All strategies designed for trading on Forex market are divided into two groups: the first includes algorithms focused on the current market price, while the second group includes methods aimed at finding the best price.

Each of these approaches has its advantages and disadvantages, so in order to eliminate confusion, let’s look at them in more detail. We should remind you that any action of the trader is nothing more than an order to your broker to conduct certain operations, so at any given time a speculator or investor always has two options: either to make transactions at current prices, or wait for a more opportune moment to "catch" the trend.

In the first case, the market orders are used that involve buying (selling) of the instrument for the ask (bid) price at the time of sending the application (order) to the broker, while a similar approach is used by virtually all scalpers and pipsers. If the trader adheres to the second approach (prefers to wait for more reliable signal), their strategy, as a rule, uses pending orders on Forex.

Why "as a rule"? Because the professional knows in advance at what level they can expect a rebound or breakdown with high probability, but some speculators prefer to observe the behavior of the price around the level, since false breakouts on the market are not rare today. On the other hand, pending orders are often used in despair, i.e. when there is no opportunity to reside at the monitor, and the potentially profitable transaction is upcoming.

Limit pending orders on Forex

It is impractical to review the trading on the market, because it's all very simple, so we'll start studying the most popular group of "pendings" – limit orders. In the MetaTrader terminal, this type of orders is marked as buy-limit and sell-limit.

To find them, you need to right-click on the current chart, and then select "Trading → Order" in the opened context menu (you can use F9 “hotkey” as an alternative navigation). As a result of this operation, the familiar window with order settings will open (with the current quotes), where you need to choose "pending order" in the "type" field.

After the correct order has been selected, it remains to set the price at which it triggers. The main feature of the limits is that they are always set at the "best price" (if we can say so), i.e. buy-limit will be located strictly below the current price, and sell-limit is always higher than the latest quotes.

Such pending orders on Forex are used in three cases: firstly, the limits are relevant when trading with the trend, when the trader is looking for a point to buy or sell on a pullback towards the prevailing trend; secondly, in the grid strategies (one of the riskiest strategies trading by which is not recommended); and, thirdly, when you try to catch the news pulse.

In the latter case, the speculators start from the assumption that the first surge after the announcement of an important official or publication of statistics is false in most cases, so instead of concluding a deal on the market immediately after the event, a pending order is set at the best price. As a result, the risk decreases.

Stop pending orders on Forex

Buy-stop and sell-stop orders are radically different from limits, as in this case, the trader places an order at the "worst" price, i.e. when working with a buy-stop, the order to buy is executed above the current price, and with a sell-stop – below. The "worst" is a relative concept, which is used only for a brief description of the price, but in fact the trader misses the unfavorable situation and loses nothing, just changing approach to trading.

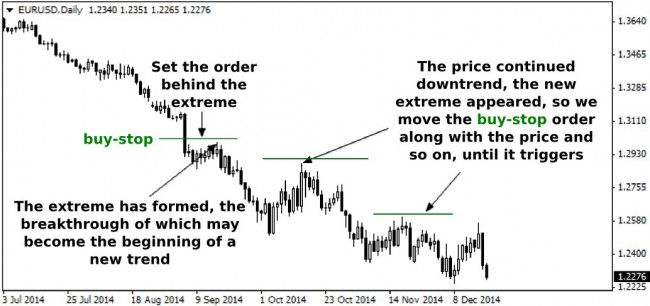

Now we shall understand what exactly the benefits of stop pending orders on Forex are. It is known that you can trade with the trend not only from the rollback, but also on the breakdown of the previous extreme, this tactic has became the basis for the majority of trading strategies that use the orders of the «stop» type. The figure below shows a theoretical example of what actions a trader could take when trading with the aforementioned method:

A fundamentally different approach is an attempt to catch a new trend at the reversal of the former: in this case, the reversal should be understood as the breakdown by the price of the last high of the downtrend, or the breakdown by the price of the last low of the uptrend. Accordingly, in order to make profit, you need to keep track of the extremes and periodically pull a pending order along with the price until it triggers, for example:

The next strategy, the centerpiece of which is the stop orders, is a grid of the same name. In contrast to the limit grid, it almost completely eliminates the risk and can earn from 15 to 30% per annum with minimal time management.

It makes no sense to schematically display an algorithm for constructing the grid, since it is impossible to come up with an easier strategy, especially taking into account that there are several of its modifications today, including using trading robots. We can only note that the main advantage of the stop grid is that most of the orders there are opened along the trend. Of course, losing trades will also occur, but if you follow the rules of money management, you can’t lose your entire deposit with such an approach.

The last class of algorithms where pending orders on Forex may be indispensable is reduced to trading on a range breakthrough. This group includes such well-known strategies as "Breakthrough of the morning flat" and "London bombings", the logic of which is very simple: the trader recognizes flat and then sets the buy-stop and sell-stop orders behind the upper and lower range respectively, for example:

What else you need to know when setting up the pending orders on Forex

A lot of attention above was paid to the practical side, but we would like to focus more on theory. In particular, it should be remembered that when placing any pending order, you can immediately set the take-profit and stop-loss. This can be done in the same settings window.

The second issue is related to the time during which the order will be relevant. If the pending orders on Forex don’t trigger before that date (see figure above), they are deactivated. The beginner may consider such possibilities excessive, but in many profitable strategies, the signals are relevant for a well-defined period (either for the average period during which the signal is worked out, or the countdown goes by certain hours, usually before the overlap of trading sessions).

One last caveat is a stop-level, which is equal to the minimum distance in points taken from the current price to set a pending order. In the strategies mentioned today, this restriction of the dealing center has almost no effect on the result, but during the setting of stop-loss it can seriously degrade the results of intradayers that set the short stops, but this, as they say, is another story.

Social button for Joomla