- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3506

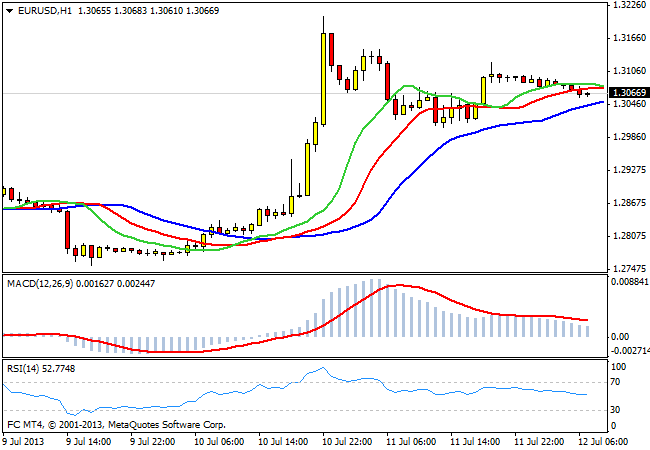

For the first half of yesterday's trading session was characterized by a symbolic strengthening of the dollar. Publication of the minutes of the last meeting of the Federal Open Market Committee, the Fed is not particularly affected the dynamics of the major currency pairs. Grown up a little volatility in the moment of the news has been replaced by a continuation of the growth of the U.S. currency. Market participants have not heard specific statements from the representatives of the monetary authorities. The main focus of the report was made on positive expectations regarding the U.S. economy.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3330

Despite published in August of interesting macroeconomic data, the major currency pairs continue to drift lower level of volatility. It seems that in the near future we will see a way out of quotes from well-established ranges. Given the length of this phase is no trend, the movement is rapid and high amplitude. The first signals of an impending storm is coming from the stock markets of the world, where there is increased volatility in the background begun reduction indexes.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3448

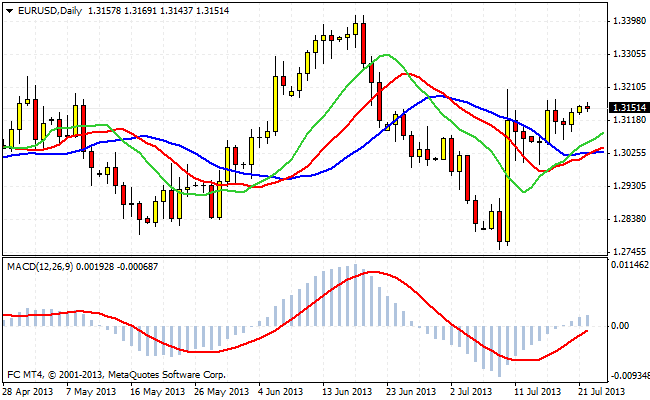

At the end of last week, the U.S. dollar has lost weight again against major competitors. The reason for such a negative attitude to the dollar from investors was the publication of disappointing macroeconomic data in the U.S.. This week, market participants will have the opportunity to evaluate the protocol FOMC. This may lead to new estimates of the prospects for monetary policy the FED.

The current situation in the U.S. economy and the euro zone rather ambiguous. In this regard, the major currency pairs continue to trade in the usual ranges. The data on business activity, which is out this week, can provide some support for the European currency. In recent years, more and more experts are inclined to believe that there are risks of short-term improvement of the macroeconomic parameters Eurozone and the UK. In the event that such assumptions will receive confirmation of the reports, the demand for the pound and the euro in the near future may increase.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3213

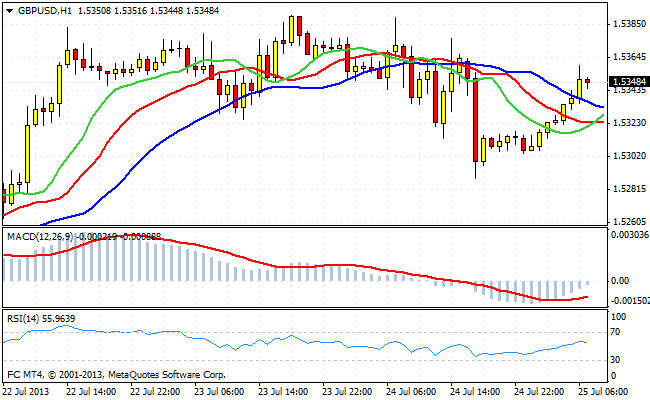

Current trading week in the FOREX market started with the strengthening of the dollar. But on Thursday, the U.S. currency again come under pressure. Data on capital flows disappointed bull increase the dollar, and quotes the U.S. currency lost all reclaimed levels. Was a strong report on retail sales in the UK. This allowed the pair GBP/USD to rewrite the local maximum and go higher.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3311

