- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3728

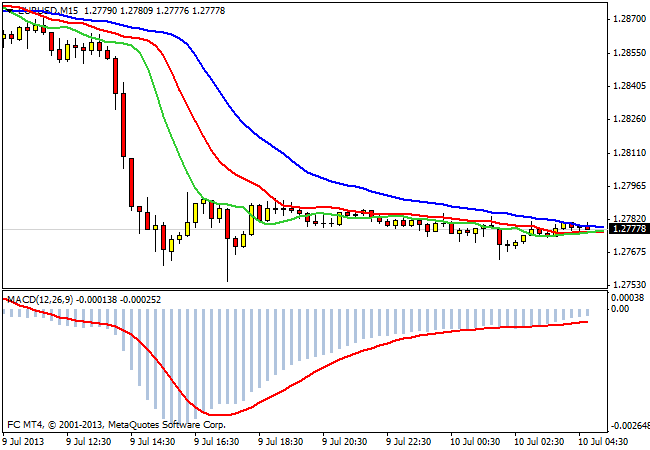

On tuesday, trading in the foreign exchange market were some imbalances. Investors do not hurry with the occupation of large positions, but, nevertheless, in some currency pairs observed increased volatility. Since EUR/USD pair showed decline in the second half of the trading session, reaching a three-month low of 1.2750 . The reason for this was the reduction of the credit rating of Italy. Specialized rating agency S&P cut the rating by one notch to BBB with BBB+, confirming a negative outlook. Thus, the agency's analysts believe that the situation in the economy and the financial sector will only get worse.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3706

Despite the fact that the market has a lot of skeptics in regard to the future prospects of the dollar, the experts of a number of large investment banks are convinced that the dollar is currently on the verge of a powerful wave of growth. So UBS believe that an increasing number of members of the Federal Reserve will maintain the initiative on QE3 minimize the program and the transition to tighter monetary policy. Due to the fact that the current week is not very rich in news, the main topic of discussion is the situation in the U.S. labor market. Tomorrow, the publication of the minutes of the Fed meeting, resulting in the dollar could get support.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3510

