- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3429

That day came, so long expected by market participants. Today will be the FED meeting, which will provide new information about the quantitative easing policy and the further development of the U.S. economy. On Tuesday, the major currencies traded restraint, keeping almost neutral. In general, at the end of the day the dollar suffered minor losses, but almost all currency pairs remain in a narrow range since Monday. Other important news today, waiting for data on the British pound.

The EUR/USD showed a rise on upbeat data on business activity in the euro area and Germany. The European currency is trading against the U.S. dollar within a daily candle formed on Monday. All eyes are on today's FED meeting. What to expect from the meeting? - The opinion of Goldman Sachs.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3741

The dynamics of the dollar last week was mixed. Friday's trading was very volatile matter is that commotion about the new head of the U.S. Federal Reserve. News block only added fuel to the fire, if you look at the data published this week, unfortunately, we see poor numbers. But it is not all that bad, positive news pleases investors the UK economy. The main event of the week will be the FOMC meeting and everything connected with it - speech rates, statements and reports. Recall that market participants are interested in the fate of the quantitative easing program, so there is no doubt that the FOMC Steytment stir markets.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3601

The dynamics of trading on Thursday, will largely depend on the news background. Yesterday's economic data provided support to the British pound and the euro. Many believe that there was a rise in the euro against the abolition vote on military intervention in the conflict.

So, the European currency broke the level of 1.33 and is now trading in this area. An important event that may affect the dynamics of the pair EUR/USD will be the M. Draghi's speech today. Of America are expected labor market data.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3503

With the start of the new trading week is to analyze the recent movement in the market, and analyze near-term prospects. Although the focus of last week was the U.S. dollar, as a result, he was able to strengthen only against the euro and other currencies such as, for example, the British pound and the Australian dollar showed growth, the latter being very important.

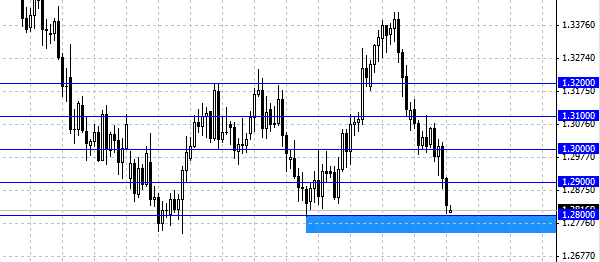

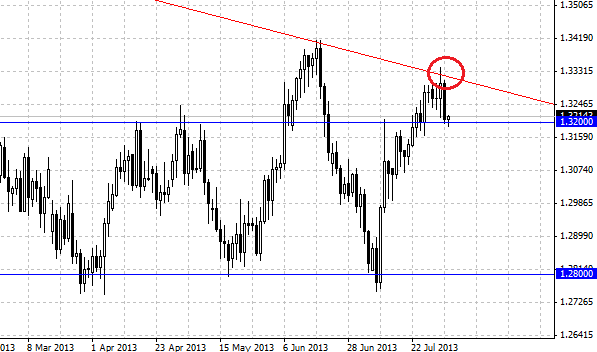

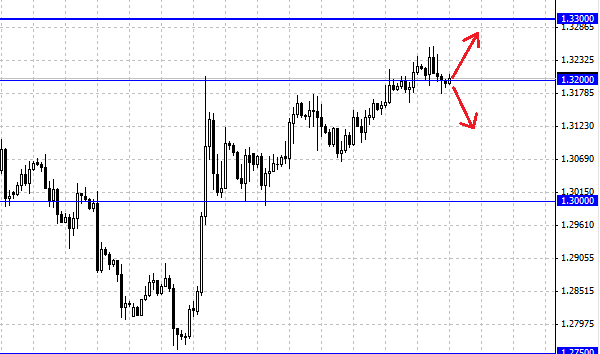

The EUR/USD has made an important break below 1.32 and is currently trading below the mark. Motion quotation EUR/USD is possible to note some correction after the breakout. Today, there are no important economic data that could affect the course of the auction, so the market is likely to be smooth motion. We believe that the European currency will continue to decline, the final goal is the level of 1.28, intermediate 1.30 . With the growth of pair EUR/USD Resistance 1.32, you can open a deal to sell with the above objectives.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3688

The markets remain dynamic, and set trends continue to evolve. American news block on Tuesday fixed the positive values that were better than analysts' expectations, which supported the U.S. dollar. At the same time, the report of the Bank of Australia and the interest rate, which remained unchanged, the Australian currency pushed up, released in the UK Construction PMI was better than expected, which also had a positive impact on the pound.

