Beginning traders have an opinion that trading by tools of the stock market requires the big equity. This statement is correct only partly as nowadays almost each dealing center allows to work with indices CFD.

Beginning traders have an opinion that trading by tools of the stock market requires the big equity. This statement is correct only partly as nowadays almost each dealing center allows to work with indices CFD.

Indices CFD is special contracts which buyers and sellers stake on growth or decrease in the stock market. It should be noticed that the word «stake» in this case has no relation to gambling games as it characterizes the whole complex of actions of the trader for forecasting of future dynamics of assets.

Specifics of indices CFD

It is necessary to remember stock indices before considering basic analytical methods. In general, such indicators are the indicators reflecting dynamics of the stock market that is technically is a regular data asset.

In application to the financial market, the index is the weighted average index of exchange or share information consisting of indices of securities on groups of goods, companies and entities, or other derivative financial instruments. The Olsen Ltd company borrowed the idea for the development of this auxiliary tool for decision making by large and retail investors from a Richter scale technique for measurement of the intensity of earthquakes.

Any market is under «seismic blows» caused by economic, political and other events. The Forex indices calculated based on the tick data measure impact of these events.

Similar indices are calculated almost in each country with a market economy nowaday, but the most known indicators about which references in mass media and textbooks on trading regularly meet are:

- SP500 – an index is calculated based on the share prices of five hundred largest companies entering listing of NYSE;

- NASDAQ100 – the index reflecting a cost dynamics of hundred of the strongest and successful corporations of the USA in the sphere of high technologies;

- Dow30 – the tool allowing to estimate capitalization of 30 industrial giants of the USA;

- FTSE100 – the main indicator reflecting tendencies in the British stock market;

- DAX – the most popular stock index of Germany;

- Nikkey225 – the main economic indicator of Japan.

All listed tools are calculated and aren't used for direct stock exchange transactions. In particular transactions on purchase and sale of «indices» are opened by special exchange financial derivatives – the standardized futures.

The index future is a settlement contract, buying and selling of which the parties stake on growth or decrease in a basic indicator. In other words, if the buyer opened a long position, this transaction can be considered as a purchase of a block of securities entering this index. With sales a situation opposite – in this case, the trader opens short directly on the whole block.

Indices CFD are already derivative of derivatives, that is in case of trade on Forex, not indices, namely futures about which we mentioned above, are underlying assets. Therefore the specification of any «contract for difference» will have much in common with parameters of the forward market, namely:

- CFD is nominated not in dollars, but in points;

- the cost of one tick and size of a step of such similar assets often corresponds to similar indicators of tools of the futures market.

Nevertheless, if CFD were the exact copy of futures, they would hardly enjoy popularity among small customers, respectively, they have peculiar features, which shall be known by each trader, irrespective of his personal experience of trade on share assets.

The minimum amount of transaction corresponds to one standard contract on futures, therefore, many tools become unavailable to owners of small deposits. A possibility of opening of transactions in small amounts (fractional lots) which allow beginning work with the small equity is an advantage of indices CFD.