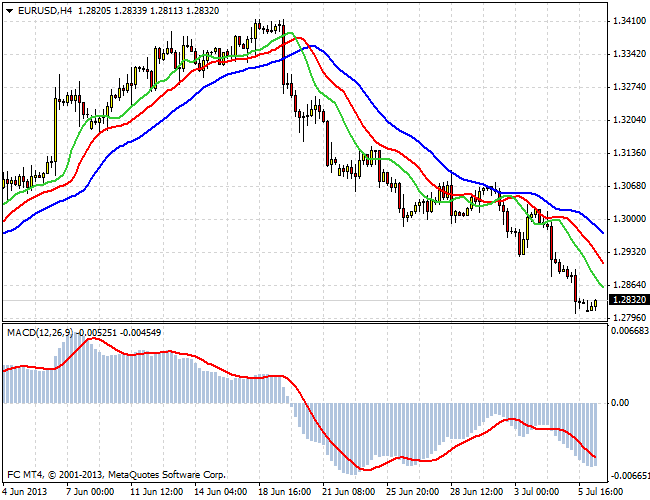

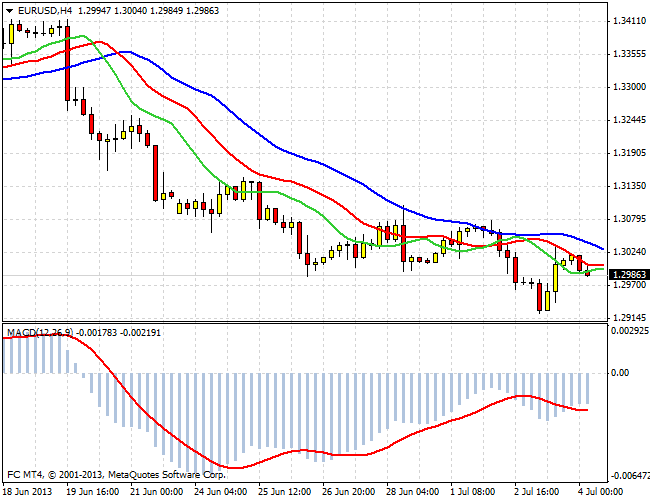

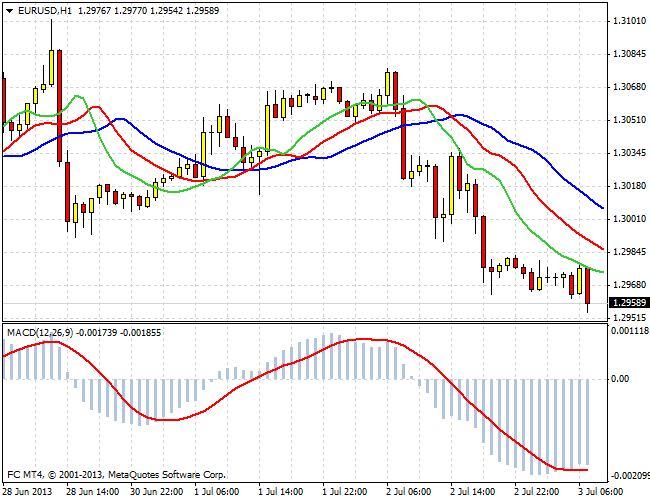

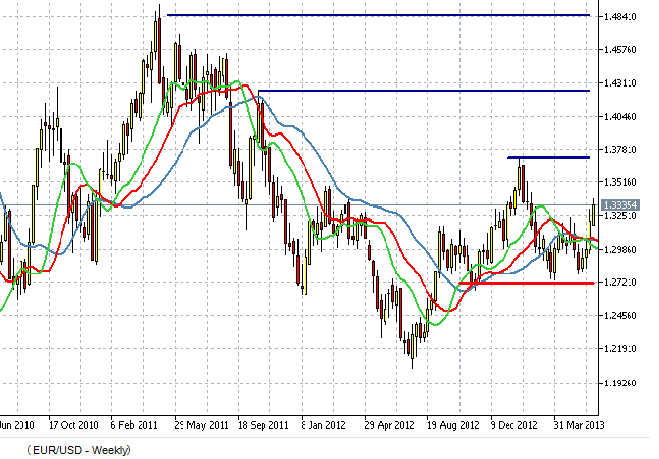

The previous trading week for currency markets was somewhat critical. Central banks have decided on the course of monetary policy. The Fed has made it clear that it intends to begin curtailing stimulus measures already in September, if the labor market will continue to show strength. The ECB and the Bank of England, by contrast, have expressed readiness for further easing. EUR/USD was under pressure all week and showed a decline in area of 1.28 .

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3449

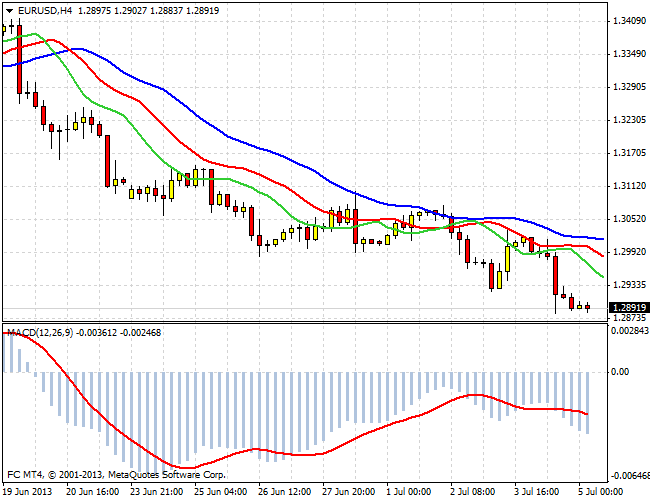

ECB meeting held no surprises, the interest rate has remained at the same level. Draghi said the bank's monetary policy will remain soft. The head of the European Central Bank does not rule out any further easing. In addition, in the comments, it was noted that the ECB is ready to launch OMT program at any time. But while it's still only at the level of conversation. Experts believe that the special effect of lowering the deposit rate below zero can be expected.

