The financial market exists due to the competition between the strong and weak participants. The serious predators («wise money» or smart) take profit by manipulating the money and trade decisions. Nevertheless the large Forex players are not the enemies but rather more experienced partners for the reasonable trader.

From the trade tactics perspective the most dangerous participants are those who at their own expense manage the process and shift the price to some levels which are profitable to themselves. At the same time a number of small players is always present at the market for the smart traders not to «hunt» each other if there is a shortage of gain.

Usually the concept of the «large Forex players» embraces the Central Banks, hedge funds, bank structures and multinational corporations, namely all those which need constantly to convert huge volumes of currency and whose positions affect market anyway. In order to ensure that there is a liquidity the market maker uses own means using broad rights, capital, and great opportunities.

Large banks, pension funds, investment and industrial structures constantly bring huge volume of money to the financial market. However, in most cases their purpose is an exchange and hedging, but not a speculation. Therefore, they buy/sell at any current price.

The banks and the governments provide global funds transfer between various financial and other institutions. The Central Bank’s intervention is sometimes unofficial, but if so, the large Forex players push a rate to great accumulation of stops, remove them and develop the market in the necessary direction. Nevertheless, 90% of trading volume in Forex are created by net speculators.

Bank in Forex is not a speculator

Contrary to the opinion which is imposed on most of beginners, the large banks do not earn on fluctuation of the rate, they invest in the safe assets and receive the interest. The only purpose to enter the market is to diversify the currency reserves. Nevertheless these are not speculative transactions, for example, either purchase, or sale, but single time and on current price.

The banks do not trade on Forex directly because:

• such transactions are not considered as sources of the guaranteed income because of the high risk of losses;

• the bank has no right to use an insider information for the trading activity.

For the operation in the foreign exchange market the large banks (only at their own expense, but not at the expense of the clients) create affiliated structures like proprietary trading which trade at the expense of bank or large hedge funds, with harsh discipline and limits. In case of receipt of a loss beyond the limit unprofitable firms are liquidated, and if necessary the firms are set up for the specific trade idea or particular team of traders. It is practically impossible to determine to what extent a specific prop-company is affiliated with any large client.

Therefore, if there is an information that «Deutsche Bank has opened a position for sale of yen starting from 110.00», then it is merely the opinion and recommendation of local analysts for the clients, rather than a real position of the bank as a market player. Nobody except special employees is aware of the structure of positions in the bank’s opened trade portfolio and such data, as a rule, is not disclosed.

Quotations as a means of gain

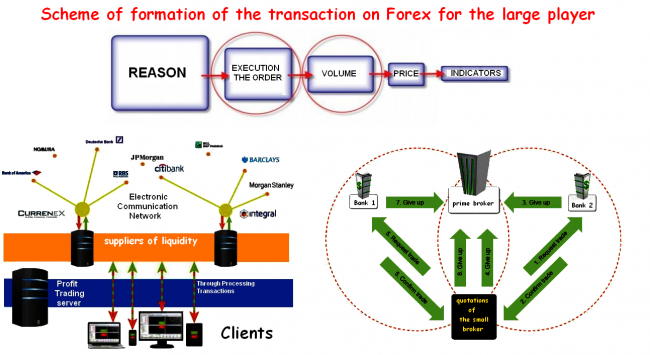

There is no single center of quoting in Forex, and therefore the different rate and trade conditions are established depending on the size of the equity and the status of the client. The flow of requests for the market consists of the limit orders, so that each participant states the price at which he is ready to purchase/sell an asset and exposes the request for purchase/sale. The difference (spread) between the Limit-orders closest to the current market price (bid - the price of the closest order of purchase, ask - the price of the closest order of sale) is narrowed or extended depending on what volume is stated by both sides. The sellers raise the price, and the buyers lower it. The more liquid the asset, the higher the activity of the market playersand the smaller spread is offered by the broker.

It is the global banks as the large Forex players that are the first to receive quotes because they make direct transactions through interbank and interdealer platforms (quasistock exchange market). For example, interbank Velocity from Citibank or Autoban from Deutsche Bank or EBS ICap interdealer platform have transparent pricing.

