The popular opinion, that trade on news is for lazy beginners, isn't true now at all. Trade during the periods of information splashes is very profitable and available to any trader, irrespective of the tool, experience and a deposit amount.

Let's remind, news in the financial market is any event or information capable of displacing market balance of the demand/offer and to cause the rate movement sufficient for speculative trading. Panic is an excellent trade asset which is profitably used not only market makers, but also active politicians and competent speculators.

Use of result of a battle of Waterloo is the largest financial speculation and an example of successful trade on news. Nathan Rothschild was the most informed at the London exchange of the beginning of the 19th century because of personal mail and messenger service (high-speed communication channels), and his trade behavior had a huge influence on other players. The «misinformation» started by him about Napoleon's victory (trade on rumors) caused panic and depreciation of the English, Austrian and German securities. Rothschild, as well as his brother Jacob in Paris, also defiantly sold the problem inventories (to the agents – the first brokers). When real information (the news fact) was filled, competitors were ruined, the rate of papers went up (kickback of the price) and strategy on news brought to young stockbrokers more than 40 million pounds sterling.

Practice shows, not all news marked with a marker «important» are suitable for real transactions. Not only speculation during a release of data but also the subsequent short-term trade on a trend is referred to trade on news.

General characteristic of trade on news

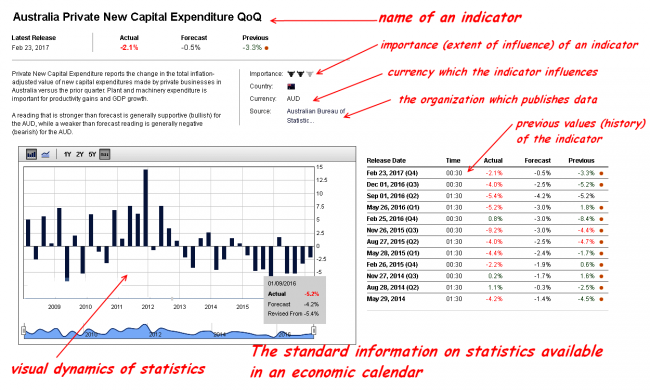

The economic calendar includes the of statistical and economic indicators release schedule, and also political and economic events which can potentially put pressure on the stock exchange rates. The degree of importance of news to the market is shown by the quantity of markers.

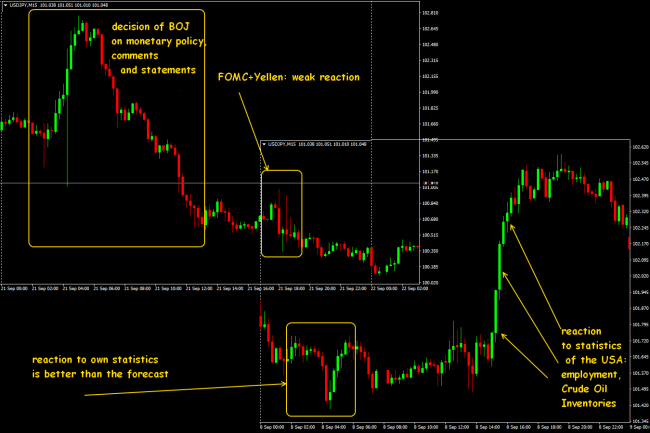

Statistical data always have three values: previous, future (estimation) and actual. Reaction of an asset at the time of breaking news and the direction of further movement depends on compliance or a deviation of the fact from the estimation, therefore, those who regularly trade on news collect additional statistics on each macroeconomic indicator – how the asset reacted (the direction, points, availability of «thorns» and so on).

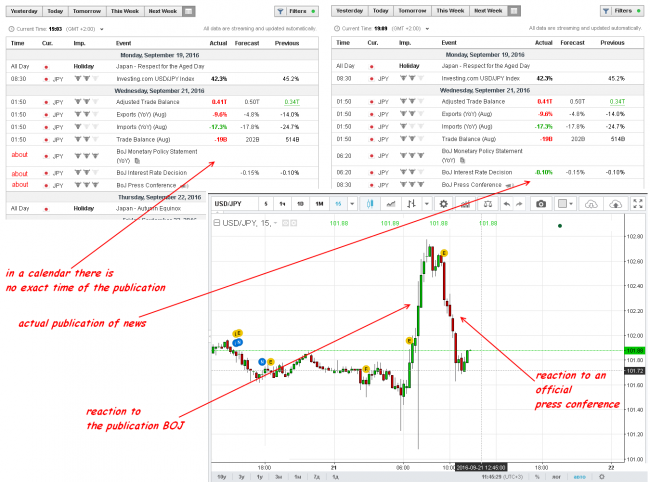

Sometimes the exact time of a publication of important news is unknown, especially often it happens to the news on Asian assets. In that case, it is possible to try to trade only the result of this news or comments on them.

