Each modern person knows a concept of seasonality, for instance, increase in prices for fresh vegetables during the winter season or rise in price for fuel in biting frosts, but very few people know that it is possible to earn on similar regularities. We will consider seasonal spread-trading by means of contracts for difference.

In the case, the spread is not a difference between the ASK and BID prices to which many Forex traders got used, but a divergence between the prices of two (or more) baskets of commodities or securities. For instance, if the bushel of corn costs $4, and wheat $3, the spread between them will be equal to $1. The CFD transaction on spread can mean the purchase of a basket of platinum and simultaneous sale of a basket of silver, or soybeans and products from them (for instance, soy oils and soy flour), or purchase of oil and sale of oil products.

The most important in seasonal spread-trading – is to pick up correctly the assets which will make your «settlement» financial tool. It`s important that the difference between their prices changed in some range during most of the time. Usually, they select assets with high correlation and similar characteristics, for instance, the shares of the same company which are traded on the different exchanges, or futures with different dates of an expiration, or securities of the companies/enterprises of one industry sector.

The popularity of seasonal spread-trading has already led to the formation of the stable relations suitable for the transaction:

- Crash spreads (between soybeans and products of them);

- Crack spreads (between oil and its products);

- Intercurrency spread (platinum/silver; gold/silver; platinum/palladium; palladium/silver);

- Index spreads.

Options of such trading are pair trading (spread between two tools with high correlation) and arbitration trading (the spread between connected or identical tools, and at the same time – there is no market risk).

From the point of view of technical and fundamental analysis, seasonal spread-trading differs in nothing from usual speculation − trends, impulses and kickbacks which can be used for generation of profit, are formed on these synthetic indicators. In this case, it`s generated greatest interest in seasonality, as it has an effect even at such moments when basic assets have critical (very strong or very weak) correlation.

Some theory

As we already noted above, seasonal trends are known to each person, moreover, if the increase in prices, for instance, provoked by devaluation and high inflation, always causes concern and indignation, then periodic increase in price tags in shops on some goods is psychologically perceived by the mass consumer absolutely normally.

For instance, demand for soft drinks increases in the summer practically in all countries of the northern hemisphere due to that their retail prices raise also a little. If to consider not retail, and global macroeconomic trends, it`s possible to give another example – grain traditionally rises in price in December as still rather far to the next harvest, and spring sales of the remains will begin approximately in April-May when prospects of a new season become clear.

The similar principle works at the financial market (if more precisely − commodity), that is quotations of some derivatives depend on a number of factors which are shown nearly an every year and stimulate key players to sell or buy an asset. Similar tendencies are also called seasonal.

Now about spreads. There is a natural question – why not to trade in usual contracts (CFD or futures), they submit to seasonal trends first of all? The matter is that such tendencies, which are imperceptible on basic assets, occasionally are created due to the influence of specific factors on inter-commodity spreads.

For instance, the price of corn and wheat synchronously grows in the current market reality, at the same time, this trend has no long-term regularity. At the same time, the spread between these commodities seasonally increases as corn grows in the price quicker than wheat.

The similar seasonal trend on spread could be created also based on another initial conditions, namely:

- Corn rises in price, and grain price falls;

- Wheat became cheaper quicker than corn.

Thus, in case of spread-trading, we eliminate the influence of unpredictable events (a speculative factor) and fulfill only the most reliable regularities reflecting dynamics of a demand/offer on commodities in the real sector of the economy.

Grain and oil crop market

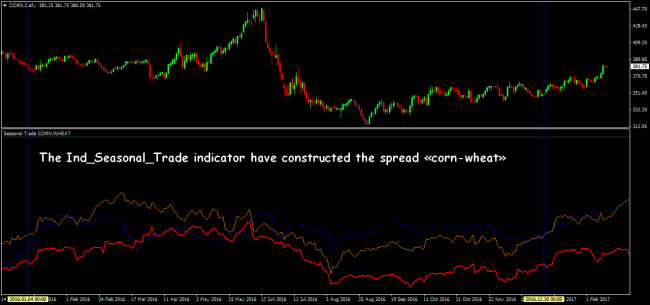

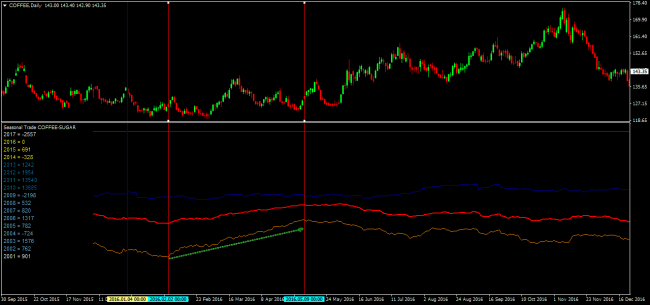

As we already mentioned corn and wheat, we will begin the review from them, in particular, it`s possible to use the Ind_Seasonal_Trade indicator which automatically brings some quotations into a comparable form to obtain the appropriate trends in the MetaTrader4 terminal. It`s impossible to tell that this algorithm is very popular, but you can easy find it in the MQL5 database.