The EUR/USD holds tight after a 1.32 mark at the moment the European currency is at 1.3170 . Market participants are also waiting for the ECB meeting, which will take place on Thursday. While the pair EUR/USD is below 1.32, prevails further downside to the values of a pair of 1.30 - 1.28 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3454

At the end of last week, all the major currencies except the yen fell against the U.S. dollar. Reduction of the euro and the Australian dollar was the most ambitious, EUR/USD for the week decreased from the level of 1.3380 to reach 1.3220 (-1.22 %), AUD/USD closed at 0.8897 (-1.37 %). The British pound also closed in the red zone, but with fewer losses, GBP/USD fell from 1.5570 to 1.5491, thus losing 0.47 % for the week.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3373

Today, Wednesday, the foreign exchange market with the opening of trading the U.S. dollar shows growth. A significant decrease was observed for the pair GBP/USD and AUD/USD, the European currency is in no hurry to fall against the dollar, although moderately reduced.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3517

The trading week began with no surprises. With the opening of trading, as usually happens on Monday, there has been little activity. The European currency shows a slight decline, the British pound sterling and the Australian dollar traded unchanged.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3333

Price movements on Thursday showed the expected dynamics. The European currency reaching a value of 1.33 against the U.S. dollar retreated, the British Pound was down, while the Australian dollar is fighting for the level of 0.90 . On Thursday it was a lot of important economic data, which also had a significant influence on the course of trading.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3407

Over the past week the dynamics of exchange was mixed. Since the euro exchange rate ended the week little change -0.04 %, although during the week EUR/USD pair was quite volatile. The situation is similar to the Australian dollar, which ended the week down by 0.14 %. Showed a positive trend British pound (pair GBP/USD) which added almost 1 %.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3043

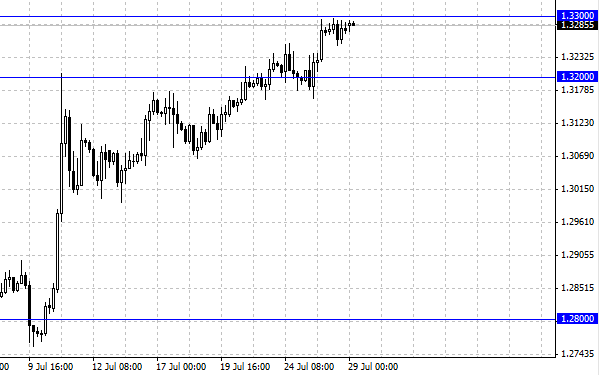

Thursday was marked by a sharp decline in the U.S. currency. Significant dollar sales have caused a surge of activity in other currencies. The EUR/USD jumps to 1.3350 and is trading near which at the moment. The reason for this increase is possibly a break of 1.33 . Prior to that, the dollar steadily in strength, and reached the level of 1.32, the purchase of this support level could also be a catalyst for a strong movement for the pair EUR/USD. After a number of positive statistics investors began to liquidate part of long dollar positions. His role in the weakening of the U.S. currency has played and the growth yield on 10-year U.S. Treasury bonds to two-year highs, which was perceived by market participants as an additional proof of intent FOMC to begin phasing out of stimulus measures is already at its September meeting.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3387

On Tuesday took place in the "dollar" bulls. Currencies continued to decline against the U.S. dollar. Since the euro fell against the dollar to 1.3230 level. Even the expected news on industrial production and positive economic sentiment could not stop the downward movement. Industrial production in the euro zone rose to a seasonally adjusted 0.7 percent in June on a monthly measurement, offsetting a decline of 0.2 percent the previous month, which was revised from 0.3 percent fall. Economists forecast that production will grow more rapidly by 1.1 percent. It also became known, the index of economic sentiment in Europe's largest economy rose to its highest level since March. A key indicator gave hope that a prolonged recession in the euro zone is coming to an end. Centre for European Economic Research ZEW reported an increase in the index to 42.0 in August, down from 36.3 in July, ahead of the growth forecast to 40.3 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3594

The trading week began with the strengthening of the dollar, which has recently felt quite weak. Market participants are buying the U.S. dollar, in connection with the major currencies are losing their value.