It is the global banks as the large Forex players that are the first to receive quotes because they make direct transactions through interbank and interdealer platforms (quasistock exchange market). For example, interbank Velocity from Citibank or Autoban from Deutsche Bank or EBS ICap interdealer platform have transparent pricing.

In the regular foreign exchange market the dealer gives to the client the quotation which already contains his commission, and earns on spread. For example, the interdealer FX All platform belonging to Reuters provides different quotations to different clients (depending on transaction volume). The large corporation always receives more beneficial price, than the small participant, because the former enters the market not for the speculation, but, for example, for converting.

The private clients and the small broker company do not enter into agreement directly, they need an assistance of the prime broker which acts as the guarantor of the transaction, demands the client to provide financial security of the position and also receives the commission from the client. In this case the prime broker does not disclose his own transactions, and carries out the transaction opposite to transactions of the client: if purchase is performed, then he sells immediately and consequently avoids the risk.

The small Forex dealer adds the margin to the quotation of the prime broker and shows it to the regular private client in the point-of-sale terminal. Most often small transactions are secured (hedged) in the broker’s platform and do not get to interbank market. But if the broker is more reliable, then he put small orders into a pool and brings them to the real market as a part of the global order of the bank or other financial institution.

Please remember: the small trader has to to work under quotations of the specific broker, therefore do look for the access to a flow of the prices with the minimum number of intermediaries. And as soon as means allows you - pass to exchange platforms.

Volumes

The volumes is the only more or less reliable indicator of the market activity available to the ordinary trader, and its correct analysis will help to come over to the side of the large player in time. The price always derives from volume in the financial market. Therefore, the initial point of any trend is an entry of the large operator with limit orders. They enable to observe the origin of the trend, and dynamics of the volumes will help to identify the key levels received as a result of opertor’s manipulations. It is rather difficult for the large deal to enter directly into the market. A considerable slipping is possible that creates the small range (a phase of the market accumulating).

Tom Williams in his book «Owners of the Markets» has for the first time described practical trade on volumes, VSA (volume spread analysis) which is actively used and developed nowadays. The large Forex player, as a rule, comes into position for the long term. Therefore the volume analysis yields the most precise results on the periods above D1.

The real information on transactions’ volume, their direction, and structure is available to those who work at stock exchange platforms or active MarketDelta, ATAS or Ninja Trader point-of-sale terminals. Special indicators of a market profile show who and at what price levels control the market at present – the sellers or the buyers. Only tick volume is available to the ordinary MetaTrader 4(5) users (strategy of work of is here). But the logic of actions if the large player appears is approximately identical.

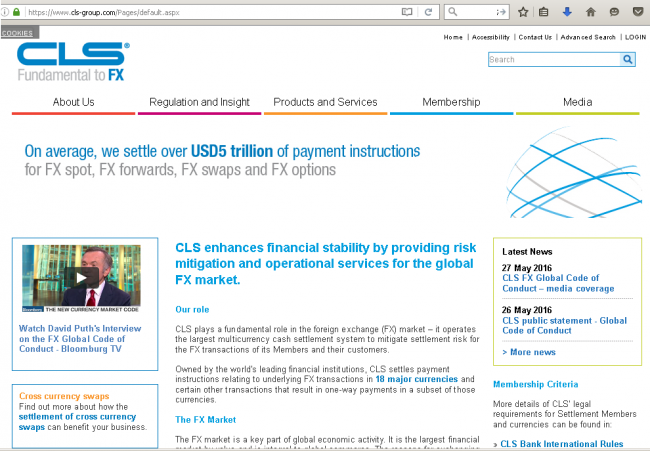

The huge volume of Forex transactions in CLS-group reports is created by the hedge funds or prop-firms. Following the active development of HFT trade, the contracts which last from 3 seconds to 5 minutes are taken into account in daily trading volume calculation. It is quite difficult to trace the market maker's entry only on volumes, the assessment of a fundamental background is necessary.

The huge volume of Forex transactions in CLS-group reports is created by the hedge funds or prop-firms. Following the active development of HFT trade, the contracts which last from 3 seconds to 5 minutes are taken into account in daily trading volume calculation. It is quite difficult to trace the market maker's entry only on volumes, the assessment of a fundamental background is necessary.

