It is assumed that only the one who believes that a cataclysm is possible can avoid it. Modern times of crisis almost completely changed the dynamics of markets, decreasing technical dependences and increasing the value of fundamental factors. But any experience in trade on Forex in times of crisis – it will be definitely useful.

Unlike with the stock market, the foreign currency market is sustainable (in an own way, of course) in times of any cataclysms, moreover – always increases turnovers. It allows to earn regardless of economic situation – the experienced trader will prevail both on growth and on fall. Forex – the one financial market, which was not crashed in the period of 2007 – 2009, it is not connected with problems of policy, revaluation of assets, production volumes, customs barriers or transport communications, and its demand/offer always forms in sufficient amount.

Of course, each player uses its own tactics and scale of cataclysms. Technically trade on Forex in time of crisis is as the option of trade on news, but more extremal. For the correct estimation a trader need information not only about the event, but also its cause and possible consequences, as well as accompanying factors of the world economy. The main advantage of such trade is wide opportunities for maneuver.

Crisis as an opportunity to earn

The global crisis in the financial market arises 1 time in 10 years, less serious – 1 time in 3-5 years, local – 1 time in 3-6 months. During the crisis the prices volatility is supported by the state inflows in banking structure and in problem sectors, besides, speculative throws are powered by market panic, which results in the unique chances for earnings appear.

Today the intraday trader catch its 50-70 points on deviations of statistics from the estimation and multi-day fundamental tendency doesn`t matter for him, but we believe that advises not to trade on Forex in crisis and «idle around» – not for us.

Actually, events which become the reason of crises, and their global influence on the world economy, are not really important for an ordinary player from the practical point of view. Consequences of crises may be both positive, and negative for the specific country, the market, an asset, and therefore it is very important to correctly estimate them and to react to events. And the first advice – quiet pertain to the abundance of appeared «news», in hard times they appear much more.

An information source, influencing on making decision, shall be reliable and timely, and skill to filter rational kernel in the informational garbage – additional protection of professional speculator. During the crisis, the most adverse factors on certain assets are turned as positive for the others. Each information has the price, and each price of exchange have the information. Let`s remember, at the beginning of the year George Soros declared, that should the British voted for Brexit, the pound will fall, at least by 15-20%. The falling from 1.46 to 1.20 (and lower) is already was and a descending trend on GBP/USD isn`t finished yet.

Not only intraday aggressors but also conservatives, preferring middle-term positions, earn on cataclysms. The periods of crisis are characterized by an absence of flat movement – the trend movements with short corrections covers the most part of the market time. But trend trading systems in such time, as a rule, are unstable and requires special accuracy, otherwise serious losses can't be avoided. If the positions were opened against of the main direction, then the possibility of win back is minimum.

Forex is the special investment zone, which is not regulated by traditional rules: crisis phenomena just increase the liquidity of the foreign currency market. Analysts say, that amounts of currency transactions during the times of crisis, actually, 2-3 times more than declared. For instance, in critical 2008 speculative turnover was $10-15 billion per day. The subject of trade which is more profitable, depend on a problem or force-majeure specific country or region.

During the stable periods large players need certain special manipulations for taking profit, but during the times of crisis much easy to earn. The practice shows, that it`s not necessary to wait for global situations – even small problems in the economy of the specific country or region are profitable for trade on Forex in crisis.

Of course, the trader who risked to trade in such unstable time, shall have an extraordinary self-discipline, accurately developed strategy, the ability to momentary analysis and making decision. Volatility in crisis is most estimated, but money management shall be much hard – trend may change the direction simply for an hour, supported by the closing of many stop-losses.

«Planed» cataclysms

Such situations may be regular political events in large countries or national votes on serious problems, such as referendum in Scotland or the most outstanding modern example – Brexit, which consequences all types of markets will overthink for a long time.

Active diversified preparation is the peculiarity of such events – incentivized players earn serious amounts on manipulations with the market just before the event. Before an event within a few weeks (or months) despite simulated volatility, they may create rather an accurate trend, and the most desperate scalpers may quite earn on such preliminary speculations. After the fact of the event such trend usually absolutely turn for a short time, the continuous reaction, as in the case of Brexit is a black swan.