EUR/USD to the publication of the results of the ECB reacted to decrease by about one piece. Market participants decided that the euro has virtually no prospects for medium-term period of time. The pair quickly fingered the level of 1.2880, and is trading near it. Current downtrend develops. Short positions should definitely hold, because at the bottom there is a lot of goals. These levels are 1.27 and 1.26.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3541

Despite remaining at the moment the upward trend for the dollar, the chances of a significant correction movement across the front are quite large. As part of the bullish trend dollar reached a number of important levels against the major currencies, and now some market participants are preparing to play in the opposite direction. Arguments for the classes of aggressive speculative positions today may be enough. This data on changes in the volume of euro area GDP (13-00) solutions at the rate of the Bank of England and European Central Bank (15-00 and 15-45). In the United States today are celebrating Independence Day, so the stock exchange and banks are closed.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3151

Since the beginning of the trading session, an increased demand for the dollar. Most likely, the correction phase is over and we will see further strengthening of the dollar against major competitors. The fundamental factors that contribute to this scenario, remain the same investor expectations regarding future monetary policy of the FED. Some experts predict a further sales of risky assets around the world, and care dollar. Markets are closely watching the macroeconomic data, as they determine the rate at which the FED will cut the program QE3.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3486

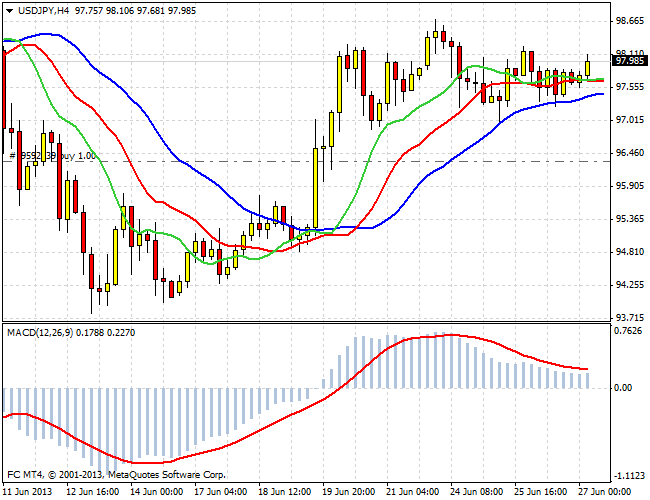

Immediately after the opening of the Asian trading session, the major currency pairs were calm. Except, perhaps, were quotes USD/JPY. Euro opened neutral and gradually grows in European trading. The pair is attempting to test the upper limit of week channel at 1.3090 . District 1.3 proved to be quite a serious level of support for the stock of the single European currency. This may be due to the fact that, as a rule, round values are optional and psychological barriers. At the same time, such a long stop can result in a major boost when the support will still be passed.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3364

Reactions of the markets to verbal signals from strong financial this world - an everyday occurrence. When Ben Bernanke has started talking also potential turning of the program of quantitative mitigation, high volatility has come to the markets. Everything was in a fever, beginning from debts and finishing commodity derivatives. For example, capitalisation of the world markets of actions has decreased more, than by 2 trillion dollars. In the currency markets recently the dollar continues the offensive actions. A number of experts believe that head of FED tries to prepare the markets for hard times.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3829

Despite a flow of important news, trades on Forex this week were low-key. Investors were slightly disappointed by final data on gdp from the USA, nevertheless demand for dollar is still quite high, and this tendency will most likely stay during the next week. They say that generals do not run. This means that if large-scale players decided to play for dollar growth it will last long. And aim levels in this game on the main currency pairs, can be quite serious.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3991

Previous day passed without any significant movements on stock market. After publishing final numbers on gdp from the USA, that were revised from 2.4% to 1.8%, American market of stocks demonstrated the growth on the whole spectrum of indexes. In financial circles all the discussions were concentrated around the subject of QE. The markets are worried about the rumors about a possible exit from the game of the current FRS chairman Ben Bernarke.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3514

The data published yesterday on real estate market and durable orders from the USA did not provoke growth of activeness of trades on Forex market, and the situation remained the same- investors expect new information which can move the quotations. Today the USA gdp data will be published. Market participants expect this data growth by 2,4% cv/cv. If there are no surprises, then investors will most likely continue buying dollar.