As for calculations, it`s allowed to use the usual «stuck» CFD as a base. Of course, such technique concedes on accuracy to the analysis of urgent contracts, but, from the point of view of statistics, this error is insignificant.

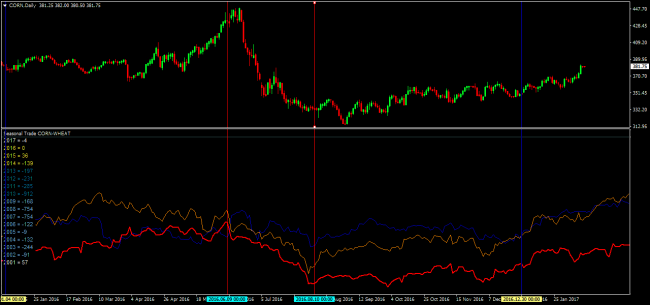

So, dynamics of average seasonal tendencies on spread «corn wheat» for the last 3, 5 and 15 years respectively has been presented above on graphics. As you may notice, the first obvious trend is formed «winter-spring» since December to the middle of May.

Within the designated tendency corn is in great demand, than wheat, therefore, it`s expedient to buy contracts for a maize and along with it to sell the equivalent volume of wheaten CFD at the first of December. Certainly, no two times are ever the same, therefore, sometimes the considered signal will yield a loss, but the statistics show that the probability of fulfillment of this pattern makes about 87% (13 cases from 15).

It`s very easy to explain such regularity. Firstly, demand for corn from livestock complexes increases in winter, as the cereal is one of the most widespread nutritious forages. Wheat doesn't get such strong support as it`s used mainly in the food industry, demand for which production remains at the stable level almost all the year round.

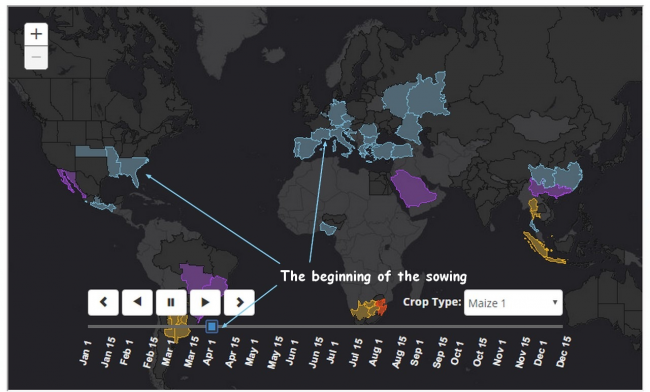

Secondly, along toward spring farmers and consumers of corn fixedly watch weather conditions in USA/Europe and at the slightest hint on a late sowing campaign begin to hedge risks by purchasing of the relevant forward contracts. There are no such pressing problems with wheat as it yields two harvests – winter and summer.

The last reason is indirectly connected with previous. The matter is that in April and May (when it`s possible to estimate the potential of a new harvest according to the condition of spring crop on fields) farmers and wholesale dealers begin to get rid of old stocks of wheat. These actions put pressure on the prices.

And the second trend on this spread is a diametrical contrast of just considered cycle. In particular, long-term observations show that since June to the middle of August demand for wheat exceeds the needs of the market for corn.

As you may notice, sale of corn and simultaneous purchase of wheat in the designated time interval made profit in 13 cases from 15 (from the point of view of seasonal spread-trading the minus sign before figure in the table means not losses, but that the price of spread fell), therefore, the mentioned regularity can be considered rather reliable.

As for the trend formation reasons, the explanation should be looked for in real sector again. We will remind, CFD quotations are connected to the futures listed on CBOT, and the prices of them, in turn, depend on moods of large producers and processors of raw materials in the USA and Canada.

In June the listed above subjects begin to monitor fixedly a situation on fields: study publications of the US Ministry of Agriculture about a condition of crops, meteorological service forecasts, and also monitor researches of the independent organizations which collect and process the statistics, and other information, connected with this sector. And painfully react to any negative news.