Political events

The main and at the same time traditional event – elections (any level) are considered by traders as a separate case of potential political instability, which affects the national currency. Influence, at least, middle-term. Change of the president or the government often means change of economic course, monetary and/or fiscal policy. Pre-schedule or snap elections (for instance, as a result of governmental crisis) have more speculative meaning, especially if political changes are accompanied by civil protests.

Conclusion: The power of more responsible (in the economic aspect) parties or certain politicians usually causes the grow of a currency price. But most often, the currency of such country becomes cheaper, because the watchful investors remove capital out of the country, till the policy of the new management is to be clear. As a rule, such political instability in short-term period is more substantial than awaited positive and the currency of the country will fall.

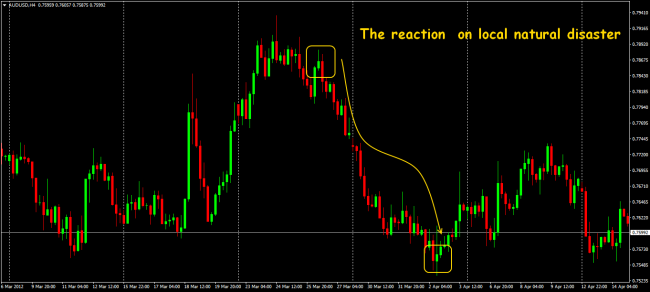

Natural disasters

It is logical to assume, that any ecological negative badly affect the economy and national currency. To the affected country the resources for the liquidation of the consequences, and, first of all – financial, are required: additional borrowings, sales of gold reserves and other forms of financing. The reduction of consumer spendings, export/import, private capital investments will be added to it, and power of any economy is quickly neutralized, especially in comparison with other countries, which wins because of such losses. As a rule, the first throw in a case of such cataclysm for an entrance to the market is lost, but reaction usually keeps, at least, a few hours and you have had a chance to enter.

But in practice, it`s not all that simple. It`s hard to predict the reaction to a natural disaster within the trade on Forex in crisis. For instance, numerous ruinous hurricanes on the American coast and the Gulf of Mexico traditionally cause a far smaller reaction on the dollar, than usual rumors about an interest rate changes.

If to remember the floods in Australia in March and in England in June 2012, then the results were absolutely different: if the AUD/USD has kept falling, then the pound remain within the current range.

Even an amount of damage does not help with estimation: economic losses of New Zeland because of the earthquake in Christchurch on 22 February 2011 is assessed in the amount of $15 billion, but result there was a one-day fall of the ZND/USD rate only by 200 points.

26 March 2010, the beginning of the long volcanic eruption in Iceland – may be an example of the connected reaction on a natural disaster. The hugest cloud of volcanic dust broke the flight connection almost under the whole Europe for a month. The important EU members meeting concerning a default of Greece (the banking terms expired for the hours) was shifted for several days. As a result –the local fall of the euro, which is especially provoked by the large speculators, and it was quite possible to «jump into» it.

Several conclusions:

- the influence of the ecologic factors depends on the scale of disaster very much (affected, destructions, pollutions etc.);

- the national currency reacts depending on current condition of the economy and the aggregate amount of necessary external inflows for the rectification of the consequences.

- Raw material and energy depending currencies are the most affecting.

Fukushima – an example of nontypical reaction

Curiously enough, but a large-scale cataclysm along with radiation hazard favorably affected the yen rate, which is considered as a currency-hiding place for many years because of low-interest rates. The largest environmental disaster for 80 years in Japan induced, at first sight, absolutely illogical reaction – the national currency rate have sharply increased, and even common with G7 countries currency intervention could suspend the revaluation only for some period. High demand on yen from national investors, which returned the capital in the country, and also demand from insurance companies were determined as the main causes of this fact.