Please remember: The «thin» market with its small volumes rather than an active market is much more dangerous to the small player. The strong price movement in case of sharp decrease in volumes is observed on an outcome of the trend when there are practically no persons interested in pivoting already, and there is no inflow of the new money. When the market lacks liquidity, then even not really large, but rare transactions, sharply shift the price to both sides and it is impossible to predict it by the means of the technical analysis.

Basic tactics of large players Forex

At any moment there are several hundreds of large players in the market, and, as a rule, they generally play against each other. Therefore it is not always possible to find adequate opposite transactions, and for the purchase or sale of the large volume, average and small volumes at the closest price are neglected and the market is gradually shifted in the necessary for the market maker direction.

Information manipulations

The concept of the insider’s information has come from the stock market where it is accepted to use any important, but inaccessible information for the receipt of a trade benefit. Information on corporate, political and financial events, open positions and actions of the large customers allows not only entering into deals, but also avoiding the risk.

Medium-term movements originate in stock and the debt market. The ordinary Forex traders do not analyze them, and therefore cannot correctly assess a situation with a view to 1-2 months. «Smart money» always has more information which can «move» the market and take it into account in the positions several hours (or days) before the publication. It is a fundamental background - the official statistics, mass media, analytics and comments of all colors, «recommendations» of brokers, banks and the hedge funds – that creates opinion that «all buy» or «all sell», and it makes most of traders to open transactions in a certain direction.

Sometimes incorrect information is specially thrown to the market to create a certain direction, and then the large speculator can change the market where he has waited for publication of information and change of a tendency. It can be so if such player has enough means for keeping the position against the market.

Inexperienced speculators, even having real insider information, most often enter the market too early or incorrectly treat it and make mistakes with the direction.

So, on a global «bear» trend the price is periodically pushed up in short term, creating a convenient position for sale by the large players. At the same time both technical and fundamental factors are used. For example, «smart money» based on Brexit actively bet for the fall of pound and euro. For this reason Morgan Stanley sent to VIP clients the recommendation to sell pound at 1.35 on June 22. Even though the pound before vote was so overbought, one day before the publication of the results the rate of GBP/USD was raised by 2 figures up that it would be more profitable to fall. Those who managed to assess this situation correctly have entered the sales in advance and could squeeze most profits out of the subsequent fall.

Please remember: The short-term insider information is regularly thrown into the market for the manipulation of the crowd and fight against competitors. The actions of the large market players are always fundamentally proved even if it seems that technical factors serve as the reason of movement.

Please remember: The short-term insider information is regularly thrown into the market for the manipulation of the crowd and fight against competitors. The actions of the large market players are always fundamentally proved even if it seems that technical factors serve as the reason of movement.

Use of postulates and errors of the technical analysis

The market maker's purpose is to buy when everybody aims to sell, and, on the contrary, to sell on the excess of offers for purchase. Therefore, the large players will buy up volumes and hold the positions even in the falling market as they have got a lot of money. In the same time the trading «plankton» which is adhered to a traditional technical analysis constantly looks for standard patterns on a price chart and as a result joins the market at the end of strong movement.

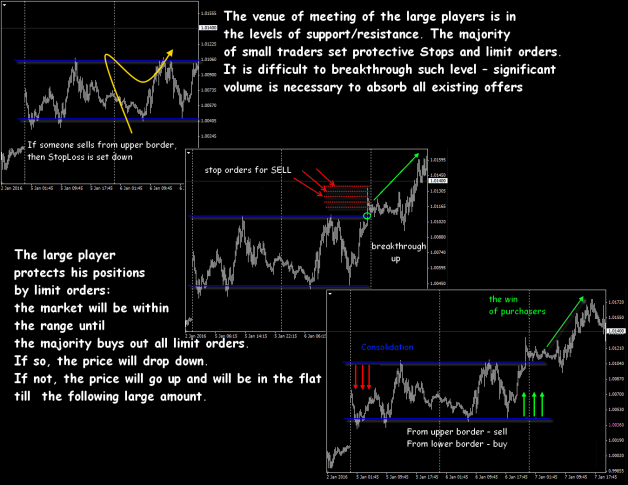

Even all false breakdowns of the levels are followed by sharp bounces of volumes. During the flat the positions for purchase/sale are gathered on borders of the channel and the positions are not closed on both sides till the moment when one party lacks money and there will be a breakthrough towards the winner. Force of an impulse is supported by Stops on both sides of consolidation border. Market makers see this bulk of orders and intentionally push the price to them. Your losses lead to their profit.

