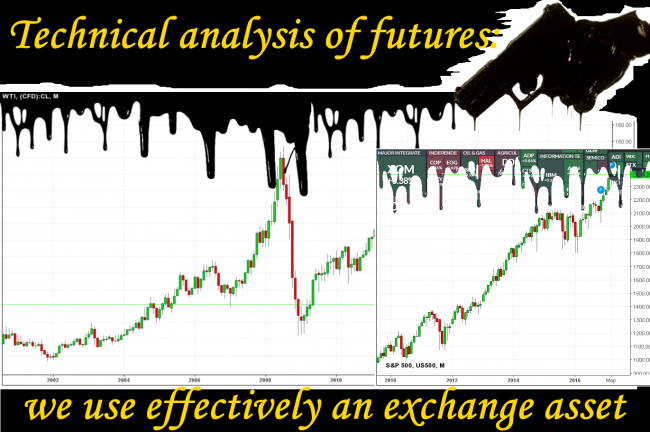

The modern future is a part of the capital market, the effective tool of price fluctuation compensation and «instant» averaging of monetary demand without sharp change of the offer. The technical analysis of such assets has features, using which it is possible to avoid mistakes and to increase the reliability of your transactions in Forex.

The main distinction between assets is covered in the structure of the Forex market and the market of future contracts, that is in the principles of formation of market price.

The Forex market is off-exchange interbank, is used by banks and other financial structures for speculation and regulation of financial streams. Actual volumes aren't visible just because there is no uniform trading floor. The volume of speculative transactions – more than 70%. Despite active attempts of regulation, control of such market is low. The technical analysis is complicated by the fact that each broker has the stream of the prices.

The market of futures is centralized (transparent) exchange market which in the course of clearing of transactions connects at the exchange of the seller and buyer. There is no spread, floating bid/ask is minimum and is regulated by the volume of client transactions. That is if the real client buys the real future contract, but the price of an asset falls, then this client incurs losses, and the one who has sold this contract to him gets the profit. The loss of the client doesn't become profit of the exchange or the broker at all. The exchange earns at the commission with a turn which is appointed to the client individually: if transactions aren't enough, the commission is equal to spread (similar to Forex), if a large number of transactions – much lower.

Pay attention: the majority Forex brokers quietly declare that they guarantee trade in futures, but at the list of trade tools, as a rule, there are only CFD assets. The difference is strongly recommended to be studied and experienced before the opening of real transactions.

Some words about a subject

All futures which can be interesting for trade in Forex are settlement, that is the actual delivery according to them isn't supposed. Today a lot of trade assets in the form of term contracts is offered: exchange rates, commodities, share and settlement indexes, securities, metals, energy carriers. The technical analysis of futures has to more consider fundamental factors. At the exchanges, there is constantly business in contracts with different terms of an expiration, therefore, there is a special exchange calendar for several years with the accurate indication of the delivery date on all assets.

Now it is absolutely optional that a real asset to be in the base of the future (share, bond or goods) – it can be any information, such as the probability of an increase in an interest rate or result of national elections. Demand and conditions for such assets are created by the market.

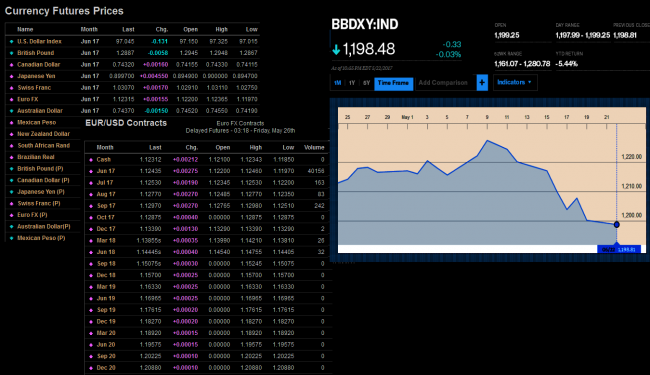

Index futures can be considered the separate group of assets: general, industrial regional. The additional factor influencing dynamics of composite or industrial indexes is the reporting of the enterprises entering its calculation – pay attention to the corresponding calendar. The new index assets are appeared constantly, for example, recently CME Group has started the future for Bloomberg Dollar Spot Index − a new index for an estimation of actual cost of dollar (by analogy with DXY), it is calculated on the basis of a basket from ten currencies (EUR, JPY, CAD, MXN, GBP, AUD, CHF, KRW, CNH, BRL).