In this situation, the prospects of corn practically don't cause fears, because the maize is one of the most unpretentious cereals, the main thing is to seed it in time, but absolutely another situation develops with the wheat. The matter is that at a stage of active vegetation grain is afraid of any deviations from the climatic norm, its crops equally badly transfer heavy rains, heat and frosts. But what summer has no local anomalies? This is a reason for an imbalance in demand and offer.

And one more spread, concerning the agriculturalmarket, assumes studying of divergences between the prices of soybeans, corn and wheat. As practice shows, during the period from October 12 to May 29, it`s expedient to buy oil-bearing and to sell grain (volumes in each link of such transaction have to be equivalent).

If not to consider the exchange specifics, this transaction will look as follows – we buy a bushel of beans and at the same time we sell a bushel each of corn and wheat. Certainly, the actual volume of speculative operation will be much more as even the minimum lot on CFD assumes work with several tens bushels.

When the bull cycle on spread comes to an end, there is a sense «to turn over» as from June 1 to October 11 soybeans begin to become cheaper in relation to corn and wheat. The matter is that the fresh harvest of soy reaped in Brazil comes to the market in the mentioned time interval, which puts pressure upon quotations.

The statistics show that for the last 15 years sale of spread «beans-corn-wheat» have been made a profit in 12 cases, it turns out that the probability of fulfillment of this movement approaches to 80%. Besides, one bear «junior» cycle is formed within this trend which proceeds since September 7 till 11.10 – it can be used for «refilling».

So, as we just convinced, inter-commodity dependences give quite good opportunities for earnings on CFD contracts for trade by spread − actually, we have additional tools which are absent in the terminal and the specification of the broker.

Seasonal spread-trading by sugar, coffee and cocoa

In addition to the grain contracts, so-called «soft goods» enjoy special popularity at the exchanges, therefore, some dealing centers began to add coffee, sugar (USA) and cocoa to the specification, which prices, in turn, also depend on weather factors and a vegetative cycle.

You should notice that it`s a little more difficult to analyze the listed tools, than grain market, as their quotations are more subject to various force-majeurs, for instance, the severe drought in Brazil can lead to decrease in coffee productivity for the next 2-3 years due to that habitual seasonal trends will work with failures.

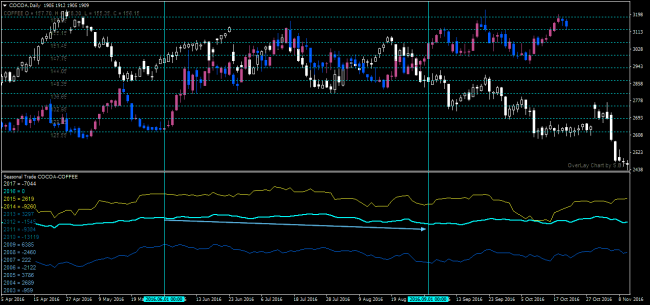

Nevertheless, the statistics − stubborn things, in particular, they show that rather strong ascending trend is formed from April 22 to May 31 on the «cocoa coffee» spread for the last 15 years, which can be used for generation of profit.

Since 2002, this signal has fulfilled in 11 cases from 15 – is this much or a little? In comparison with patterns on grain, the calculated probability seems «ordinary-looking», but in relation to the financial markets in general chances seem not such bad any more.

By the way, we didn't focus attention on the dimension of contracts earlier, as the prices of soy, wheat and corn are specified as «cents for bushel», but during the work with «cocoa-coffee» spread it`s necessary to consider several important specific features:

- The cocoa price is measured on a scale «dollars for ton»;

- The coffee price is measured in cents for weight pound (0,4535 kg.).

The divergence has been already recalculated on graphics above, but it`s necessary to make so that links of spread have turned out equal in the case of the conclusion of the transaction. For instance, if during the work with CFD lot of cocoa is equivalent to 100 kg of a real product, then the volume of «coffee» operation also has to be equal to 100 kg (or 220 pounds). As specifications usually differ at different brokers, it is technically simpler to carry out recalculation at the tick price.

As for signals for sale of «cocoa-coffee» spread,it`s quite difficult to find qualitative entry points in this situation. Apparently, deficiency of cocoa beans which didn't allow quotations to decrease the last decade considerably impact the situation.

The one interesting «bear» interval is observed from June 1 to September 1, but even in this case, it`s expedient to open short positions within seasonal spread-trading only after formation of strong UP impulses – at the time of return of an indicator to the average price. In our opinion, beginners should refrain from such trading.