Bidding on Wednesday did not bring any surprises the foreign exchange market participants. The head of the Federal Bank of St. Louis in his speech yesterday noted that the campaign to curtail the FED's monetary stimulus needed more positive U.S. economic data. Players continue with great attention the state of macroeconomic statistics. Dealers said today, investors will focus on the data on the volume of retail sales for July in England. Many players are waiting for improvement of this indicator. These positive expectations may be the cause of the speculative demand for the pound in the last session.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3648

Many experts believe the financial markets, after the FED will begin to curtail stimulus program, the U.S. stock market will decline. But there are reputable experts who predict an even greater increase of the market. Jim Paulsen, chief investment strategist of which Wells Capital Management, confident that in 2014 the U.S. stock market will be a new wave of growth.

The main argument in favor of this scenario appears that the role of loose monetary policy of the FED in the recovery of the U.S. economy is much less significant than the majority suggests. According to the strategist, the economy is not only able to get out of the stagnation phase, but also to begin to prosper and grow. Thus, the essence of the situation lies in the trust. If the markets get a hint of what the economy can fully function without feeding the FED, it will be a much more powerful stimulus than the actual program of quantitative easing.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3922

FED officials literally chorus continue to declare that the U.S. economy is in a recovery phase and macroeconomic indicators fully meet the conditions for the onset of decline of redemption of bonds. Eurozone monetary regulator, however, goes on to say that he intends to continue to maintain loose monetary policy despite clear signs of improvement in the economic situation.

Investors are divided into two camps: some are waiting for the inevitable, in their opinion, the dollar growth on all fronts, while others, apparently, do not rush to conclusions and can count on the fact that the FED will offer something in return QE. And all this spiced sauce confidence to data of macroeconomic statistics. Analytical discussion among experts on the subject of fundamentalists like the tug of war. The reality at the moment is that the U.S. equity indices are storming the highs and the dollar continues to give up their positions against the euro and other currencies.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3628

Over the past week the dollar again lost some of their positions. But despite continued pressure, the rate of weakening of the U.S. dollar against major competitors have considerably decreased. Some analysts attribute the current weakness of the dollar to seasonal factors. Here are taking place, as an imbalance in demand for currency by the period of tourist trips and low trading activity due to the holiday season. Major participants (market makers) may again take to the dollar closer to the fall. Thus, August can be a turn-month for the U.S. currency. The cause of the dollar can be a mass closing of short positions by speculators. According to some brokers foreign exchange market in recent weeks, the volume of Short euro against the dollar is at record levels.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3471

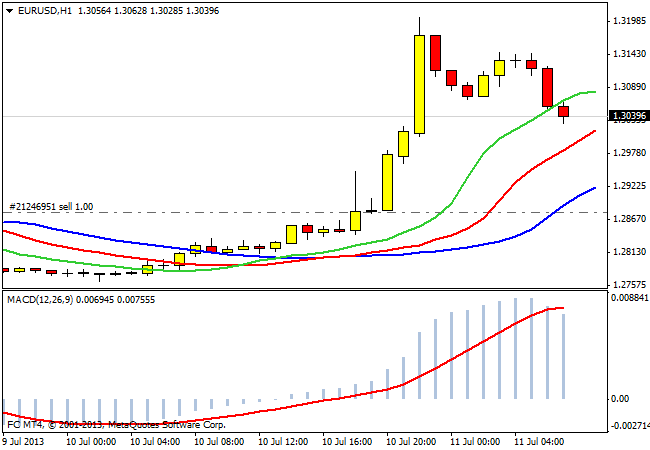

Bidding on Thursday marked the continuation of the reduction of the dollar against major competitors. The relatively strong data on Macroeconomics European region are forcing market participants to sell the U.S. currency in favor of the euro. Balancing the position players on the FOREX has been going on for a long time. According to analysts, the markets still do not believe the FED will take active measures in the near future.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3618