Currency futures is term derivatives from basic currencies and are trading by contracts with the period 3 months, that is 4 contracts a year. Currency futures give us the chance to correctly analyze the volume, which comes to the market directly from the exchange, for the rest − the schedule of the currency future from the point of view of the technical analysis is absolutely identical to currency pair, certainly, except for assets with the reversed quotation. Actually, data on actual volumes can be obtained through exchange trade systems to which the flow of quotations directly from the exchange comes. It is also possible to obtain information on the postponed orders (except for «hidden»), but most often such access is paid.

Features of the technical analysis of futures

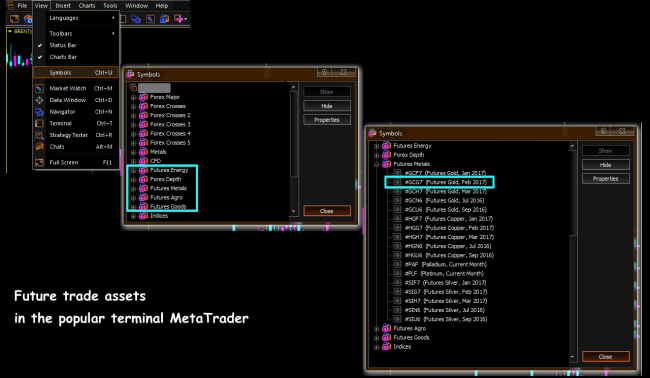

The main futures may be traded through standard Forex terminal, practically by the same principles of the fundamental and technical analysis, using standard types of orders. Moreover, initially all technical tools were developed for trade in commodity contracts.

Quotations on Forex arrive from a set of sources, and the price of CFD assets which offer you in the ordinary Forex terminal can significantly differ at the concrete moment on different platforms. It is impossible with the real futures, business is only at the exchanges, and only concrete trade pair buyer-seller create the quotations. All exchange platforms openly publish the prices for the previous trading day to within 1 tick, therefore, all clients during the work with futures in trade terminals have identical data.

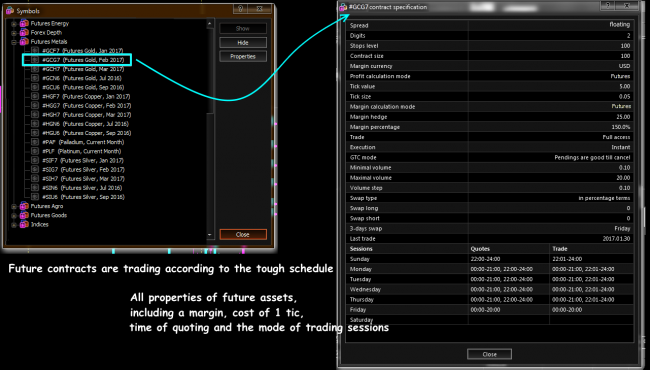

Future contracts are term assets, that is they have a final date of closing (expiration), the contract has to be executed to this date, that is the client can voluntarily get rid of the assumed obligations. For deduction of the transaction longer than the term of an expiration it is necessary to pass to later contract regularly. If you don't close the transaction on the future in time, then the broker will close it forcibly and the price will be not the best. By itself that most of the speculators own an asset rather short time.

The future is a volatility, first of all, because at the real exchange the share of short-term speculators is also very impressive. But at the reasonable approach, such activity can quite bring in the stable income on Forex transactions within a day. Nervous reaction to fundamental news or force majeure can be compensated by the analysis of the connected markets.

The heterogeneity of future volatility affects constantly. Even if the term of contract «life» is averages from 3 to 6 months, then the main trade volume on it occurs in the last 3 weeks (for short-term contracts) or in the last 2 months (for long-term), that is when this future becomes the next by date of expiration.

It complicates the long-term analysis. Right after the opening of the contract, it lacks liquidity – there are sharp jumps of the price, stable, but too strong volatility appears closer to the closing. As a result, when Forex asset approaches the strong level of support/resistance, the future asset can not to react because of «youth», or give false signals because large volumes of transactions before the closing of the current contract are fixed. Therefore for the analysis of CFD in the Forex trade terminal, it is necessary to use data of the future in the «middle» of the term when it most corresponds to the technical analysis and not subject to calendar speculation.