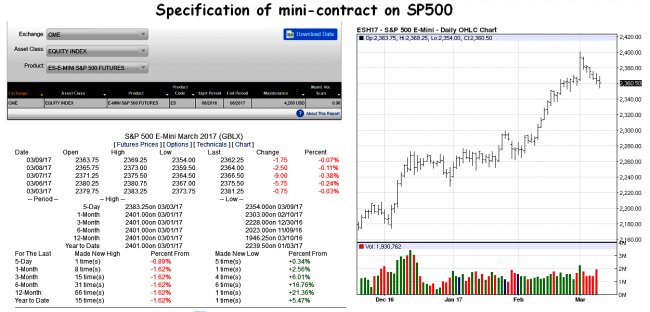

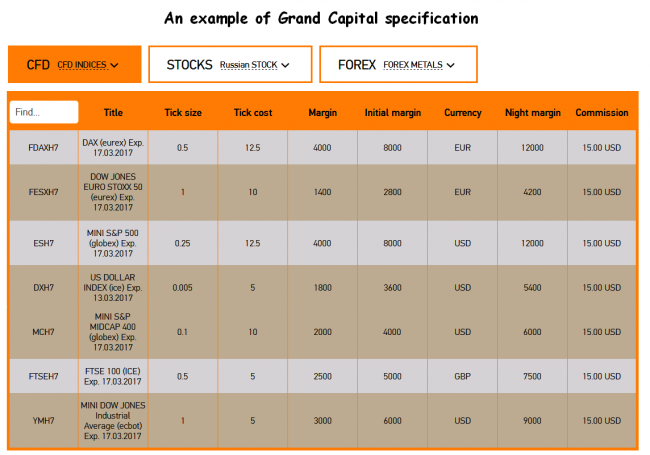

Let`s review the elementary example to check this point. Marginal requirements for position opening for the mini-future for the SP500 index are given in the table above. As you can see, it is necessary to deposit to account 4200 dollars for only opportunity to work with this tool.

As for other trade conditions, close attention should be paid to the cost and size of one tick. In particular, in case of the work with one contract E-MINI S&P 500 FUTURES the tic price (0,25 basis points) is equal to 12,50 dollars, it means that if the stock market of the USA decreases on only 20 points, the buyer of the future will suffer the losses equal to $250, that is much, considering strong volatility of the market.

Indices CFD transactions are much cheaper even if not to take into account low marginal requirements, fractional lots allow to open positions which amount will be 100 times less than the main future. This feature allows constructing a flexible system of a risk management.

Certainly, shortcomings of contracts for difference are also available, in particular, the commission and spreads much higher in the dealing centers, than in exchange brokers (of course, in relative expression, in relation to the price of one tick). Secondly, in case of work with DCs legal protection of the client leaves much to be desired, and, thirdly, working conditions at the exchange are strictly regulated, and the companies can change the CFD specifications somehow and at any time, therefore, it is necessary to monitor amendments to the offer and announcements.

What indices CFD quotations depending on

In general, the stock index is a barometer of an economic country situation, therefore, in the long term the dynamics of similar indicators depends on macroeconomic and political factors, in particular, most often for forecasting of trends on shares the following indicators are taken into account:

- Unemployment – growth of an indicator over natural size negatively affects moods of investors, at the same time the shares of the companies from a consumer sector are under the strongest pressure as solvent demand is reduced;

- The consumer price index – as a rule, deflation negatively affects share value, and inflation, on the contrary, gives support to the stock market as its moderate rates stimulate economy, and hyper - and the galloping sizes force investors to invest money in assets (for protection of the equity);

- Dynamics of production (in percentage expression by the last periods) – positive dynamics gives to investors of confidence that the real sector of the country will continue to grow that is especially important for the companies entering the Dow Jones industrial index;

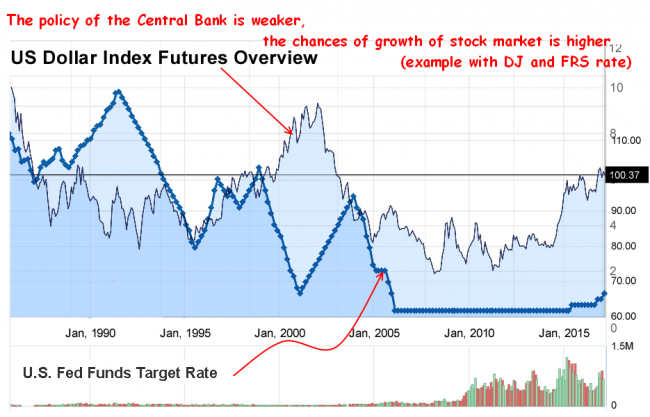

- The rate and policy of the Central Bank of the country − mitigation of policy always leads growing of the stock market as it is followed by depreciation of currency and financial injections in economy (toughening gives boomerang effect);

- The GDP dynamics (in quarter and annual terms) – theoretically, indices CFD shall depend strongly on similar statistics, but practice shows that trends on GDP often correlate with the listed above indicators, therefore, this regularity has rather informational manner.

