Round-the-clock work of the Forex market causes quite clear desire to trade (and to earn!) every day, for this reason, intraday trading − the most popular type of trading. Gradually each trader gets rid of the illusion of the «fast» money, but it´s preferable to pass this way without considerable losses. We will try to help you with it.

Intraday trading enjoys wide popularity in the exchange market. Transactions within one market day always attract with the active price movement, low level of an entrance to the market and a possibility of fast earnings with the use of high leverage. At the same time, the profit is planned to be got even on the minimum market fluctuations because of a mess of transactions. Also, the possibility of short-term hedging due to the opening of the same short-term opposite transactions is considered as an advantage of such trading.

This type of trading is suitable enough for aggressive traders and opens a way for the use of various additional strategy. Intraday trading assumes using of rather high leverage. Respectively such trading assumes a set of risks, in case of non-compliance with elementary receptions of an insurance.

Before making several general recommendations, we suggest defining some moments at once. We will consider that intraday trading (or daytrading) means transactions duration from M15 to D1, which are opened and fixed within one working day, rather, during wakefulness of the specific trader − in trade time, convenient for him. Moreover, all types of a scalping on the time frames below M1-M5 are strongly recommended to be considered as not a special case of intraday trading, but separate trading technique, because on the midget periods the standard principles of intraday trading are almost not applicable.

You shouldn´t forget that there are general requirements in the financial markets, but there are no tough rules. The profitable intraday trading − it doesn´t mean an obligatory entrance to the market and a set of transactions every day at all.

Actually, trading within a day is one of the most complex in all parameters − you won´t find any scalper or intradayer among the most successful traders. It´s very difficult technically to transfer the transactions to the profit on the background of the «market» noise, which is the intraday market, especially as all speculative factors have as much as possible an adverse effect on trading during the day.

Nevertheless, there are periods, assets and techniques which make intraday trading rather favorable and our task is to learn using them.

Specific features of intraday trading

Basic requirements for successful trading within a day on the real account

- The experience

- Psychological endurance, stability, observation.

- The efficiency

- Competent money management (management of load of the deposit, stopes and losses).

Money management for the intraday trading.

It´s always necessary to remember that any new transaction is an additional risk which has to be rather proved by favorable market conditions. High psychological stress easily causes anger because of unprofitable transactions, and attempts to return losses, especially with risk from 5% and above in each transaction quickly devastate the deposit. Stops are obligatory in case of intraday trading!

The correct use and calculation of stops sharply reduce the influence of various negative emotional and psychological factors on the financial result, and the technique of two stops − physical and subconscious − is just necessary for intraday trading.

The most admissible level of losses which you determine for yourself proceeding from strategy, the chosen asset and reality of expectations by profit, is considered as real or physical StopLoss.

Subconscious StopLoss is put at a sharp turn of a trend when the instant closing of a position is required from the trader as the incorrect direction of the movement has really been chosen.

Most of us define an only real stop for a trade position − the most admissible day loss at which achievement all trade operations stop. Beginners, besides, can move StopLoss further towards a loss, hoping for a fast turn. As a rule, also, they earn on it.

Stop-orders hunters

A lot of small transactions leads to the fact that intraday trading will have a smaller percent of advantageous transactions because of the frequent closing of positions on stop-orders. The desire of small «fast» profit force intraday traders to put very close stops and to become market «forage» for large players.

Large institutional traders, as well as your broker, see a real flow of orders and levels where congestions of stop-orders of retail intraday traders are placed. Then your stops «get off» even small or average volume (on both sides!), then the price quietly comes back to a trend. The correct calculation of stops and reasonable management of the capital can be a remedy for such effect. We don´t forget one more unproductive expenditure item.

Accounting of costs for the broker

Spreads and commissions become an important factor of capital management in intraday trading. The transaction in 1 lot which in a couple of hours gives you $30 of profit as regards spread will «cost» the same as transaction lasting 5 days and the income of $300. Each entrance has to be reasonable and favorable − don´t give the money to the broker!

The general risk has to be constantly under control, both in the separate transaction, and on the closing of the day that losses in one day could be easily offset as a result of the next trading session. At successful trade, the capital will gradually grow and it will be possible to increase the single volume of positions and to increase profitability because of it.

Choice of trade strategy

We will remind − at first any strategy should be carefully tested before use on the real account. The intraday market can be rather technical, but the intraday trader has to learn:

- to close reasonable losses,

- not to have complex concerning «the missed opportunities» at the strong movements.