The matter is the Japanese investors understanding that the yen shall hardly fall, began to purchase actively it (that automatically led to its growth), besides it was made not only because of financial reasons, but also for support of the country. Practically unpredictable step from the point of view of Europe or America – strong demonstration of national consciousness in case of trade on Forex in crisis.

Though subsequently, it became clear that they overcarry with purchases – within first few days the yen grew and began to decrease only at 5th day. As a result, the currency intervention was necessary for the return of currency to the previous level – because similar rate fluctuations are the source of negative for the world economy, and too high yen sharply increased the amount of charges for the elimination of consequences of an accident.

Conclusion: during the times of cataclysms you should not hope that everything is going to be within the usual logic – you should be maximum observant to any external information.

War conflicts and terrorism

It will sound cynical, but the experienced trader at the moments of such cataclysms, first of all, shall carry out an instant analysis, enter the terminal and open a transaction, and then listen to the detailed information about the conflict. More often, you can't help affected people yet, therefore your main task – to use the advantageous opportunity. There are facts, that such transactions were opened even by traders which were in the WTO building in New York, obtained information on an attack to Pentagon – they made in time the stakes on fall of the dollar before they were attacked in a similar way. For the short period prior to the moment when the American exchanges compulsorily closed the trading, thousands of traders increased the capitals.

Any uncertainty usually makes not good to the national currency – in such situations, it means the currency of the country, affected by the accident. For instance, during the oil accident in the Gulf of Mexico, in spite of the fact that tragedy happens near the American coast, the responsibility was imposed on England – the pound, but not the dollar, has fallen.

The consequences become ruinous for the economy and the currency as well as in the case of a natural disaster. The measures for reconstruction are usually financing by external loans, that unavoidably lead to reducing of national currency cost. Actually, the opinion that the large business and investments like the war is long since out of date. Theoretically, in the middle-term period the next economical growth of the affected country during the elimination of the consequences is possible, but it possible only in case of a strong infrastructure of planning and management, and also weak dependence on external raw materials resources. For instance, for now, the risks of the Asian-Pacific region are included in the American dollar rate, and any conflict provokes the fall of the stock market. And far from always such short-term losses may be compensated by the subsequent growth of raw material prices or benefit from the future investments.

Conclusions: if you want to earn on war conflict – watch the dollar, oil, gold and treasury papers of USA. In any case, understanding of behavior in times of such accidents is necessary, especially, if you into the market with open transactions.

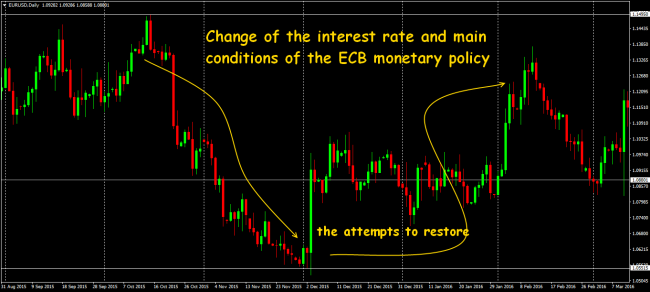

An example of cataclysm-panic – the crisis of the euro 2010

A debt crisis of Eurozone (since December 2009 till June 2010) caused fall of the euro more than by 20% − in that time an opinion first appeared that EU countries are incapable to work under one currency. It was a clear panic, especially provoked by Greek fears, but not realestimation of the situation.

Greece showed rapid economic growth since 2000 till 2007, but after losses of 2008, it was caught intended distortion of statistic and manipulation by data. The goal was a suppression of real level of debt to keep the country within monetary rules of the union. The fear of the expansion of Greek crisis to the remaining part of the EU made the common currency a market hostage and caused its massive sale on all assets. Those traders, who understood problems of Greece in time (and correctly!), carried out a successful speculative attack on Euro and earn good money. Euro was stabilized only by April 2011.

Conclusion: the monetary policy of the leading countries become a source of constant pressure on the financial market today, «generates» the mass of short-term speculative signals, but to discover more or less long structural changes serious multifactor analysis is necessary. More often, these signals are not the crash for the market and are gone to the scalpers.