Thus, in the long term the stock indexes always reduplicate dynamics of key indicators of the country, and in the medium-term period trends in the stock market generally depend on detailed macroeconomic statistics which allows distinguishing recession or an economic boom timely.

Certainly, similar regularities work only in the conditions of political stability, as a rule, it is possible to see powerful long-term trends on indices in the developed markets. Everything is much more difficult with developing countries as regular political crises increase the risk of bankruptcy even for the strong companies.

The main strategies for indices CFD trading

Considering the fact that contracts for difference differ from futures only in the size of the minimum lot, all trade strategy showing a positive result on the forward market will bring income in case of CFD trade either. The exception is only high-speed systems within which robots hold the transaction less than a second (anyway, similar techniques for the ordinary trader, most often, are uninteresting because of high requirements to the equity and technical capabilities).

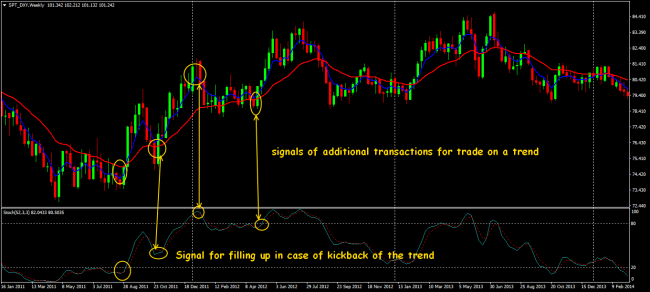

Thus, it is reasonable to begin acquaintance to indices CFD with those investment systems within which tools of the stock market are only bought, and short positions − are ignored. Significant assistance in the development of similar approaches is given by classical indicators – exponential moving averages and the stochastic oscillator.

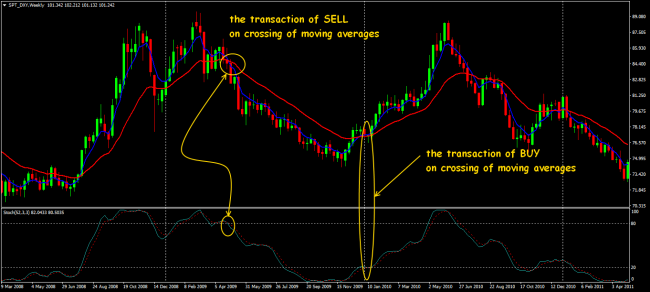

As it`s easy to guess, the main transactions on the purchase of contracts will open at the time of crossing of EMA(26) and EMA (104) on the week schedule. The specified periods were chosen in accordance with calculations that the first moving average shows a trend for the last half-year, and the second moving helps to estimate long-term dynamics of an asset (for 1-2 years).

It is obvious that in case of similar tactics transactions will be concluded extremely seldom, in particular, since 1997, on the SP500 index such strategy will open only three orders – in December 97, January 04 and April 10, therefore, for filling up a trend it is reasonable to use regular Stochastics (52; 3; 3).

By the way, on the chart above key differences between actions of investors and speculators are evident directly, in particular, in 2011 many traders staked on decrease in indices as they waited for the second wave of crisis, but it was only the kickback for investors, on which it was possible «to buy in addition» profitably on a trend.