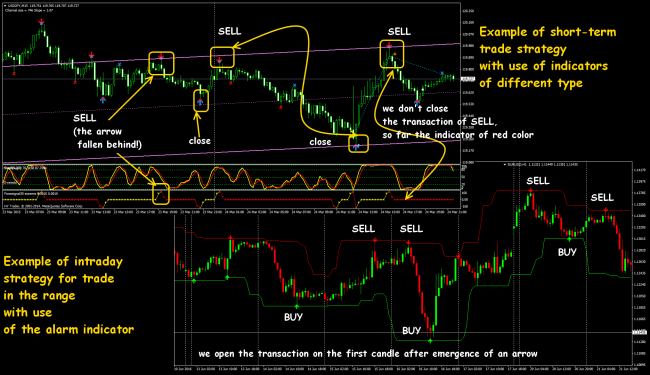

All variety of intraday techniques can tactically be divided into three groups:

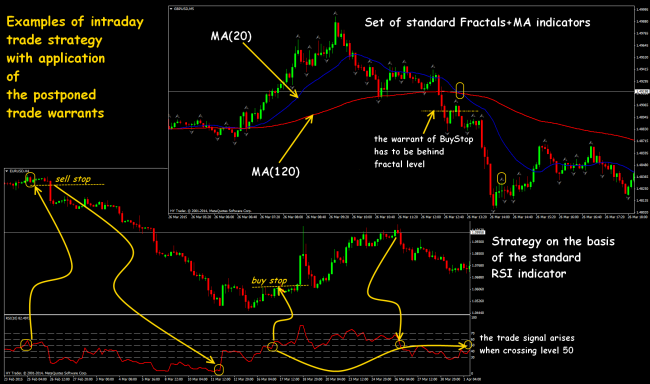

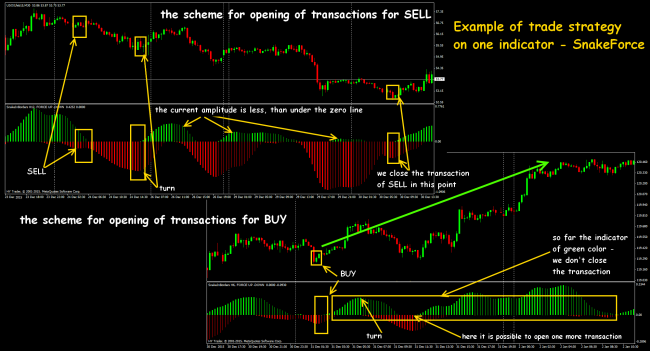

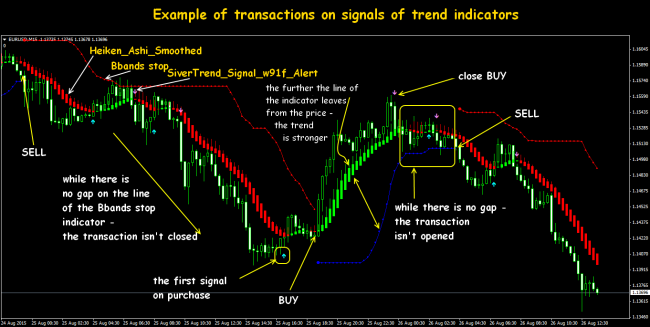

Trade on a trend on the basis of average values

Options of moving averages remain statistical classics on which almost all famous traders have made primary capitals. The practice shows that presence at trade system of at least one oscillator is required for the increase in accuracy of signals within a day and decrease in the effect of delay.

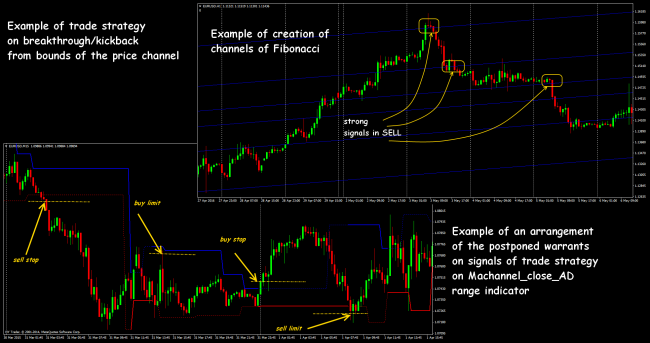

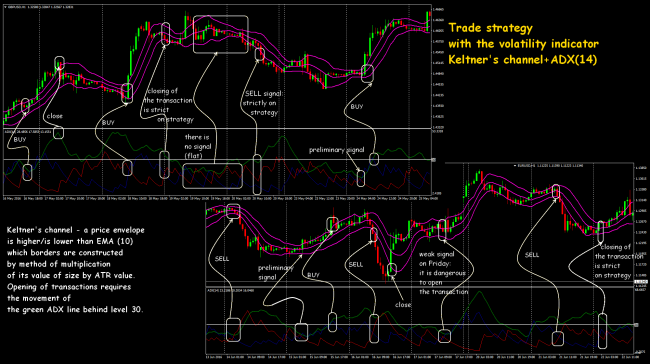

Trade on breakthrough/kickback from bounds of the channel or power lines

Rather wide price channel, both horizontal, and trend, should be the basis for such trade. Practice shows that dynamic trend lines and dynamic indicators of the channel are much more favorable to intraday trading, than «rigid». They are used generally in the middle of the most active trading session on the chosen asset taking into account price dynamics for last day.