Market information background is very large and multiple-factor, but if you have some practical experience you can allocate the general news making a global impact on the market, and the regional news influencing only separate assets.

The most important statistics for each asset, which publications practically always cause the growth of volatility on the main couple and sometimes on crosses, are:

- key interest rates and amounts of quantitative stimulation;

- final estimates of GDP (in a quarter and year);

- production statistics (index purchasing prices and producer price index (PPI), industrial production amount and so on);

- inflation indicators;

- financial data (crediting of a private sector, consumer crediting);

- level and quality of unemployment;

- financial sector statistics (account balance of current transactions, cash aggregate M1 and so on);

- consumption indicators (CPI, the consumer confidence index, a business climate, PMI (in retail, production, construction sector, in a service sector));

- trade indicators (indexes of the retail and transfer prices, net of a trading balance, retail sales);

- statistics of industrial and housing construction, the amounts of mortgage lending;

- labor market indicators (level of unemployment, salaries).

Political events, which usually act as catalysts of price movement, are:

- speeches of heads and deputies of the Central Bank;

- government economic estimations;

- statements (and any information) on monetary policy;

- summits and meetings of heads of the EU and G20.

Protocols of the Central Banks on monetary policy are published in 1-2 weeks after the meeting, therefore, there are no speculative throws, as a rule.

In addition to the abovementioned news there is several American, making an impact on the market in general:

- a speech of the chairman of FRS (market reaction strongly depends on place and reason of speech);

- FOMC information (statements, protocols, economic estimations);

- unemployment statistics;

- PMI from ISM;

- CB consumer confidence index.

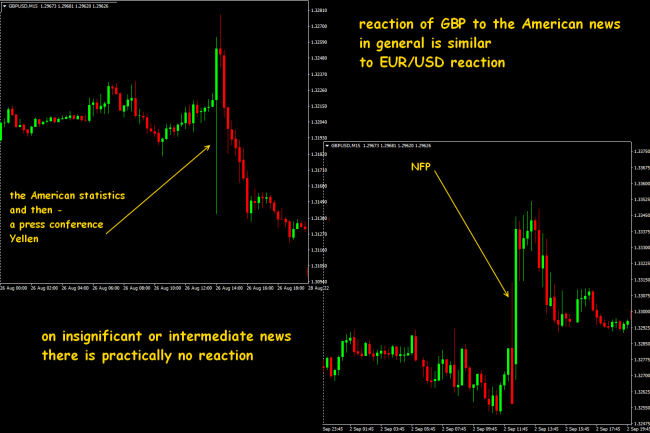

We recommend tracking the statistics of reaction to these data separately because the influence of such information (even statistical data) on specific assets is different, it is possible to catch by regular methods only NFP. The reaction of raw assets should be monitored in a complex with the stock market.

Euro

The interest rate and speeches of the head of the ECB remain the most volatile news. Reaction at the time of the publication of a rate is usually weak, the subsequent Draghi`s comments, as a rule, turn the first throw and create the main trend. Speculative throws on the monthly report of the ECB or a Eurogroup meeting are possible, but they are badly predicted.

GDP of the eurozone: influence on a rate is estimated as strong, but the indicator is total, therefore, practically there are no surprises − the market is prepared for any scenario by the preliminary publication of its components data. The negative in case of the publication GDP of Germany or France can give a throw till 50-70 points with the subsequent kickback.

Inflation indicators: this indicator loses value for trade on the news because there is practically no risk of a sharp surge in consumer inflation in the eurozone (unless in the case of a speculative increase in prices for energy supply).

