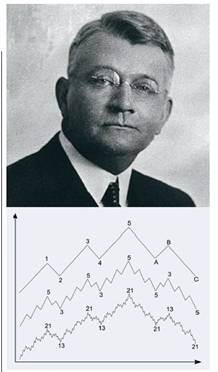

Forex wave analysis is one of the most popular method of predicting the situation on the market among traders. It was created by sixty-year old accountant Ralph Nelson Elliot, who started searching for additional source of income due to health problems and he began learning the objective laws of the development of stock market.

Forex wave analysis is one of the most popular method of predicting the situation on the market among traders. It was created by sixty-year old accountant Ralph Nelson Elliot, who started searching for additional source of income due to health problems and he began learning the objective laws of the development of stock market.

Forex wave analysis is based on the notion that any movement of the price is made within a certain wave. Determining these waves helps in predicting market situation that is why while using this method, traders will be able to gain great profits from deals completed. Forex wave analysis makes exchange market’s players’ job easier and that is the main reason of success.

According to data which were provided by wave analysis of Forex market it is possible to determine the movement of prices but it should be done with caution. Such situation is explained by the fact that wave analysis of Forex market is demonstrating the trends of preceding periods in details. While building the wave for perspective often requires using additional methods, for example Fibonacci levels. Nevertheless using this wave analysis will allow a trader-beginner becoming a professional in his field and getting great profits.

Forex wave analysis: main definitions

Forex wave analysis divides the market into two types: bull and bear. The important features of the first type are: high volatility, abrupt changes in the price, dynamics and aggression. Work on this market requires the trader to be concentrated and prepared, because otherwise he can merge his deposit in a short period of time. But the main advantage of the bull market is that in case of successful deal it is possible to gain great profits. The majority of traders prefer working precisely on this market while pursuing high profits. The second type of the situation on market which emphasizes Forex wave analysis is distinguished by calmness, moderate and flexible changes in the prices.

Forex market wave analysis marks out 8 waves in the full cycle, and they are divided into 5 growing and 3 falling for bull market, and three growing and 5 falling for bear market. Alternation of the waves happens subject to constant mutual correction, thus wave analysis of Forex market proves the rule according to which any ascending wave is substituted by the descending one (or the descending one by the ascending). Wave analysis of Forex divides the waves into impulsive, following the trend and traversing (correction waves), acting against it.

Social button for Joomla