- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3399

On Thursday 22.11.2012 the USA will celebrate Thanksgiving Day. For those who know the past of the USA it is clear that it is a very important and respected day in the USA. And certainly during the most important day for one’s country brokers will not descend into a virtual pit. Put simply there will not be any tradings in the USA on Thursday, which will make its corrections in the regime of trading of world traders.

On Thursday 22.11.2012 the USA will celebrate Thanksgiving Day. For those who know the past of the USA it is clear that it is a very important and respected day in the USA. And certainly during the most important day for one’s country brokers will not descend into a virtual pit. Put simply there will not be any tradings in the USA on Thursday, which will make its corrections in the regime of trading of world traders.

One should understand that even on European areas will be low amount of bargains, since the markets of these two parts are closely connected and some players will limit their actions, knowing that their colleagues and partners will not support then that day.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3396

Probably every single analyst has expressed throughout the week his thoughts about possible “fiscal steep” in the US and its circumstances.

Probably every single analyst has expressed throughout the week his thoughts about possible “fiscal steep” in the US and its circumstances.

“Fiscal steep” is a situation that is possible from January 1 of 2013, when the budget amendments will come into effect in the USA. The amendments stipulate tax boost and reduction of government spendings in the amount of 600 billion dollars (approximately).

This event is especially important for analysts and prognosticators from Wall Street and neighbouring houses. Yes, the situation is not easy, but the economy of the US should not follow this scenario, since it is based on high government spending and a huge budget gap, what will happen to it in case of cutting the consumption is not clear. At best we will see zero growth indicators.

Of course lately there has been an escape from the risk and descent of all stock indexes in the US as well as other indexes.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3455

On Friday European Parliament rejected the solicitation from the European Commission to increase the budget of European Union by 9 billion euros in 2013. The Eurocommission wanted to spend the money to help with the budget gap, which endangers the activation of some of the projects in education, research and infrastructure area.

On Friday European Parliament rejected the solicitation from the European Commission to increase the budget of European Union by 9 billion euros in 2013. The Eurocommission wanted to spend the money to help with the budget gap, which endangers the activation of some of the projects in education, research and infrastructure area.

But the most surprising part is that the European Parliament agreed to increase the budget which equals 129 billion euros, by 2,8%, but the members of the European Commission weren’t interested in this compromise and they didn’t get anything.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3602

The major event of the week for all the markets (and political world) was the elections of the US president, based on the data of 06.11.2012 current president of the US Barack Obama was re-elected. And now all the speculators are focused on presidents’ new decisions.

The major event of the week for all the markets (and political world) was the elections of the US president, based on the data of 06.11.2012 current president of the US Barack Obama was re-elected. And now all the speculators are focused on presidents’ new decisions.

The new president of the USA has decisions to make and these problems are urgent. The main problem is the high unemployment rate, that according to the latest data on labour market it is not going down (7.9 %). The “everlasting” problem of the United States needs to be solved as well- growing national debt. This problem becomes even more serious with the arrival of 2013, that according to analysts of the US it will face “fiscal steep”, that means the end of effect of tax concession, that was approved by George Bush. There will be budgetary restraint,that along with critical budget gap limits the tools for market stimulation.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3470

Despite the good impression from the news on unemployment rate (although it returned to 7.9 % a month earlier after 7.8 %, but there are more jobs created than it had been expected), the markets on Friday experienced a considerable fall, and dollar grew afterwards. EURUSD pair stopped at a support level of 1.2830, after a pretty good fall.

Despite the good impression from the news on unemployment rate (although it returned to 7.9 % a month earlier after 7.8 %, but there are more jobs created than it had been expected), the markets on Friday experienced a considerable fall, and dollar grew afterwards. EURUSD pair stopped at a support level of 1.2830, after a pretty good fall.

GBPUSD pair acted alike, falling down to the diapason of consolidation.

American stock markets fell considerably in their indexes, though European markets closed in the green zone, and the overall background is positive.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3698

Despite a slight weakness on Monday dollar kept growing on Tuesday. Probably dollar’s growth may be explained by traders’ expectations concerning news on Wednesday: the speech of the president of ECB and FOMC meeting. Dollar keeps growing, since nobody expects that Mr Dragi will say anything extraordinary. Recently he hasn’t disclosed any decisions or steps connected with European bank regulator. During FOMC meeting the main subject will not be the rate of interest, which will remain at the same level, but the decision about a new program of quantitative easing.