The EUR/USD during trading on Monday dropped below 1.33, but fixed below failed. The European currency is currently trading above 1.33 dollars - the level of support. The pressure on the EUR/USD pair has waiting for data on euro area GDP, today traders will wait for the sentiment index and industrial production data. The dollar may have economic data, the output of which is scheduled for this week. Earlier this year, discussing the possibility of reducing the stimulus from the FED propped up the dollar, but in the last week, the dollar was down due to lower expectations reduction of redemption of bonds by the FED in September. To further strengthen the dollar should be fixed below the level of 1.33, the immediate goal will be to support at 1.32 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3714

In the course of trading in the currency market on Thursday showed growth of major currencies against the U.S. currency. Dollar shows a negative trend, and every day is losing ground. Support currencies have economic data, as well as statements of central banks.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3485

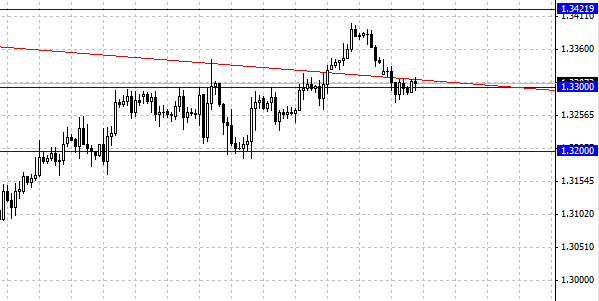

Bidding on Wednesday ended with the fall of the dollar strong. Since EUR/USD pair showed a strong upward movement. To do this, there were many factors, primarily the support of the European currency was positive data in Germany. The Federal Ministry of Economics and Technology reported that as a result of June's industrial production in Germany increased substantially, thereby exceeded the forecasts of most economists. The second factor of growth of pair EUR/USD was the announcement that the agency Fitch Affirms Germany at 'AAA' with a stable outlook. Fitch said that the German government has exceeded the plan by some key financial goals. "Germany has all the ingredients to reduce the national debt - said in a statement. - The economy is growing, the state budget is relatively favorable, nominal interest rates at low levels." On such a positive pair managed to break through resistance at 1.33 and consolidate above. Now the pair is constrained by resistance, which passes through a maximum on July 31 - the level of 1.3350 . The Euro is trading near the downlink long-term trend. We believe that the EUR/USD pair has the potential to grow to a level of 1.35, but downside risks still remain.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3923

Bidding on Monday were mixed. Economic data was played against the dollar in favor of the pound and the Australian dollar. The British pound as expected, grew up and was fixed above the level of 1.53 . Positive impact on the pair GBP/USD had a PMI output index in the service sector, which was better than analysts' forecasts. Recall that we expect a further decline of the pound against the dollar, we believe that the increase in GBP/USD is limited by resistance at 1.54 and downside risks still predominate in a given currency pair. The immediate goal for the pair GBP/USD rate is 1.5270, the next target will be the level of 1.5100 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3324

