- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3432

On Tuesday the gold was descending, signaling the sales. Signals for sales are confirmed by two factors:

1. The price rebounded from the upper border of the diapason.

2. Three latest candles form reversal candlestick pattern with classical hammer.

Another factor of descending is the closing of long positions by bulls right before the commentaries from the meeting of FRS, that started on Tuesday and will go on until Wednesday. Since lately there have not been any positive news from the USA for traders, so there is a risk of descent of current quotations.

Thus one should occupy the short position on gold (which means to sell) displaying a short stop for reducing the risks of getting wastage in case of very positive news from the United States.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3710

Today the anticipated raise up of the gold triangle has occurred. As we have mentioned earlier this impulse is a great indicator of continuing ascendant movement.

Despite the fact that the impulse was good and strong the gold is still limited in its growth by resistance of 1636.

The Wednesday break should be perceived as a fake one by no means, since the price has not returned even to the boundaries of the triangle after the break that is why the upcoming days it is recommended to make only long deals with gold.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3599

The tension on markets drives gold rates to a narrow band, which becomes dangerous for intraday traders. Why dangerous? Because gold usually has a tendency to break down its bands with abrupt impulses, which may yield big losses to intraday traders within a very short period of time, that do not set limitations on the beatings.

Graphically one may notice a classic isosceles triangle on a daily chart, the triangle which is already done. The price is gripped between two frames, leading to traders who will be waiting for a breakdown towards any direction. On Monday a breakdown attempt failed and the price grew. On Wednesday a raise attempt might become possible.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3584

There is summer slackness on markets. Seemingly… But one should look at the active trading of petroleum and stock indexes, to understand that the slackness does not exist on all markets. As far as the petroleum is concerned, it is growing well and overcame the resistance of 99 -100 (the brand in question is Brent), from the rebound that made it possible to buy. Currently the obstacle for further development is a level of 106-107 $ for one barrel, which would be nice for consolidation to calm down the bears and continue the growth.

There are no reasons for petroleum not to grow. The reserves of oil and gasoline are falling in the USA, the correction of all Arabic crises has come to an end, the heating season is approaching and world economy is increasing and it still needs fuel for functioning. There is a high demand for petroleum and with a growing share market it must increase. That is why purchasing is well grounded both technically and fundamentally. However, those who are not in long yet should wait approaching the level of 106-107 and a price behavior at a given level.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3245

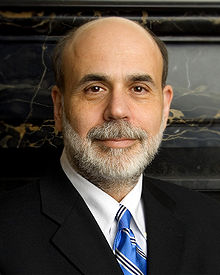

Summer is affecting traders’ activity. On Tuesday, despite good corporate accounts of American companies for the second quarter, the markets were decreasing until a kind man Ben Bernanke (a chairman of FRS) arrived. Of course markets were affected by the pressure and high inflation of Great Britain and low business expectations in Germany.

Summer is affecting traders’ activity. On Tuesday, despite good corporate accounts of American companies for the second quarter, the markets were decreasing until a kind man Ben Bernanke (a chairman of FRS) arrived. Of course markets were affected by the pressure and high inflation of Great Britain and low business expectations in Germany.

But there was one important idea that appeared after hearing Ben Bernanke’s ambiguous statement about a possibility of continuing and expansion of a current program of quantitative easing. It was just a reference to low rates of inflation decrease and US economy growth.

Such hint gave markets a pushup but not for a long time, since it was either a hint or just thinking aloud. The situation is really interesting, with markets ignoring economic indicators and reacting to another money printing, nobody believes in economy effectiveness.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3855

In spite of traders’ superstitions, last Friday the 13-th was pretty successful for markets. Is there a rational explanation? Let us try to understand it.

In spite of traders’ superstitions, last Friday the 13-th was pretty successful for markets. Is there a rational explanation? Let us try to understand it.

According to newsfeed it is obvious that there weren’t any positive changes or serious news. Thus a couple of leading American banks reported their results. Wells Fargo got by 15% more profit for the first quarter of 2012, in comparison with a year earlier, but the profits of J.P.Morgan Chase turned out to be worse than the prognosis. The prices of manufacturers in the USA have increased by 0.1%, though a decrease by 0.4% was expected. However these were all economy news worth paying attention to for the day. Nothing special, and since under the conditions of prolonged decrease a famous English saying works well “no news is good news”, the background at least did not hamper the development.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3426

Recently the market has been increasing, if there are no meaningful news, and every time this slight growth is interrupted by another negative factor, that causes panic for average trader.

Recently the market has been increasing, if there are no meaningful news, and every time this slight growth is interrupted by another negative factor, that causes panic for average trader.

On Wednesday the market was increasing evenly (share market and market of raw materials and also risky assets). But then transcripts of FRS meeting that was held on 20-s of June were released stating the decrease of growth of US economy from 2.4% down to 1.9%, and everybody started panicking and the quotations started deflating.

It is very good that there are sensible people and they remember that Ben Bernarke has already mentioned these data after the meeting and the market had to overcome them. So we should not pay attention to this mishap in a newsfeed.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3425

Last week began with Euro decline and an established breakdown of EURSUD pair by 1.2320. However, in order to trade it is essential to wait for active auctions on Monday (that is at least the opening of European area) and to ensure that the breakdown that took place on Friday was not false, which is possible at such level. Unfortunately, there are no real confirmed data of positions in Forex, and that does not let perform the analysis of the balance of the power of customers and sellers at such level. That is why the confirmation of the breakdown is so important.

The decrease in petroleum price led to decline in value of Australian dollar compared with USD. Under speculator’s pressure the rates of AUDUSD pair broke down the support level of 1.0225. Perhaps on Monday Australian dollar will decrease significantly, and it will become possible to enter trading on market openings with short stops for support level of 1.0225. The deal seems to be pretty good, since the mark of reduction is at 1.0000, which makes up more than 200 points at current price.

- Details

- Written by Admin

- Category: Forex analytics

- Hits: 4196

In May currency pair USDCAD showed soaring and on the last day of the month reached the maximum at 1.0365 creating bullish trend, which is marked on our chart with the channel of linear regression.

The fall in oil prices which was caused by the crisis in Europe destabilized the commodity currency of Canada and made the dollar stronger and more popular as save haven currency.

Future growth of currency pair USDCAD is supported by the canadian statics and technical analysis evidence. It is forecasted in the first half of June. As it became known on the May 31 in the first quarter of this year the current operations balance deficit of Canada grew from 10,3 billion to 9,7 billion in the last quarter of 2011.

- Details

- Written by Admin

- Category: Forex analytics

- Hits: 4051

Market now is on the positive side. Eurozone heading towards recovery, says ECB boss Mario Draghi and this tendency is going to continue. After that there was a stock market rising on Wednesday and then rising of the all the risk-generating assets including currency.

Remarkably, main currencies had reached their support point just before that and were on that level for several days. The growth of the currencies was only due to the fact of today's positive news. Of course different currencies reacted in a different way to the news. So Currency pair EUR/USD did not show high level of growth it just compensated the previous fall on Tuesday. Most likely it is connected with the eurozone risks, which concern investors. Currency pair EUR/USD could face resistance at 1.2630.