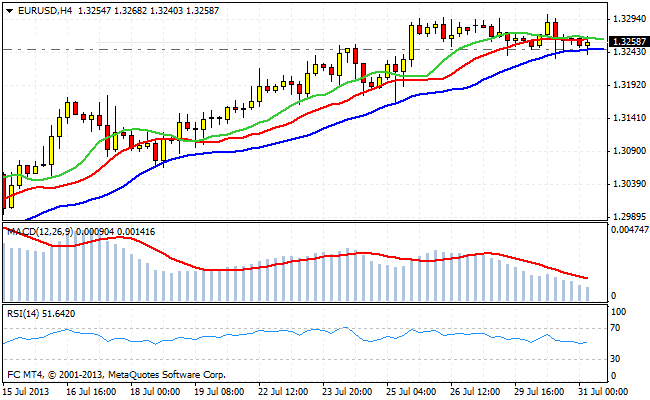

Quotes of the major currency pairs on the news the last days of testing the local levels of support and resistance. The dollar continues to gradually take their positions on all fronts. Apparently, the speculation about the decline in the FED's bond purchase program on the backburner, and market participants act out a relatively strong economic data from the European region.

The dollar index currently stands at 81.15 . After overcoming a local minimum at 81.50 is the next target in the medium-term support near 80.50. This day is not filled with any important news events, and for this reason, some traders can sit on the couch and take action.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3392

Trading in the FOREX market on Wednesday are expected to be active during the second half of the day. Is expected to yield important reports on inflation in the UK and the performance of the Bank of England's Mark Carney. This could determine the fate of a pair GBP/USD in the coming weeks. Market participants' attention will be focused on the pace of economic growth and inflation expectations. Constructive comments Carney can be the reason for the short and medium game to improve the pound.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3341

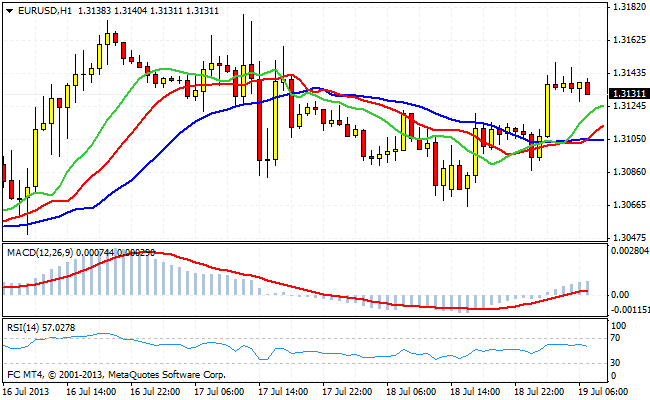

Beginning of the week did not bring with them any significant movements in the currency markets. Trading activity on the first day of the week was slightly above the average for this period. There has been some different trends among the major currency pairs. The fact that some couples who traditionally have a high degree of correlation, went in the opposite dealers attributed to the fact that the participants were guided by the local trend of the fundamental parameters. Good data on the business activity of the Eurozone could not keep the European currency at the highs on Friday. As a result, a pair quietly slipped into the close. News flow today will be mainly from the European region.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3295

The last two weeks the markets get a large amount of information that could identify the medium-and long-term vector of currency movement. But as long as the participants do not rush to take aggressive positions. This limits the range on the major currency pairs. Despite the important data on the U.S. economy and the publication of results of the meeting of leading central banks, the situation in the foreign exchange market remained relatively calm. Apparently, at the moment dominated by technical factors.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 2917

With so many traders are looking forward to applications from the central banks, which, apparently, partly burned. The result of publication of the results of the Fed meeting, the ECB and the Bank of England became the volatility at current levels. Ultimately quotes have not moved from their original values. In yesterday's trading session was quite a lot of news. Due to this dynamics of the major currency pairs was at a certain point in different directions. Despite the strong economic data from the Eurozone, investors chose to eventually sell the European currency. In the speech Draghi quotes pair EUR/USD started the downward momentum.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3475