And one more important commodity spread is called sometimes by «coffee with sugar» as he reflects divergences between coffee and sugar quotations. To be fair we will notice that the similar analysis seems not absolutely logical, the listed products strongly differ in many parameters, but, despite it, the strong seasonal up-trend is formed on this synthetic asset from the first of February and till May 8-9.

In particular, the probability of fulfillment of the considered signal (simultaneous purchase of coffee and sale of sugar) make of about 73 % that is very quite good. And if we talk about specifics of commodities, we recommend to pay attention to the following important features:

Quotations of sugar hardly depend on dynamics of Brazilian real as Brazil is the largest producer of a sugar cane (strong strengthening of BRL can level completely the seasonal factors putting pressure on the prices of a «sweet» product);

- Deficiency of «arabica» coffee is partially compensated by the supply of «robusta» due to which abnormal splashes in the coffee market also quickly decreased.

- In recent years sugar is more often used in the production of biofuel, therefore, in the future demand for it can grow considerably.

Thus, if seasonal spread-trading in the form of seasonal transactions without additional filters is still admissible in the grain market, then during the work with «soft goods» it is better to make secure by the technical tools, for instance, it`s possible to eliminate false entry points in the direction of moving average.

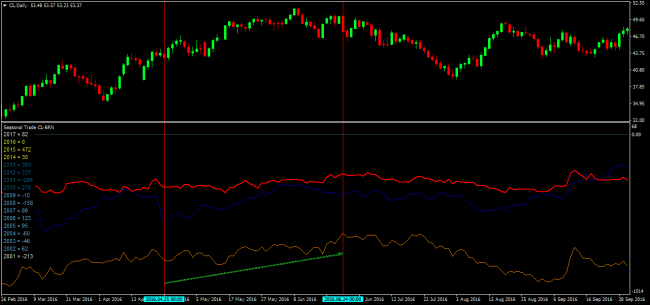

Oil spread

And the last tool which is necessary to remember reflects divergences in moods in the American and European markets of oil products. By the way, if it still can be problems with access to CFD on agricultural products, then there are no difficulties with oil as both brands are presented practically in all broker centers.

As it was already noted earlier, due to impact on moods of bidders specific (political, economic, territorial) factors, the prices of different brands of oil or products of oil processing can significantly differ. That is, from the point of view of statistics, temporary violation of mutual correlation of assets then quotations begin to move within the general global trend again is observed.

From the point of view of the seasonal analysis, it will be reasonable to hold a long position on «WTI-Brent» spread from April 25 to June 24 as preparation for «an automobile season» begins of the USA in the mentioned period. The term means both increase in activity of private drivers, and commercial carriers.

All rest of the time the considered spread is mainly in a flat, therefore, it`s impossible to distinguish seasonal impulses on it. Even when receiving an obvious trade signal, the probability of its fulfillment leaves much to be desired. By the way, seasonal spread-trading from corridor bounders is also very popular at spread traders, but this subject is beyond today's review.

Conclusions and additional recommendations

The seasonal spread-trading is a deviation from classical methods of trade on Forex. This mode gives the chance to gain constant income irrespective of market conditions.

Today we were once again convinced that the movements in the financial markets aren't casual at all, on the contrary, quotations of many assets depend on fundamental factors which are shown nearly an every year. If to summarize the following advantages can be noted for the seasonal analysis:

- The methods

- Seasonal entry points are known in advance, that there is no need for the daily analysis.

- The probability of pattern fulfillment is also known long prior of a position, therefore, the speculator can quietly and deliberately estimate the opportunities.

On the other hand, our own observations and responses of the western traders show that beginners begin to lose enthusiasm and are disappointed in this method after a while after the beginning of seasonal trade, as it has certain shortcomings:

- force majeurs sometimes break long-term regularities;

- not all speculators have enough patience to wait for the fulfillment of a trend which can proceed to half a year;

- sometimes brokers close the trade in commodity CFD without notice due to which all strategy falls;

- the spread often reaches seasonal peak/bottom before the specified time (for instance, according to the statistics the trend comes to an end on May 5, and the maximum of floating profit has been fixed on April 15).

If to construct correctly «estimated» spread, then seasonal spread-trading is more favorable, than by separate assets from its composition. The behavior of spread is more predictable, than the behavior of its separate tools, as market factors affect similar financial instruments synchronously, and there is the synchronous falling or the synchronous growth.

Actually, the listed problems only seem serious, but skilled speculators learned to fight with them for a long time, in particular, for increase in effectiveness we recommend to put stop losses, to connect the swap-free service (which will allow holding a position for a long time), and also to use take profits, equal to average profit. Besides, it is possible to segment a position and to fix result on a measure of the price movement in the direction of the forecast.

Social button for Joomla