Labor market: the release of these data, as a rule, causes weak movement as the labor market to a lesser extent influences actions of the European Central Bank than other leading Central Banks. Even the sharp discrepancy the fact/estimation can cause movement on EUR/USD no more than 30-50 points.

Industrial production: is important for the eurozone in general, but volatility, sufficient for trade, can be received only on indicators of the certain countries (no more than 30-50 points).

Production PMI: the publication of a preliminary indicator is in the third week of the reported month, and the specified data − in the first days of the next month. The first estimation, as a rule, much differs from the forecast and can give decent movement for euro. The specified estimation and review of data for a previous period can provoke movement not only on EUR/USD but also on EUR/GBP and EUR/JPY. The similar services PMI indicator for trade on news is usually not interesting.

Reaction to the American statistics depends on deviation level the fact/estimation. On NFP – reaction is always, with the subsequent kickback.

English pound

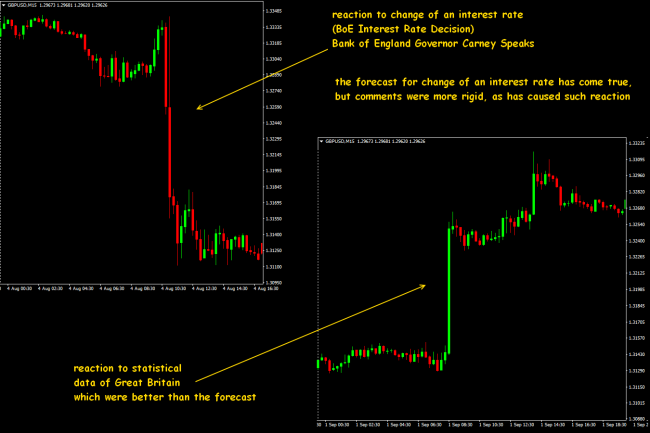

The pound always gives strong speculative movement on the data on GDP, retail sales and consumer inflation. Great Britain always calculated a separate indicator − net of a trading balance without EU countries − and now speculation on these data will only grow.

As about 60% of the English export go to the eurozone, in the background of the forthcoming divorce with the EU the pound became very sensitive to industrial production indicators. Trade on news on GBP/USD is dangerous by the volatility, but in the case of the correct money management and personal endurance of the trader, it can be very profitable − the riskiest beginners rather successful «increase the account» on news on the pound.

Britain has the set of indicators of housing prices (general, Nationwide, Halifax, Rightmove) and they should be estimated only in a complex, therefore, they aren't suitable for trade on news. The pound traditionally strongly reacts to information of the Bank of England, and, in addition to Carney's performance, the strong factors are the quarter bulletin BA, BA Reports about financial stability and on inflation, hearings of the report on inflation. Besides, the decision on an interest rate is followed by the publication of the Minutes of Committees on financial and on credit policy, therefore, after the first reaction, the direction is generally determined by their content.

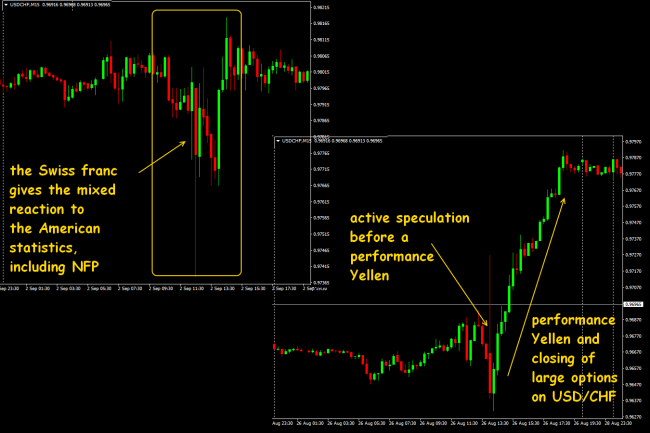

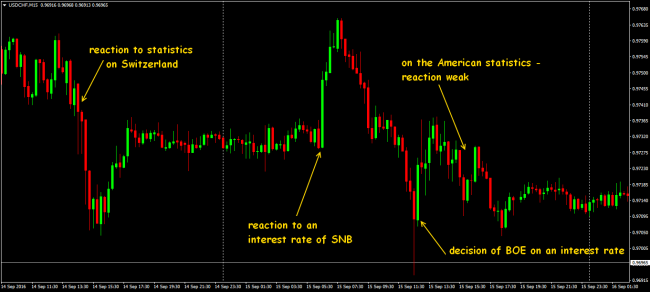

Swiss franc

Reacts with a delay to all European news including political.