As the future is a transaction of two parties (seller/buyer), the concept of quantity of open positions shows a degree of interest of bidders in the determined movement of the price, and the more open interest in the certain future, the more movement of the price you should expect. We take data on open interest from CME reports or on other exchange resources.

Moreover, in addition to the volume of open positions, the distribution between legal entities and individuals on longs and shorts at 19:00 (GMT) of each trading day are published in exchange data on future contracts. These data can serve as the additional soil for the analysis, as the sharp prevalence of one of the groups of participants can provoke the movement in the corresponding future.

The closer to the term of future expiration, the more transactions on it are fixed. The market for an asset becomes thin, with gaps, large players with large volumes which speculate and displace the price in the direction, necessary for them become more active on it. At such moments the future price can't already be used as «guide» or a source of trade signals for CFD assets or currency pairs.

There is no possibility of locking of positions and there is no swap at the future trade, but there are a rollover and a clearing. There is always a difference between the spot prices and a future analog – it is maximum when opening the new contract, and decreases as approaching the date of closing of the contract. Besides, price calculations are complicated by a difference on one asset, but with different terms.

We are going to trade the future

Before beginning to trade in any future, it is necessary to carry out some preparatory work in addition to the minimum technical analysis. At first, we specify an asset ticker (either on CME , or on ICE ), for example, gold is included in the section «Metals», in the column «Precious» with a «GC Gold» ticker. Further, we study the specification of the contract — «Contract Specifications» with key parameters of an asset. Tens of contracts (are visible in the section «Listed Contracts») can be trading at the same time, we need the most liquid. We look for data in an appropriate section, for example, on the website BarChart, in the column «Volume» − the largest volume is necessary. If data of the next contracts are approximately equal, then we choose the more distant term.

Surely we specify the last day of the trade and date of an expiration of the chosen contract not to remain with the open transaction in the last hours of its existence. Otherwise, at best, you have to be closed in the thin market with non-standard spreads, and in the worst – the broker will fix your transaction on very unprofitable price.

It is recommended to transfer the transaction to the following contract (to close current and to open new on the future, more «distant» on terms), at least, prior several working days for monthly futures, and prior 1,5-2 weeks – for the quarter futures.

Warning: on futures instead of leverage the concept «mortgage margin» is used, which can differ for different contracts, as well as the cost of 1 tick.

Strategy for trade by futures

Almost all trade strategy, which have well proved on future assets, can be applied successfully on Forex, but at the observance of some rules.

Despite high average volatility – scalpers on futures don't survive, the vast majority of real exchange traders – trend middle termers, and large volumes almost entire period of futures are in long positions. As a result, before the closing of contracts, the swing movement appear to bring as much as possible closer market price to the contract level. After the opening of the new future the price also quickly can return to the previous level.

As a rule, large players use a minimum of the technical analysis, preferring the technology of the volume analysis and VSA to traditional settlement indicators. Almost all advertized indicator strategy of coryphaeuses of trading have been created for Forex. Use of RSI or Stochastic oscillators on trade in futures usually only adds false signals, but trend indicators, in particular, a combination of moving averages, and also indicators on the basis of a momentum are used surely.

The movement of futures on news, as a rule, very strong (especially on indexes), but looks illogical. The statistics show that in 90% of cases future traders use the fundamental information which isn't fulfilled by the market or lost relevance at all. Influence of fundamental factors, especially on raw futures, always multiple-factor, and for normal, reasonable reaction some time for the analysis is required to the market.

The insider's factor most of all affects the main futures (oil, gold, S&P500, dollar index): having important information before the main market, large players before news artificially move the price against the logical movement to force the bulk of traders to jump into the market, and upon later exit of news expedite unloading of the gathered position. For this reason, contrary to the technical analysis, even on negative data basic futures always give short-term impulses in an opposite direction and also quickly roll away back that very dangerously for small deposits with the insufficient StopLoss level.

It is supposed that in the stable market exchange players will always follow the trend revealed on graphics within a day. We will remind one simple, but a stable strategy for trade in futures.