Block macroeconomic news yesterday to make quotations of the main currency pairs fluctuate in different directions several times during the trading session. Well, at the end of the day began very real roller coaster. Strong and positive U.S. economic data the day contributed to the development of demand for the dollar, but before the FED's statement quotes again returned to previous levels. Data on employment and GDP of the United States have caused such a positive response on the dollar, as they could be an argument for the soon to minimize the program of quantitative easing. But Ben Bernanke's statement did not contain any hint of that in the near future may be a reduction in incentives.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3213

Tuesday on the FOREX market was relatively quiet. In the major pairs was some different direction. Quotes of the single European currency have attempted to test the 1.3 area, but the dynamics of the pair GBP/USD had a bearish trend. Drivers to start more or less strong move today will be enough.

Macroeconomic data will reveal different sides of the current situation in the Eurozone and the U.S. economy. In the European session, extend the data on the labor market in the Eurozone. Later, during the American session, participants will assess leading indicators of the labor market, to win back the GDP data for the second quarter (8:30), and at the end of the session to interpret the statements of representatives of the Federal Reserve (14:00).

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 2856

Judging by the importance of the upcoming news, trading this week promises to be quite active. Monday can be considered symbolic of the U.S. dollar during the day, as there have been some attempts to play on the rise of the U.S. currency. But, despite the desire of speculators to warm up before the markets publications outcome of the meeting of the central bank, quotes, currency pairs held by the current narrow ranges. News flow of the most powerful, the degree of potential impact on the markets, the data is expected in the second half of the week. Prior to that, most likely, further consolidation.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3201

Last week was quite an active market for FOREX. A number of macroeconomic news brought volatility to the market. U.S. dollar up again lost ground against major competitors. The dollar index reached 81.50 in the downward momentum that began in early July, after Ben Bernanke slightly dampened investors. This week will be rich in important data that could lead to a radical change of emphasis in the market. On the courses of further monetary policy and tell the FED, the ECB and the Bank of England. Apparently, these two days (Wednesday and Thursday) will be decided mid-term fate of the major currency pairs.

It should be noted that the focus will not remain without such data for the United States economy, as GDP for the second quarter and labor market statistics. All this will greatly affect the course of monetary policy. While the situation is such that the FED would prefer to delay the start of reducing redemption of bonds.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3763

Trading on the foreign exchange markets Thursday was very dynamic. Tension of the last days has resulted in attempts to pound and the European single currency to test the strength of local support. Driver of these movements served as a data packet on business news for the euro area and the UK's GDP in the second quarter. In the European session, the indices were published research institute IFO. The ratios presented in this time were worse than expected, it is somewhat disappointing investors. After a short period of volatility in the local maxima of the euro and the pound headed down.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3601

Bidding on the major currency pairs on Wednesday were in the ranges. Some increase in volatility was seen in the U.S. trading session, but overall significant changes in quotes did not happen. Bearish sentiment slowly return to commodity markets. Investors believe that the Fed's tightening policy will contribute to re-evaluation of risks and buying the U.S. dollar. In addition, investors are worried that China's economic slowdown will increase the negative attitude to the prospects of commodity assets.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3513

Beginning of the week in the currency markets is calm. In the absence of important macroeconomic data exchange drift up and down. In recent days there has been a strengthening of the single European currency and the pound against the dollar. Experts believe that this situation will change in the near future, as the fundamentals are now in favor of the dollar. Representatives of the European Central Bank said that the bank may continue to cut interest rates, given the current economic situation. The markets believe that the European regulator did not follow the example of the FED for a very long time. But ,nevertheless, the euro grows slowly due to technical reasons. Investors simply adjust long dollar positions due to a change in the rhetoric of Ben Bernanke for QE3 from aggressive to neutral.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3412

U.S. dollar slightly losing ground against its major competitors in the absence of significant macroeconomic data. The company regularly conducts Bloomberg survey of economists to determine the expectations regarding monetary policy the FED. Recent survey data indicate that experts are more likely to believe in the FED's willingness to act in September. So say about 50 % of the respondents surveyed Bloomberg. Their point of view, some experts based on the fact that the markets, in their opinion, has the potential to adapt to changes in the policy of the FED, and now tightening does not carry the risk of high volatility. In a sense, the representatives of the monetary authorities would be prepared as markets for end of stroke easing. The second half of the respondents believe that the FED will act only in the second quarter of next year.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3582