It is indifferent to the American data, except for NFP and FOMC on which gives the mixed reaction. In general, it is not suitable for active trade on news.

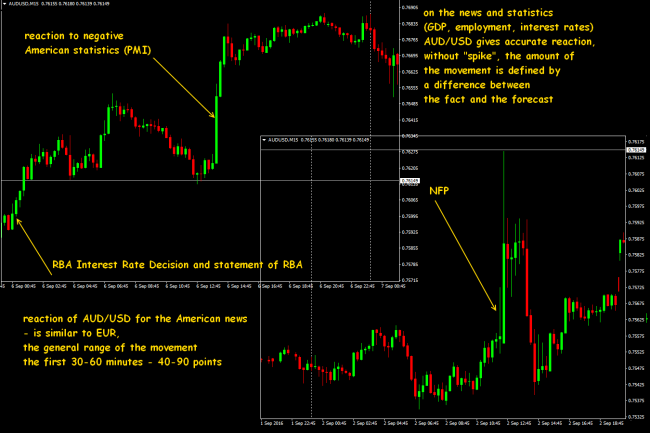

Australian dollar

30% of export is the share of China and about 20% − of Japan, therefore, the rate of AUD/USD and AUD/JPY nervously reacts to the Chinese and Japanese news. Reaction to the Chinese statistics comes at the time of a breaking news, in the case of a strong deviation from the forecast – till 50-70 points.

In spite of the fact the current calculations show an easing of direct correlation of an Aussie with gold, the rate of AUD/USD gives strong short-term reaction to any speculation with gold, with a delay for 5-15 minutes.

In the case of AUD trade, it is recommended to track the stock markets of Asia (interim 4.00 to 7.00 CET), especially closing of option contracts on iron ore, copper, gold, a Nikkei index rate. On fixing of the market there can be rather big jumps in prices of AUD/USD and AUD/JPY.

Information on an interest rate change is usually fulfilled by the market before the publication, therefore, reaction (with delay!) is shown only on the statement of the bank or the subsequent press conference.

Data on consumer inflation are published in Australia on a quarter basis that attracts a keen interest to them. In the case of an essential deviation from the estimation the reaction can be to 50 points with the subsequent dominating direction within an hour.

Those, who trades on a bunch of the postponed orders, need to be especially careful during the work with AUD. Insider information leakages are shown at the Sydney exchange by 3-4 times more often than on Europe or America, therefore, a feature of news of an Aussie (on currency pair!) is the speculative reaction of a rate of AUD/USD in 30-120 seconds prior to the officially declared time. Such situations meet much less often on currency futures for AUD.

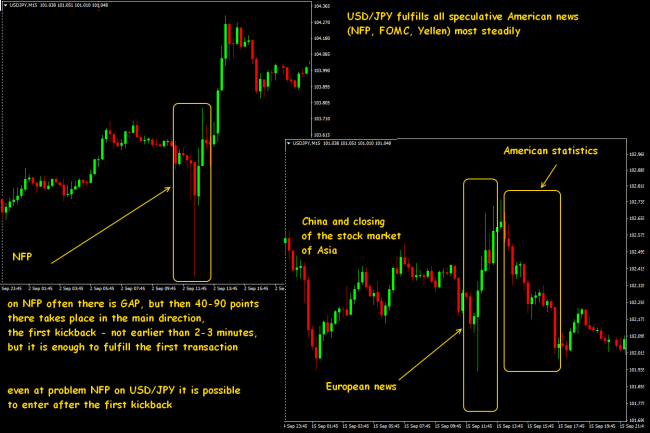

Japanese yen

Along with a dollar index and S&P500, it is considered the best news asset for the fulfillment of all American news. It poorly reacts to the stock market of Asia and other Asian assets. Time of a breaking news can be not specified or displaced concerning the declared time.

It usually fulfills the fundamental data in both sides within 2-3 hours. Constantly there is a threat of the hidden currency interventions before or just after the strong news to compensate strong movement, therefore, a bunches of orders on the Japanese news can be dangerous.