Despite a slight weakness on Monday dollar kept growing on Tuesday. Probably dollar’s growth may be explained by traders’ expectations concerning news on Wednesday: the speech of the president of ECB and FOMC meeting. Dollar keeps growing, since nobody expects that Mr Dragi will say anything extraordinary. Recently he hasn’t disclosed any decisions or steps connected with European bank regulator. During FOMC meeting the main subject will not be the rate of interest, which will remain at the same level, but the decision about a new program of quantitative easing.

Under such conditions it is hard to foretell the behavior of the market. What reaction will the market express on the news, are the events taken into account? Probably! That is why we look at the market technically and we reduce the risks. And technically dollar is strong and is growing compare to other currency pairs.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3579

The correction towards the rapid growth that started on Monday, after the statement from FRS about a 3-rd stage of quantitative easing continued on Tuesday.

A rebound signal for sale has formed on EURUSD pair- falling doji-star. The signal is good and one should not ignore it. It is dangerous to sell, since it is a strategy against the trend, but it is not unlikely to perform with a little stop. The price is going down gradually without jerking, that is why the stop may be short. That will reduce the risk of losses.

Pound and gold are still at a maximum level; the correction reminds consolidation, especially on gold which grew actively on Tuesday after the correction on Monday. The sales on precious metals from current levels look interesting, since the stop will be short. The goal of the short sale may be the level of 1755 for an ounce.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3380

After a rapid growth next week On Monday the markets stepped aside a little bit. It was especially evident on AUDUSD pair, on the graph of which the rebound signal for sale has appeared- the falling dodji-star. However, taking into account the overall market sentiment, one should look at this as a correction of the current growth and the reaction to false breakdown of the level of resistance of 1.0600.

That is why it is not recommended to occupy short positions, it is better to wait for the signal for buying on Tuesday, since the pair has all chances to finish the correction and to reestablish lost positions.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3556

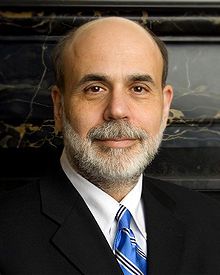

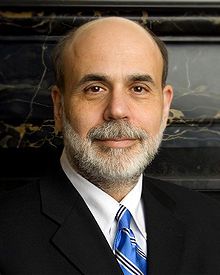

Ben Bernarke again omitted to answer the main question: will there be a new phase of quantitative easing. The FRS chairman’s closing words that were uttered in Jackson Hall were received by many investors as a hint for beginning new quantitative easing.

Ben Bernarke again omitted to answer the main question: will there be a new phase of quantitative easing. The FRS chairman’s closing words that were uttered in Jackson Hall were received by many investors as a hint for beginning new quantitative easing.

"Taking into account uncertainty and limitations, laid in instruments of monetary policy, the Federal Reserve will utilize additional stimulating means, if it is necessary for supporting the renewal of economy and stable improvement of the situation on the labor market in context of price stability”.

However the experts do not hurry to estimate the size and date of potential easing, since the implementation of monetary stimulation is in question. Recall that this is not the first public speech in which Ben Bernarke makes ambiguous hints, that may be interpreted as a hint and an intention to launch one more round of quantitative easing. Nevertheless nothing has happened since, that is why there is a possibility that this time the chairman of FRS will limit himself with hints.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3504

Today all the traders that were occupying short positions on risk instruments, found themselves in a very difficult situation in the middle of the day, since according to statements made by Mr. Dragi, the head of ECB on newly developed program on saving Eurozone and promises to save Euro at any price, the market was filled with optimism, that raised the quotations.

Thus the EURUSD pair raised abruptly, breaking the resistance of 1.2320, activating the stops of bears and orders of buying bulls. However, the disappointment that came to the market after refutation of the possibility to buy public bonds of Spain and Italy at ECB’s price, that was uttered by Minister of Finance of Germany Wolfgang Schauble, led to long positions liquidation and the market descended. Thus on Thursday the EURUSD pair stopped on support level of 1.2160, though during the day it was lower.

Such outcome of the events was anticipated, though neither Great Britain bank, nor CEB could change its monetary politics and the problems were left to its resources.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3533

On Monday EURUSD descended, rebounding from resistance of 1.2320, after a false breakdown on Friday. Since EURUSD pair is moving in accordance with news, one might find the reason in newsfeeds.

The Friday breakdown was an echo of numerous promises from supreme politicians of European Union about all-round aid to “difficult” members of the union.

After the promise to do everything possible for euro support and for Eurozone stability, EURUSD pair broke the support up to 1.2320, but could not consolidate on Friday, since the operators decided to exit the market after fixing the result.