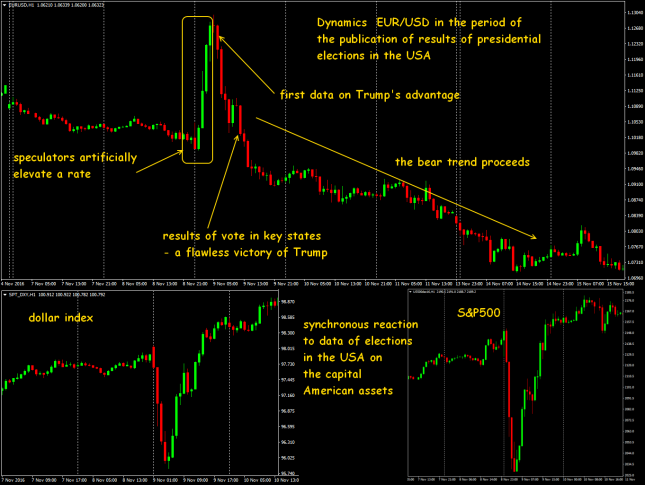

Next market collapse: Donald Trump is U.S. President

Fundamental assessment of analysts before the publication of a total:

Passions in a pre-election race of the USA approach the highest point. From the point of view of Wall Street Trump is perceived as political misunderstanding, which can lead to review or correction of trade policy of the USA. If to consider that the market already pledged in the price increase in a rate in December, then increase in risk of election of Trump was forced an index of dollar to weaken and, possibly movement will continue down. The world of big money will «be extremely disappointed» if its stakes on Clinton don't come true.

All large and «reputable» analytical agencies predicted Hillary Clinton's victory with probability of 70-90%.

If the victory Clinton has been already considered in the price why the main currencies have shown active growth against dollar several hours prior to the first official results? Work of speculators who understood the true value of preliminary polls, and specially elevated a rate of the main currencies to new price levels that then it was more convenient «to fall» is obviously visible.

Result: to each asset − on «tramp». The world outlived the next shock from unexpected election results in the USA: share assets and all base currencies crashed, gold and treasury securities of the USA jumped up in the price. Politicians in panic, investors in confusions, the business, which staked on Trump, is quite happy. The market calms gradually down and turns, and is strict according to the technical analysis.

Conclusion: the reliable insider and rather big size of the deposit is necessary for the correct reaction to a similar situation.

Technical conditions in times of cataclysms

As a rule, the entrance to these moments is especially dangerous. After an accident with the Swiss franc, most of the brokers before the possible speculative event secure the risks, first of all, and therefore toughen trade conditions on basic assets, including widening of spread, increasing of margin requirements (by 5-10 times – on Brexit), a prohibition on pending orders and opening of new positions (close only mode). It means, those desperate, who risks trading in this period have to count with it. Besides far from always you will be informed prior – you should attentively study of contract terms with a broker.

Conclusion: in the case of trading on Forex – forget about market trend. Nobody knows how the movement will be long. Don`t try to look for rational in current situation – follow the money and try to catch an impulse, of course, if your broker it allows you. The main thing – know for sure where at the same time there are your stop-orders, which you have to place right after opening position, it distinguishes professionals from the amateurs.

And as conclusion …

As if classics didn't convince that the market develops on the spiral, always remember: all crises – different, and in general, and in details – on the scenario, technique, assets, a list of participants, results. Any parallels with previous situations may be studied, but not to copy in the current market and not to make plans for similar movement.

In particular, fundamental financial estimations suffer from a set of inaccuracies in the modern world. The Nobel committee in 2009 even considered a refusal of assignment of an award in the field of the economy, because none of the world economists could predict crisis of 2007 -2008.

The modern market of raised volatility is always very profitable, but even more – is dangerous. It is possible to trade on Forex in crisis, but trading on cataclysms is riskier, even than usual opening on news. Only experienced can earn on them, and above all – informed traders with good skills of fundamental analysis and good reaction. It is just the case, when it`s better to wait out the events if you have no necessary such skills.

Social button for Joomla