Trade on news

During the intraday working, it is impossible to ignore the news base. Even if news won´t break the current tendency, the speculative movements can bring a mass of trouble. Practice shows that fulfillment of skills of work at the sharp news movements can be useful also in usual trading − it tempers character, trains reaction and fixes technology of work with various types of trade orders. Besides, work on news allows checking the quality of work of the broker, communication systems and your equipment.

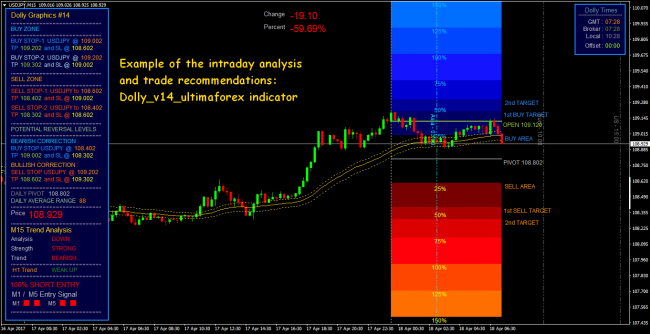

The correct estimation of daily average range of volatility allows to find not only a convenient point for an entrance, but also to estimate the approximate price of closing of a position: if the market is active and difficult predicted, then it´s possible to close when the price reaches border of average range, or if the market keeps a profitable tendency – it´s possible to keep a position until the end of trading day.

Choice of a trade asset

Though it is considered that investments into several tools reduce the general risk, the argument doesn´t work in a case on Forex within intraday trading. It´s necessary to study carefully asset´s dynamics during the day, and in various conditions and on the different periods because the liquidity, activity and rather big price range of the chosen asset tool in trade time, convenient for the trader, has to become the main criterion. Besides, the chosen asset has to correspond to trade system and risk level as much as possible.

As a rule, stable efficiency can be achieved in case of working with 2-3 assets. Daily average volatility at 40-60 points within the most active trading sessions are enough for several successful transactions per day. In case of keeping transactions within several hours, the profit needs to be fixed by parts, to avoid losses at a sharp turn or other unusual situations.

A wish to trade on everything at the same time destroys the deposit in the direct ratio of your activity − the practice shows that simultaneous positions more than on three assets sprays attention of the trader. We don´t forget that in case of critical situations it will be necessary to make the fast decision on several assets, that complicates trade in addition.

Market analysis features

The difference between the beginner and the skilled intrady trader is most obvious within a day:

- The beginner still considers that fast intraday trading doesn´t need the deep market analisys while the skilled player already understands that each successful transaction during the day is the result of the correct analysis.

- The beginner wants to get quickly to the direction which the market shows at present, to earn quickly and to leave quickly, without analysis of the actions − as before opening of the transaction, and later. Skilled considers that the market has to come to his settlement point.

Technically intraday trading in the Forex market gives many trade signals, but it´s necessary to choose the most probable as there will be few time for correction of mistakes. The analysis is traditionally made from a bigger interval to smaller, it´s recommended to begin with the day schedule taking into account the fundamental analysis for the current day.

In particular, within a day the behavior of the price almost aren´t given for estimation under the influence of fundamental factors, and therefore it´s necessary to be ready to any of possible options of events. If you have no successful experience of trade on news, then it will be optimum for you meet the news without open positions, to monitor the reaction of the market and then to enter on a stable trend. In case of open positions, we tighten stops and partially fix the profit, that not to interfere with the process during the speculative movement.

The success of intraday trading directly depends on your purposes, but the market can be unstable or on the contrary, has a weak volatility, and therefore won´t allow you to carry out objectives. It is recommended to put for itself restriction both on losses, and on profit, that is to stop trade not only when receiving a loss, say, 50 points, but also when receiving such profit level already.

If you stable intraday trader – don´t leave a position for next day. A new day will create an absolutely new market and if you are sure that you can execute the reliable forecast more than for day, then create and apply full-fledged medium-term trade system, but don´t try to trade on medium-term strategy with old, intraday rules.