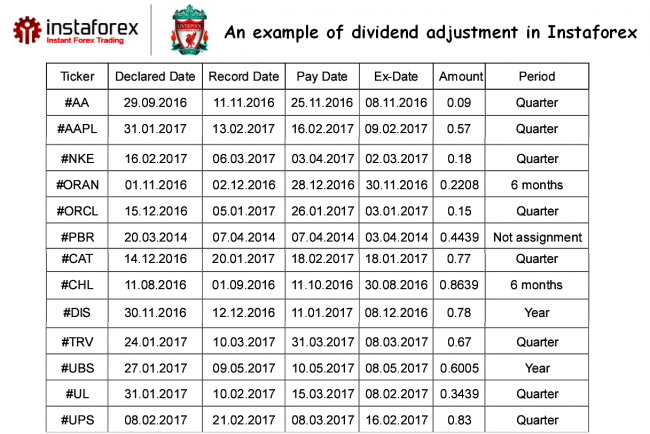

The second strategy within which indices CFD can be used for the investment purposes is oriented to receipt of dividend adjustment. Let's remind, this term is understood as transactions on charge and write-off of the amount of dividends if positions for purchase/sale respectively are open on a joint-stock asset «the contract for difference».

It is required to satisfy several conditions for the creation of this system.

- First, the account should be opened in the dealing center which establishes both minimum, or allows to disconnect, or in general levies swaps on the CFD tools. Instaforex company can be considered as an example.

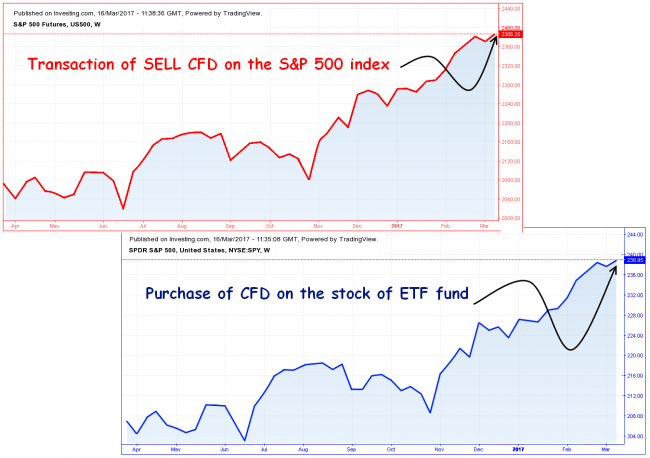

- Secondly, at the tools list of the DC CFD shall include a SPY ticker – this is a contract for papers of ETF fund which works with the components entering the SP500 index. We will buy this asset as on it the maximum dividends are charged.

So, the investment transaction will consist of two components, the first is a purchase of SPY, and the second – sale of indices CFD (if more precisely – on S&P500) by an equivalent amount. As a result, we will have the trend - neutral position on which the dividend adjustment is charged.

Benefits of such approach are obvious, first of all, it`s the elimination of a market risk as the trader (or better to say − the investor) creates trade «lock» within which the loss on one asset is compensated by profit on the second. Besides, nowaday many DCs gives an opportunity to trade termless contracts on indices without collection of the additional fees for holding positions after the date of an expiration of futures is expired, leading to the chance for creating a pure cash flow.

By the way about cash flows, if to observe policy of the dealing centers, it is possible to notice that many companies because of the competition reduce appetites and offer more profitable fees and spreads leading to the payback period of similar transaction doesn't exceed half a year then the client begins to gain a regular income.

Certainly, a game on dividends can't be considered as the main earnings, but in case of trade of indices CFD similar transactions can be used for compensation of losses of some unprofitable transactions, that is in this case the trader is insured against speculative risks.