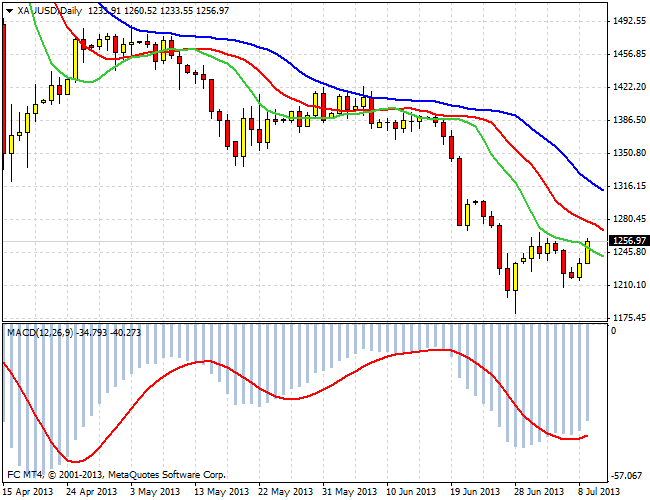

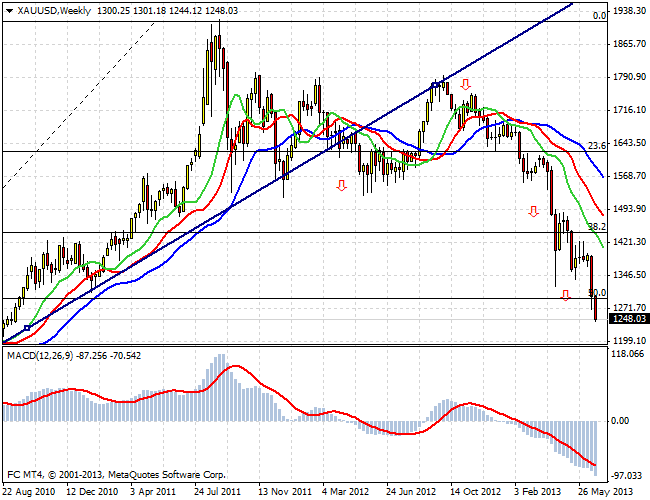

Gold and silver quotations experience serious pressure from sellers. Bear trend has been developing here from Autumn 2012 and now it is in the phase of acceleration. The most active sales of last weeks can be the consequence of overestimation of inflation risks by investors, and they are decreasing. Such assets as gold and silver have traditionally been tools of protection from inflation. And now when FRS is planning to close monetary stimulus, investors have to reconsider their models and stake on dollar.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3578

Modern trading technologies on Forex market allow players to choose those methods and strategies that suit well every trader and fulfill the necessary requirements of risks and profitability. Some traders prefer working with long-term tendencies, while others on the contrary seek to carry out the deals as often as possible, operating in the narrow timeframe.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3304

The strengthening of dollar slowed down and there is a consolidation on currency markets. The participants are waiting for new information and are forming positions. The renewal of activity on Forex can occur today after publication of macroeconomic data. At the beginning of American trading session investors will receive information about the situation on real estate market, as well as data about the durable orders. Any positivity will most likely be considered as an argument in favor of folding monetary stimulus.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3504

The beginning traders quite often hear the word “scalping”. Some say that it is a profitable tool of trade, and some assure that it is a strategy and a quite unprofitable strategy, and some assert that is a coffee cup divination and they consider scalping a roulette. Let us try to make out what it is and if there is a profitable scalping, or every trader trading with this method is doomed to failure.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3672

Dollar purchase continued this week as well. From the beginning of Asian trading session the inertial movement of American currency took place. It can be caused by participants of the market making long-term bets on dollar consolidation against the main currency. And it is most likely that we will see another week of increased demand for dollar.

According to experts, investors have less doubts that FRS is ready to act decidedly. Consensus opinion towards macroeconomic data, coming from the USA is heading towards positive expectations. Thus, the market is leaning towards beneficial (for closing stimulating) measures numbers.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3706

The main event of this week was meeting of FRS, based on which the investors found out about future plans of monetary authorities. After publishing the decision on rates of interest and commentaries about vector of monetary policy, the markets became exposed to high volatility. The head of FRS Ben Bernarke gave investors to understand that this year will bring collapse of stimulating measures and that the main reference point in this issue is the situation at the labor market in the USA. As a result we saw an abrupt growth of dollar and sale of risky assets all over the world.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3717

Outcome of FRS meeting turned out to be within the limits of expectations for many participants of market. Percent stake remained unchanged. After the words about decrease of volume of program QE3 the demand for dollar started to grow on markets. Stock markets EM and lost in their capitalization, because investors went out of their positions and shifted into the American dollar. At the same time, FRS did not specify any timeframes. Thus, investment community does not understand when the decrease of stimulating measures will begin.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3727