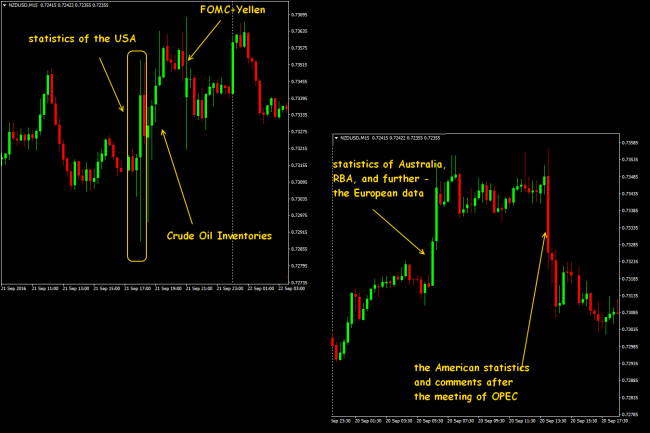

New Zealand dollar

Actively reacts to all Asian news, events and the stock market. On the Australian data, as a rule, gives 30-50 points synchronously with AUD. On the data usually gives a strong steady reaction with the subsequent kickback to initial levels.

It fulfills incorrectly, with unstable volatility, the political news and problem American statistics (for instance, NFP). Actively reacts to any information on energy resources and the American data on oil.

Canadian dollar

Along with USD, it is quite suitable for trade on news, but it should be taken into account the Canadian not «political», but raw currency. USD/CAD pair fulfill the political news quite poorly, but reacts quite productively on the oil prices (inventories and general dynamics), dynamics of precious metals and a shock of the stock market.

If the Canadian reacts to the news, then the movement in 70-150 points is quite possible.

Reacts to the statistics only in the case of a strong deviation of the fact from the forecast, but, as a rule, by the several strong bars in the main direction:

How to trade the «planned» force majeurs

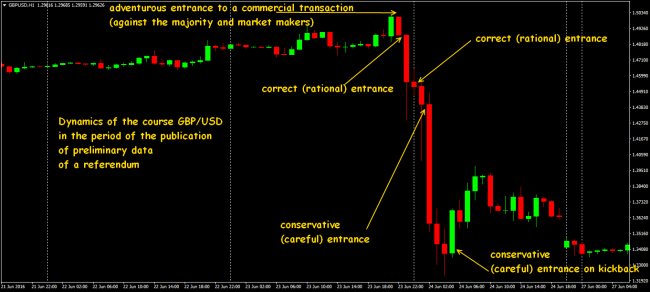

Let's separately talk about trade rather rare situations of a public shock, like Brexit, natural cataclysms, presidential elections, changes of the constitution, historical decisions of the Central Bank (for example, franc 15.01.15.).

Let's remind, before the vote on June 23, 2016, practically all opinion surveys predicted preserving Great Britain as a part of the EU, therefore, the day before all exchange platforms were closed on a positive. However at night (on CET time) as soon as the first statistics began to appear according to which the British separatism prevailed in results of a historical referendum, all trading platforms from Tokyo to Frankfurt and further transit across Russia and USA – amicably fell.

Now aren't already important the reasons which caused Brexit and the consequences of it aren't important yet, the fact that it was an absolute surprise for the world markets is interesting. It would be desirable to understand how it was possible to earn on it.

The probability of a negative result of a referendum, even small, was assumed more than two years. Some days before Brexit some analytical centers published reports which obviously show the number of supporters of an exit from the EU promptly grows, but on a general positive background preferred not to hear them.

However, large banks and the brokers respecting themselves in a mailing to VIP clients a couple days prior suggested to put on fall of the pound and the European stocks. The author of the article also used one of such recommendations, having opened a position for sale at the beginning of a week.

In general, the strategy of trade on news within the periods of big shocks traditionally are divided into strategy «BEFORE» and strategy «AFTER» of an event.

Strategy «BEFORE»

Depends on your admissible risk level – psychological and financial. Your answer to a question: «What is more important — to earn or not to lose?» will determine the choice from four possible options.

Speculative – for the riskiest players: the position opens in advance (according to the market) in the direction corresponding to the most probable (according to analysts and so on) event result. Serious confidence in such preliminary information is necessary. The money management in such approach – rather tough. In a case with Brexit, such approach would be a failure.

