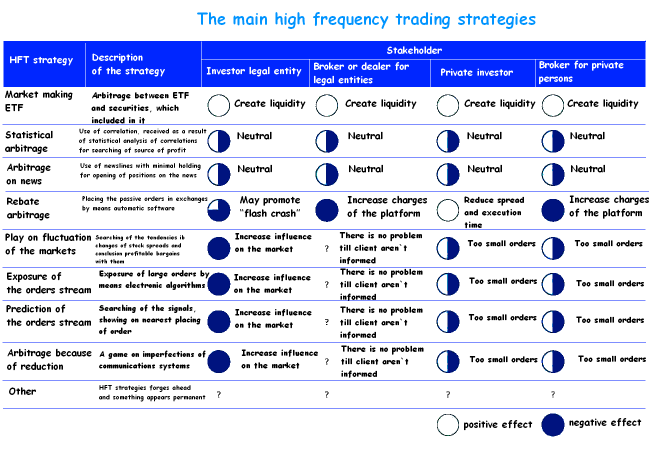

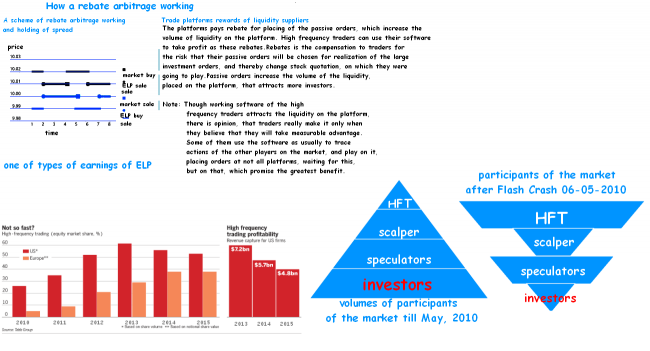

- Services of provision of electronic liquidity or electronic market maker (Electronic market making, Electronic Liquidity Provision): the HFT trader in the course of addition of liquidity on the market gets profit on work in spread. In the exchange biddings constantly there are moments when the spread increases (extends), and if the market maker can't find clients for maintenance of balance, then such HFT trader shall block by the own money the demand/offer on an asset to hold spread in a tough framework. Besides, for the liquidity provision increasing trade volume and, respectively, attraction of electronic trading platform, traders in addition receive rebate payments from the exchanges (or ECN), or receive a discount for the transactional actions.

- The statistical arbitrage consists in search of correlations between different assets and receipt of benefit from such imbalance. Search is conducted between the exchanges of one or different countries, between asset forms, for example, of shares and the derivative, the future for euro/dollar and its spot analog. Trade robots constantly monitor a huge array of quotations in search of the moments for earnings. The investment funds and commercial banks, having the corresponding licenses and sufficient technical capacities, usually use such transactions.

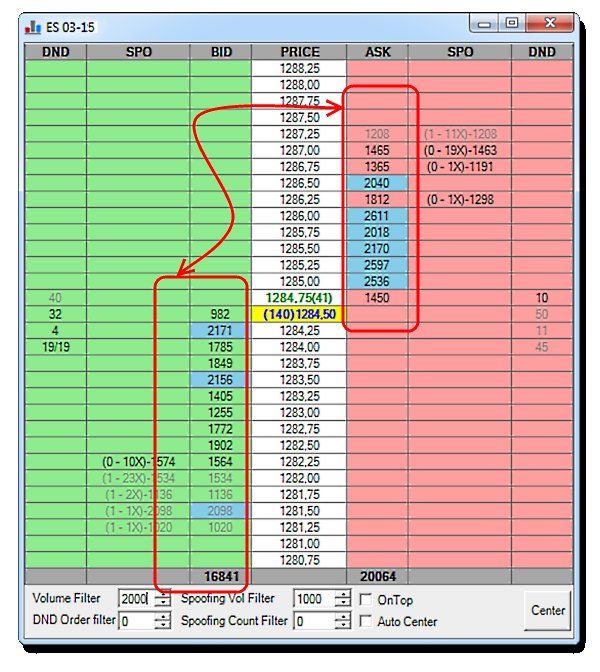

- Search of pools of large liquidity in an exchange glass (liquidity detection) is the detection of the large or hidden orders by placing of small test positions to get to the strong movement generated by these pools as «an exchange parasite». Active high-frequency brokers monitor the market regarding placement of large orders and as soon as such is, the broker places the orders taking into account execution of this transaction in the nearest future and from what consequences it will cause.

- Arbitration of delays (latency arbitrage) or use of a benefit from earlier access to exchange information, for example, due to direct connection to the main trading platform or placement of servers as it is possible closer to servers of the exchange. It`s used generally by traders who strongly depend on regulation of national exchange system, for example, in the USA (NBBO system). Such access usually paid, and optimum (geographical and technical) provision of the trade points requires serious finance costs.

Main delusions of high-frequency trading

Today about 40% of all trade volume are the share of amount of the dark (hidden) pools of liquidity and other off-exchange transactions (invisible to the majority of small players).