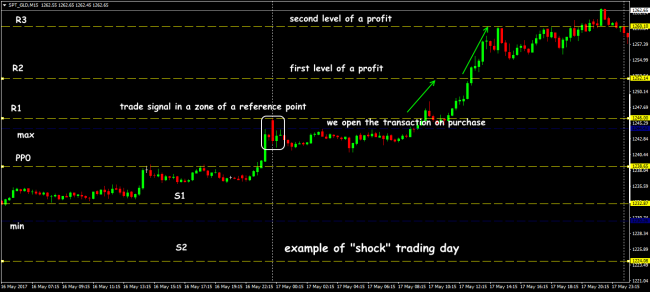

Trade on reference points (pivot points)

This technique most corresponds to the logic of real exchange players who consider data of previous day as the base of the dominating trend. Trade assets: share indexes; oil; gold; main currency pairs.

The technical analysis defines pivot points as the price levels of support/resistance calculated at the prices of Low, High and Close of the previous closed period (H1/D1/W1/MN1). If necessary calculations are carried out for all time frames consistently, but, naturally, the range of data for calculation is less, the accuracy of the constructed levels is lower. Day reference points allow constructing the scheme of work for each subsequent currency session.

The classical scheme for calculation of day pivot points begins with determination of the central reference point of the day: PP0 = (Low+High+Close)/3.

We calculate the first resistance from it: R1 = (PP0*2) – Low; and first support: S1 = (PP0*2) – High.

The second couple of support&resistance is defined as: R2 = PP0 + (R1– S1); S2 = PP0 – (R1 – S1).

The technology of trade is elementary: we open the transaction every time at the breakthrough of the next reference point (on the closed candle).

From the point of view of the base, it is considered that the values described above show levels where interests of large players long enough are in balance. Skilled stockbrokers use reference points in a combination with other tools to determine most precisely an entry point by additional indicators or a graphic pattern.

We don't forget: the whole world trades on reference points several decades and there is no secret in it. In case of a rigid money management the strategy of trade on pivot points will be profitable only if observe three conditions:

- it is necessary to define correctly shock day;

- during the trading session to open strictly on a trend;

- to hold a profitable position before achievement of the following basic level.

The idea of reference points is rather effectively used by the theory of shock day at which it is possible to look in Rezvyakov's strategy. Shock trend day is defined at the beginning of the session: if the price begins the movement in a zone of a reference point, then with a probability of 90% a day will be trend. If the price at the beginning of the trading session doesn't get to the range of a reference point, for example, above R2 or below S2, then we wait for flat and is necessary reducing the volume of the open transaction or not to enter the market at all.

The strong price levels created by limit orders, repeatedly checked by the market for breakthrough/kickback are applied for many years by large players to the determination of a trend. According to the system of shock day, it isn't recommended to open new transactions on Friday (because of the high risk of a gap on Monday) and at the end of the future term.

As a rule, in addition to reference points, the stable oscillator is used in the strategy, for example, classical MACD – its signals reduce the quantity of entry points approximately by 3 times, but considerably increase reliability, especially in further support of the transaction.

Use of futures as the indicator

The tick volumes don't matter at all for an assessment of futures, so any Forex technical analysis, both on the real future, and on a CFD asset will estimate only mathematical dependence. Future analogs can be used as «guides» by means of author's indicators, which are used in exchange trade terminals. Then it is possible to receive the trade signals considering dynamics of actual volumes. The successful example can be considered trade system of Sergej Rublyov and his futures indicator System Ryblev ArrowSTUDY created for a trading platform of Thinkorswim.

Using its signals as a reference point, it is possible to trade in the short term on usual currency pair or CFD versions of futures in usual MetaTrader. So, on the exchange schedule of the future we have:

- a pink arrow or «a starting candle», as a result of conditions for an entry point on strategy;

- horizontal level – for the postponed order on 2-3 points higher or below;

- a white arrow − breakthrough of the level of the postponed order.

As a result, we take signals from TOC, and open transactions on MT4. The trade system works strictly on a trend, has perfectly proved to be on the main currencies and raw futures, the work time frame from M15. A stop ratio to profit at least 1:4.

And as the conclusion …

Full contracts are inaccessible to most of the small traders on financial conditions, but almost on each popular index and raw future, there is a version of the mini-contract, for example, E-mini S&P500, E-mini DowJones, E-Mini NASDAQ or E-mini Euro, with more loyal conditions and, naturally, only for speculation. At the expense of traders with small deposits under such contracts liquidity is always higher, than on capital asset.

As professional traders consider, the future is eternal, because it is the usual trade agreement of participants of the exchange, it has more logic, and the technical analysis is much more reliable on it. Besides, it is a natural stage of development of the small speculator in the serious player.

Social button for Joomla