If the high volume is visible directly at the price level, then the kickback of the price is more likely to happen. After mutual «compensation» of the opposite transactions,

the price after false breakdown returns to a zone and easily punches the level even by small efforts. In case of splash in volumes close to the strong level it is possible to open a position and to deliver stop loss behind a candle with the increased volume.

Please do remember: When the current trend comes to an end (irrespective of the direction), the large Forex players yield the position to smaller speculators (a distribution phase), that causes a short-term growth of the volumes at the end of a trend. The late beginners enter the dying trend right at the end and enable the large clients to earn. If you are ready to risk, then it is possible to come right after large volumes, but for the reliability it is worth waiting for confirmation on closing of the period.

Trade against a trend

The large player always works with limit orders, and exposes the bulk of orders on the neighbour prices in some range. Let's say there is some rather strong movement on which the large player has received the position. Further he begins to push the price in the opposite direction, creating the thought of change of a trend and when the market trend becomes «obvious» to most of small customers, a task of the market maker is to support this movement and not to allow returning to the main direction.

Further the task of the market maker is to leave the positions against the market until the pressure of crowd becomes critical. Closing of the positions of the large volume (or removal of limit orders) creates an imbalance between orders for purchase/sale and as a result the price goes in the direction, necessary for the large player, that is against the crowd forced to accept a loss.

Further the task of the market maker is to leave the positions against the market until the pressure of crowd becomes critical. Closing of the positions of the large volume (or removal of limit orders) creates an imbalance between orders for purchase/sale and as a result the price goes in the direction, necessary for the large player, that is against the crowd forced to accept a loss.

Please do remember: "Smart" money practically always works against a visible trend, they are not interested in a short-term current situation in the market. At the current levels the large Forex players do not create anything, but also they do not close positions so far. The emergence of candles with big shadows evidences the work of the large player. Thus it creates positions against the crowd not aggressively, within several days, with a view to 3-4 weeks.

The stop of trend by the large player

We will imagine a long trend movement when everybody understands what should be bought, and everybody trade in such a way. The price gradually reaches strong obvious level. Suddenly there are big candles with long «tails» and all indicators show splash in volume.

Nevertheless, the market goes further, the situation with an abnormal candle repeats until the market does not begin to brake, movement of the price is slowed down and finally changes the direction. In such situation the cluster analysis shows that there is the performance of the large limit orders on «tails» of such candles – the candles are set by those who possess not only big money, but also some information.

If are sharp bounces in the market with the subsequent fixing and kickbacks without the visible reasons, then the large Forex players gradually «swing». The main turning movement becomes powerful and sharp, due to operation of stops of those who supported the previous trend.

If the obvious bull growing market does not react to positive news and good statistics on an asset then it is worth waiting, at least, a strong correction down.

If the descending market does not react to an obvious negative, and «tails» constantly begin to appear in the bottom of candles, but not above, then it means that smart money constantly redeems positions for sale and it is worth waiting for an increase.

Please do remember: The large participants have an opportunity to hold an irrational position until from the book of orders opposite requests arrive. First of all, stop orders for strong (round or historical) levels will be removed: «obvious» points of a turn, support/resistance levels, for example, Fibonacci's levels will be a beneficial zone.

As the conclusion …

There is no additional value in Forex, and therefore it is necessary to reconcile the fact that your loss is always someone's profit. Small clients cannot influence the price, it is moved by million deposits. In order to catch the true market direction, it is necessary to adapt. The financial market needs not only your losses, but also the commissions on the transactions made by you. Therefore mass media, premarket, mailings, technical and financial analysts, Forex guru and other interested persons work for compulsion of small players to make obviously unprofitable transactions.

The market maker always trades a step ahead of the crowd, knows and «sees» the main participants, monitors their actions and successfully manipulates them. Experience and market thinking, the analysis of dynamics of volumes and understanding of tactics of exchange traps of large Forex players allow any trader to follow them, to avoid losses and to successfully take away money from weaker colleagues. Only the strongest player will survive.

Social button for Joomla