Adventurous – is similar to the first option, but at the same time desire to earn much stronger than fear to lose. That is the market position opens against general logic (preliminary opinion of the market). Higher risk is compensated by stronger movement. Brexit – an obvious successful example.

Rational – installation of a bunch of the postponed orders with the reasonable checked stop/profit/distance parameters between orders to earn on any movement of the market. If, of course, the broker allows to trade according to such scheme. In a case with Brexit according to such scheme, it was possible to open a position for sale already from 01.00-02.00 (CET), of course, if the broker allowed it. For instance, most of the brokers before Brexit didn't allow to place (and furthermore, to open from the market) new positions (at least, on pound) and increased the mortgage cost of lot many times over.

Conservative approach – «you sit on a fence» without open positions till quieter times, that is till the market won't create an accurate trend after the historical event.

Strategy «AFTER»

Such techniques of earnings on public shocks strongly depend on an asset (and on the market) on which you prefer to trade, therefore, it is necessary to estimate correctly extent of influence of event result on the subsequent movement of the price. Here not to do without complex analysis.

Again, we will take Brexit as an example and, first of all, not pound, but other assets. Even according to regular schedules it is possible to see that future influence of Brexit on America and Japan by participants of the market was estimated directly much more negatively, than on Europe. The yen and dollar reacted with sharp fall in the first hours which then only amplified while euro even for the next session won back nearly 30%.

If the fundamental influence of an event on a specific asset is estimated as minimum or indirect, then after the first speculative throw you should open a position in the direction, reverse to initial fall. And you should do it directly after the first signs of delay of the main movement are shown.

If the serious influence on a currency or raw asset (euro, dollar, yen, kiwi, Aussie) as a result of an event or the publication is expected, then it`s better to wait for technical correction after the first throw and to open in the direction of initial movement.

Some practical notes

First of all, your broker shall support (to permit) trade on news – technical requirements to news trade can, and also serious requirements to a technical equipment and communication channels.

From the technical point of view versions of the ECN account will be the most suitable, but it is necessary to check what is declared by the broker – how are placing, fulfilling and closing the orders in the period of news, expansions of spread, slipping, minimum allowed time for an open position (from 30 sec. up to 5 minutes), possible breaks of communication and other parameters. And it is better to test on the real cent account because, as a rule, all «perfectly works at a demo account». Besides, the cancellation of already closed orders of such speculative trading, usually the most profitable, is possible.

For each news, you should determine in advance an asset on which you will trade, features of its dynamics and its average reaction to deviations from the estimation or for possible force majeure. Attempts «to catch news» directly on several assets are very dangerous and most often don't make a sense, only if you don't trade multidirectional pairs.

Practice shows, it`s more profitable to use futures (on indexes or currencies) instead of regular currency pairs for such trade on news. Futures give the advancing news reaction, therefore, they can be used for news trade in currency pairs as «guides». There are much less speculation with futures before news release and if there is an access to exchange information on amounts, then accumulating of amounts in a glass shows the arrangement of speculators interests which provide the first price jump on the news publication.

If the statistics imply a comparison with any level (for instance, 50), then at the time of the publication the market reacts directly to a difference between the estimation and the fact, and then to a deviation from recommended levels. That is in the case of the fact 46 if the forecast was 49 the movement is usually stronger, than the fact 51 in the case of the forecast 50.

Separately let`s mentioning temptation of trade in volatile exotic, for instance, EUR/SEK, EUR/NOK. Movement on such pairs can reach hundreds of points, but about 25-30% of them will leave on the spread and slipping. Trade on them is possible only in case of the correct understanding of the base of the «adjacent» country, the good deposit and strong nerves.

And as the conclusion …

Now the latest technologies work for a decrease in ping from the exchange to the broker, that`s why the speed of receipt of news in general access is minimum. The news factor is actively used for pressure on the market and forming the mass of players with unreasonable expectations of strong movement (it is possible to look news «traps» here).

Any kind of analysts with the great pleasure will pick up «suitable news» to prove any unclear price throw. If you are ready to do constantly trade on news, then you should accumulate independently the necessary statistics and remain unprovoked.

Social button for Joomla