On Monday the pair descended because of the disappointment that was provoked by Minister of Finance of Germany Wolfgang Shauble, who announced that the buyout of bonds from Spain and Italy is not going to happen. This step would allow lowering the profits of these papers and would make them attractive for investors also that would lessen the indebtedness of the governments of both countries.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3677

On Thursday European politicians supported euro giving the market positive subjects for conversations.

On Thursday European politicians supported euro giving the market positive subjects for conversations.

On Thursday Jose Manuel Barroso, who is the head of the Euro Commission said that Greece is going to remain in Eurozone anyway, despite the statements of Citibank that Greece is going to leave Eurozone right in the beginning of next year. Theoretically Greece exit from Eurozone, which is not a key country, will not lead to automatic union disintegration, but problems with stabilization will increase.

Barroso promised to do all in his power to maintain Eurozone stability, which means new programs for helping old debtors of Europe.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3396

On Monday trading on world financial markets passed evenly, since many institutional traders are waiting for comments and decisions after the meeting of European Union ministers of finance.

On Monday trading on world financial markets passed evenly, since many institutional traders are waiting for comments and decisions after the meeting of European Union ministers of finance.

Trader’s main expectations are connected with the approval by heads of financial structures of Europe to help Spanish financial sector, which requires, according to experts around 100 billion euros for stabilization.

It is also assumed that europartners will allow their Spanish partners to exceed the time limit of passing the 3 % level of budget deficit for another year, which will untie hands of Government of Spain.

At this time Finland expresses discontent over necessity to finance negligent allies, when proper problems require financial resources. But such statements are groundless, although they were uttered by minister of finance of Finland Jutta Urpilainen.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3502

It was announced on Thursday that the rate of European Central Bank would lower from 1.0% to 0.75%. Which can be regarded as a signal of priming the economy that together with the approval to allocate 100 billion euros for banking sector of Spain for financing its obligations, must be considered by markets a positive sign of possibility to recover. But the markets have not increased, and euro rate decreased on Thursday.

The reason of such “incomprehensible reaction” might be the president of European Central Bank Mario Draghi’s statements about permanent risks for European economy, lack of economic development and a catastrophically high unemployment rate, and also constant sovereign debts. All of these might destroy the efforts to regenerate the economy. These problems are long-existing, whereas the news about rate decrease has appeared today. Then why didn’t the investors and speculators react to this fact by rate increase?

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3799

On Thursday global microeconomic news from exerted pressure on markets. US GDP growth in first quarter of 2012 was lower than expected (a 2.2% increase was expected, but it resulted to be 1.9%). A prognosis on consumer expenditures increase also adjusted towards decreasing (it was stated before that the increase would be 2.7%, but later the number lowered to 2.5%). There is a development and the economy must recover, but the unemployment rate does not seem to be decreasing.

On Thursday global microeconomic news from exerted pressure on markets. US GDP growth in first quarter of 2012 was lower than expected (a 2.2% increase was expected, but it resulted to be 1.9%). A prognosis on consumer expenditures increase also adjusted towards decreasing (it was stated before that the increase would be 2.7%, but later the number lowered to 2.5%). There is a development and the economy must recover, but the unemployment rate does not seem to be decreasing.

The rating agency Fitch also lowered the estimated numbers of prognosis on the development of developing countries of Asia. Thus anticipated 6.9% turned into 6.3%, which is connected to increase of external risks that hamper the development of exporting from the region.

On Thursday the information about microeconomic development of Great Britain became available. The GDP in the first quarter decreased by 0,2% (this indicator was predicted at the level of -0,1%), and more importantly a deficit of balance of payments has increased significantly to more than 11 billion pounds (with estimated 9 billion pounds).

- Details

- Written by Admin

- Category: Forex news

- Hits: 4292

On Thursday the FED (the Federal Reserve) chairman Ben Bernanke reported on the economic advances the USA.

On Thursday the FED (the Federal Reserve) chairman Ben Bernanke reported on the economic advances the USA.

Just a day before Bernanke's colleague Mario Draghi commented favorably on the eurozone economic tendencies, consequently on Thursday markets were anticipating growth and positive changes. However, Bernanke was not so optimistic. He highlighted the positive tendencies on the american market, but his comments were conservative. Bernanke also spoke about sovereign risks in connection to the Europe and promised to tackle this problem efficiently, so FED is watching the situation in the eurozone carefully.

After such comments all investors were expecting Bernanke to offer support to the american economy by all means and announce readiness to consider the third round of quantitative easing. In spite of this no signals were received by the investors and the market growth ceased. As a result Bernanke supported current short-term rates, but he did not give a hope on long-term perspective support from FED.