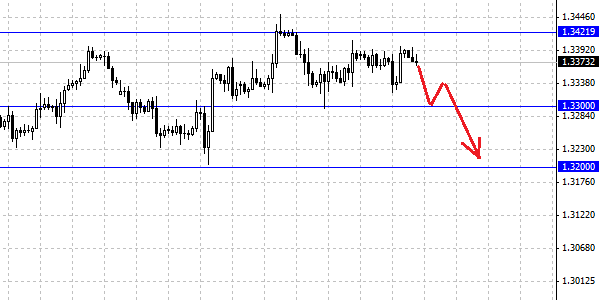

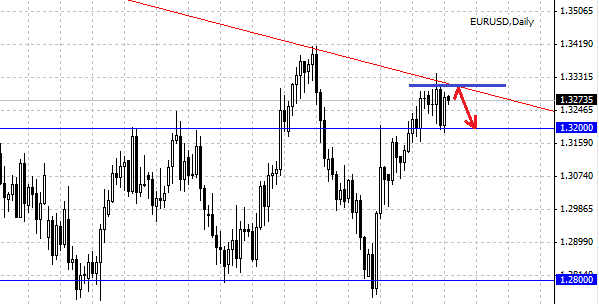

Over the past week, the U.S. dollar was feeling confident against other currencies, but report on the labor market on Friday, the dollar has seriously shaken. So at the end of the week EUR/USD pair almost did not budge. Most of the losses of the euro was able to play on Friday. The pair of almost 100 points, and in just a few minutes. From a technical point of view, we continue to see a sideways trend for the pair EUR/USD with the boundaries of 1.32 - 1.33 . It's worth recalling that the downward trend line passes through the 1.33 level in the euro area is closed. We expect a decline in the euro this week with the immediate goal of 1.32, on a break of this level will open the way to 1.30 .

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3552

On Thursday, the dollar rose significantly against the euro. One of the main factors contributing to the growth of the U.S. currency was a report published by the Institute for Supply Management (ISM). The PMI for the manufacturing sector in the United States July rose to 55.4, a value above 50 indicates expansion of industrial activity. The volatility of the pair also provoked statements of the ECB's Draghi. He said that the base rate of the European Central Bank at 0.5 % would not go up, at least until 2014.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3292

On Tuesday, during the trading U.S. dollar rose against the euro, thereby continuing strengthening. The EUR/USD closed the trading day at the same level at which it was opening day - 1.3260 . On the daily chart shows the pair remains in a tight range with the boundaries of 1.3300 - 1.3250 . Such dynamics proves once again that market participants expect the FED and the ECB speeches, and yet refrain from any action.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3585

The new trading week will be busy, traders can expect heavy traffic and increased volatility in the markets. The economic calendar is full of important news and economic data, which will undoubtedly be the determining factor in the movement of the market. At this point in the foreign exchange market, the U.S. dollar remains under pressure. This week is how to reverse the trend of the dollar to weaken and strengthen it. Market participants will take positions based on economic data, some of which is from the United States - a decision on the discount rate and the accompanying statement of the Committee on the Federal Open Market on the part of the Euro zone, similar information - press conference by ECB interest rate decision.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3520

Week draws to a close and we can take stock of trading on the foreign exchange markets. This week the U.S. dollar continued to weaken, the initiative seized the riskier currencies, the reason for this, of course, is the ever-increasing market confidence about the imminent decommissioning program of quantitative easing.

The EUR/USD this week managed to grow to 1.33 area, but apparently the market does not have enough power at the moment to overcome this level. At the end of the week, many traders take profits and exit positions, so in the last hours of trading European currency is likely to trade below 1.33 dollar. The momentum needed to break through the resistance may occur during the U.S. session, but such a scenario is likely to be postponed until next week. The nearest support level for the pair EUR/USD is at around 1.32 . The trend for the pair remains bullish.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3400

Wednesday evening, the U.S. dollar rose against major currencies after strong data on manufacturing activity and new home sales. As the results of studies in July preliminary index of business activity in the U.S. manufacturing sector rose to 53.2, up from 52.2 in June. At the same time, the results of last month new home sales rose markedly, reaching a five-year high at the same time, increasing the likelihood of an early economic recovery. According to the report, in June, sales of new homes rose to a seasonally adjusted 8.3 %, reaching a level with 497 thousand units. We add that this was the highest since May 2008.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3124

During the trading session on Tuesday, the European currency rose against the dollar after weak data on the Richmond FED manufacturing activity. Report of the Federal Reserve Bank of Richmond (FRS - Richmond) showed that the producers of the central Atlantic region of the U.S. this month reported a decline in activity. Calculated by the Federal Reserve - Richmond index of current business conditions in the manufacturing sector in July fell to -11 from 7 in June, and the June value was revised downward. The index values ??below zero indicate a decline in activity. Meanwhile, the Eurozone came positive data on consumer confidence, the value of the index fixed at -17 and -18 analysts had forecast. Although consumer confidence remains in negative territory, the dynamics for growth also supported the euro.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3551