Last days in the FOREX market are characterized by low trading activity and moderate volatility. Apparently, quotes, currency pairs felt for some equilibrium zone, the output of which will be very dynamic. Fundamental factors that move the markets at the moment, most likely, will be the news of the central banks of the U.S., Eurozone and Japan. Rates of monetary policy the world's largest banks - is by far the main story for all financial markets. Renowned expert on debt markets, Bill Gross thinks that the FED is still quite a long time will not start tightening monetary policy. Finance believes that any decisive action the U.S. central bank may begin only in 2016. In the meantime, according to the expert, the FED will be limited to verbal tools and levers.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3266

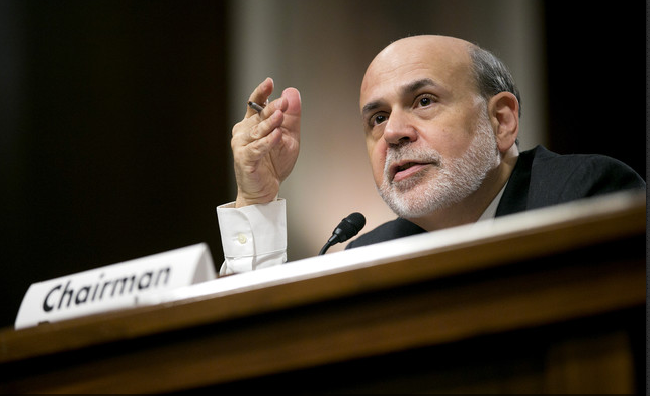

The second day of speeches from Fed Chairman before Congress did not bring volatility in the currency markets. Ben Bernanke went on to do quite restrained statements, citing economic trends. The position of the Fed is extremely clear. In a sense, all the responsibility for further action Reserve shifts the dynamics of macroeconomic data. Market participants continue to monitor the incoming information. The rating agency Moody's yesterday revised its outlook on the U.S. rating to stable from negative. The main reason for this upgrade was provided by data on the situation in the economy of the state, which indicates a steady growth.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3651

The attention of investors at auction on Wednesday was focused on the speech of the FED to Congress. In recent days, the participants of the market was not easy to decide on the further prospects of the major currency pairs. The reason for this was some ambiguity in the statements of Ben Bernanke. A month earlier, the head of the FED, it would seem, has made it clear that the folding of the quantitative easing program will begin in the near future, almost in September. This caused a massive dollar purchases and avoiding risky assets around the world. But now the rhetoric of Ben Bernanke has become much softer. Abstracts of yesterday's report were also quite flexible.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3180

Today and tomorrow in the evening Ben Bernanke will speak to Congress. According to experts, the chairman of the FED once again remind the members of Congress and the markets that in the beginning of the collapse of stimulus measures will not follow the growth of the interest rate. Such updates often are taking place in recent years, as markets tend to overestimate the FED's intentions with regard to monetary policy. Rather, Ben Bernanke will continue to keep making controversial statements. The main guidelines in the Federal Reserve's monetary policy remains - economic growth and labor market situation.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3861

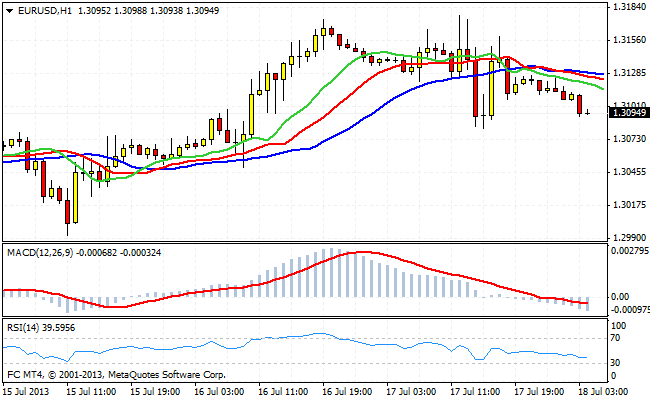

The trading session at FOREX market on Tuesday - July 16, runs quietly enough. Partly activity is noted in the USD/JPY pair before the European trading session. In general, the situation is neutral. Apparently the players have decided not to take decisive action before the publication of the FED's Beige Book on Wednesday. Yesterday's weak economic data on retail sales in the United States has not allowed the dollar to resume growth. Thus, the market is now felt certain equilibrium level, get the ball where he can help only significant news.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3975