Today at 22-00 Moscow time FRS will publish results of its two-day meeting. Afterwards by tradition Ben Bernarke will conduct press-conference. The whole intrigue is about expectations of contraction of the volume of taking out of bond. However, a range of professionals assume that statements after the meeting will be neutral and the markets will not receive any specific signals. There is little time left before the situation is cleared out.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3570

Within several trading sessions just before the FOMC meeting dollar yielded its positions. According to experts such weakening of American currency has a quite aggressive nature. Currently markets are not active, they expect news about QE3. Opinions of market participants in reference to correction of monetary policy are different. Some people think that such measure as decrease of QE program is forced and that excessive liquidity does not promote normal rehabilitation and economy development. Others on the contrary are confident that solution of monetary authorities about decreasing program on stimulating economy will only confirm the fact that the economy has been restored and can continue to grow without any support. In general, toughening monetary politics will provoke lack of appetite of market participants towards risky assets and will encourage increased demands for assets that re in dollars. Otherwise, we will become witnesses of another wave of US currency weakening.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3500

Recently dollar index has been demonstrating obvious descent. The news background of the last week was only encouraging it. Technical picture in DXY is hinting to the fact that very soon we can see a significant correction of index to the current descent. And the aims of probable deployment can be levels of 82-83. It is a good trading opportunity for short-term speculators. But if the descent continues in that case the index might move to the area of 79.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3754

Last day on international stock market turned out to be pretty active. The participants of the trades had to react quickly to new information. US dollar was losing its positions almost in all the places. The whole trading day passed in an obvious tension, starting with data on capital movement, published in Asian session and ending with positive macroeconomic statistics of the USA.

According to dealers, positive data on the labor market and retail sale strengthened the confidence of the market in the quick collapse of the QE program. And that, in turn, increased the pressure on dollar. Today American currency is making attempts to win back the losses.

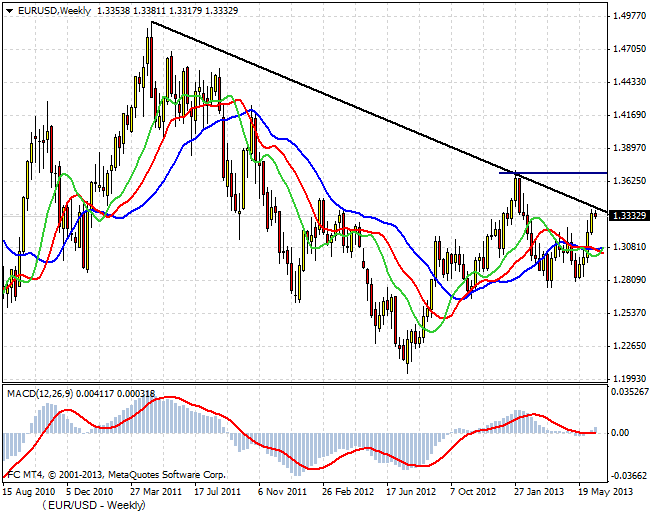

Medium-term technical picture in EUR/USD is still neutrally positive. After passing local maximum of 1.3242 the pair will continue its ascending. A serious level of resistance will be an area of 1.3690 – 1.3710. Here some participants will prefer consolidating profits, while others will try to open short positions.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3517