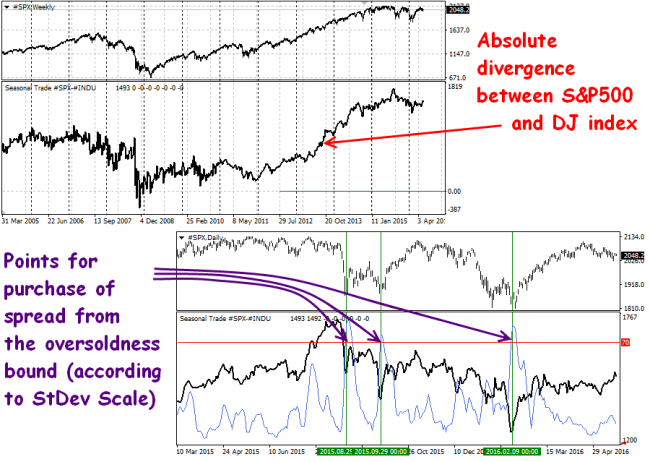

The third strategy allows benefiting by fluctuations in the stock market and to the analysis of discrepancies between different industries and the exchanges. In literature, such tactics named spread trading or trade in a spread difference.

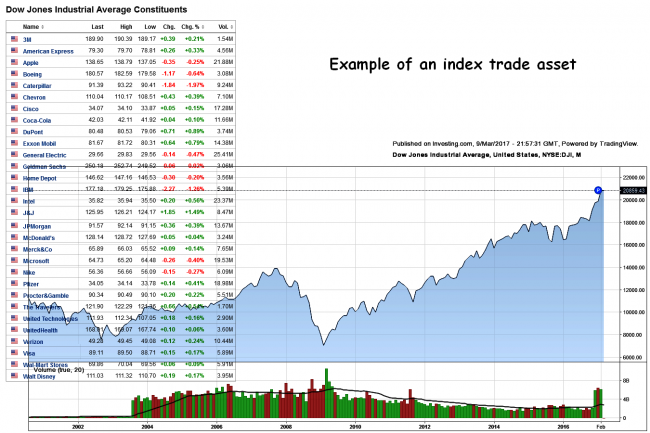

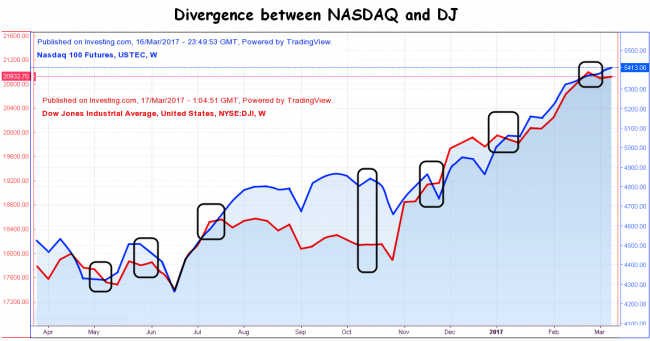

The example of a divergence between the SP500 and DJ index is on a chart above. Can seem that this information doesn't bear anything interesting and useful, but if to remember that the first index reflects dynamics of all stock market of the USA, and the second indicator reflects tendencies in industrial sector, there is a possibility of profitable purchases of the Dow Jones index at such moments when it begins to leave off all economy.

Auxiliary tools require for work on this strategy, namely, any indicator of spread (showing a difference between values of two assets, currency pairs, goods, etc.) and classical Standard Deviation which, in turn, will be calculated based on the received synthetic algorithm.

As it is easy to guess, it`s better to buy CFD on the Dow Jones index after the standard deviation of spread from the average size reaches critical values. Unfortunately, the trader shall determine border for an oversold condition as the universal scale isn't provided in the Standard Deviation indicator.

In a similar way, you can use spread between DJ and Nasdaq, but you should analyze discrepancies between industrial sector and the sphere of high technologies in this case, and this research carries local, but not comprehensive nature already.

Certainly, one technical analysis for the formulation of forecasts and the conclusion of transactions isn't enough, it`s desirable that the trader has a good understanding of specifics of the researched industries, as «financial bubbles» distorting a real picture are formed from time to time in the markets. In other words, if one of the sectors is overbought, there can be an impression that all other spheres are underestimated.