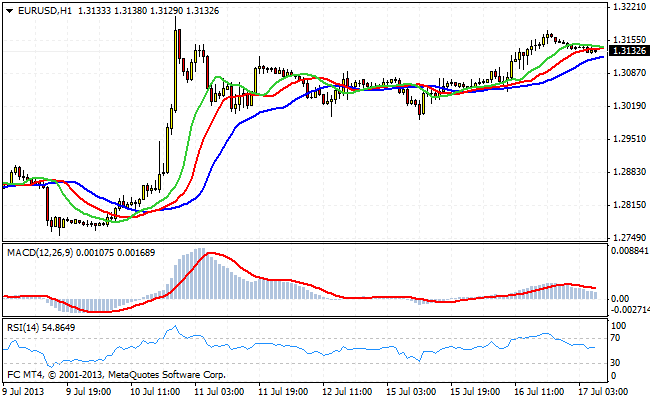

Trading in the FOREX market on Monday held in moderation. The past week has been rather volatile, and the reason for this was neutral comments from FED Chairman Ben Bernanke and a number of macro-economic data from China. The situation in the Chinese economy worries many market participants. Representative of the Middle Kingdom financial authorities forecast a further slowdown in economic growth, and this will adversely affect the commodity currencies, and on the desire of investors to invest in risky assets. FED policy takes into account the situation in their forecasts in China, so market participants will closely monitor the actions of the Federal Reserve and the rhetoric of its president.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3439

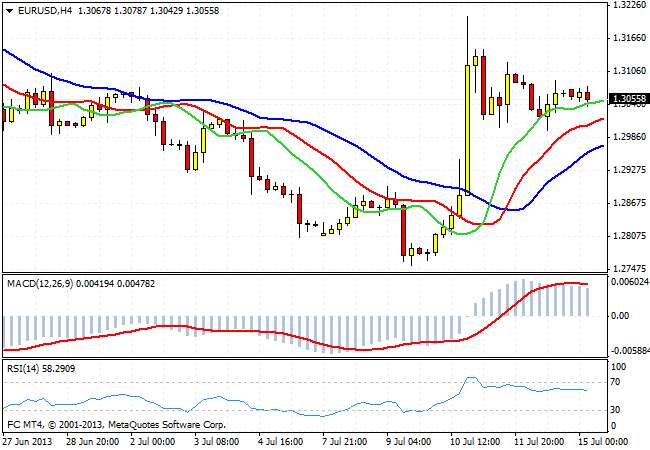

In recent weeks, the dollar has made a very serious bid for the long-term growth. In this regard, his abrupt departure this week is the subject of much debate among traders and analysts. Skeptics on the dollar in one voice insists that the markets since the beginning overestimated the FED's willingness to take decisive action, and that such a total purchase of U.S. currency was no reason. So as soon as Ben Bernanke's rhetoric changed to neutral, market participants revised their forecasts and have had to close a lot of long dollar positions. If the quote currency pairs will not change much until the end of Friday's trading session, the first time in a month dollar closes the week lower against its major rivals.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3519

At yesterday's auction at the end of the U.S. trading session, the chairman of the Federal Reserve signaled to the market that the possible start reducing stimulus measures - this is not the tightening of monetary policy. Thus hinted that the time of cheap money has not yet passed. According to some experts, Bernanke is trying to show that the decline in QE3 will not result in a reduction in the balance. And, do not jump the gun, as long as the labor market is still quite weak, and inflation rates are low, and that's all, in turn, suggests that reducing the volume of bond purchases at this time early. Thus, Ben Bernanke said that as long as until the cogent arguments supporting a significant improvement in the economic situation, the FED intends to continue to pursue accommodative monetary policy.