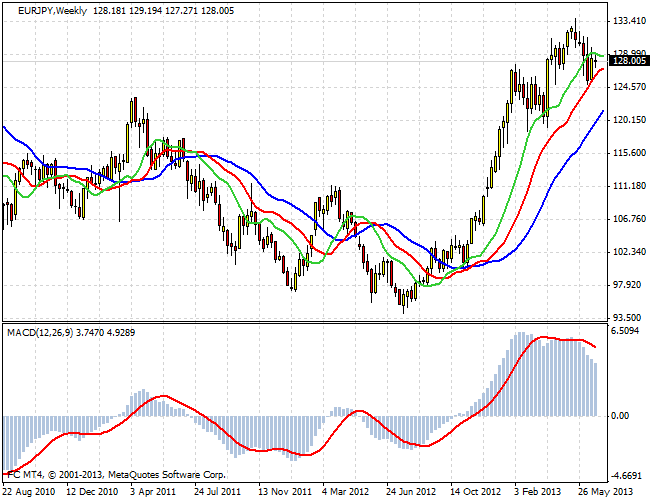

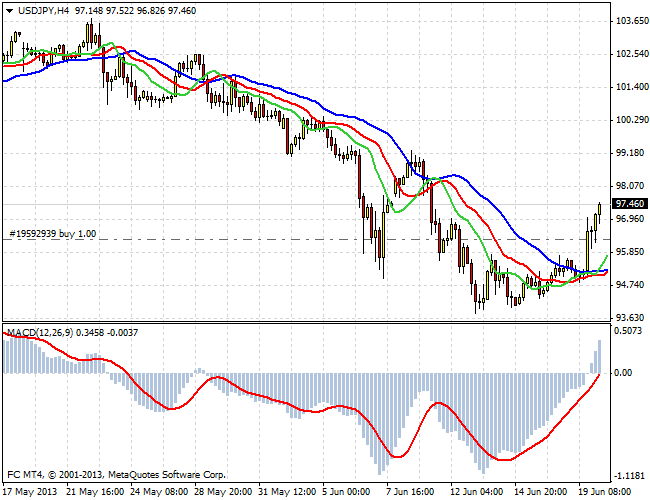

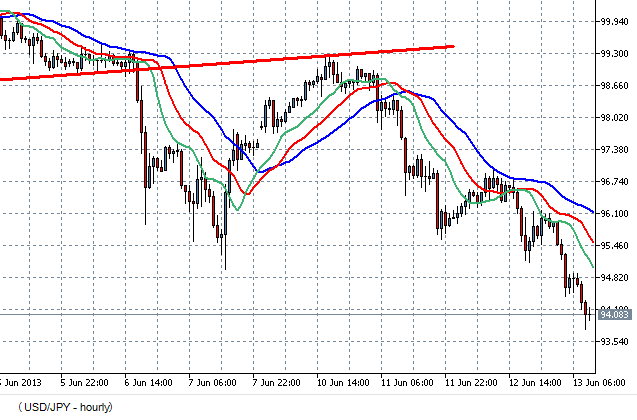

Morning trades on currency markets were significant for strong growth of Japanese Yen against Euro and US dollar. The reason for such an impulse, in the opinion of the experts, can be the statement on taking a passive approach towards measures to lower the profits of public bonds, made by Japan Bank, the report on capital movement also made an impact.

The main problem is that at the early stages of weakening of Yen the participants of the market expected the support from Japan Bank, which aggressive acts had to encourage Japanese investors to actively purchase assets abroad. But despite the expectations of the market the Japanese currency that has lost its positions became the reason of selling foreign assets in order to consolidate the profits.

During the current trading session USD/JPY pair dropped two figures, reaching the level of 93.80. In this situation it is logical to keep the positions of the pair that were opened earlier, while pulling the protective stop. One should refrain from opening long speculative positions.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3576

On the first day of the week there was a low activity of trading on forex market. It was provoked by lack of significant macroeconomic data. The exception was yen, that was losing its positions all over the place in expectation of meeting of Japan Bank.

EUR/USD

Eur/usd pair continued its ascending movement heading towards the level of 1.3700, after successfully passing the resistance at the level of 1.3230.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3830