Therefore, despite active criticism, only some countries decided to take measures for restriction of HFT-trading for the separate financial organizations, for example, in the USA Volcker's Rule led to the fact that commercial banks were forced to close the HFT divisions. In Europe Italy which imposed on September 2, 2013 the specific tax against high-frequency dealers became one of the first: from transactions lasting less than 0,5 sec., charging the tax in the amount of 0,02%.

Illusion 1.

The opinion is created and is actively supported that high-frequency trading is exclusively a field of activity of ingenious programmers who thanks to wonderful algorithms collect remains from the financial market, trying to earn to himself more or less decent life. Alas, the main trade activity on HFT transactions is the share of HFT divisions of financial monsters (Goldman Sachs, Morgan Stanley, Deutsche Bank and so forth).

Illusion 2.

After general disappointment with Flash Crash investigation by the US Congress on May 6 the 2010th, when the small future broker Waddell&Reed (nobody heard about them neither to, nor after crisis) were found guilty, there was a belief that HFT — only the modern, covered with laws insider trading form for creation of a criminal trade benefit to certain participants of the market.

We remind: the insider trading is a serious criminal offense in the USA, but it doesn't belong to the rest of the world.

Substantive charge in the insider trading which is claimed to high-frequency trading is placement of the exchange order by the trader for the minimum time before the order of very large volume from the third party (so-called front running) appears. Until in a glass large volume for satisfaction of the large order «gathers», the price will be guaranteed to move in the necessary direction and small HFT-order will manage to take the cents. There is practically impossible to prove uses of the insider trading in that case.

Illusion 3.

Trade benefit (let microscopic in each order) can be received from HFT transactions only if settlement movement joins exchange crowd, therefore an active method of pressure of the high-frequency trader upon the market is creation of illusive liquidity. Installation of a set of small, short-term limit orders creates illusion of trade intentions in a certain direction and «presses» on the market. Fraud? Deception? Manipulation? Certainly. But no more, than the exposed regular limit orders, which provoke the market and quickly are removed (or turn over) after the deceived plankton begins to move in the necessary direction.

For the last 3-4 years all attempts to prove criminal nature of HFT didn't give success in no one country. Of course, HFT abuses and manipulates the market, but does it technologically, using imperfection of exchange mechanisms and winning thanks to handling speed. As in sport, only each won millisecond costs money.

Recent turbulence in the share markets has caused some experts to point the finger of culpability at computerised HFT -trading. In 2009 HFT transactions were 73% of the American and about 63% of world volume of the stock market. In Australia HFT has made significant inroads into the market. In 2015 it accounted for nearly one-thied of all equity market trades, a level similar to Canada, the European Union, and Japan. ASIC estimates that HFTs in Australia are collectively earning an not inconsequential $100 mln to $180 mln annually.

Recent turbulence in the share markets has caused some experts to point the finger of culpability at computerised HFT -trading. In 2009 HFT transactions were 73% of the American and about 63% of world volume of the stock market. In Australia HFT has made significant inroads into the market. In 2015 it accounted for nearly one-thied of all equity market trades, a level similar to Canada, the European Union, and Japan. ASIC estimates that HFTs in Australia are collectively earning an not inconsequential $100 mln to $180 mln annually.

Interesting the fact, that with development of information technologies to get profit on HFT transactions becomes more difficult and more expensive. Constantly growing costs on competitive software, the equipment and systems gradually push the small companies out from the market.

Financial traders may also be put in jeopardy by the sheer magnitude of large foreign-funded HFT players. In recent times, the incursion of HFT into other asset classes such as interest rates futures has shown that local traders are being forced out by the computing power of internationally-funded «flash boys».

Besides, HFT-trading chronically suffers from technical failures and program, quite often fatal, mistakes (an example – ruin in 2012 of the Knight Capital Group company, by actions of only one trader). At the moment the share of high-frequency trade was stabilized and HFT transactions provide at least 55% of exchange liquidity - the main vital force of the market.

And as the conclusion …

The modern financial market represents war of trade robots, and therefore high-frequency trading is not just legal game on an advancing or the automated data analysis. Modern algorithms of HFT-trading are used not only private players for a long time, but also are pledged in a basis of the principles of work of the Federal Reserve System of the USA and Central Banks of a set of the countries.

What is truly problematic is that the algorithms are not cognisant of when to stop or change a trade and thus can continue to pile money and exaggerate a trade well beyond what the market would consider a correct response. The computers do not have the «affirmative obligation» to keep the markets orderly.

According to the analyst of JPMorgan Nikolaos Panigirtsoglu, recent 6% Flash Crash of the British pound became the new warning of the structural changes happening in the foreign exchange market where high-frequency traders continue play a role of market makers in the foreign exchange spot markets. The same participants can create big problems for trade in forwards and other currency products in the near future. Catastrophic failures of liquidity in the foreign exchange markets become a reminder on events 2006-2010 which were observed only in the stock markets and bonds earlier.

High-frequency trading didn't reach peak of the development yet. It`s clear, that such type of financial trade to us, ordinary people, is unavailable. However, each small trader shall know structure of exchange manipulations and understand, that in 50% of cases against him on the market there are algorithmic traders, and not so chaotic emotional crowd or one large player as we are told by unfair brokers. Each of us has time to learn to leave from losses and to earn together with HFT traders.

Social button for Joomla