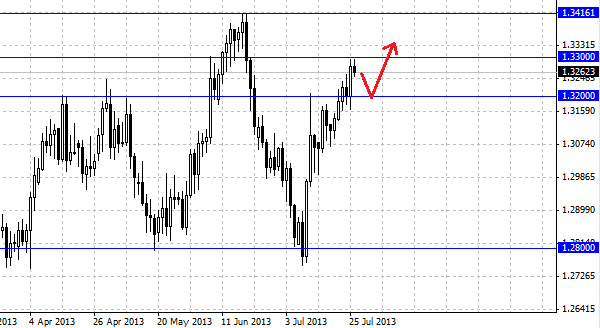

The past week has been winning for most currencies against the dollar. The Australian dollar closed at 0.9170 mark, although on Wednesday almost reached 0.9300, the growth of this week was 1.61 %. Weekly result of the euro is not so high (0.60 %), but nevertheless the pair EUR/USD has been the focus of traders largely due to economic data, which was enough.

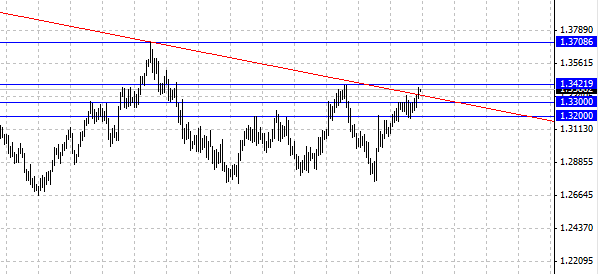

The currency pair EUR/USD traded kept, the range is between the 1.3000 - 1.3200 continues to dominate the current market situation. If you look at the performance of the greenback, you'll find that over the past week, he basically continued to weaken. But the pair EUR/USD is not so distinct, the reason for this lack of positive factors for the growth of the euro, and even such catalysts as good economic data is not in force to provide the necessary support for the euro. Eurozone indicators remain weak, investors and traders see it, the downtrend in the euro reflects the state of the economy. The European currency close to a tipping point, which is located at the intersection of the descending trend line and the line at the level of 1.3300 . We are looking forward to further developments, but determined to sell the pair EUR/USD. Now even the 1.3200 level seems insurmountable for the euro to sell from this value - it means to get a deal with a lot of potential, but little risk.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3110

The EUR/USD rises during Tuesday's session. This was facilitated by the economic data for the euro area, as well as the expectation of my head of the Federal Reserve Ben Bernanke held today. Markets expect that he will be able to shed light on the future of the program to purchase assets, as well as their timing. Economic sentiment in the euro zone data showed, improved to 32.8 from 30.6 the previous value. Markets had expected a more modest increase. Indicator for the current economic situation has also improved and now stands at 74.7 points. It's worth noting that interrupt the growth of the European currency could not even positive U.S. data on consumer prices and industrial production. The pair EUR/USD continued to the level of 1.3172, the immediate goal is the level of 1.32, which is a strong resistance. Traders should be cautious before Bernanke's speech, as his speech can have a powerful effect and the euro could change dramatically in either direction.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3588

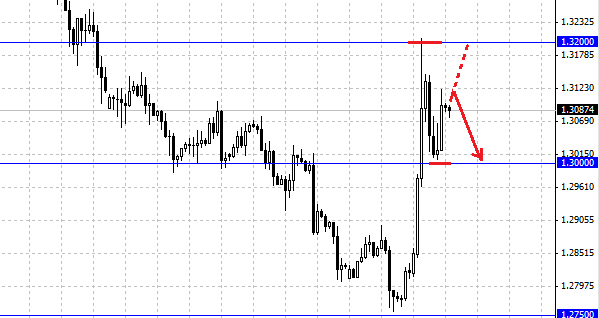

The EUR/USD opened slightly higher at 1.3080, but immediately began to lose ground, falling progressively. This week, the pressure on the European currency should be maintained, and we expect the EUR /USD pair is trading below 1.3000 in the near term. The upward movement of the currency pair is limited to resistance at 1.31 and 1.32 . Trading on Monday may be very volatile due to low trading volumes, so it's sensitive to the opening of positions. EUR/USD can also show the trading range for the week, but the move below 1.3000 will indicate the resumption of the downtrend for the pair and will give a sell signal of the European currency.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3708