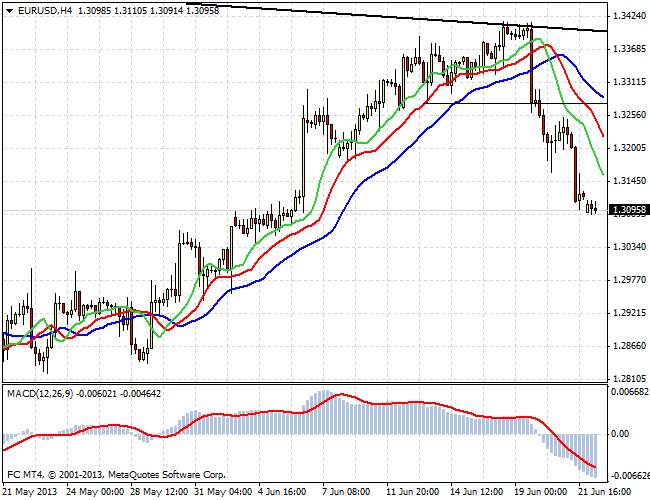

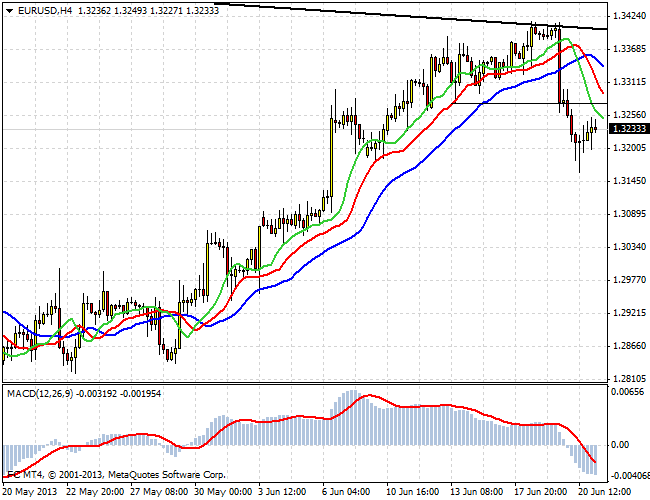

Analytical review of EUR/USD with a forecast for Wednesday, June 5 of 2013

Yesterday American currency was trading slightly better than euro. However, the trading session closed with euro growth by 8 points, despite entering side movement and volatility of the market by 62 points.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3645

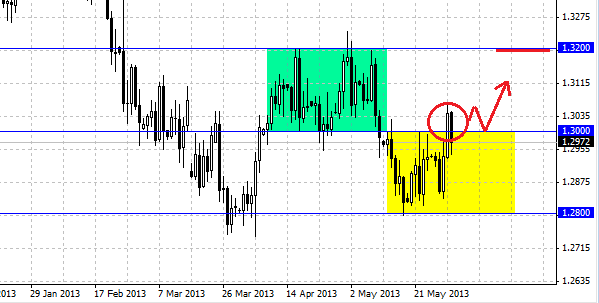

Euro is forming a new diapason

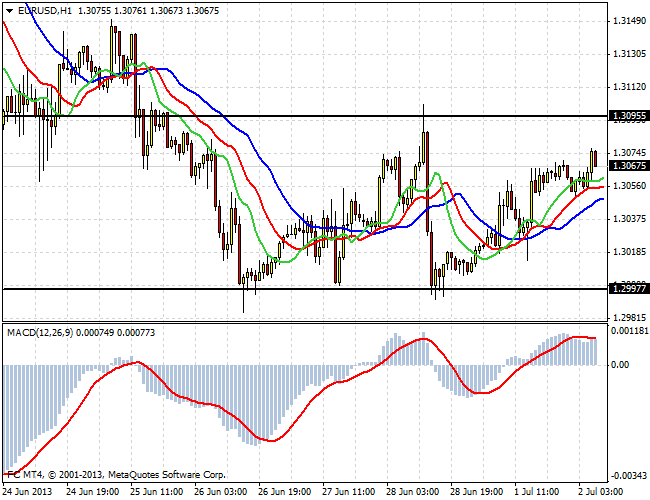

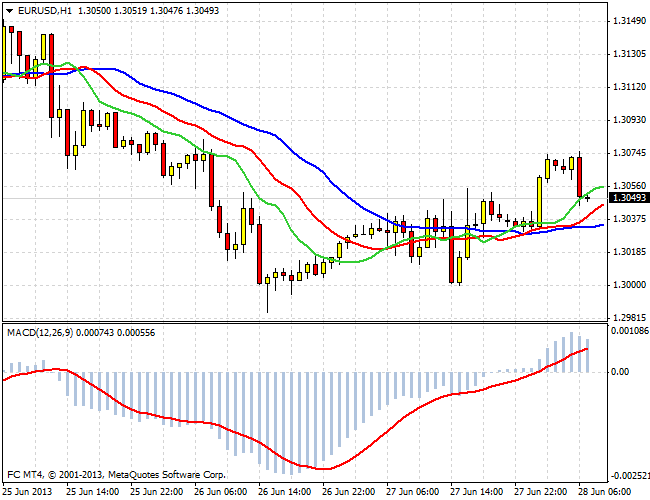

On Thursday EUR/USD pair reached a level higher than 1.30, breaking the resistance, but as it turned out only for a short time, Friday market influenced negatively the European currency. Probably short-term traders locked in the profits, due to that euro returned into the area lower than 1.30. It was a quite strong pass, we think that the market is ready to begin the movement into the upper part of a bigger consolidation.