The special attention should be paid to a strategy which analyzes discrepancies in dynamics of the separate share and the stock index. As a rule, correlation assessment between similar CFD allows to appropriate to papers a category «better than the market», «neutrally» and «worse than the market» which considerably simplify subsequently selection process of assets, suitable for trade.

Where indices CFD are traded

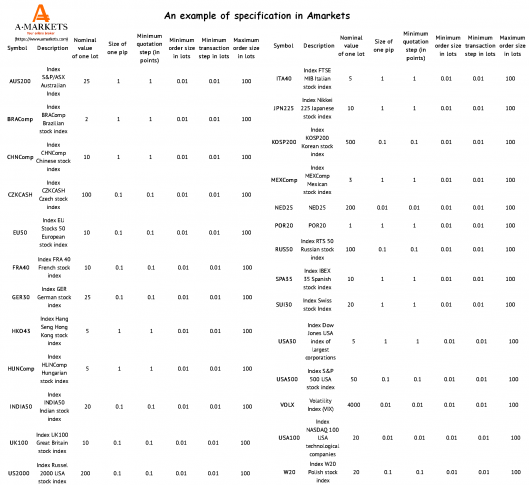

Nowaday there is no deficit in offers of the companies, on the contrary, almost all dealing centers try to expand a line of tools. A set of indices in rather known company Amarkets as an example.

As you can see, indices CFD of several regions are available for work on this Forex dealer, namely, Brazil, China, Australia, USA, France, Germany, Great Britain, Russia, Poland and many other countries, therefore, the trader has an opportunity to create very interesting portfolios.

As for CFD on the share of the ETF fund specializing in S&P500, they can be found in the specification of Instaforex. I remind, the «dividend» strategy oriented to receipt of a passive income will be completely useless without this asset.

Besides, a set of basic indices which includes key American, European and Asian indicators can be found in the Grand Capital specification. Set of indices is less here, than in Amarkets, but for the strategy listed here, it more than is enough.

Short summary and conclusions

So, this time we considered the main features of index contracts for difference, and also determined some strategy in which basis similar tools are pledged. Let`s make some conclusions. Let`s begin with strengths.

First of all, indices CFD are available to most of the traders. In other words, if there are not contracts for difference, much the beginning speculators couldn't try to trade in the foreign stock markets as access to the exchanges opens not from one thousand dollars.

Secondly, contracts for difference open ample opportunities for hedging of risks and portfolio diversification as they cardinally differ from currency pairs. This circumstance allows finding application for difficult and interesting strategies.

Thirdly, indices CFD is the first step on the stock market for many traders, i.e. in the course of trade the speculator begins to study specifics of exchange tools, therefore, when the necessary equity appears, the transition to the respective platform will be followed by smaller risks.

And the last important benefit of the contracts considered this day is that they are suitable for investment. The matter is that Forex pairs can't be considered as an equity remedy, and CFD is a dollar asset which is inclined to growth in the long term.

Nevertheless, in the comparison between FOREX and regular futures, CFD has also shortcomings. In particular, the fact that such tools are emitted by the dealing center isn't a secret, it means that transactions on them are extremely seldom brought to the market and generally «turn» in the company dealer.

The similar scheme is under specific risks, most important of which is a forced termination of the biddings, that is closing of transactions on contracts and removal them from the specification. It may happen if DC can't construct an effective system of hedging of risks.

One more shortcoming is connected with the need to make special requests for the opening of access to CFD, though it can be considered rather peculiar feature. Such conditions are provided not in all DCs though in the serious large companies they meet. Possibly, it becomes for the protection of nonprofessional traders.

In spite of the fact that indices CFD is a cheap alternative to futures, expenses on spreads and the fees on them in relative expression turn out much higher, than on the forward market. Thus, if the CFD trader has a large equity, conditions of DC become less attractive. In case of stable trade system and practical experience such players will have direct way to transactions on exchange platforms.

Social button for Joomla