In general, a trading session refers to the working hours of one or more stock exchanges relating to one region. Originally the term was applied to the stock and commodity markets, but later it was applied to Forex as well.

So how is Forex different from the stock market, which is known to almost every modern person? The matter is that Forex has an important function: it allows large companies and banks to change currency in the necessary amounts, and since the corporations make deals around the clock (many companies have affiliates around the globe), the need for currency requires rapid access to liquidity at any time, regardless of the time zone.

However, contrary to the opinion of the novice speculators, around the clock operation of the currency market does not oblige you to constantly stay at the monitor, as liquidity in the market varies depending on what kind of financial center is currently carrying out most operations. Similar periods in the day are called sessions, each of which was assigned a name on a regional basis – in particular, there are the following trading session on Forex:

- Pacific – starts with the opening of Wellington and Sydney;

- Asian – starts after the opening of trading in Tokyo;

- European – traditionally tied to London;

- American – starts with New York.

Trading sessions on Forex and their features

Pacific session is rightly considered the most peaceful, since after the start of the working day in Wellington and Sydney, volatility of virtually all instruments is minimal. The only pairs that can generate an impulse in this time are AUD/USD and NZD/USD, while bursts are usually caused by news releases across Australia and New Zealand.

In addition, the probability to catch a strong movement at the opening of the market on Monday is much higher than on any other day of the week, as speculators begin to win back the news and events that took place over the weekend. It is noticed that the Australian dollar may very sensitively respond to statements from major corporations in the mining industry, and traders working with the New Zealander are taking into account the statements in the dairy market and in the agricultural market in general. In all other cases, trading on a "clean" Pacific session does not make sense.

But the Asian session may already be interesting for scalpers and intradayers, as with the opening of the site in Tokyo, the volatility of the pairs with Japanese yen is significantly increased (e.g. USD/JPY, GBP/JPY and AUD/JPY). It would be needless to remind that the headquarters of large corporations and conglomerates are located in Japan, so the growth in demand for currency after the start of the working day is a natural phenomenon: by the way, according to rough estimates, the Japanese yen accounts for about 16% of all transactions on Forex.

The other Asian financial centers – Hong Kong, Shanghai, Singapore, Pattaya, Mumbai, Bombay and others ¬– join in later. Respectively, the "offshore" yuan, Singapore dollar, Thai baht and the rupee become interesting from a speculative point of view.

But the most important trading sessions on Forex are certainly the European and American ones. We have already noted that the beginning of the European session is considered to be the opening of London, which is the largest financial center in Europe.

After European traders and banks have begun to make transactions, the volatility of all pairs with the pound sterling and the euro increases significantly: it does not matter whether the European "majors" are the base or quote currency, only their presence in the pair is important.

Opening of New York is a key event on the Forex market, as in this case there is an overlapping of the European and American sessions, so the market faces a lot of orders, resulting in the formation of false movements and impulses. In addition, statistical offices and ministries start to publish a lot of important statistics.

It s not hard to guess that the greatest volatility during the American session will be observed on the US dollar, Canadian dollar, Mexican peso and the Brazilian real, although many analysts often overlook the latter two currencies, thus making a blunder.

When trading sessions on Forex start

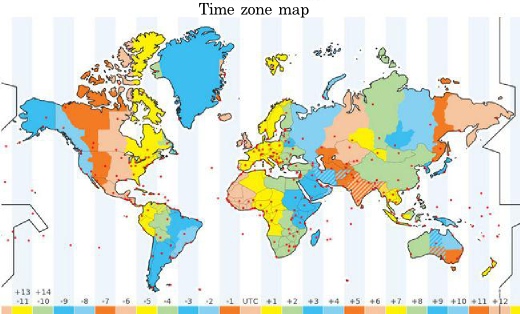

Actually, it is not hard to determine the time of the sessions, all you need is to consider the two important things: firstly, you should always start from the zero meridian in the calculations (Greenwich Mean Time), and secondly, you must remember about the daylight saving change in the United States and Europe, which is particularly important for the countries that do not make such changes.

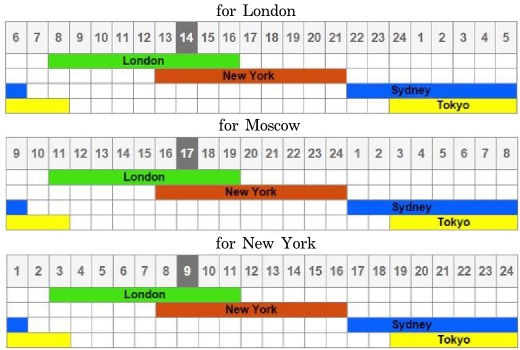

If you base on the GMT time, the Pacific session can be considered as the interval from 10:00pm Sunday (Wellington is not taken into account, so only consider the beginning of the working day in Sydney) to 5:59am Monday, the Asian – from midnight to 7:59am, the European – from 8:00am to 4:59pm, and the American ¬– from 1:00pm to 9:59pm. The figure below shows a schematic representation of these intervals for different time zones:

Despite their simplicity, these schemes allow to very accurately determine the hours when trading sessions on Forex overlap. Of course, an experienced trader will not open any clues, but novice speculators are recommended to always focus on the related tables and services in the development of trading systems.

Trading sessions on Forex are a relative term

Some readers might have a legitimate question – which session includes the Russian ruble, the South African rand, and maybe even the Turkish lira, because in recent years the currencies of developing countries are becoming increasingly popular due to their high volatility?

The answer is simple –none of the above, so you have to focus on country-specific time zone: for example, the ruble and rand are better to trade starting from 7:00am GMT. As for the closing trades, it is not so clear: the fact is that all pairs that include the developing currencies and the US dollar see high liquidity until the last hours of the American session, so you can continue to trade even after the working hours of the "national" banks and companies are over.

Speaking of "non-standard" sessions, we should note one more fact: not all European countries have euro, so the term "European session" is valid only in relation to the euro-zone. For the rest of currencies, such as the Norwegian krone, Swedish krona, Hungarian forint, Polish zloty, etc., you will have to calculate your trading sessions on Forex.

In conclusion, we should note that the programmers created many special indicators for MetaTrader4, which mark the beginning and end of sessions directly in the working window. As an example, we can recommend the expert advisor called I-sessions, which will help remember the hours of opening and closing of financial centers. Of course, it is necessary to make a correction to the terminal time of the broker before installing it.

Social button for Joomla