But for that purpose the level of 1.30 has to begin functioning as a support, which is not happening at the moment, and the level of 1.32 in that case will become the resistance. It is hard to understand the reasons of growth of EUR/USD, because European Union has many problems, but current situations is pointing at the tendency towards growth. Euro has consolidated over the last two days, but the area where the trades are going on is a strong resistance, that is why the euro growth will not be easy.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3351

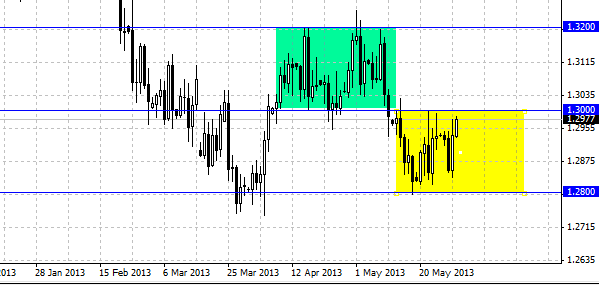

How long will the level of 1.30 stay?

EUR/USD pair made a strong movement on Wednesday, despite not as very positive economic data from Europe, the pair is approaching the mark of 1.30, which will restrain the growth of euro, while the level o 1.28 at the base of the block acts as a support. As it was stated earlier traders are trapped within these levels, and until they are not broken the market will stay profitable only for short-term deals.

We also assume that the level of 1.30 is a middle part of a bigger area of consolidation for EUR/USD pair. It may be assumed that now we are in a lower part of a bigger area of consolidation. Even the movement of the pair higher that the level of 1.30 wouldn’t mean that the market is ready for a big movement upwards and the period of bulls is over. In case of a breakthrough of the level of 1.30 the market will continue to drift in the corridor of 1.30-1.32 and move just like the previous days. After all it describes significantly the whole month of April for the EUR/USD pair.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3275

Thursday was an active day on the market due to news background from the USA where the situation of the job market continues worsening (first claims of unemployment have increased). With this said the US dollar at the second part of the day lost its positions significantly.

Abrupt descent of dollar raised the quotations of GBPUSD pair higher than the level of 1.5200 and the question about development of the ascending movement became urgent again.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3478

On Thursday the GBPUSD pair demonstrated a good interdaily growth. A longer white candle of Thursday absorbed the black candle of Wednesday which together with the lower shadow of Wednesday is hinting at the possibility of continuing the renewal of GBPUSD pair. The resistance of 1.5200 interferes with the renewal.

Now the quotations for closing the trading session on Thursday are straight under this resistance, which means that on Thursday the price couldn’t break down the resistance by abutting it.

It is worth mentioning that a “round” resistance of 1.5200 was broken down three days earlier but the price couldn’t consolidate itself higher that this mark, which was the reason for lowering the quotations of GBPUSD during the week.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3648

Thursday was full of news: announcement of rates of Euro and pound sterling, the data on US job market and ECB president Trichet’s announcement… Thus on Thursday the market was nervous, active and very speculative.

The main blow was aimed at euro. From the announcement of rates of ECB EURUSD pair quickly descended, breaking support level of 1.3500. However, despite the fact of breaking down the support, the ascending trend is not crashed and is the main for trading.

- Details

- Written by Jeremy Stanley

- Category: Forex news

- Hits: 3671

Despite the fact that there are two trading days left in 2012, it is over. Since there hasn’t been any serious activity recently on the market, because western traders are on vacation since Christmas and they come back only after New Year. All the movements will be ineffective and thus predictable.

Despite the fact that there are two trading days left in 2012, it is over. Since there hasn’t been any serious activity recently on the market, because western traders are on vacation since Christmas and they come back only after New Year. All the movements will be ineffective and thus predictable.

Correspondingly simple traders had better keep the same planning in their operating graph.

The end of the year is a time to sum up and to make forecasts for the next year. However as the practice shows, the history doesn’t guarantee profits in future, and even the most successful analysts’ forecasts might not become a reality.

That is why it is better to concentrate now on yourself and your trading. Analyze at what phases of the market you felt better, which tools brought more profits, which signals became the most profitable ones and etc. As a result you can find ways to improve your trading strategy.

Dewinforex website wishes you trading success, glowing eyes and health in order to complete your plans, and we wish health to you family and loved ones.

Happy New Year and Merry Christmas!