Choice of trade time

Each trader defines operating time individually, but you should understand that large players − the exchange, banks, corporations, the Central Banks and funds work according to the schedule. The biggest fluctuations of the asset chosen by you during the periods of day activity of the leading region, for example, EUR/USD − from 5:00 till 18:00 by Greenwich, and raw or commodity assets (and the related currency) «are strong tied» to working hours of stock exchanges.

We will note the following as especially volatile moments:

- Opening/closing of key trading sessions.

- Morning closing of Asian stock exchanges.

- The end of Asian (without China!), the beginning of European and the beginning of American sessions is considered an optimum point for the turning set up which are overlay the morning and day movement.

The gap at the beginning of a week, as a rule, doesn´t bargain by intradayers, but it´s necessary to track its influence on the general trend. On Monday most of the large participants don´t trade that usually weakens price levels of the last week and then even small trade volumes can cause considerable fluctuations and formation of the new purposes.

Friday evening is dangerous because of the same reason − many players fix positions before the weekend, and also don´t risk to trade on US macroeconomic data which is traditionally published at this time. From the point of view of news fulfillment, it´s also possible to consider Wednesday evening with its traditional publications of FRS protocols and data on inventories of energetic raw materials as speculatively dangerous.

Nevertheless, there are situations when it´s possible to risk opening a new position against the main day movement at the American session:

- The market reached, but didn´t break the strong levels of support/resistance (on D1).

- The daily average range on an asset is exceeded and the strong technological level is reached.

- The main movement is a speculative response to fundamental factors.

The urgent trade plan for the day has to allow probability and parameters of a possible turn of the already opened positions, and the turn, if necessary, is carried out by the turning stop order in a point of opening of the main transaction.

Main mistakes of the intraday trader

Averaging of unprofitable positions without serious reasons for a turn of the current direction. There is an overstaying of losses, trade means are reserved for the new (unprofitable too!) positions, which could be used for the opening of new transactions more likely of a profit, for instance, on other assets. Within a day it´s necessary to leave bad transactions as soon as possible and to wait for the new favorable moments. Monitoring of volatility of the chosen tool will allow closing positions in due time − at the moment when the potential of profit comes to an end.

Incorrect behavior before, interim and right after the news. You should understand that there is an accumulation of the market and postponed orders before the news, which stops are get off with pleasure by the large players in 1-2 minutes prior to the news exit. That is the reason for «nervous» turns, still before the main reaction is created.

Attentive monitoring of news will allow estimating correctly a situation, sometimes some events completely turn a trend. The beginner should abstain from the opening of orders in 30 minutes prior to the publication of important news blocks, and also apply in the course of work the data from an economic calendar.

Excess of admissible risk for the purpose of receiving a fast profit. The optimum level of risk (for any deposit!) in case of intraday trading − no more than 1% for one transaction, so then will be high chance to return such noncritical losses. Trading should be done by 1-3 open positions. A large number of orders increases the probability of to get confused and lose money. The beginning participants of the market, in general, should master strategy on one pair —after you achieved skills on receiving profit, it´s possible to start using the additional tool at the same time.

Psychological mistakes in case of trade within a day. Intraday trading is featured by the constant search of signals on an entrance and control of open transactions, and therefore required strong nerves and health, absolute discipline, internal tranquility, infinite patience and extremely fast reaction, as making of the trade decision happens in severe conditions. Usually, traders overestimate in themselves such abilities. As a result: the constant tension, the infinite working day, chronic fatigue, constant aspiration to win back losses, mistakes and excess of risk.

The overestimated expectations from the trade of this kind can be considered as the separate negative factor, and when goals aren´t achieved for any reasons, including on market, independent of the trader, they, as a rule, come to an end with all above-mentioned problems. You shouldn´t set a framework or limits of earnings — at the moments of a stress the risk of mistakes or the wrong entrance increases. It´s better to set a restriction on the lost means, that is, to designate a level, after which it´s better to finish the trading day − it gives the chance to avoid unnecessary emotions and spontaneous decisions. Only work on the accurate trade plan and a rigid money management solve all similar problems.

And as the conclusion …

In the modern markets, intraday schedules look as the «market noise» overflowed with false signals, because of the popularity of various automation tools of trade, and also high-frequency trading.

Nevertheless, most of the beginners trade exactly within a day in hope to increase as much as possible the deposit within a short term, and with the minimum intellectual efforts. In reality, about 80% of traders are ruined on intraday trading because of the «market noise» is hard to the statistical calculations put in traditional technical indicators.

But after all such players have rather high chance to earn, but not the size of earnings, but stability as result of the correct trade behavior of the trader has to be the trade purpose. The intraday trading strategy has to give rare, but very qualitative signals even if it gives the small profit as a result. And then in case of complying with the rules of capital management, each your trading day will be lived not for nothing.

Social button for Joomla