The first question anyone who has decided to seriously engage in trading must answer is not even the kind of strategy or a currency pair to choose for trading, but rather how to choose Forex broker to work more comfortably and safely.

Thus, the main stumbling block novice speculators face is choice between dealing center (hereafter DC) or a licensed broker. One would say that there is no difference in this case, but it is not true. Firstly, the contract with the brokerage company has all the signatures, required details, and, as a consequence, legal force. The offers of any DC cannot be regarded as a legitimate document in most trials – in fact, everything will hang by a single thread and reputation of the company.

Secondly, the broker mainly earns on commissions, so it is beneficial for it when the client is trading a lot, operating by large volumes, sometimes even scalping is encouraged by a variety of services. As for the DCs, the situation is somewhat different. Of course, now most DCs function relatively honestly, but that does not change the fundamentally different approach to dealing with the trader.

We won’t recall the hackneyed subject of placing orders at the market, as it does not matter for a successful trader how a company manages its internal flows: the main thing is to make timely profit payments and no attempts to get into the pocket. Speaking about the “pocket”, some companies intentionally widen spreads, and relation to the spikes in the chart is a separate matter.

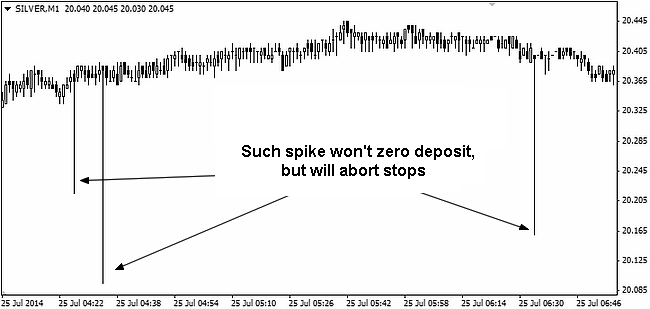

Spike is generally non-market quotations, which are usually filtered by DC, but from time to time, such a formation can appear on the chart, at the same time zeroing someone’s account or activating take profit on the orders. And such a situation is a quality filter for unscrupulous DCs, because a serious company would fully restore the orders and funds on deposits of their customers who suffered from such a "failure" – you don’t even have to apply for support, everything is done as soon as possible.

Dishonest representatives from the industry will find a lot of reasons and reservations to cancel the return on the spikes, but refuse to recover zeroed accounts or losses on the stop-losses resulting from this incident. Of course, it is difficult to know at once to which group your selected DC belongs to, but still possible, and now we’ll gradually move to the second fundamental point.

How to choose Forex broker who treats clients honestly

One of the most objective indicators of reliability of the company is attitude of dealing department and technical support to existing and potential customers. Even if the real account is not open yet, reliable companies will answer any questions both in chat rooms and on the phone, including the provocative ones, since they are well aware of the fraud of their competitors and use their “objectivity” as a marketing tool.

If the support is not responding or starts to depart from an apparently unpleasant topic, it is better to forget about that DC. Additional information can be obtained from independent forums, where scandals erupt regularly, and the fact how the representatives of a particular company solve questions and complaints can say a lot.

In addition, many have a question of how to choose Forex broker with a rapid withdrawal of funds. Unfortunately, if we are talking about the DC, there is no unambiguous answer in this case, as no clear criteria exist, but once again you can read the reviews on forums. In addition, it is wise to pay attention to the list of withdrawal methods: the more of them, the better.

Deposit size and account type as criteria for choosing a broker

Talking about spikes, we got away from the topic about the differences between the brokers and the DCs. It is already clear that the first option involves much less problems. But since the brokers provide access to the futures market, most novice speculators simply can’t afford opening an account for trading on the exchange – for instance, the cost of one price “tick” when trading on the CME with one futures micro-contract on euro equals to $1.25, which is quite expensive for training.

In the meantime, most DCs allow trading with minimal lots, on which tick price is one cent. Therefore, it is recommended to start training with the largest and most popular DCs, especially if you are doing good – then shifting to a real exchange will be even easier, because commissions are lower there, and speed of order execution is higher.

The alternative option that will both suit the DC and the trader is ECN account. Today, many companies offer such accounts, and the minimum deposit for the transactions is in most cases just $1,000. The main advantage of this option is elimination of the conflict of interest between the trader and the DC, and, as a consequence, high speed of order execution, no requotes and slippage, the opportunity to observe the situation in a market depth.

How to choose Forex broker with ECN account? It is easy – today many resources correlate trading conditions of different companies, so you can define an appropriate criterion in search filters and make your choice. Of course, the real and comprehensive picture of the Forex market can’t be seen through the depth, given the decentralized nature of the market, but in a particular ECN system, the information will be the most complete and allows to extrapolate the sample to the entire market.

How to choose Forex broker with a convenient trading platform

It is known that the selection of the first platform determines trading style and choice of strategy for a long time, so it is best to go on the reverse – first decide on the general principles of the strategy, and only after that pick the appropriate terminal for them. For example, the most controversial method is locking, which is an invention of the DC, as it is used in the MetaTrader 4 program (hereinafter referred to as MT4).

If you plan building grids, the question of how to choose Forex broker is no longer relevant – any company that supports MT4 is suitable, other things being equal, of course. But if the strategy involves a stop-loss, it makes sense to try to master the software, which is close to the usual exchange terminals, to minimize the adaptation period during the transition from the DC to the futures market.

A good option would be MT5, which lacks locking – in addition, some companies develop their own terminals – for instance, Rumus 2 of “Forex Club” may seem uncomfortable at first glance after MT, but work with the requests and orders there is as close as possible to the usual exchange. The only caveat is that it lacks “real” volume and request depth for obvious reasons. Analogs can be found in other DCs, especially in the western ones.

Mobile trading deserves special note: if there is no opportunity to work at the desktop computer or a laptop, you need to select only the broker who provides mobile applications or web terminal, but trading on the phone is now completely useless, although the sites of several companies can offer such services.

Social button for Joomla