The EUR/USD during the trading session on Thursday declined. The euro exchange rate began to fall back from their maximum values achieved after comments from Fed chairman Bernanke. The focus of the players was a weekly report on the U.S. labor market, analysts forecast a decline in applications for unemployment benefits. However, the report of the Ministry of Labor showed that the number of initial claims for unemployment benefits rose and reached 360K. And although the data were worse than expected, released the report has increased the pressure on the single currency, EUR/USD pair dropped to 1.3005 . Not having enough strength to this level is broken, the dollar began to lose its positions. By the end of the pair EUR/USD was trading at 1.3100 mark, which apparently will be playing the role of resistance in the near future, support is at 1.3000 . Important news for couples today will be the publication of data on industrial production in the euro zone, analysts predict the declining trend.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3449

Sometimes come true, even the most unimaginable forecasts, trading on Thursday began with the fact that Bernanke's speech on Wednesday resulted in the strongest sell the U.S. dollar. Such a strong reaction to his speech, most likely, not expecting anyone. The currency pair EUR/USD began a sharp rise after Federal Reserve Chairman Ben Bernanke said there was risk in the U.S. economy and persistent high unemployment have signaled thereby that the imminent reduction in the amount of QE3 may not be, per night the pair reached the level of 1.32 . In the previous forecast, we expect that the correction in the euro could reach that level, but not at such short notice. Now we need to look at the European currency to a new height. Despite the weakening of the dollar, we still believe that the upward movement of EUR/USD will be limited to the level of 1.32 . EUR/USD has not met resistance in its path breaking level of 1.30 and 1.31, but the level of 1.32 in our opinion was the first and last level which could reach the European currency in the near future. Low economic activity and domestic problems the euro area point to the weakness of the euro, and the long-term downward trend we believe is important.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3722

On Tuesday were subdued by the majority of currencies is still moving sideways, with the exception of the European currency. The euro fell to a 3-month low against the U.S. dollar. The reason for that was representative of the ECB's comments about low interest rates. Governing Council member Joerg Asmussen, explaining ECB President Mario Draghi made to them last week, said the ECB will probably keep rates low for more than 12 months. Asmussen also said that would not rule out another round of cheap credit. These statements have a negative impact on the euro and the currency fell sharply as investors are not profitable to keep the assets in Euro if the ECB does not intend to raise rates. Later, however the ECB acted with objections as to the timing relative to the course of action guide monetary policy.

- Details

- Written by Jeremy Stanley

- Category: Forex analytics

- Hits: 3765

During the previous week in the foreign exchange market the U.S. dollar showed a significant increase, against almost all currencies. The biggest losses were British Pound (GPB/USD) and Japanese Yen (USD/JPY), also showed a decline in the euro (EUR/USD) and Australian dollar (AUD/USD). In the analysis of these currency pairs you can see an interesting situation, almost all of them are located near strong support levels. The three-week dollar strengthening logically suited to the stage of consolidation and correction is most likely the dollar may start exactly from these support levels. We believe that the long term trend of the dollar to rise does not change, but, nevertheless, now the market looks as if he needs a break, if he plans to move on.

The European currency is near significant support at 1.2800 . On Friday, the pair EUR/USD failed to fall below this level. At present, the euro looks very vulnerable to the dollar, but as long as the level of 1.2800 fails decline in the euro will be difficult to roll back the level of 1.2800 could end up increasing the value of 1.2900, where bears with new force could come into play. In the event of a further strengthening of the dollar next goal for EUR/USD 1.2750 level will be - at least, that was made in April 2013.