- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3534

On Monday EURUSD descended, rebounding from resistance of 1.2320, after a false breakdown on Friday. Since EURUSD pair is moving in accordance with news, one might find the reason in newsfeeds.

The Friday breakdown was an echo of numerous promises from supreme politicians of European Union about all-round aid to “difficult” members of the union.

After the promise to do everything possible for euro support and for Eurozone stability, EURUSD pair broke the support up to 1.2320, but could not consolidate on Friday, since the operators decided to exit the market after fixing the result.

On Monday the pair descended because of the disappointment that was provoked by Minister of Finance of Germany Wolfgang Shauble, who announced that the buyout of bonds from Spain and Italy is not going to happen. This step would allow lowering the profits of these papers and would make them attractive for investors also that would lessen the indebtedness of the governments of both countries.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3685

On Thursday European politicians supported euro giving the market positive subjects for conversations.

On Thursday European politicians supported euro giving the market positive subjects for conversations.

On Thursday Jose Manuel Barroso, who is the head of the Euro Commission said that Greece is going to remain in Eurozone anyway, despite the statements of Citibank that Greece is going to leave Eurozone right in the beginning of next year. Theoretically Greece exit from Eurozone, which is not a key country, will not lead to automatic union disintegration, but problems with stabilization will increase.

Barroso promised to do all in his power to maintain Eurozone stability, which means new programs for helping old debtors of Europe.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3399

On Monday trading on world financial markets passed evenly, since many institutional traders are waiting for comments and decisions after the meeting of European Union ministers of finance.

On Monday trading on world financial markets passed evenly, since many institutional traders are waiting for comments and decisions after the meeting of European Union ministers of finance.

Trader’s main expectations are connected with the approval by heads of financial structures of Europe to help Spanish financial sector, which requires, according to experts around 100 billion euros for stabilization.

It is also assumed that europartners will allow their Spanish partners to exceed the time limit of passing the 3 % level of budget deficit for another year, which will untie hands of Government of Spain.

At this time Finland expresses discontent over necessity to finance negligent allies, when proper problems require financial resources. But such statements are groundless, although they were uttered by minister of finance of Finland Jutta Urpilainen.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3507

It was announced on Thursday that the rate of European Central Bank would lower from 1.0% to 0.75%. Which can be regarded as a signal of priming the economy that together with the approval to allocate 100 billion euros for banking sector of Spain for financing its obligations, must be considered by markets a positive sign of possibility to recover. But the markets have not increased, and euro rate decreased on Thursday.

The reason of such “incomprehensible reaction” might be the president of European Central Bank Mario Draghi’s statements about permanent risks for European economy, lack of economic development and a catastrophically high unemployment rate, and also constant sovereign debts. All of these might destroy the efforts to regenerate the economy. These problems are long-existing, whereas the news about rate decrease has appeared today. Then why didn’t the investors and speculators react to this fact by rate increase?

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3804

On Thursday global microeconomic news from exerted pressure on markets. US GDP growth in first quarter of 2012 was lower than expected (a 2.2% increase was expected, but it resulted to be 1.9%). A prognosis on consumer expenditures increase also adjusted towards decreasing (it was stated before that the increase would be 2.7%, but later the number lowered to 2.5%). There is a development and the economy must recover, but the unemployment rate does not seem to be decreasing.

On Thursday global microeconomic news from exerted pressure on markets. US GDP growth in first quarter of 2012 was lower than expected (a 2.2% increase was expected, but it resulted to be 1.9%). A prognosis on consumer expenditures increase also adjusted towards decreasing (it was stated before that the increase would be 2.7%, but later the number lowered to 2.5%). There is a development and the economy must recover, but the unemployment rate does not seem to be decreasing.

The rating agency Fitch also lowered the estimated numbers of prognosis on the development of developing countries of Asia. Thus anticipated 6.9% turned into 6.3%, which is connected to increase of external risks that hamper the development of exporting from the region.

On Thursday the information about microeconomic development of Great Britain became available. The GDP in the first quarter decreased by 0,2% (this indicator was predicted at the level of -0,1%), and more importantly a deficit of balance of payments has increased significantly to more than 11 billion pounds (with estimated 9 billion pounds).

- Details

- Written by Admin

- Category: Forex news

- Hits: 4293

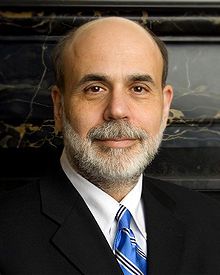

On Thursday the FED (the Federal Reserve) chairman Ben Bernanke reported on the economic advances the USA.

On Thursday the FED (the Federal Reserve) chairman Ben Bernanke reported on the economic advances the USA.

Just a day before Bernanke's colleague Mario Draghi commented favorably on the eurozone economic tendencies, consequently on Thursday markets were anticipating growth and positive changes. However, Bernanke was not so optimistic. He highlighted the positive tendencies on the american market, but his comments were conservative. Bernanke also spoke about sovereign risks in connection to the Europe and promised to tackle this problem efficiently, so FED is watching the situation in the eurozone carefully.

After such comments all investors were expecting Bernanke to offer support to the american economy by all means and announce readiness to consider the third round of quantitative easing. In spite of this no signals were received by the investors and the market growth ceased. As a result Bernanke supported current short-term rates, but he did not give a hope on long-term perspective support from FED.